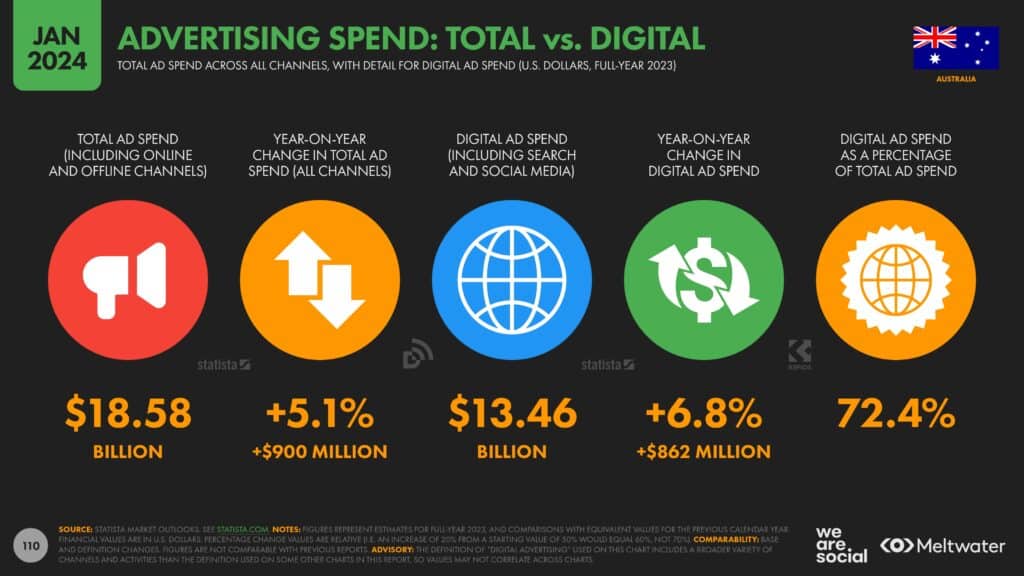

Digital advertising spend in Australia has grown in 2023 to reach US$13.5 billion, representing 72.4% of total ad spend, now at US$18.6 billion.

The Digital 2024 Australia report by We Are Social and Meltwater provided in-depth analysis of the country’s digital, social and e-commerce landscape.

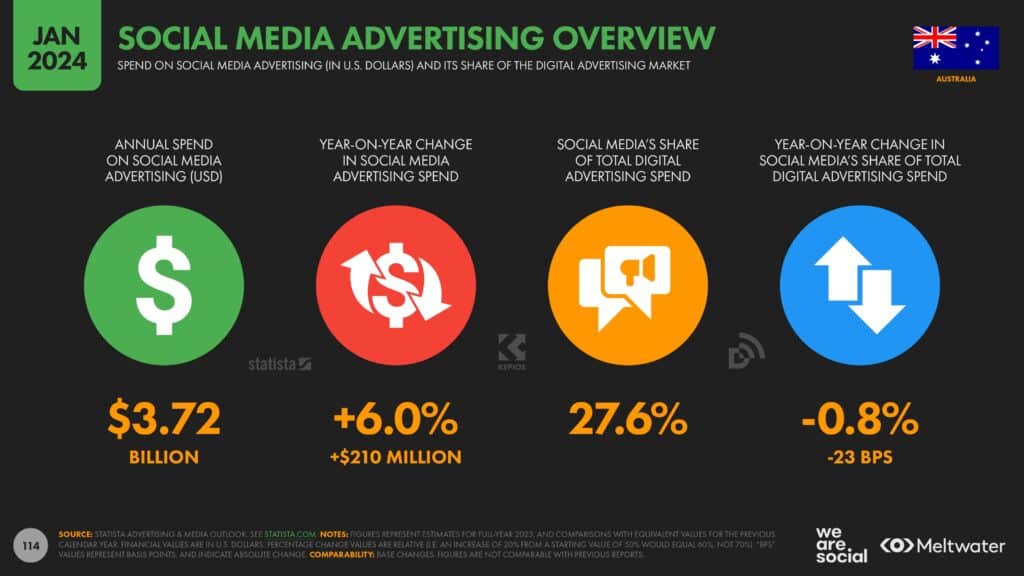

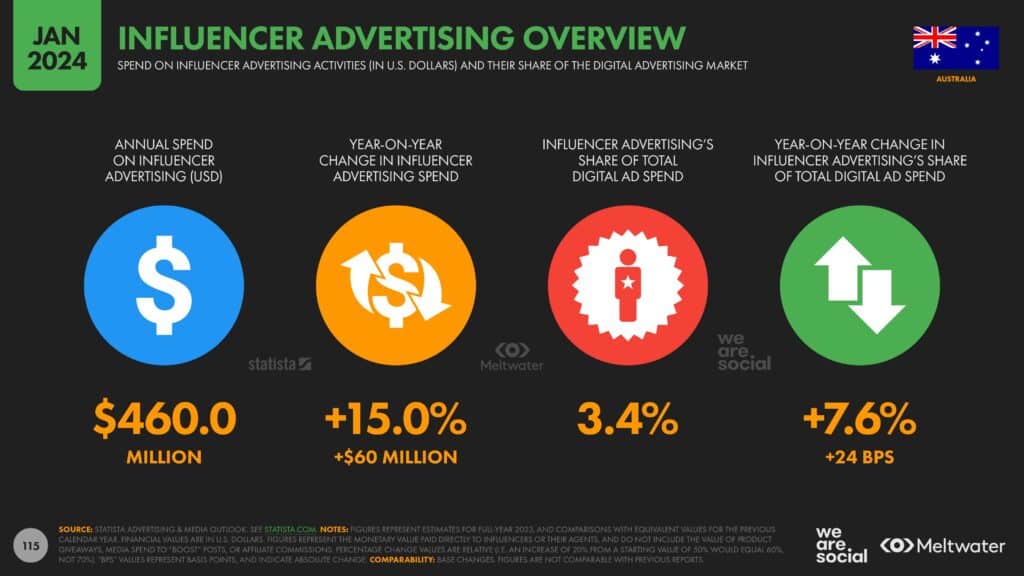

Social media advertising maintains a significant share of the digital advertising market, with US$3.8 billion (+6%), representing almost one-third of the total digital ad spend. Meanwhile, influencer marketing spending has increased by 15%, representing an increasingly larger portion of digital advertising spending.

The report found digital platforms continue to reshape the retail landscape with a surge in online shopping activities, particularly in categories like electronics, fashion, food, and beverages.

Online spending has grown substantially in the travel and tourism sector, reflecting Australians’ preference for digital booking channels, according to We Are Social and Meltwater.

The data found the annual online spend on flights surged by 44%, amounting to over US$10 billion, while spending on hotels grew by 34%, reaching almost US$6 billion. It also highlighted the importance of social media as a key source of information about brands and products, with 58% of users aged 16 to 64 turning to social networks for this purpose.

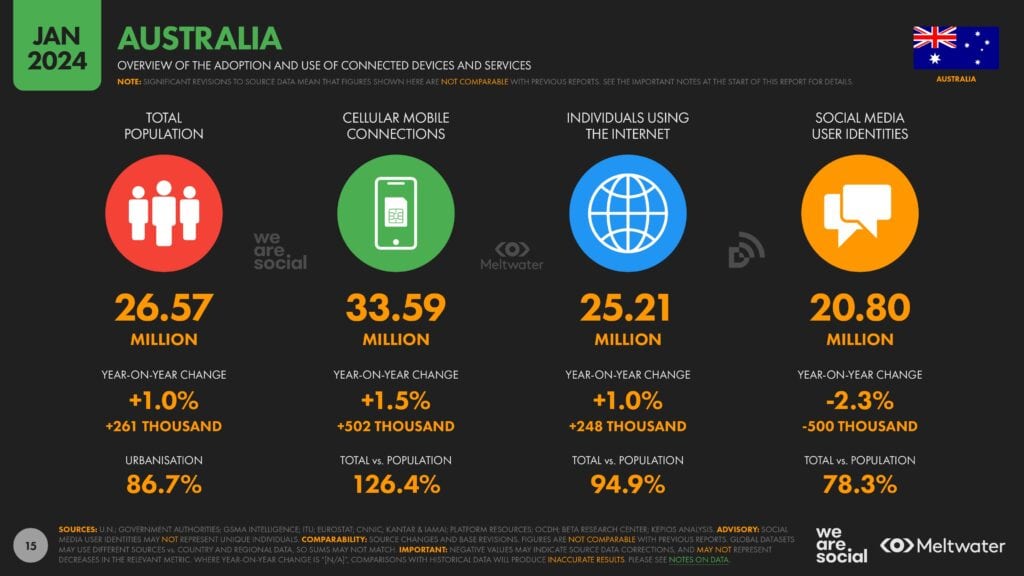

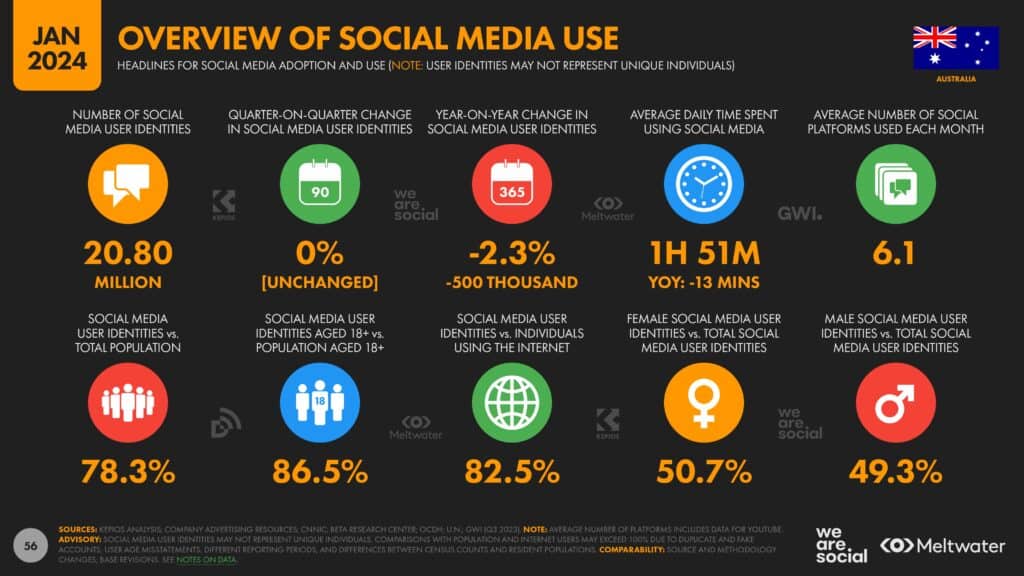

The digital space is of growing importance in Australia, according to the report. The data showed there are 25.21 million internet users, representing 95% of the population, and 20.80 million social media identities, equating to 86.5% of the adult population.

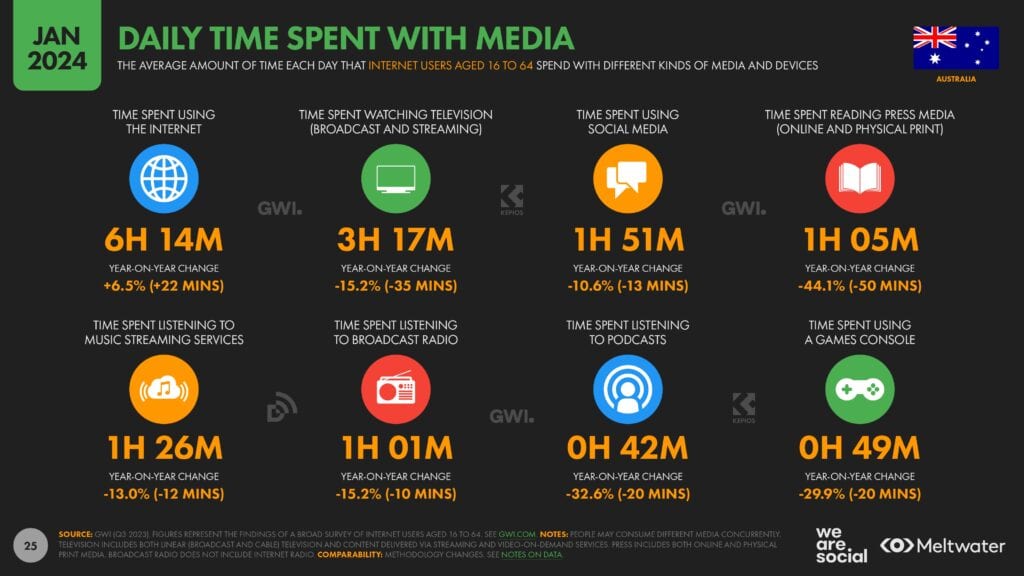

This is further reflected in the daily time spent online for Australians aged 16 to 64, which is an average of 6 hours and 14 minutes using the internet each day and 1 hour and 51 minutes on social media.

Conversely, there is a notable decline in time spent using traditional media. Watching broadcast and streaming TV (-15%), reading online and press content (-44%), streaming music (-13%), listening to broadcast radio (-15%) and podcasts (-33%), and using game consoles (-30%) is down, according to We Are Social and Meltwater.

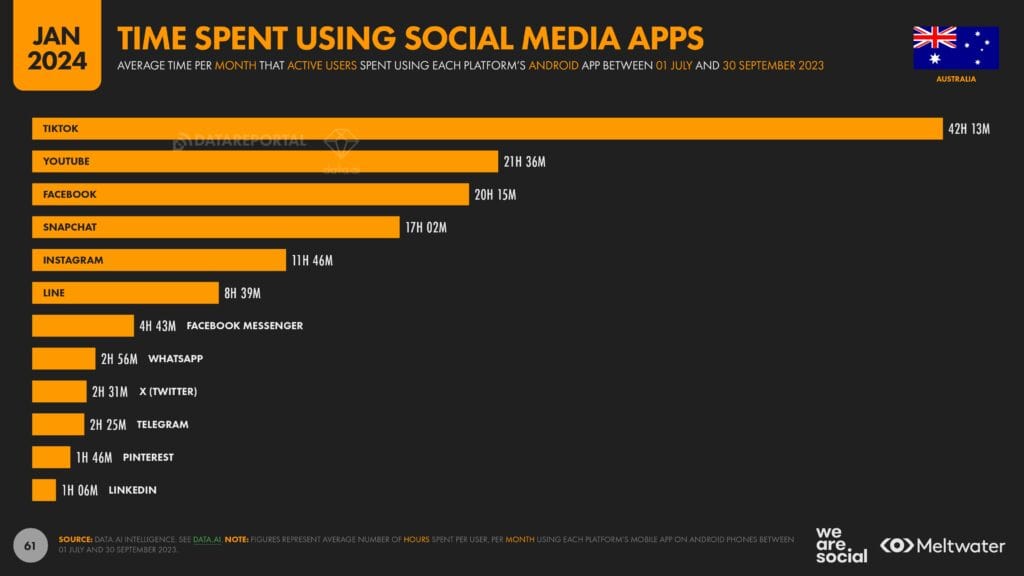

We Are Social and Meltwater’s data found TikTok had the highest average time per Android user of any social app, with 42 hours and 13 minutes per month – equating to almost one and a half hours per day using the platform. Right behind TikTok is YouTube, with the average user spending 21 hours and 36 minutes per month on its Android app.

The report noted that TikTok’s significant ad reach, now close to 10 million (+17%), and high volume of downloads and consumer spend, are indicative of its rising prominence in the social media landscape in Australia, otherwise dominated by Meta.

Facebook remains dominant as the Nation’s favourite platform, with one in four Australians spending an average of 20 hours and 15 minutes per month. The platform also boasts a potential ad reach of over 16.65 million users or 66% of internet users.

Following closely behind is Instagram, with three in five internet users engaging with the platform and spending an average of 11 hours and 46 minutes per month.

The report noted that its total potential ad reach shows the biggest growth among the top social apps, increasing by almost 20% in the past year, now close to 14 million. Meanwhile, Snapchat users spend 17 hours and 2 minutes and 619 sessions per month on the app.

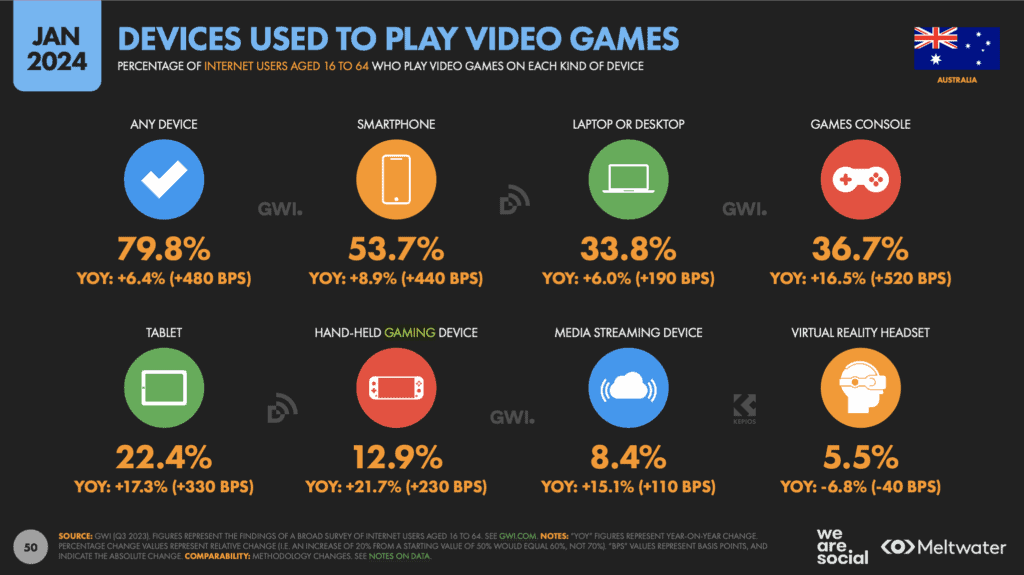

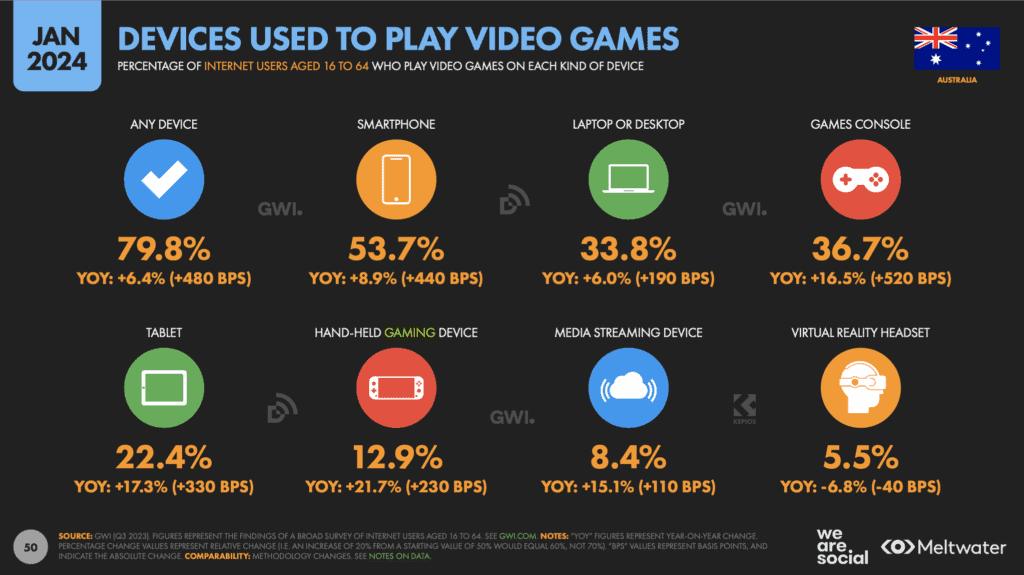

The report also shed light on gaming habits, revealing that nearly 8 out of 10 Australian internet users aged 16 to 64 play video games, with hand-held gaming devices showing the strongest growth, +22%, signalling momentum behind on-the-go gaming.

Suzie Shaw, CEO at We Are Social, said the data speaks volumes about how integral digital platforms have become in the daily lives of Australians.

“With almost all of the population active on social media, it’s clear that these platforms are no longer just an option but a necessity for brands to connect and engage with their audience.

“The remarkable surge in TikTok usage is proof of its evolution from an ’emerging platform’ to a pivotal channel. With its engaging content and sophisticated algorithm, TikTok captivates users’ attention like no other platform.

“Creators can be powerful allies for brands on the platform, boosting their cultural clout, helping them reach new audiences and influencing people’s choices. But TikTok is different from any other social platform. Marketers must grasp its nuances to capitalise on its immense potential.”

David Hickey, executive director of Asia-Pacific at Meltwater, said the report shows how social media stands as the cornerstone of brand engagement and consumer interaction. He noted the growing investment in social media advertising underscored its pivotal role in a brand’s overall marketing strategy.

“As social media continues to shape consumer behaviour, it has become imperative for marketers to understand and capitalise on key insights from these platforms.

“These insights not only inform the refinement and effectiveness of future campaigns but also serve as the bedrock for maximising returns on their investment,” Hickey added.