If you thought the holiday season would bring peace and goodwill to the Warner Bros. Discovery (WBD) takeover saga, think again. There is no love lost in the trenches of Hollywood M&A.

Because, as of today, Thursday, January 8, the WBD board has delivered its latest verdict on Paramount Skydance’s persistence.

It’s a polite, corporate-speak version of “please go away.”

WBD has unanimously recommended that shareholders reject Paramount’s amended tender offer.

As reported by Front Office Sports, the board has effectively parked the bid in the “too risky” lot while keeping the engine running on its preferred merger with Netflix.

The ‘thanks, but no thanks’ letter

In a statement released late yesterday and published by PR Newswire, the WBD board didn’t mince words. They have officially determined that Paramount’s hostile tender offer is “not in the best interests” of the company or its shareholders.

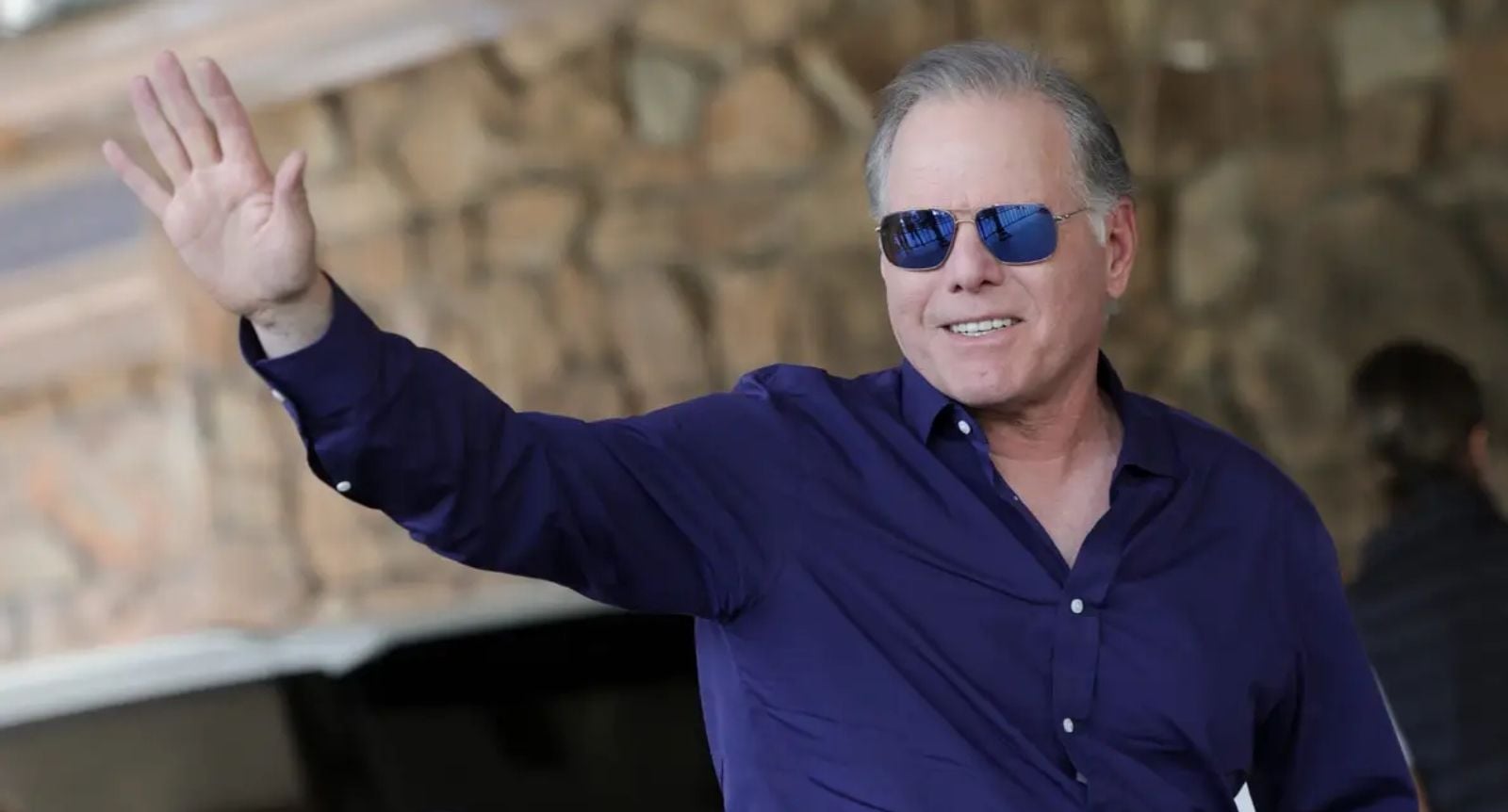

WBD’s David Zaslav, keeps trying to wave goodbye to Paramount Skydance

The rejection is a heavy blow to the Ellison family.

They had hoped that throwing a $40.4 billion personal equity guarantee from Oracle founder Larry Ellison into the mix would calm nerves.

It didn’t. Instead, WBD Chair Samuel Di Piazza Jr. reiterated that the board views the offer as “financially inadequate.”

The board’s logic is simple. Why bet the farm on a leveraged buyout structure laden with debt when you have a ‘superior’ and ‘certain’ deal with Netflix on the table?

The debt bomb vs. the streaming dream

The crux of the rejection lies in the financing. AP News notes that the WBD board has branded the Paramount proposal as a debt-heavy monster.

They argue it would pile more than $50 billion in new borrowing onto the combined entity. They claim this structure creates “excessive risk” and could lead to “considerable value destruction” for shareholders if the market sneezes.

Contrast this with the board’s current darling, the Netflix merger. Announced back in early December 2025, this deal is valued at around $82.7 billion.

It would see Netflix acquire WBD’s crown jewels, the Warner Bros. film and TV studios and HBO/Max streaming assets.

Meanwhile, the linear TV and news chaos (CNN, Discovery) would spin off into a separate, debt-free entity called ‘Discovery Global.’

For WBD, the Netflix deal is the safe harbour. It offers cash, Netflix stock, and a clean separation of assets. Paramount’s bid seeks to swallow the whole company. MS NOW reports the board views this as a messy, regulatory nightmare that could take 18 months to close.

Larry’s cash guarantee doesn’t seem to be helping the Ellison offer

Larry’s billions can’t buy love

You have to feel a slightly wry sympathy for the Ellisons.

Paramount Skydance has now thrown everything but the kitchen sink at this deal.

When WBD complained about financing certainty in December, Larry Ellison stepped up with an “irrevocable personal guarantee” to backstop the equity.

Yet WBD’s board remains unimpressed.

They noted that even with the guarantee, the deal’s execution risks are too high.

Furthermore, they pointed out that the operational restrictions Paramount wants to impose on WBD during the closing period would essentially hamstring the company for over a year. In the fast-moving world of media, being unable to pivot for 18 months is arguably a death sentence.

What now? The clock ticks to Jan 21

So, is the Paramount bid dead?

Not technically. It is a hostile tender offer. The Ellisons are trying to bypass the board and go straight to the shareholders. The offer is set to expire on January 21, 2026.

However, with the board firmly locking the gates and urging investors not to tender their shares, Paramount’s path to victory is narrowing significantly.

Unless David Ellison pulls another rabbit out of a hat in the next two weeks, this bid looks destined to remain permanently parked.