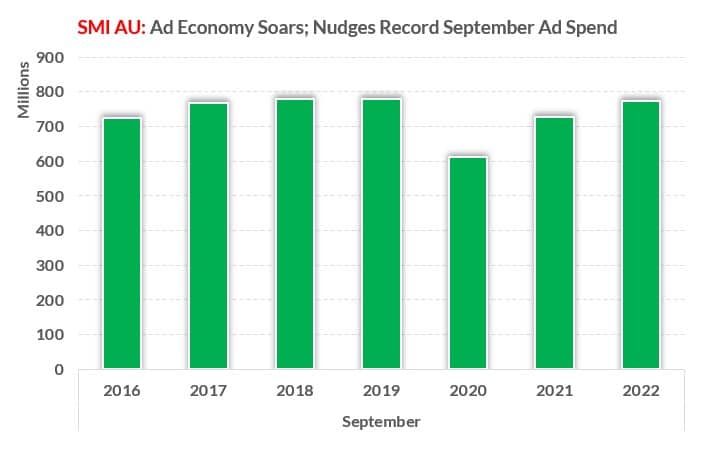

Australia’s advertising market continues to boldly shrug off global uncertainty, and a pessimistic economic outlook as advertisers significantly increased their media investment in September, with the total value of ad spend growing 6.6% to $774.9 million.

That puts the market just 0.7%, or $5.5 million, below the record September level set well before the onset of COVID in 2018.

SMI AU/NZ managing director Jane Ractliffe said the market’s extraordinary resilience looks set to continue into October, with SMI’s Forward Pacings data showing bookings (ex Digital) back just 7% with that payment data extracted when there was still a full week of trading to occur.

“Australia’s ad market continues to disprove the pessimists, with ad spend nudging a record level in September as Automotive and Travel advertisers return strongly to the market and the Outdoor and Cinema media continue their extraordinary recovery from the impact of COVID,” she said.

“Overall ad demand is clearly very robust and as there’s a very strong correlation between ad spend and GDP it does suggest the current wave of economic gloom maybe misplaced. There maybe a few advertisers taking a very cautious approach and reducing media investment, but the SMI data proves the vast majority are continuing to grow their ad spend,” Ractliffe added.

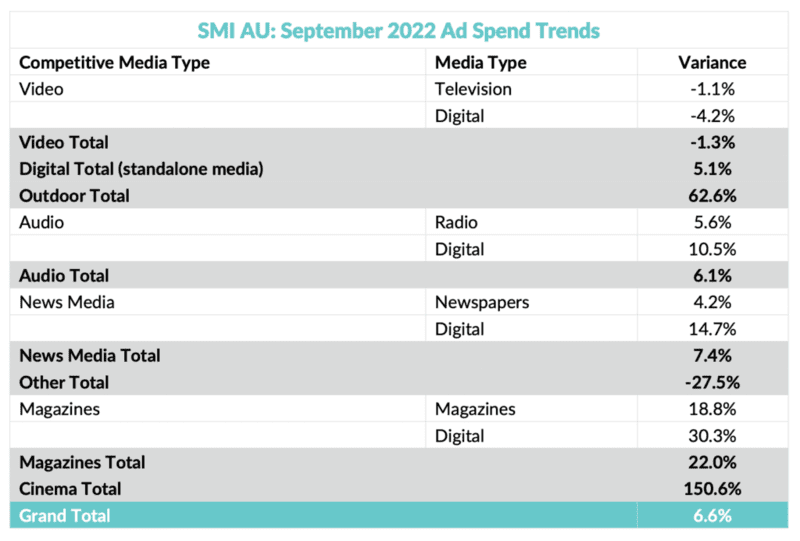

Outdoor emerged as the standout performer for ad spend growth in September, with the total soaring at a record growth rate of 62.6% while Cinema delivered another strong month with bookings up 150.6% year- on-year.

But Ractliffe said both the TV and Digital media seemed to be affected by the stronger demand evident in Outdoor, with linear TV ad spend back 1.1% and Digital reporting slower growth of 5.1%.

“Each of the TV, Outdoor and Digital media compete fiercely for the ad campaigns requiring mass audiences so it’s clear Outdoor’s success has dented the fortunes of the other larger media,” she said.

And TV and Digital will no doubt be looking more closely at the growth drivers behind Outdoor as SMI Forward Pacings data shows Outdoor ad spend is already up 7% in October, while Cinema bookings have already doubled for October.

However all other major media are enjoying the buoyant September ad demand, with Radio ad spend lifting 5.6% (or 6.1% with Digital Audio added); News Media bookings have grown 4.2% (or 7.4% with Digital News added) and Magazines are reporting an 18.8% increase in ad spend (or +22% with Digital titles included).

The September growth also ensured a record level of September quarter ad spend, with the total up 3.6%, while for the CYTD the market is up 8.5% to another record level beyond $6 billion.

Ractliffe said that at the current rate of growth the size of total ad market spending could move beyond the record $8.4 billion achieved last year.

“In September the Retail category was one of the fastest growing (+12.7% year-on-year) and if that trend continues into the final quarter of the year – coupled with the continued return of Auto and Travel advertising – we will certainly be seeing yet another record level of Australian ad spend in CY2022,” she said.