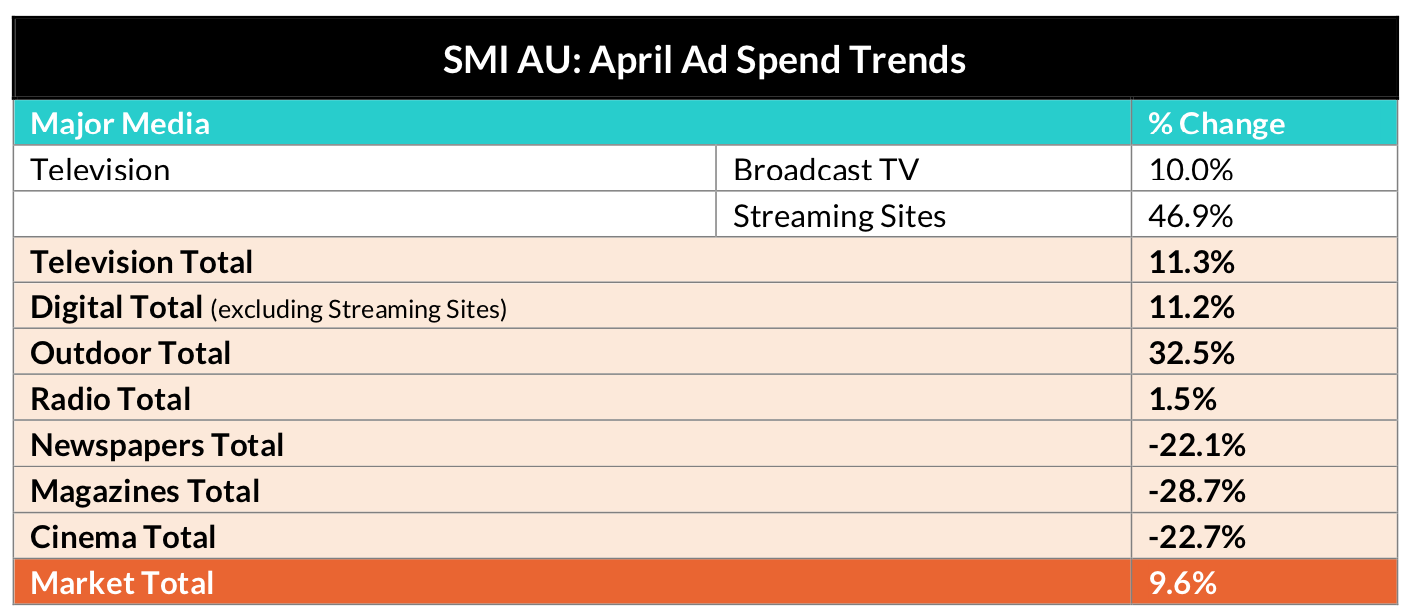

Australia’s media market is experiencing a mini advertising boom, with Standard Media Index reporting unprecedented demand for the month of April (total spend up 9.6% to $586.5 million) and for the calendar and financial year periods.

The market is being aided by a series of one-off events and timing issues in April but, even so, the underlying market also remains strong with ad spend for the four months of the calendar year up 6.1% and ad spend for the 10 months of the financial year breaking through $6 billion for the first time.

The Commonwealth Games were a key driver of higher demand this month, lifting the Metropolitan TV sector by 15% YOY to its highest level in eight years, while Seven’s online streaming of the Games ensured the Digital Video Sites sector was the fastest growing in the digital media this month (up 54.9% YOY) with Seven Digital becoming the second-largest revenue contributor after YouTube.

The Commonwealth Games were a key driver of higher demand this month

Total Digital ad spend lifted 13.3% in April (or 11.3% with the Comm Games streaming excluded) with Social Sites still being unaffected by the ongoing debate on data privacy (total Social bookings grew 18.9%) but by far the highest growth this month was in Outdoor.

Total Agency spending on Outdoor soared 32.5% in April, but a large part of that growth was due to the fact the month of April included an extra sales cycle for the large Posters/Billboards and Retail Outdoor sectors.

SMI AU/NZ Managing Director Jane Ractliffe said the Financial Services Royal Commission also continued to drive advertising demand, with Domestic Bank category emerging as the fastest growing for the month (+54.9% YOY) to make that Category the market’s third-largest in April.

“We really are seeing a perfect advertising storm with the Commonwealth Games, the Royal Commission and a lesser Easter impact this month combining to deliver record ad spend,” she said.

Among those Categories delivering higher spend in April, SMI is reporting a 15.4% increase in ad spend from the largest category of Auto Brands, a 10.8% increase in Insurance ad spend and a 20.7% increase in Government ad spend.