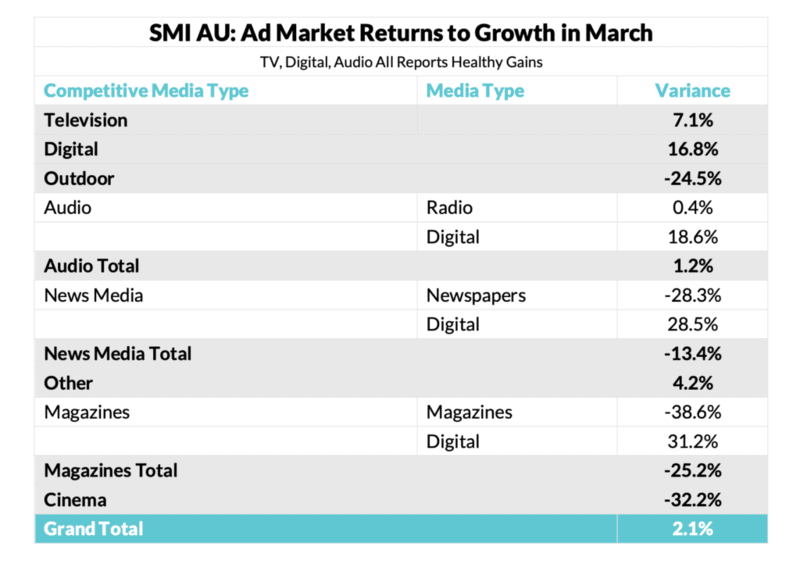

Australia’s media agency market has shifted strongly into recovery mode in March with total bookings up 2.1% while early bookings for April and May show growth of more than 20% from last year’s Covid-affected months, reports Standard Media Index (SMI).

The March result came after a large $116 million surge in late digital bookings was recorded, giving digital the strongest growth rate this month of 15.6% as bookings to programmatic media jumped 28%, social media ad spend rose 20.1% and search bookings jumped 16.5%.

Broadcast TV and radio also delivered higher ad spend in March of 7.2% and 0.2% respectively.

SMI’s forward bookings detail shows the stronger demand will continue with the early April data up 20% (ex-digital) from last year’s COVID lows and within that outdoor bookings are already up 9.4% and radio ad spend is already up 16.6%.

SMI AU/NZ managing director Jane Ractliffe said the stronger ad spend was also already evident in May with total confirmed ad spend just $900,000 below last year’s total – before the month had even begun.

“We’re now heading into unchartered territory as we’ve never before seen such huge growth in ad spend and expect to be reporting record levels of growth over the next few months, but of course it’s coming from an extremely low base,” she said.

“Even so the numbers are mind-boggling as the very early April numbers are already showing food/produce/dairy advertisers growing budgets by 68% over last April, while the home furnishing/appliances category is already up 129% in the early data and gambling ad spend is up 162%. SMI’s media subscribers with access to our forward pacings data can track exactly where this renewed ad spend is heading.’’

Ractliffe said outdoor’s return to growth in April was especially pleasing given it has been the media that’s been the most affected by Covid.

“Already we can see strong growth in key outdoor sectors in April with the early data showing retail outdoor ad spend up 22%, street furniture bookings up 5% and outdoor transit bookings up 39%. Elsewhere, the metropolitan radio market will also book a huge April result with early ad spend data up 28%,’’ Ractliffe said.

Ractliffe noted SMI’s March data was also notable for numerous new ad insights, the highlight of which was the launch of the world’s first view of programmatic outdoor ad spend with data collected from media agencies either booking programmatic outdoor spend via outdoor third parties or demand side platforms.

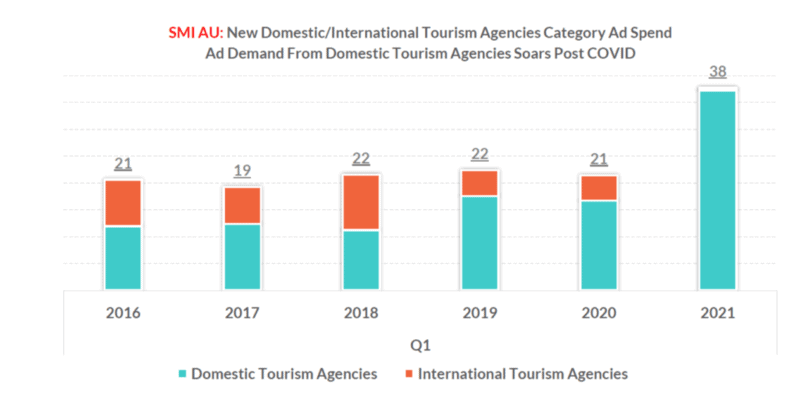

Also new this month are ad spend insights for six new product sub categories. Two of those new categories – TV streaming services and domestic tourism agencies – are currently reporting the highest increases in ad demand in the market, with ad spend from TV streaming services jumping 69% in March and domestic tourism ad spend up 196%.

“We’ve split our government travel bureaux category into new domestic and international tourism agencies categories and it’s great timing as it clearly highlights the huge growth in domestic tourism marketing and of course the seismic decline of international marketing as the total travel category’s ad spend fell 9% in March,” said Ractliffe said. “The companies benefitting most from the higher domestic tourism ad spend in March were Nine Entertainment, News Corporation, Facebook and then ViacomCBS.’’

Ractliffe said SMI has also launched ad spend insights for new categories such as online retailers, discount stores and sports cars.

See also: Zenith adspend forecast: Ecommerce and video fuel faster recovery