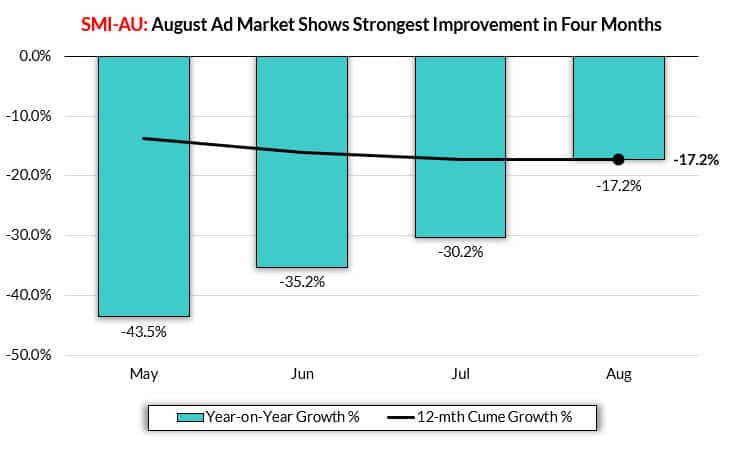

Australia’s media industry is continuing to show more signs of recovery as it emerges from the crushing COVID period, with August ad spend back just 17.2% in what has been the strongest improvement in ad market demand since the depths of the crisis, reports SMI.

The result is the third consecutive month of lower declines but also the best improvement with the level of decline improving by 13 percentage points.

Digital media reported the lowest year-on-year fall of 4.7%, driven by strong growth among Social Media and Video-based websites (such as TV streaming sites), and TV reported a solid result (-11%).

The improvement in the Australian market mirrors that seen in other global advertising markets, with SMI reporting an 18.1% fall in NZ ad demand in August, an 18.7% decline in UK ad spend and a 10.6% fall in Canadian ad spend.

And SMI AU/NZ managing director Jane Ractliffe said the US market returned to growth in August, driven by higher ad spend to both the US Television and Digital media.

“The great news is that in all sophisticated media markets the level of decline in ad spend has now fallen well below 20%, while in the US advertisers have quickly returned to TV with most of the extra advertising spend flowing to news and the revived sports programs,” said Ractliffe.

“We’re also seeing strong improvements in TV advertising in Australia with the level of decline significantly reducing from 27% in July to 11% in August.”

An important driver of the market improvement in August was the second month of stronger spending from retailers – mostly supermarkets, chemists and online retailers – which drove a combined 20% increase in Retail category ad spend.

Ractliffe noted that in August a quarter of all SMI product categories reported growth, which was a turnaround from the situation two months ago when the ad spend for all 40 categories was in decline.

“Demand is clearly picking up quickly as this month we’ve also seen strong double digit growth in ad spend for household cleaning products, technology businesses (both for hardware and software products and services) and smaller categories such as oral and haircare,” she said.

“Of course the Covid-affected categories such as Travel, Live Entertainment and Movies/Cinema/Theme Parks are still reporting devastating declines in ad spend but outside of those areas the higher demand from other categories is beginning to move the market to a far more stable position.”

Given the lower August decline, the trend for the calendar year-to-date also continues to improve with the market now back 24.0% over the previous eight month period.

And all major media continue to report double digit declines in ad spend over that time given the fact the market was initially affected by the natural disasters at the start of the year, followed quickly by the Covid pandemic.