Australia’s media agency market has emerged from a tough six months by delivering a record level of underlying ad spend for the financial year, reports SMI in a note accompanying the release of its June 2023 ad spend data.

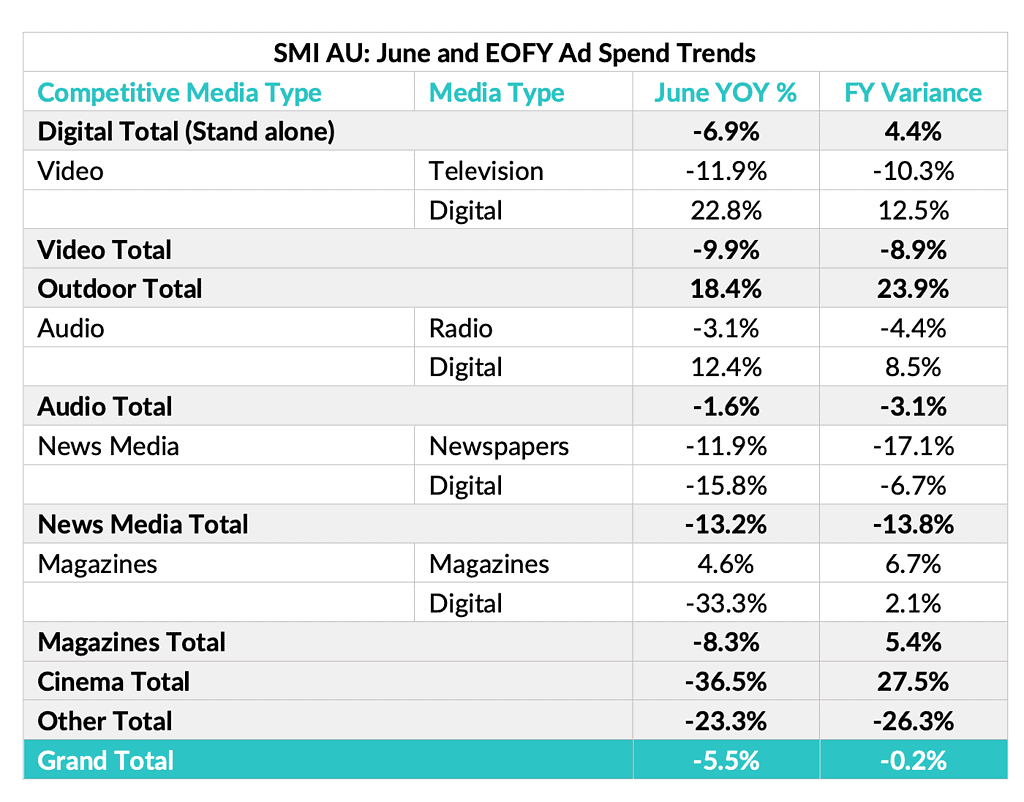

Total ad demand was up 2.2%, while at the headline level the total is back just 0.2% to $8.8 billion.

The underlying result removes the effect of abnormal Government and Political Party category ad spend related to Covid and last year’s May Federal election. Those categories are back more than $200 million on a combined basis this financial year.

The star performer over these 12 months has been Outdoor with total ad revenues lifting 23.9% to $1.2 billion. This means the media most affected by Covid has now delivered a result that is 2.2% larger than the pre-Covid FY18/19 total.

SMI APAC managing director Jane Ractliffe said the result confirmed Outdoor has finally moved beyond the calamitous Covid period.

“Outdoor was easily the media most affected by Covid given the loss of more than $300 million in ad revenues between the 2018/19 and 2020/21 periods during the public lockdowns,” Ractliffe explained.

“It’s been a long road back but the industry has harnessed emerging technologies and developed new inventory to now be in an even stronger position than it was pre-COVID.”

SMI: January to June 2023 down 4%

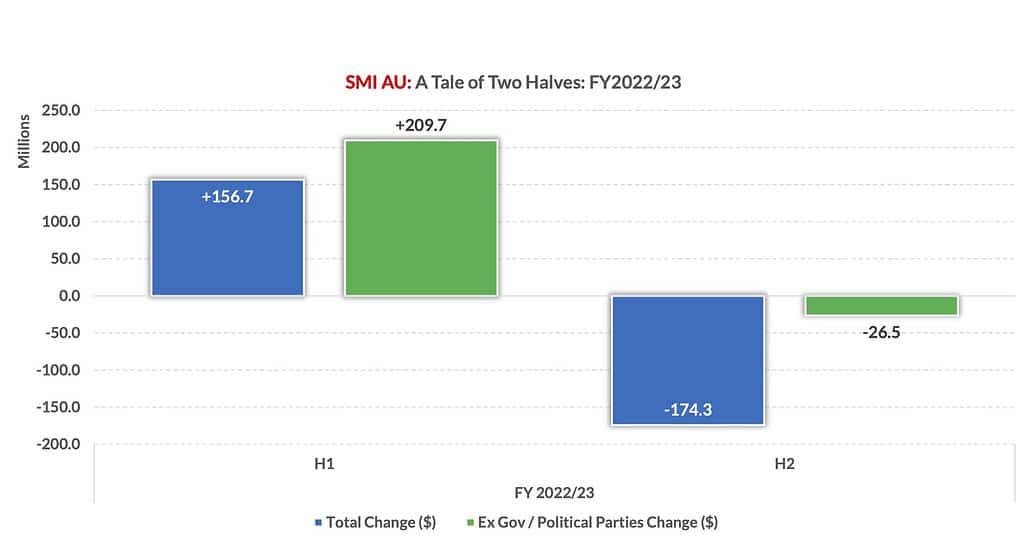

SMU reports that across the market, the financial year has been a period of two halves with ad demand up 3.4% in the first six months, only to fall by 4% in the January to June period (or -0.8% with Government and Political Party category ad spend removed).

“At the end of last year the market was still being buoyed by strong Government ad spend, with that demand lifting prices as the availability of inventory decreased,” Ractliffe said.

“But from January the sentiment changed significantly as Governments no longer needed to maintain the same levels of Covid advertising and inflation hurt consumer confidence.”

Travel and Automotive Brand also booming

At a product category level, Travel has shown the greatest increase from the pre-Covid lows with its total up 46.5% this financial year followed by Automotive Brand ad spend which has lifted 20.8%.

The month of June is the first in a year to be less impacted by 2022’s abnormal Government ad spend, but the market still struggled to match last year’s record level with a year-on-year decline of 5.5%.

Outdoor media maintained its robust gains with bookings up 18.4%, and printed Magazines increased their revenues by 4.6%.

Among the key product categories, Government increased its ad investment for the first time this calendar year, up 7.6% year-on-year.

For the June quarter ad spend was back 5.4% (or -2.0% ex Government and Political Party ad spend) and for the calendar year-to-date the market is back 4.2% but again only back 0.7% with Government and Political Party ad spend removed.

See also: Standard Media Index Australia reveal the ad spend trends of May 2023