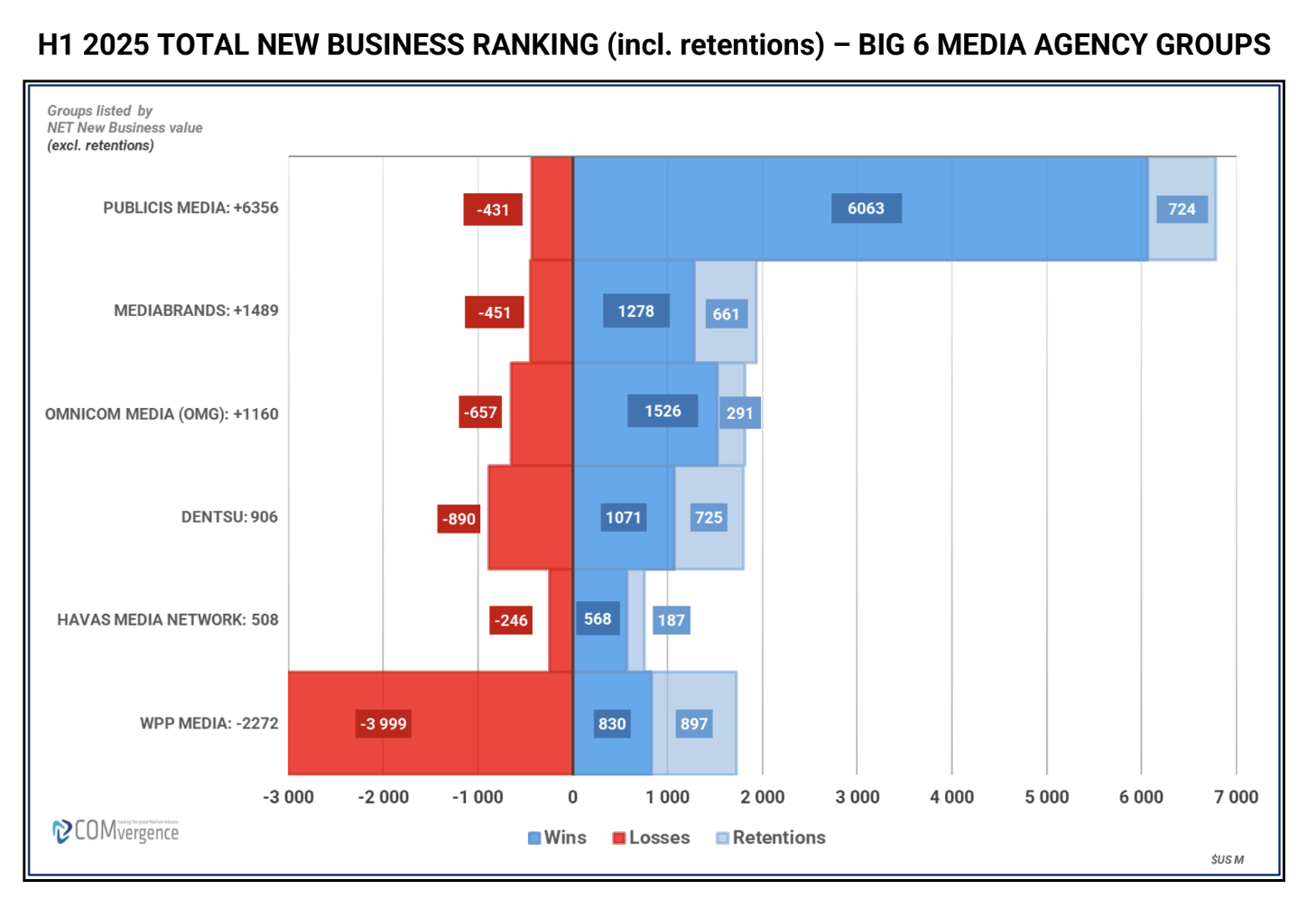

Publicis Media has taken the top spot in COMvergence’s H1 2025 Global New Business Barometer, clocking an impressive US$6 billion in new client billings, far outpacing its competitors and underscoring the group’s dominant run in global media pitches.

According to the report, Publicis Media led both Total and Net New Business results, with wins including Coca-Cola (US$835 million) in North America and eight global accounts: Barilla, Dropbox, Goodyear, LinkedIn, Mars, Paramount, PayPal, and Santander.

The group also posted the highest retention rate among the Big 6 holding companies, holding onto 63% of its billings under review.

Trailing behind, Mediabrands ranked second with US$1.5 billion in new business, driven by strong U.S. performance, while OMG came in third thanks to global consolidations like Kimberly-Clark (ex-North America) and Zurich Insurance.

In contrast, WPP Media was the only holding group to post a negative result, both including and excluding retentions, a sign of a tougher first half for the London-based giant.

Initiative leads at network level

At a network level, Initiative ranked first globally, recording US$1.4 billion in new business, powered by US wins including Paramount Network (US$450 million) and Anthropic.

Spark Foundry followed with key account consolidations such as Abbott (US$400 million) and the global win of LinkedIn (US$180 million), while Zenith came in third after successfully defending PepsiCo in China (US$225 million) and picking up PayPal in the U.S. (US$450 million).

COMvergence said the top three positions remained unchanged in Net New Business rankings, measuring wins minus losses, showing stability at the upper end of the competitive agency field.

A hyperactive global pitch market

The report tracked nearly 1,840 media account moves and retentions across 49 countries, involving 1,195 advertisers and totalling US$17.6 billion in reviewed spend, up 7% from the same period in 2024.

The US accounted for 45% of total spend, while China contributed 11%.

Local reviews represented the majority at 61% of spend, with global and multi-country reviews making up US$6.9 billion.

COMvergence noted that the overall retention rate dropped to 19%, the lowest in eight years, signalling a highly volatile market where even established agency relationships are under pressure.

Independent agencies also made a strong showing, capturing US$2.9 billion (16%) of reviewed spend.

Standout wins included Spectrum (Horizon Media, US$800 million) and Peloton (US$225 million). Notably, Accenture Song secured its first major media win in Australia with Optus (US$45 million).