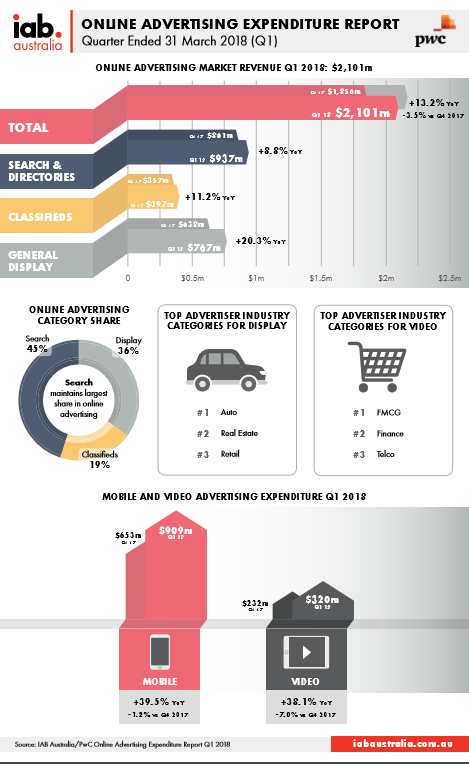

Digital advertising revenue reached $2.1 billion for the first quarter of 2018, driven by significant growth in both video and mobile advertising, according to the Online Advertising Expenditure Report released by IAB/PwC.

• Media Consumption Forecast: The rise of mobile forcing brands to transform media planning

The report also highlights a shift in advertising spend with marketers favouring General Display advertising over both Classifieds and Search & Directories.

While the overall digital advertising revenue increased 13% year on year, General Display advertising recorded 20.3% growth in the same period. Classifieds increased 11.2% year and Search recorded 8.8% year on year growth. Both video and mobile advertising were up (38% and 39% respectively) in Q1 2018 versus Q1 2017, with video reaching $320 million for the quarter, representing 42% of the total General Display advertising category.

Total revenues for Q1 were down 3.5% versus December 2017, reflecting a standard seasonal trend where the March quarter tends to be softer following the Christmas period.

The IAB / PwC Online Advertising Expenditure Report is now in its 11th year of revenue reporting for the digital industry.

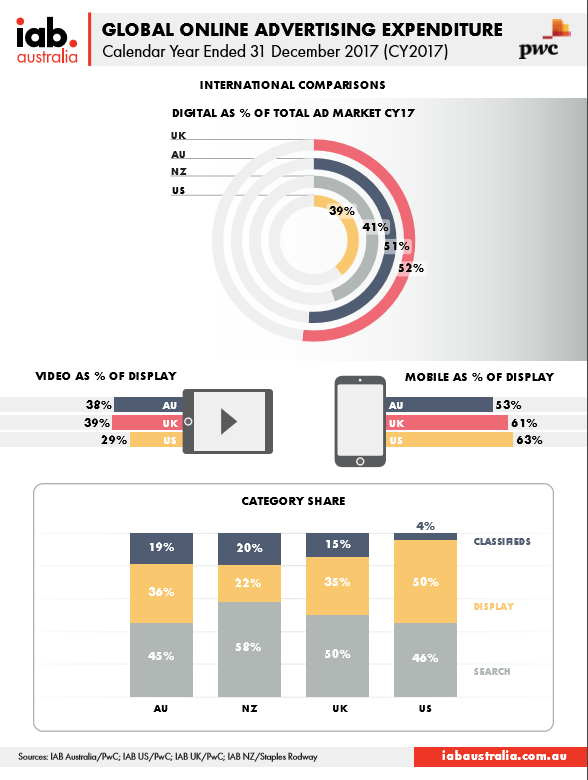

The IAB said the data shows that the Australian market more closely resembles the UK than either the US or NZ markets, with Display advertising representing 36% and 35% of ad expenditure in Australia and the UK (respectively) compared to 50% of ad spend in the US. Similarly Australia’s share of video advertising as a proportion of total online advertising is 38%, in line with the UK’s 39% and significantly higher than both the US (29%) and NZ (23%).

According to the Q1 report, auto advertisers continue to be the largest investors in digital display advertising at 18.3% share of spend. However, the FMCG industry is increasing its spend and is now the largest advertiser category for video advertising at 12.2%.

Overall the range of industries investing in video has diversified over the last 12 months, with industries including Finance (10.8%) and Telecommunications (8.7%) increasing their video spends. The top five spenders in video who make up a combined 47.4% of the total market include FMCG, Finance, Telecommunications, Retail and Automotive.

The latest report shows Search & Directories continues to represent the largest proportion of the online advertising market in Australia at 45% ($937m) for the March quarter, with General Display at 36% ($767m) and Classifieds at 19% ($397m).

Mobile advertising expenditure decreased in the March quarter to $909.1 million after record growth in the December 2017 quarter during the Christmas retail period. 56% of mobile advertising expenditure is attributed to Mobile Search and 44% to Mobile Display.

Smartphones continue to attract a greater share of advertising expenditure at 90% compared to tablets’ 10% share, increasing their share from the prior December quarter (80% and 20% respectively).

Independent research company, CEASA confirmed in March 2018 that digital represented 50.7% share of the total advertising market expenditure of $15.6B for calendar year 2017.