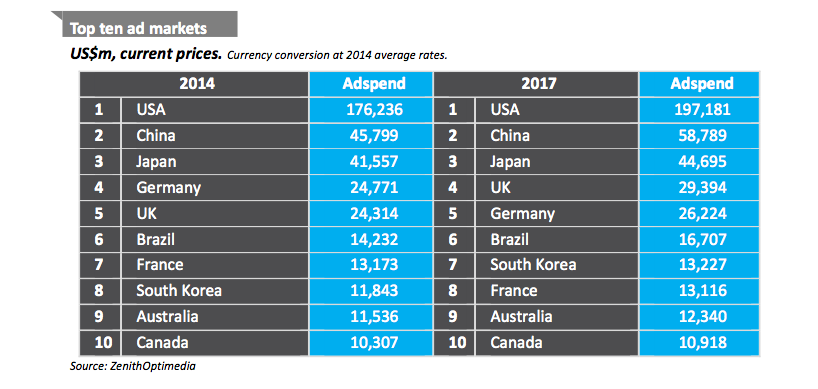

ZenithOptimedia predicts global ad expenditure will grow 4.2% in 2015, reaching US$531 billion by the end of the year. The forecast for 2015 is down very slightly from the March edition (by 0.2 percentage points), mainly because Latin America has suffered from low prices for oil and other export commodities, and the weakness of the economy in Brazil.

Advanced Asia

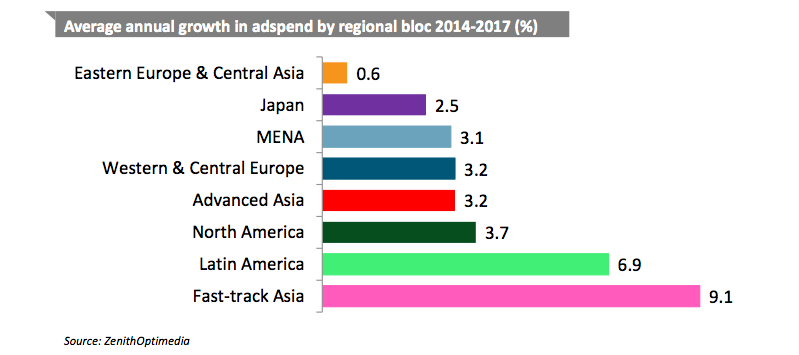

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that ZenithOptimedia has placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. The estimated growth there is 1.9% in 2014, after weakness in the property market damaged consumer confidence in Singapore and Australia suffered from low prices for its key commodity exports. As these problems recede, ZenithOptimedia expects growth in Advanced Asia to pick up to an average of 3.2% a year through to 2017.

Australia

ZenithOptimedia Australia forecasts 1.9% growth in adspend in 2015. While this will be an improvement on 2014’s 0.9% growth, adspend growth remains behind GDP growth of about 3% year-on-year. However, there are signs of improvement in some of the economic factors that influence the Australian advertising market.

Consumer sentiment improved in May after spending the majority of the previous 16 months in the negative, boosted by a well-received Federal budget (a year after the disastrous reception to the 2014 budget). There has also been a second reduction this year to interest rates, already at record lows. However, there are some factors keeping the handbrake on the economy and therefore the advertising market. Unemployment remains high with a pessimistic outlook. And a low Australian dollar continues to put pressure on commodity prices and wage growth.

This means there is a subdued economic outlook and as a result the Australian advertising market is seeing cautious, fragmented growth.

Growth by category is variable. Communications, travel and media/entertainment are all up in the year to date. Meanwhile the biggest categories – retail and finance – are down, and automotive is flat.

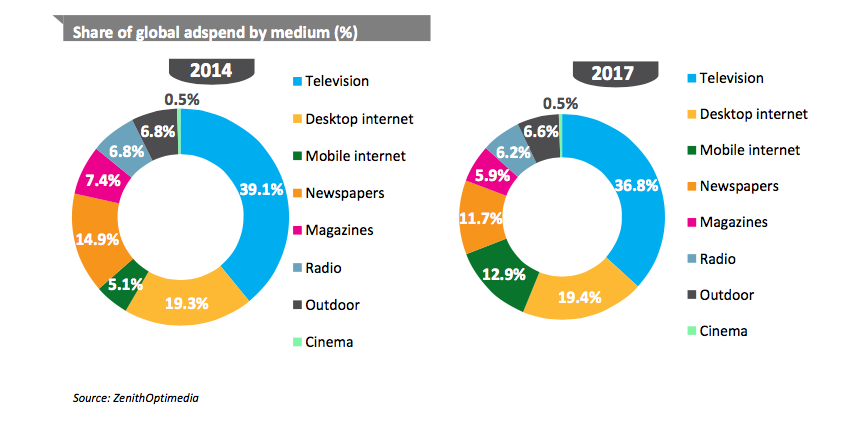

We expect most of the growth in 2015 will come from internet advertising. Outdoor, radio and TV will be relatively flat, while newspaper and magazines continue to suffer double-digit declines.