Mediaweek has been tracking the impact of the VOZ Total TV viewing data since it was introduced in 2021 and this week in our VOZ super users series we hear from Nine’s director of sales, television and radio, Richard Hunwick.

Virtual Australia, or ‘VOZ’, brings together broadcast viewing on TV sets and connected devices to provide all-screen, cross-platform planning and reporting for the television industry.

Hunwick started the Mediaweek discussion by noting that commercial television still reaches over 90% of Australians every month. He noted there has been an increasing number of people watching BVOD via connected TV, with someone else sitting next to them, “The same experience as TV has always been.”

Nine’s Richard Hunwick

The biggest surprise about an analysis of VOZ ratings data, has been how quickly “live” viewing is picking up, said Hunwick.

“Programs like Married at First Sight (above) and The Block have always performed relatively well but we’re starting to see significant viewing for things like news and A Current Affair on a nightly basis as people are choosing to stream in real-time rather than watch in broadcast.”

Hunwick also commented on the amount of co-viewing that to date has been overlooked when considering the value available. “Around 70%+ of viewing on a connected TV, an average of close to 1.5 viewers per stream, means there’s an enormous amount of audience that’s being ignored or not counted by buyers when they are considering value opportunities.”

Look at some of the results for sports on TV, said Hunwick. “Sporting events have yielded some interesting results – State of Origin 3 last year saw 313,000 viewers watch exclusively online, and almost 15% of all reach generated in under 40s by the Australian Open was exclusive to BVOD, with over 2m people in total streaming at some point – these are some of the factors that are driving growth in ‘live’ viewing.

Nine’s Love Island

“Love Island has always been the standout with young audiences choosing to view it online. With a high degree of catch-up and binging involved we saw over 45% of total audience weight delivered online across the course of the series – albeit the exclusive reach provided by BVOD was, again, more like 15%. That sort of behaviour, although not as exaggerated, has played out with MAFS, where live stream and VOD audiences have jumped by 25% YOY and now make up about 25% of the viewing.”

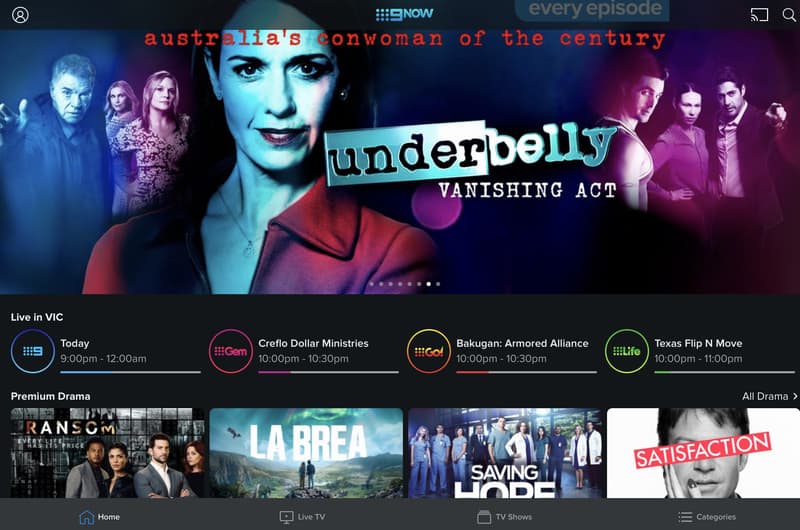

There is a growing audience choosing a streaming first option, said Hunwick. “I keep coming back to ‘live’, yet catch-up remains strong and is growing. All the networks now have a bank of exclusive programming sitting on their BVOD platforms that are driving incremental audience to broadcast. The growth of the ‘streaming first’ audience, people who are choosing to view TV in real-time but via 9NOW is the most significant development and one that we can see is accelerating.

VOZ super users: It’s about the content

“The nature of ‘on demand’ means that we need to stop thinking about dayparts in the traditional way,” explained Hunwick. “It’s about the content, and it can be viewed whenever someone wants and often over an extended period. We still see spikes after 9pm – viewers catching up after the strip shows finish. On the weekend too, but again, with ‘Live’ picking up there is increasingly more viewing in the traditional TV peak times. Big shows on linear tend to be big shows from a live streaming POV, but it doesn’t really matter. Advertisers can drive reach quickly with high-rating linear TV spots, and then use BVOD to help extend that reach significantly and efficiently when additional audiences are watching.”

Advertising opportunities

Regarding working with the new VOZ data, Hunwick noted: “BVOD is digital video, but BVOD is TV as well. We can measure it the same way and in conjunction with a linear buy and it will make for a more efficient, more effective, and higher reaching Total TV result if you buy them together. Of course, there remains a massive opportunity for mid and lower funnel consideration and conversion buys, using deep first-party data to reach qualified customers.

“Think TV and Think Premium Digital have both run significant studies showing the improved attention and STAS results delivered by BVOD over other platforms, but advertisers need to use it at the top end of the funnel in the reach and awareness space as well. The industry is working through a solution to make purchasing programmatic a seamless, cross-company opportunity. Advertisers and agencies should be using BVOD to help build reach, drive efficiencies with younger and more niche audiences and to round out Total Television buys.”

Exploring attention…how engaged is the audience?

“Now we can measure the total size of the audience, we want to look at the relative engagement of the advertising. We think the research Think TV has already done will hold that all television delivers higher attention scores than the social platforms. BVOD will probably generate higher levels of attention than broadcast (it’s non-skippable and more difficult to change channel), and it will be interesting to see if there’s a difference in attention between live and catch-up. Then we’ll look at things like ad pod length and others. Our Powered division has been working with Karen Nelson-Field for a while now and you’ll hear a lot about attention from us this year.”

See also:

VOZ super users: Delivering deeper campaign insights & reach beyond broadcast

VOZ super users: How Total TV data is revolutionising TV buying