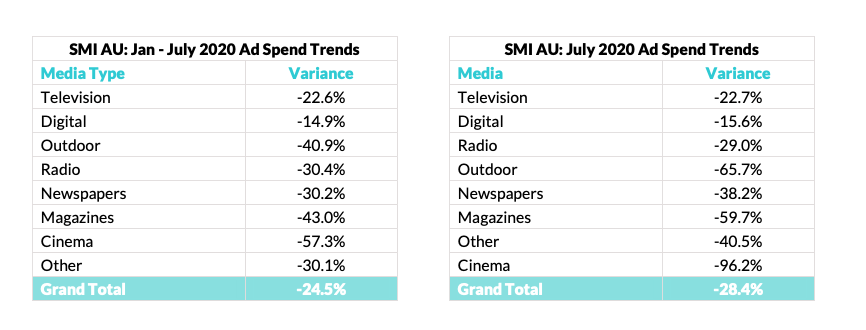

Australia’s media industry continues to rebuild following the huge COVID-19 pandemic hit, reporting the second consecutive month of lower declines with a 28.4% fall in national marketer advertising expenditure in July, according to SMI.

The organisation that tracks advertising spend was sounding a little more upbeat than the treasurer this week as the SMI July data release preceded Government details about the havoc Covid-19 had wrought across the Australian economy.

SMI added that the data for August shows advertisers have spent more in August than for the whole of July, with the strongest advertising demand seen in television (so far back just 11.2% with the data extracted with three trading days to go).

All major media again reported large double-digit declines in July ad spend, but there were some stronger sectors with regional radio bookings back just 11.6%; social media ad spend down 13.8% and bookings to video sites back just 13.7%.

The market also reported stronger demand from some key categories, with the largest category of retail delivering more stable bookings (-3.8% in total) as chemists, supermarkets and outdoor/garden retailers all grew their media investment.

But the largest percentage increase among the major product categories came from the toiletries/cosmetics market (+20.7%). Within this market the investment in advertising hair care products almost doubled with most of those extra funds moving to the TV and digital media.

SMI AU/NZ managing director Jane Ractliffe said the SMI data was already showing there will be an even lower level of decline in August with the total (ex digital media) so far back 25.2%.

“It could be that for August the percentage decline reduces into the teens as we’re seeing strong forward bookings for numerous product categories and both the television and digital media are more quickly returning to a pre-COVID state with digital’s July decline of 15.6% the lowest of any major media,” she said.

“For the month of October the value of committed ad spend is now only six percentage points behind where it was at this time last year.”

Given the lower July decline, the trend for the calendar year-to-date also continues to improve with the market now back 24.5% over the past seven month period.

That result was initially driven by the natural disasters at the start of the year but was then exacerbated by COVID with ad spend falling by 43.5% in May.