Seven West Media (SWM) and Southern Cross Media (SCA) have agreed to merge, in a deal that would create one of Australia’s largest integrated media companies.

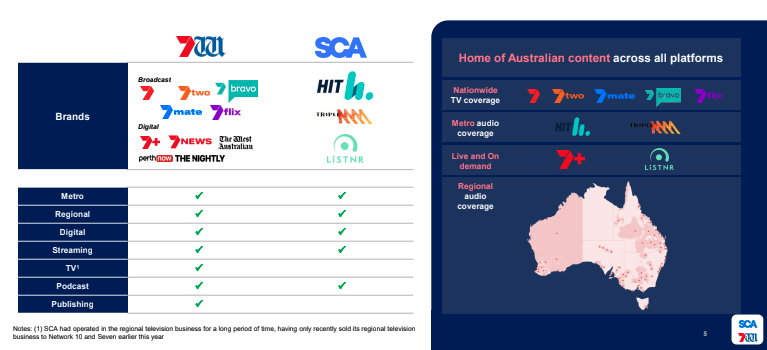

The scheme of arrangement, announced this morning, will combine the businesses’ free-to-air TV, audio, streaming, digital and publishing assets – bringing together metro and regional reach under one umbrella.

The deal would bring together holdings from Seven West Media including the Seven Network, The West Australian, The Sunday Times, and digital brand The Nightly with Southern Cross Media assets including the Hit Network, Triple M, and the Listnr app.

A new scale play

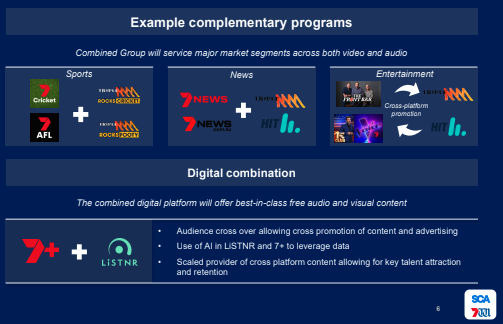

The combined group will target the core 25–54 demographic, offering what both sides are calling a “one stop shop” for advertisers.

“The combination of these two companies brings together the best creators of media content in the country, delivering significant financial and strategic benefits for SWM shareholders,” SWM Chairman Kerry Stokes said.

“This is an important merger, as the combined company will be better able to serve both metropolitan and regional viewers, listeners, partners and advertisers.”

In a mid-morning call with investors, SWM CEO Jeff Howard emphasised that revenue was the key driver for the merger: “Put simply, this merger has not been driven by the need for increased size, but rather from the substantial audience and revenue benefits that will be mined from the highly complementary and scalable offering provided by combining our respective TV and audio assets both terrestrially and digitally.”

He told the investors that “We focus on the cost-efficient delivery of the audience that matters across Australia with leading 25 to 54 radio audiences, and known and addressable streaming and podcast audiences through our leading digital audio ecosystem in Listnr. The combined entity will have comprehensive nationwide TV coverage, extensive metro and regional radio coverage, and leading digital platforms serving audiences across all mediums. Together, we will create the true home of Australian content across all platforms, with capabilities spanning metro, regional, digital, streaming, TV, podcast, and print.”

Proposed opportunities of the combined assets

The merger will see SWM shareholders receive 0.1552 SCA shares for each SWM share, resulting in a near-even ownership split – 49.9% to SWM investors and 50.1% to SCA shareholders. Both boards have signed off, with Kerry Stokes AC confirming SWM’s unanimous support.

SWM CEO Jeff Howard and SCA’s John Kelly

Leadership and synergies

Under the proposed structure, SWM CEO Jeff Howard will lead the combined group, while SCA’s John Kelly becomes Group Managing Director, Audio.

Current Chairman of SWM Kerry Stokes will serve as Chairman of the combined company until he retires from the board in February. Stokes said: “Following the improved performance of Southern Cross Media since Heith Mackay-Cruise assumed the Chairmanship, I have every confidence Heith will continue to guide the combined group successfully. Following my retirement from the Board in February 2026 I intend to continue to support the Chair and Board wherever I can add value.”

He will then hand over the chairman position to SCA’s Heith Mackay-Cruise.

Management is targeting $25–30 million in annual pre-tax cost synergies within two years, pointing to reduced duplication across corporate overheads, facilities and operations.

Howard told investors that “These savings come from four key areas. First, the rationalisation of duplicated corporate costs, including listing costs, back-office and corporate services will provide immediate savings. Second, the economies of scale benefits. The combined business will benefit from improved unit economics through pool volume and services. This is particularly relevant with respect to our growing digital platforms.

“Third, we’ll be looking closely at our day-to-day operations to identify improvements and efficiency in systems and processes. Our combined expertise will drive best practise across the enlarged network. Fourth, consolidation of facilities where we have overlapping locations will generate further cost savings for the business. We’ve already identified a number of leased offices for immediate co-location.

“We’ll be sitting down together shortly to work up the execution plans. Until then, it’s too early to say how the identified cities will impact our cost base, being our people and operations. Importantly, there’s $25-30 billion before considering any potential revenue synergies.”

Heith Mackay-Cruise

What happens next

The deal will now move through the usual approval pipeline – ACCC, ACMA, ASX, shareholder and court sign-off – before an expected completion no later than Q1 2026.

SGH Limited, which holds 40.2% of SWM, has already signalled it will vote in favour.

If cleared, the merger would mark one of the most significant consolidations in recent Australian media history, reshaping the competitive landscape for both advertisers and audiences.