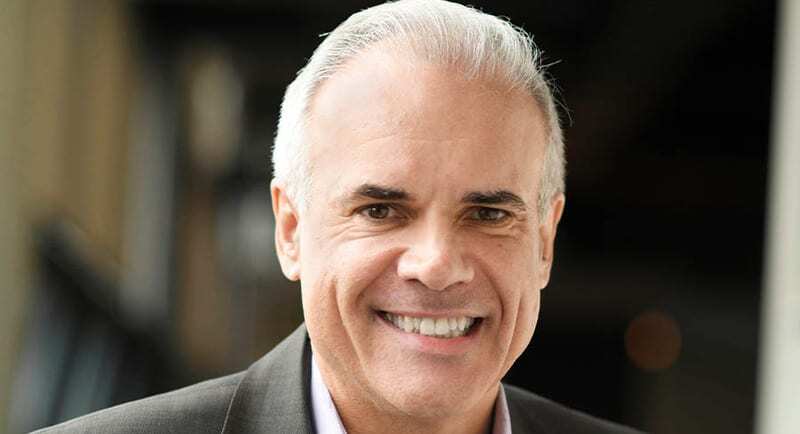

ARN chief content officer Duncan Campbell has labelled Seven West Media’s recent share acquisition an endorsement of the good health of the radio industry.

Speaking to Mediaweek following an eventful few weeks in Australian radio, Campell said “Everyone’s talking about radio, which I think is a real positive. It makes sense for Seven to take a stake in ARN and they obviously see radio as having a future – which some people don’t.

“I’ve always believed it has a future and to see people investing in it, and buying a stake in audio companies in Australia is, I think, a very positive thing.”

News broke earlier this week that Seven West Media had become the largest shareholder of ARN Media. Having thus far not made a major investment in radio or digital audio, Seven has now acquired a 19.9% stake in ARN via an off-market transaction.

See Also: Radio wars: Seven enters battle for control of audio brands Triple M and KIIS

Seven’s investment in ARN comes after a big move from ARN themselves, rounding out October by joining a private equity bid for SCA and its Hit and Triple M radio networks, alongside Anchorage Capital.

In addition to selling commercial opportunities on 99 SCA licences, LiSTNR and 96 TV signals, SCA also provides national sales representation for 56 other radio stations and 39 TV stations.

Under the Indicative Proposal, SCA shareholders would receive 0.753 ARN shares and 29.6 cents cash per SCA share.

For their part, SCA hasn’t outright rejected the proposal, with SCA Chair Rob Murray telling shareholders at the company’s AGM that “The proposal we have received from ARN and Anchorage is complex and highly conditional. Our Board and executive team are assessing it carefully to work out whether it could create additional value for our shareholders and whether the proposed terms are in our shareholders’ best interests.”

See Also: “Complex and highly conditional”: SCA address takeover bid at AGM