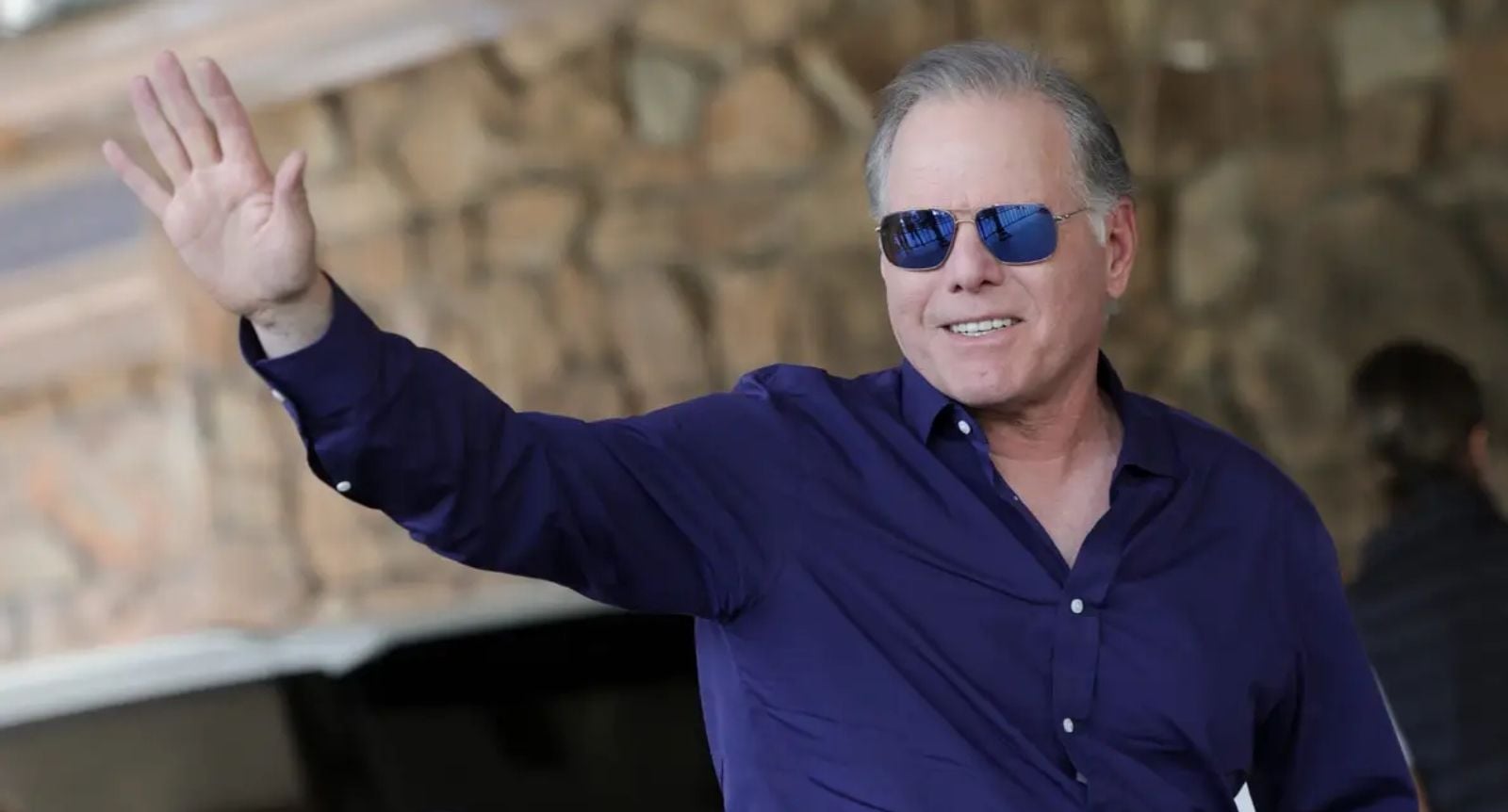

If David Ellison has learned anything from his father, it is that when a door does not open, you do not knock harder. You just buy the building.

Following the disastrous leak of ‘Project Eagle’ which exposed plans to turn Paramount+ into a scrolling UGC nightmare, Skydance-Paramount has returned with a ‘sweetened’ hostile offer for Warner Bros. Discovery (WBD). The move signals a clear pivot. Ellison needs to drown out the noise of his TikTok ambitions with the one thing Hollywood respects more than algorithms: cold, hard cash.

The billion-dollar apology

Ellison is not just increasing the bid. He is restructuring the entire deal to soothe the nerves of a jittery WBD board currently flirting with Netflix.

The new package reportedly includes a significant bump to the previous $30-per-share all-cash offer. This values the legacy studio aggressively against Netflix’s complex spin-off proposal.

More importantly, Ellison added a massive ‘reverse breakup fee.’ This serves as financial insurance. If the Department of Justice or the FTC decides a Paramount-WBD merger creates a monopoly, WBD walks away with billions.

It signals extreme confidence. Ellison bets he can charm regulators or pay them to look away.

David Ellison bets he can charm regulators

Creative shields and governance

The ‘Project Eagle’ leak did real damage. Talent agencies and directors panicked at the thought of Dune: Part Three competing for resources with 15-second cat videos. In a direct response, the new term sheet includes binding governance concessions.

Sources indicate the creation of a ‘legacy protection trust’ or a dedicated greenlight committee for theatrical releases. This essentially acts as a contractual promise.

It assures the industry that the ‘tech-forward’ pivot will not gut the Warner Bros. lot. Ellison wants to buy the history rather than erase it.

The Netflix complication

This aggressive maneuver forces the WBD board into a corner. David Zaslav and the board have spent weeks romancing Netflix. That deal involves a messy divorce where WBD spins off its declining linear networks into a debt-heavy ‘Discovery Global’ entity while Netflix absorbs the premium IP.

The Netflix deal offers strategic synergy. The Ellison deal now offers ‘immediate liquidity’ and a safety net. Shareholders generally prefer cash today over a complex stock swap involving a dying cable business tomorrow.

WBD’s David Zaslav, cannot seem to say goodbye to Paramount

The final act approaches

The clock ticks toward the February 20 deadline. Ellison’s strategy is now clear. He intends to make the Netflix proposal look like a gamble and his own offer look like a guarantee.

WBD shareholders must decide. Do they want to be part of a streaming experiment with Netflix? Or do they want to cash out before the ‘TikTokification’ potentially begins?

Ellison has put the sweeteners on the table. Now we wait to see if the WBD board has a sweet tooth or if they are holding out for a better seat at the Netflix table.