Australia’s advertising market continues to defy pessimists and shrug off all economic challenges to report another month of underlying growth in August, reports SMI.

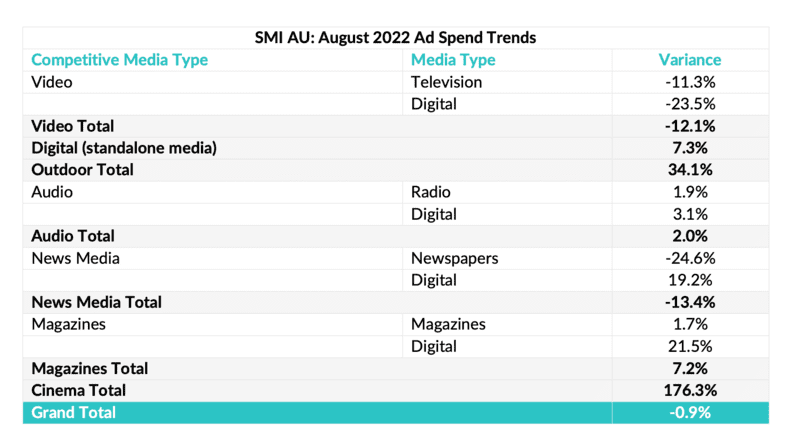

The collation of ad spend data from SMI indicates a headline dip of 0.9% transforming into growth of 6.2% once the impact of last year’s Tokyo Olympics is removed.

Total August ad spend is back just $5.9 million from last year’s record August total but when the media most affected by last year’s Olympic broadcast are excluded (Metropolitan TV and their related Pure Play Video or Streaming Sites) the market instead shows growth of 6.2%.

SMI AU/NZ managing director Jane Ractliffe said there’s no sign the current economic challenges are impacting ad demand, with SMI’s early data for September showing the market total (ex Digital) so far back only 1.1% on last year’s record result.

“The Australian ad market is proving itself to be incredibly resilient given concerns about inflationary pressures and growing interest rates. Even with the abnormal ad spend from last year’s Olympics is included the total ad spend in August is less than $5 million below last year’s record level, and incredibly it’s 13.4% above the pre-Covid total from August 2019,” said Ractliffe.

“We can clearly see that ad demand will also be higher in September as the ad revenues collected last week show the market total is already just 1.1% below that achieved in September 2021, and that’s also excluding all Digital ad spend which will further propel market growth.”

This month Outdoor media is underpinning the Australian market notes SMI, with its ad spend jumping 34.9% to a record August level as its growth accelerates out of the Covid lows. Cinema also delivered strong August gains with its ad revenues more than doubling in August.

TV ad spend was back 11.1% YOY mostly due to last year’s Tokyo Olympics as the TV broadcast only concluded on August 8. The Olympics also affected Digital media with the Video Sites sector back 15.6% due to the absence of the Olympic-inflated streaming revenues.

Radio’s ad revenues also continued to grow, this time up 2.1%. While print newspaper ad spend fell 24.6% (in part due to the Olympics) the News Media industry delivered the highest increase in related online revenues for the month with the total up 19.6%.

Among the Product Categories, Government ad spend continues to normalise with the total back 35% in August, but that decline was mostly remedied by similar growth in Travel category ad spend.

The positive underlying August result has also ensured ad spend for the first eight months of the calendar year remains in record territory with the total now up 8.5%.

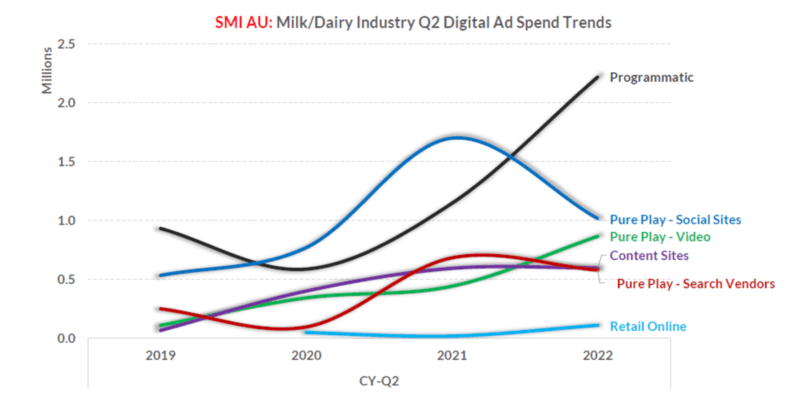

This month SMI has continued to deliver more visibility into ad demand within key Product Categories, this month making further improvements to the Food/Produce/Dairy category with ad spend now being published for four new subcategories: Chocolate, Snacks/Desserts, Dairy/ Milk/Ice Creams and Produce/Baked Goods.

See also: SMI July 2022 – Australian ad market delivers 30 consecutive months of YOY growth