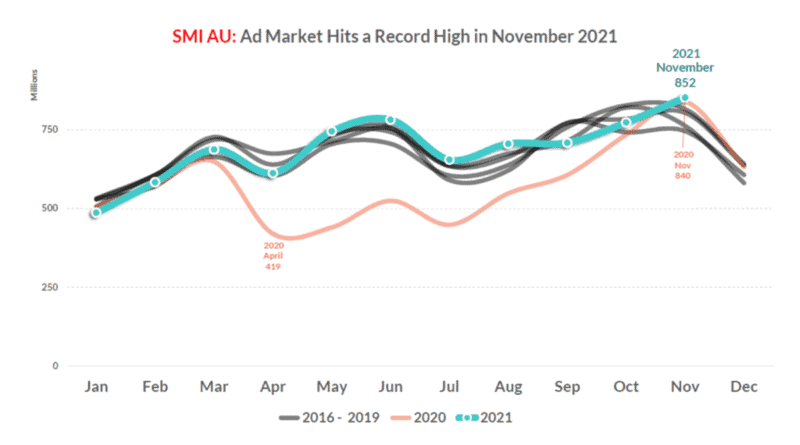

SMI has reported Australia’s media agency market has defied ongoing COVID concerns to deliver a record level of ad spend for any month in November 2021 after reporting a 1.5% increase in media investment to $852.0 million to also ensure a record level of ad spend for any financial year period.

The result has also been replicated in other SMI markets, with SMI’s US, Canadian and NZ databases also reporting record levels of ad spend in November as advertisers continue to communicate with consumers in the changing COVID environment.

SMI AU/NZ managing director Jane Ractliffe said the results again proved the advertising market was performing well above many other sectors within the economy.

“Given the level of uncertainty within the economy, it’s incredible to see such a resilient advertising market in November with the total media investment of $852 million a monthly figure a level of ad spend that has never before been achieved in Australia,” she said.

“It’s also capped off what’s been a spectacular start to the financial year with total ad spend up 16.3% from the same period in 2020 and also up 6.4% on the same five months of 2019. And to give some extra perspective on the levels of ad spend we’re now seeing, the level of 2021 ad spend is 25% higher than SMI reported for the same five month 10 years ago in 2011!’’

Ractliffe added the current level of high demand looked set to continue.

“SMI’s Forward Pacings data shows for December shows that 97% of last December’s total ad spend has already been confirmed (with Digital ad spend excluded) – and remember the December 2020 month was another large month as at that time the market was just coming out of the first COVID wave.”

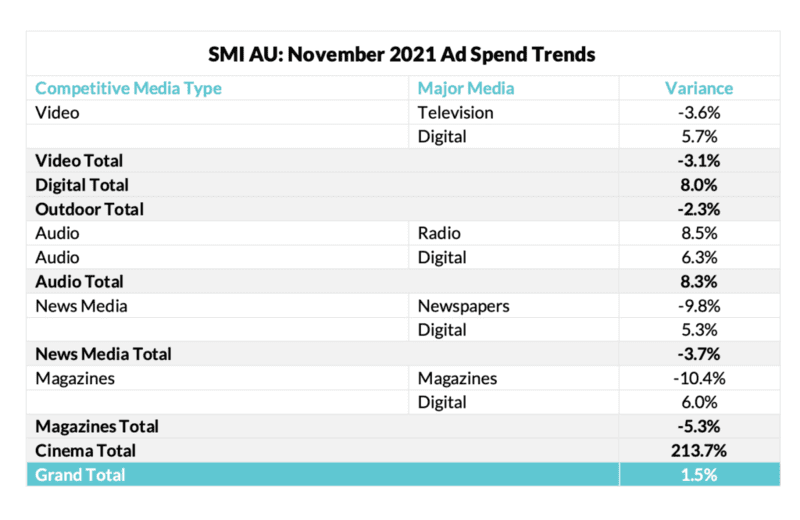

The month was also notable as in both Australia and NZ the Digital media has overtaken traditional TV to emerge as the largest stand-alone media this month as continued growth in Digital ad spend (+7.6% in total for November) coincided with lower TV spend following TV’s record post-COVID surge last year.

If traditional TV and its related Digital BVOD bookings are combined then Video media remains the largest media.

Radio delivered the highest percentage growth in ad spend in November (+8.5%) while Covid restrictions again affected Outdoor and it reported a flat result. An extra Sunday last November hurt both the Newspapers and Magazine media this month given one less edition.

The Government category continued to underpin total ad demand, emerging as the third largest category after lifting bookings a remarkable 41.1%. That partly offset the ongoing declines in Auto Brand ad spend with that total back 19.3% in November as restricted supply lines dampen demand.

For the 11 months of the calendar year total ad spend is now up 20.8% on the same period in 2020, which also represents a 1.8% increase in ad spend over the same 2019 CYTD period.

See also: SMI reports stronger agency ad spend continues in October, social & outdoor climb