Group result highlights

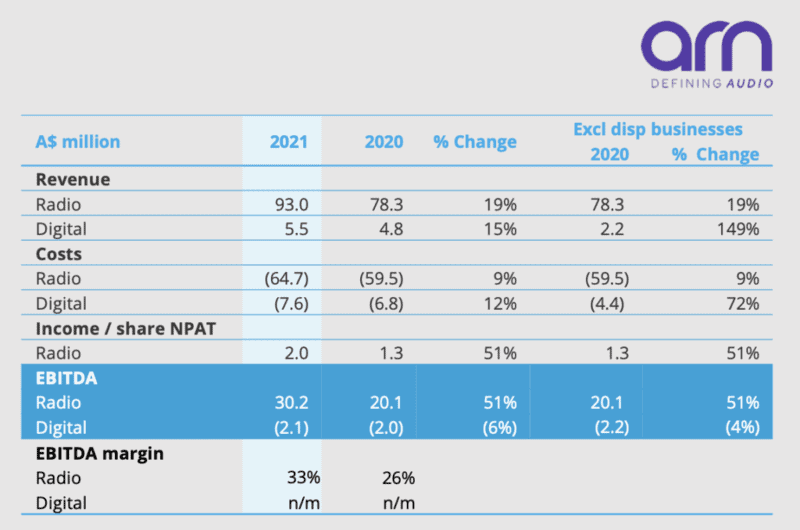

• Revenues of $109.9 million, up 21% on the previous corresponding period (on a like basis)

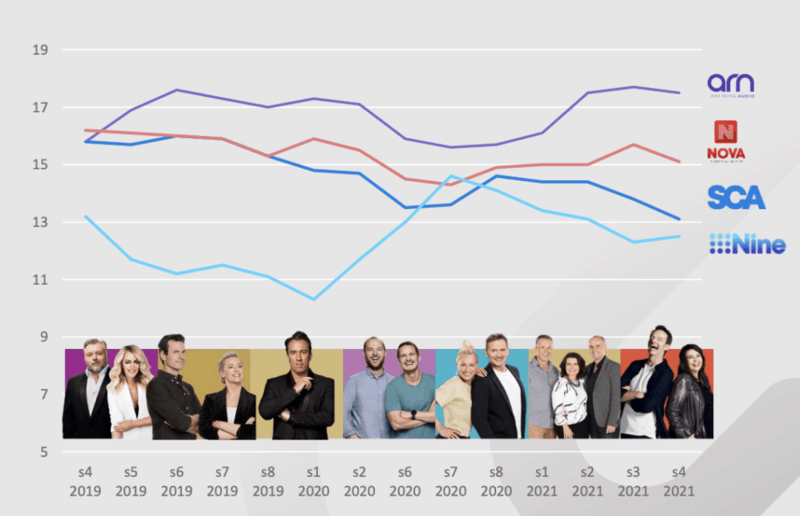

• Market-leading audience ratings performance continued, with ARN holding the #1 network position in Australia for 13 consecutive surveys

• Digital revenues ahead of expectations (+149%)

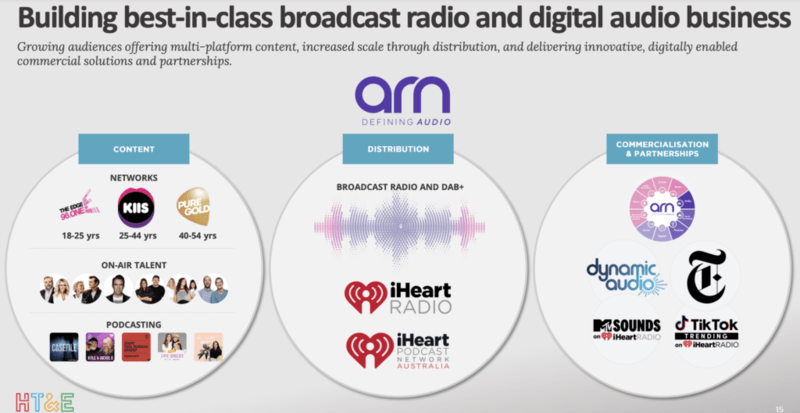

• Investing in digital and data capability in content, distribution and commercialisation to drive future growth

After Covid impacted businesses in 2020, HT&E reported it recovered strongly in the June half.

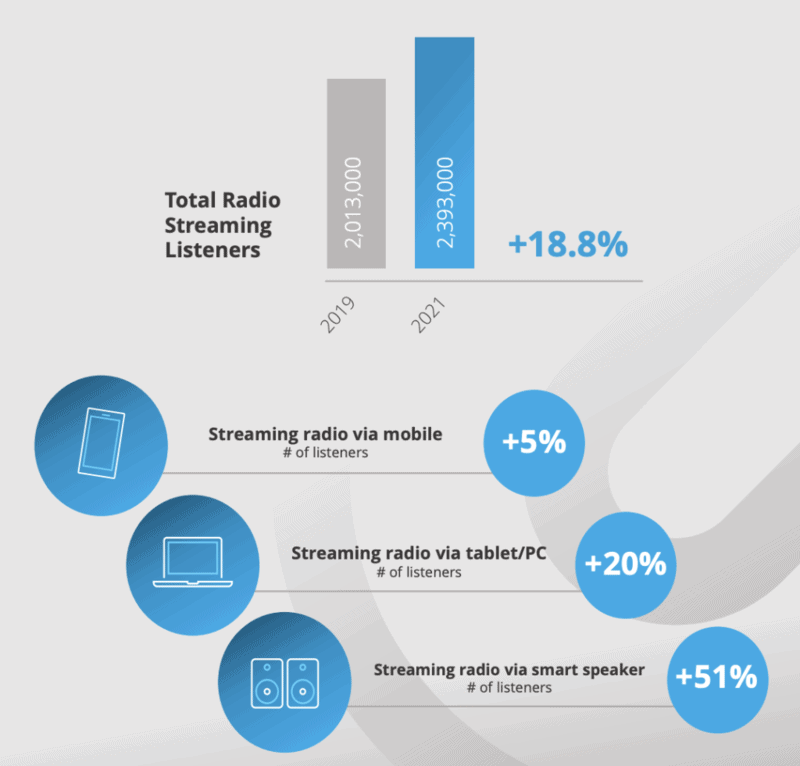

The company reported continued ratings dominance and that its radio fundamentals remain robust with radio listenership experiencing continued growth and increasing migration to digital live streaming, with digital revenues ahead of expectation.

Group revenues from ordinary activities of $109.9 million were materially higher, with an increase of $16.9 million on last year.

EBITDA increased 55% on the previous corresponding period to $30.4 million.

HT&E CEO and managing director Ciaran Davis said, “What ARN’s network has achieved in terms of ratings performance is nothing short of exceptional and confirms our strategy of investing in the right talent, both on and off air, to drive performance. We are indisputably the dominant player in Australian radio, holding the #1 network position in Australia for 13 consecutive surveys.

“We are also a leader in digital audio, making strategic investments in original content across our platforms to generate market-leading opportunities for our commercial partners. Our digital revenues are up 149%, well ahead of expectations, as we build a richer, smarter and more powerful audio business.

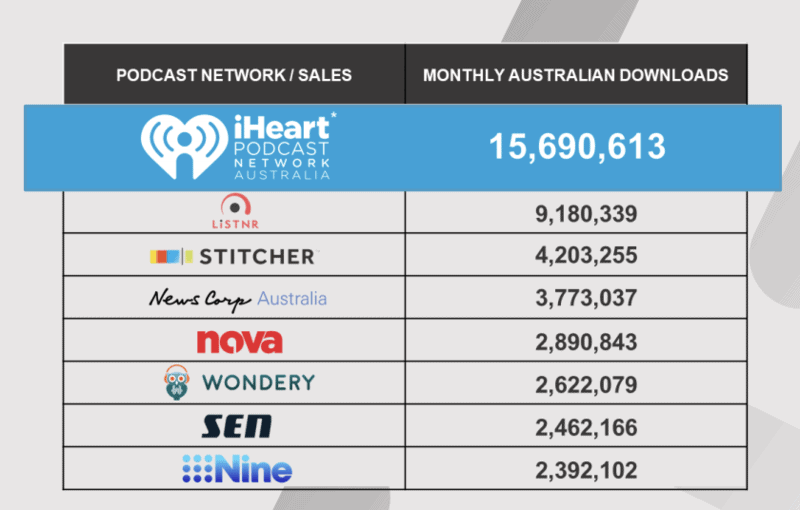

“As Australia’s #1 podcast publisher, we are delivering consistent growth for the iHeartPodcast Network Australia across our diverse content offering. The impressive numbers tell the story, with year-on-year, national total downloads on the iHeartPodcast Network Australia for June up 58%.

“We will continue to invest to deliver scale, multi-platform content, digital and data capabilities and in technology that makes it easier to plan and book with our assets.”

Australian Radio Network (ARN) highlights

• #1 metropolitan radio network in the country reaching over 5.25 million people a week

• #1 network for all key demographics, including the important 25-54 category

• Kyle and Jackie O in survey 4 secure a 15.5% audience share

• Christian O’Connell GOLD 104.3 continued to acquire new audiences and ninth consecutive survey as #1

• Will and Woody resonating with audiences and brands, #1 position in Sydney and #2 position in both Brisbane and Adelaide

• National total downloads on the iHeartPodcast Network Australia for June were up 58%

ARN is the #1 metropolitan radio network in the country reaching over 5.25 million people a week, the #1 podcast publisher in the country averaging over 17 million downloads a month, and the leading provider of integrated radio, music and podcasts digital audio content in one place with over 2 million registered users on iHeartRadio.

Year-on-year, national total downloads on the iHeartPodcast Network Australia for June were up 58%, for June, with consistent growth realised across popular podcast categories including True Crime (up 366%), Comedy (up 44%), Sport (up 178%), and Business (up 43%).

ARN outlook

In July, ARN revenues grew +19% on the prior comparative period. August has seen a slight easing of bookings, but pacing suggests a similar result for the month.

ARN noted extended lockdowns, particularly in Sydney and Melbourne, may impact FY21 performance mainly due to some uncertainty of the SME market however forward bookings for the remainder of the year are currently tracking well ahead of the same time last year with briefing activity remaining positive.

Recent digital revenue performance has continued into Q3, with average monthly revenues for the quarter pacing to finish in excess of $1 million per month.

Investments in the launch of a new breakfast show in Melbourne; the implementation of original podcast content creation strategy, increased digital commercial capability and a relaunch of The Edge will see total people and operating costs for FY21 now expected to finish ~$2-3 million above FY19 levels.

See also: Australian Radio Network rebrands to ARN, announces evolution of Defining Audio proposition