Australia’s media agency market received a one-off boost from ad campaigns related to the Voice referendum in September, reports Guideline SMI in its latest data release tracking ad spend.

Despite the marketing investment prior to the referendum vote, total advertising revenues fell short of matching last year’s record September total.

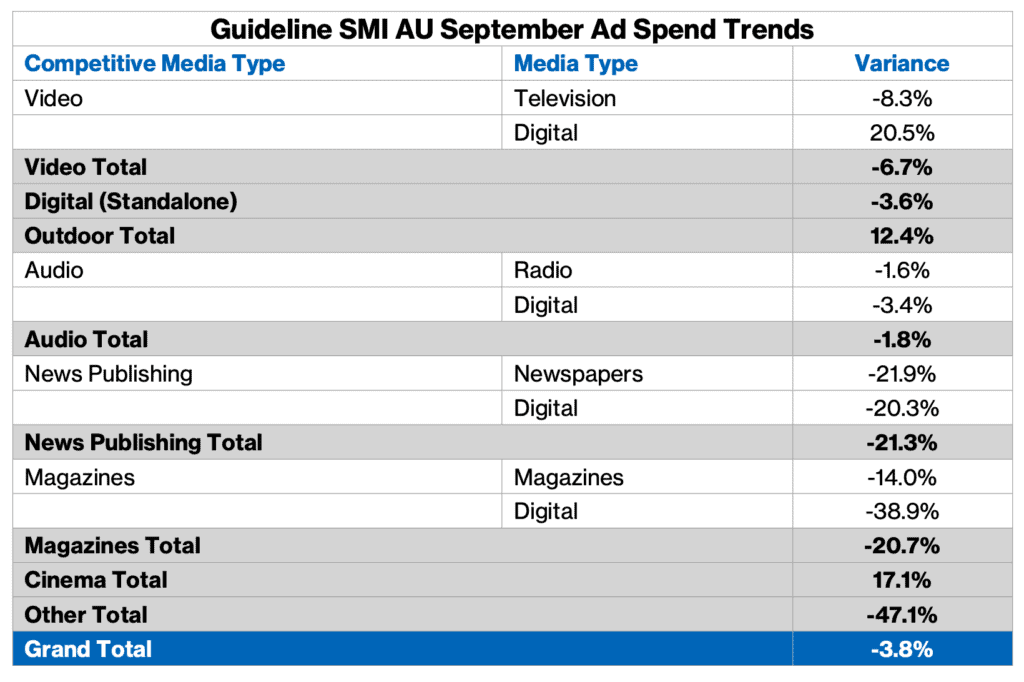

The value of total ad spend for the September month declined by 3.8% year-on-year. That’s still a good result given a record period last year for September 2022 which was the first time the market topped $800 million/month.

Outdoor and cinema big ad spend movers

SMI has reported outdoor has again emerged as the market’s largest growth media in September with revenues up 12.4% year-on-year. Cinema ad spend also continued to grow with total revenues up 17.1%.

Television bookings were back 8.3%. Inside that media type, subscription TV direct continued its strong growth while regional TV was flat YOY.

Total digital revenues were back 3% mostly due to a large decline in programmatic bookings, said SMI. Video Sites/streaming TV market continued to outperform within that media with growth of 20.6% in September.

Guideline SMI AU/NZ managing director Jane Ractliffe said despite the headline decline against last year’s record level of September ad spend, the September 2023 total was still the second largest in SMI’s 16 years of data history.

“While the headline number shows a decline against a particularly strong prior year period, the market remains 0.6% larger than in the pre-Covid September 2019 period with most product categories having returned to the pre-Covid level,” Ractliffe said.

“Key media are continuing to deliver strong growth, with outdoor lifting its share of total ad spend by 1.7 percentage points year-on-year to now represent 13.5% of all agency ad spend. Outdoor’s Covid recovery is accelerating as new inventory comes online and as key categories move share from the TV and digital media.”

Ractliffe explained the largest percentage growth of any product category this month came from the Political Parties/Industry Associations/Unions category as campaigns ramped up before the Voice referendum.

“This category reported a 72% year-on-year increase in ad spend in September with TV, outdoor and radio gaining the majority of the extra ad spend.”

This was offset by the continuing decline in consumer electronics ad spend and a large fall in retail category ad spend, mostly due to lower media investment from the hardware and alcoholic retailer subcategories.

SMI: Financial year Q1

For the July to September quarter the market is now back just 1.5% on last year’s record period, although outdoor revenues are up 13.9% and cinema ad spend has jumped 11% given the strength of hit movies like Barbie.

SMI: Calendar year to date

SMI reports the market is back just 2.5% against the record revenues reported for this period last year with outdoor (+15.4%), cinema (+4.5%) and magazines (+2.2%) all outperforming the market.

See also: FIFA Women’s World Cup boosts ad market in August 2023: Optus & Kayo benefit