As global entertainment companies struggle with their streaming business models, Netflix has revealed it is heading in the right direction.

Reporting its Q2 2023 results, Netflix revealed the introduction of paid sharing in 100+ countries was a success with revenue higher in every region with sign-ups exceeding cancellations.

“Paid net additions were 5.9m in Q2, and today we’re rolling out paid sharing to almost all of the remaining countries,” said the company in its results commentary.

It reported Q2 revenue of $8.2b [all figures are US$] and $1.8b operating profit were “generally in-line with our forecast”.

As to the outlook, Netflix commented: “We expect revenue growth to accelerate in the second half of ‘23 as we start to see the full benefits of paid sharing plus continued steady growth in our ad-supported plan.

“While we’ve made steady progress this year, we have more work to do to reaccelerate our growth. We remain focused on: creating a steady drumbeat of must-watch shows and movies; improving monetization; growing the enjoyment of our games; and investing to improve our service for members.”

The Queen’s Gambit makes the Netflix’s all-time top 10

Netflix subscriber numbers climb

The company reported global streaming members were up to 238.39m, up 8% from 220.67m 12 months ago.

No breakout of how Australia performed of course. But the subscribers in the APAC region lifted from 34.80m to 40.55m year-on-year.

Audience satisfaction

“We focus on engagement because it’s the best proxy we have for satisfaction,” the company told shareholders. “It’s also closely linked to retention, an important driver of our business. Key for Netflix members is the variety and quality of our content, with the understanding that quality is in the eye of the beholder.

“We’re often asked ‘what is a Netflix show?’ The answer is one that super serves the audience, leaving them highly satisfied and excited for more. It’s the satirical dramedy Beef (starring Ali Wong and Steven Yeun) and the dating show Love is Blind S4 (both of which were in the Netflix Top 10 throughout April), the romance of Queen Charlotte: A Bridgerton Story and the action of The Night Agent (both of which were in our top 10 throughout May)—stories that could not be more different and yet thrilled millions. The combination of content variety and personalization means that each person easily finds titles they will love.”

Beef

Global programming key to audience growth

“Q2 was a good example of the range to which we aspire. Members could choose dramas like The Diplomat and Sanctuary (Japan), adrenaline-filled action with Arnold Schwarzenegger in FUBAR (followed by Arnold, a documentary about his life) and Fake Profile (Colombia), satire with Black Mirror, sports with the Tour de France: Unchained, romantic young adult comedy with XO Kitty (a TV spinoff from the To All Boys I’ve Loved Before film trilogy) or rap competition with Rhythm & Flow France S2.

Netflix drama The Diplomat

“All these titles not only hit Netflix’s Top 10 list in their own country but also across multiple countries and our Global Top 10 – showing that, with good subtitles and dubbing, plus easy discovery, great stories can truly come from anywhere and excite audiences everywhere. Even in the US, which has historically had incredibly local viewing habits, we’ve seen non-English language titles gain increasing popularity. Shows like Physical 100 (Korea), The Glory (Korea), Alice in Borderland (Japan), Marked Heart (Colombia), The Snow Girl (Spain) and Que Viva Mexico! (Mexico) and films such as Hunger (Thailand) and AKA (France) have all hit Nielsen’s weekly original streaming TV or film top 10 lists in the US for at least one week this year.”

Building ad business “not easy”

Commenting about the importance of ad revenue, Netflix explained:

“Advertising enables us to offer consumers a lower price point and, eight months post-launch, we’re working hard to scale the business. Our key focus is improving the ads experience for both members and advertisers. In addition to now offering 95% content parity globally (by viewing), more streams plus improved video quality on our ads plan, we’re partnering with Nielsen and EDO to improve measurement and innovating for advertisers.

“Brands can also now target media buys on our Top 10, which is updated daily and enables them to connect with audiences during our biggest viewing moments. While we continue to grow our reach – ads plan membership has nearly doubled since Q1 – it’s still off a small membership base, so current ad revenue isn’t material for Netflix. Building an ads business from scratch isn’t easy and we have lots of hard work ahead, but we’re confident that over time we can develop advertising into a multi-billion dollar incremental revenue stream.”

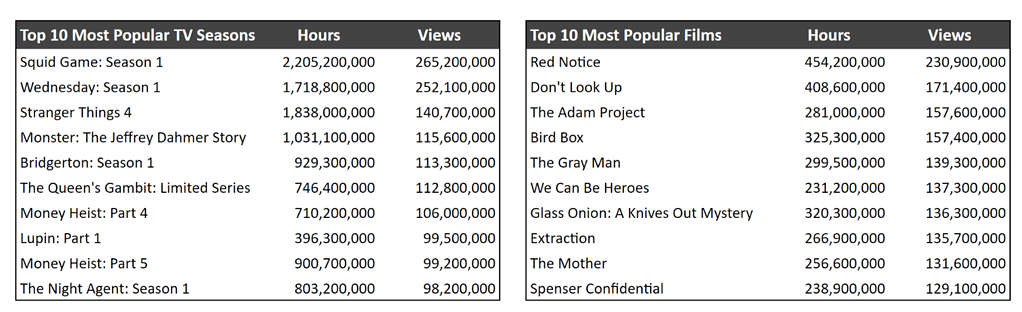

All-time biggest hits

Netflix released a consolidated list of its global Top 10 all-time most popular TV shows and movies based on views.

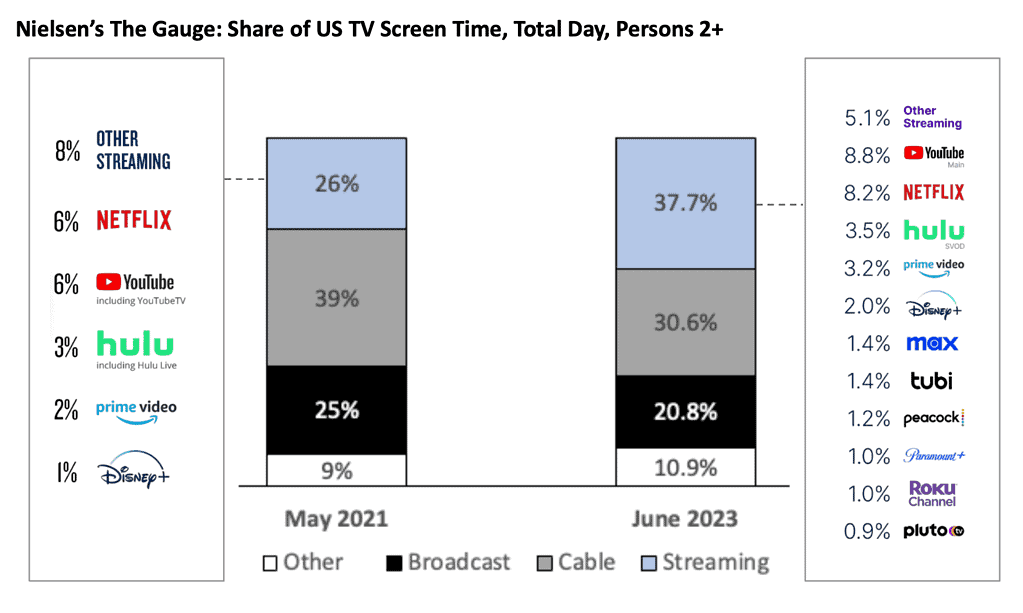

Streaming competitors

“We expect that competition will remain intense, including within streaming,” commented Netflix. “Our biggest traditional entertainment competitors, Disney, Comcast/NBCU, Paramount Global and Warner Brothers Discovery – with their large content libraries and creative expertise – are now focused on profit so they can build sustainable, long term streaming businesses. And our big tech competitors Apple, Amazon and YouTube – with their broad reach and deep pockets – continue to invest heavily to grow their streaming revenues.

“Netflix’s revenue was $32b in 2022, compared to nearly $40b for YouTube across all its products (trailing 12-month basis as of Q1’23) and Amazon’s $35b subscription revenue in 2022, of which we assume the majority relates to the Prime bundle that includes shipping, video and other services. Combined with Apple’s video initiatives, there’s quite a competitive battle happening.”

See also: Netflix – In crowded marketplace, claims leadership in engagement, revenue, profit