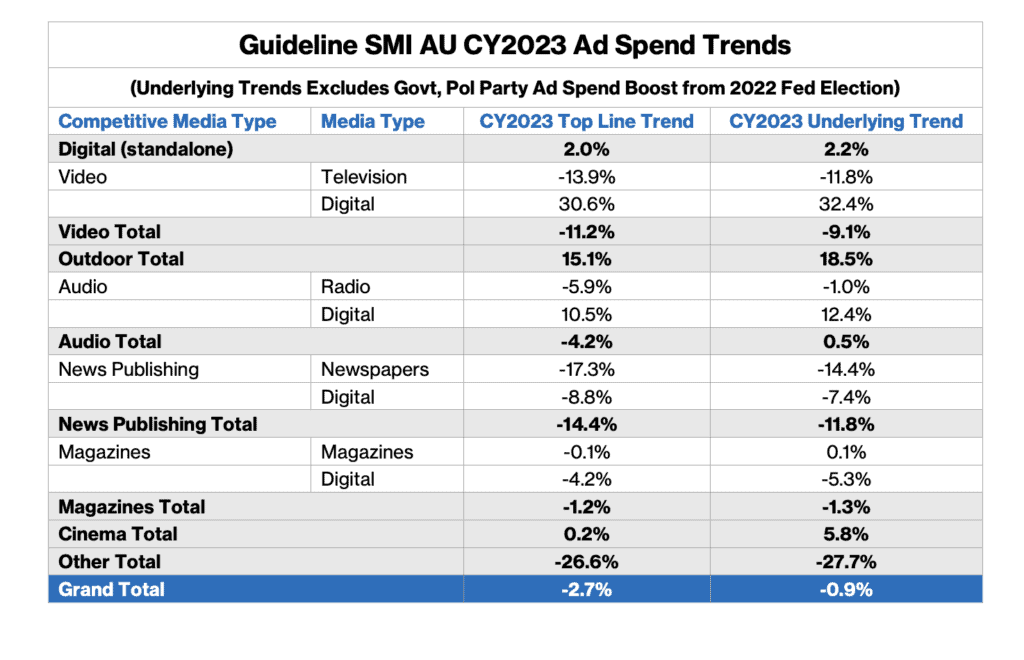

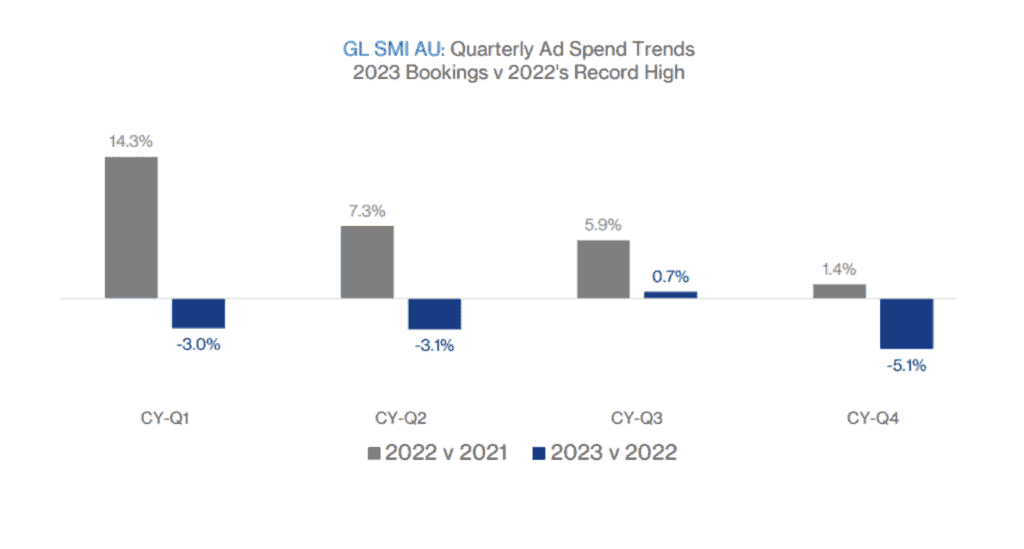

Advertising spend in 2023 dropped -2.7% to hit $660m or 8.2% to deliver the second-largest total of annual ad spend ever recorded, according to the latest figures from Guideline SMI.

The 2023 figures from the global benchmark for advertising demand are larger than pre-Covid 2019 figures, and when the Government and Political Party ad spend categories are removed from both 2019 and 2022, the underlying ad market declined just -0.9% or $72m.

The Out-of-home market was the success story of 2023, with revenue up +15.1% to achieve a record high.

Jane Ractliffe, APAC managing director of Guideline SMI, said, “Outdoor media’s recovery from the Covid era has been quite extraordinary with growth continuing to accelerate each year since the pandemic with this year’s revenues now 70% higher than the Covid-hit year of CY2020 but also 43.3% above the CY2021 total even though the media had already reported a strong recovery that year.”

“Outdoor is doing well in a market that’s emerged as the second largest ad market of all time, with last year’s abnormal Federal Election boost delivering a huge record total. And despite higher interest rates and global uncertainty, the CY2023 total is just 0.9% below that record level on an underlying basis,” said Ractliffe.

The surge of popularity in BVOD and CTV drove a +32.4% surge in growth for TV-related video content. The data revealed the value of Video-based Digital campaigns increased by +7.4%, with the category shifting towards the traditionally larger Display inventory (+1.4%) with only $150 million now separating the two categories.

Audio was another growth area, with the podcast and streaming boom continuing throughout 2023 to deliver +0.5% growth on an underlying basis.

The Automotive Brand, Insurance and Restaurant categories all recorded the highest increases in advertising investment, increasing by +11.3%, +7.7% and +8.6%, respectively.

The biggest decline was government ad spend, which dropped by more than $100m in the CY2022 year.

Guideline SMI’s figures for December revealed the economic market pressures, which overall ad spend back -9.1% year-on-year. Outdoor was the only major media to grow revenues – up 6.8%.

The 2023 Guideline SMI figures will be further explored in an exclusive webinar presentation in partnership with Mediaweek. The event will see Guideline SMI APAC managing director Jane Ractliffe recap the major media trends from 2023 and combine historical data with forward pacings to identify the key ad spend trends for the year ahead. Click here to purchase your ticket.

See also: Guideline SMI report to detail key media and ad spend trends for 2024

See also: SMI reports record ad spend in November as media agencies invest $850m+