Australian entertainment and media companies must assess trust and create, capture and monetise their trust assets in order to find growth in the next five years, according to the PwC Australia Entertainment & Media Outlook.

The 17th annual report analyses trends and consumer and advertising spend across 12 segments and shows spending is expected to rise at a compound annual growth rate (CAGR) of 3% over the next five years, but with sharp differences between industry segments and sectors.

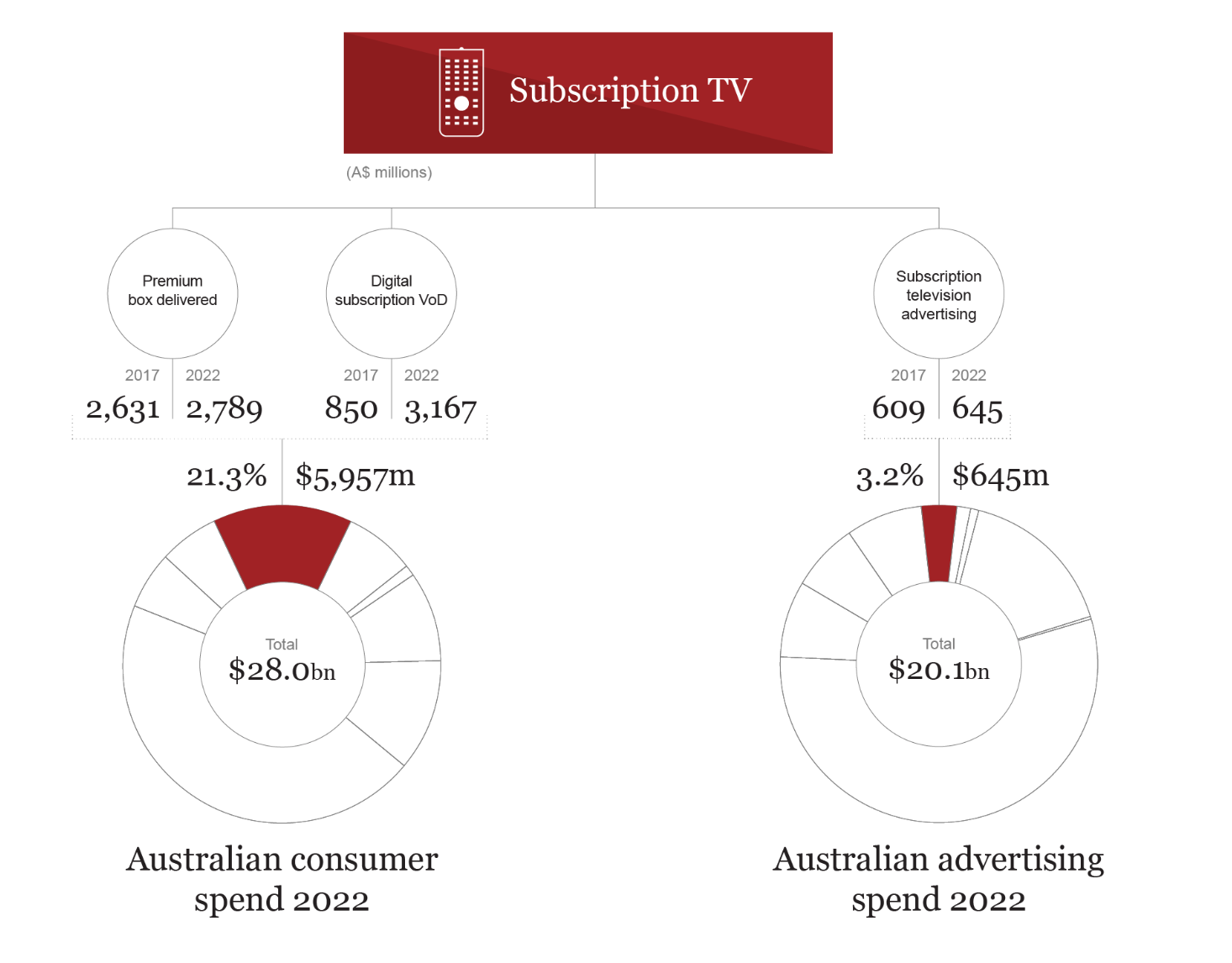

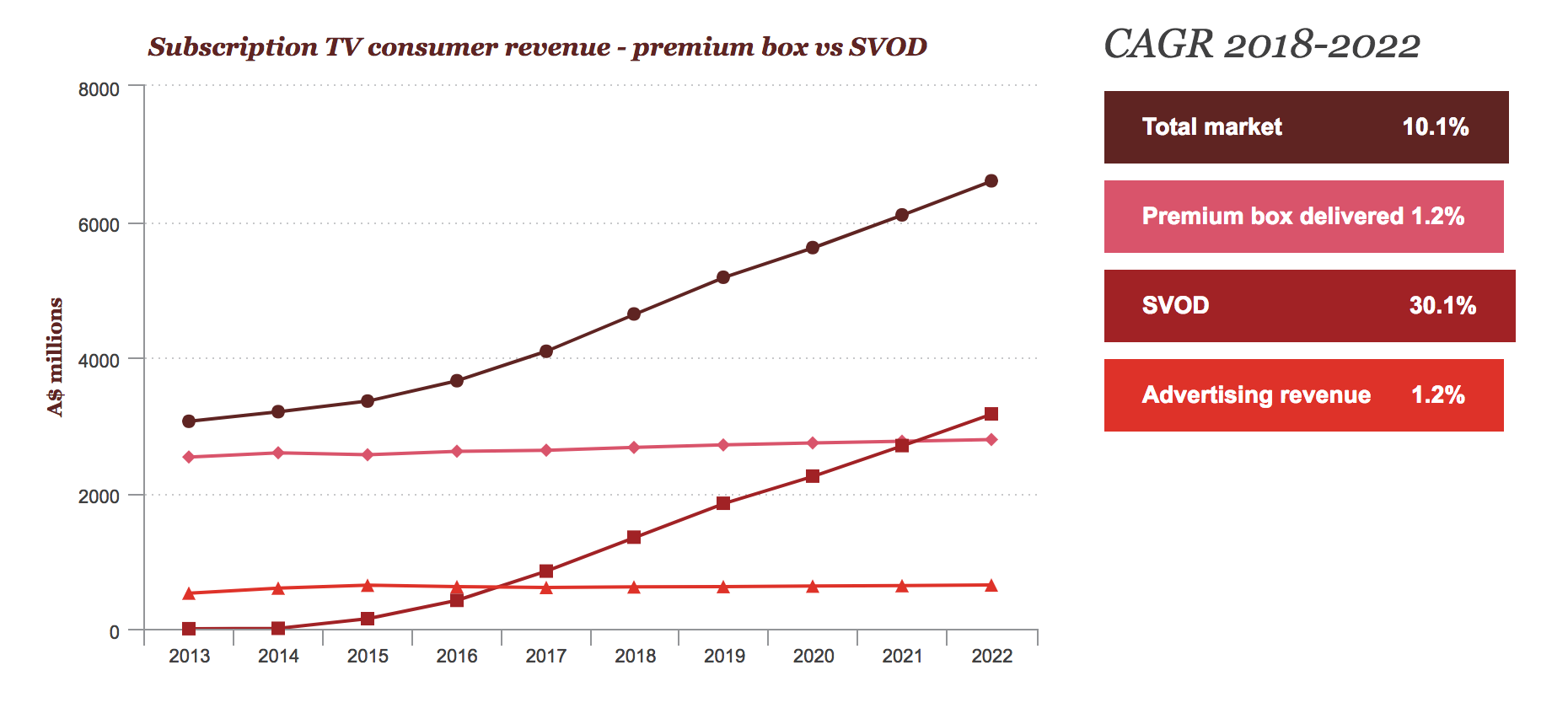

The subscription television market is the fastest-growing segment in spending, forecast to rise at a CAGR of 10.1%, trailed by the internet advertising market at 7.7%.

Digitally driven segments propelling growth

PwC’s Australian Outlook shows growth is broad-based but unevenly distributed across the industry, with the fastest revenue growth in digitally driven segments.

The internet advertising market is forecast to reach $12,681 million or 65% of the total advertising market in 2022 and will overtake the internet access market ($11,507m) for the largest segment in the entertainment and media industry.

Fast growth in video advertising, at a CAGR of 23.8%, will see the segment account for 25% of the total internet advertising market by 2022.

A substantial increase in digital revenue is underpinning total out-of-home market growth at 15.9% compared to -5.7% for physical.

Strong growth in digital music is also propelling the total music market, which is expected to rise at a CAGR of 5% and attract 6.4% ($1,792m) of consumer spend by 2022. Digital music is expected to grow at a CAGR of 10.2%.

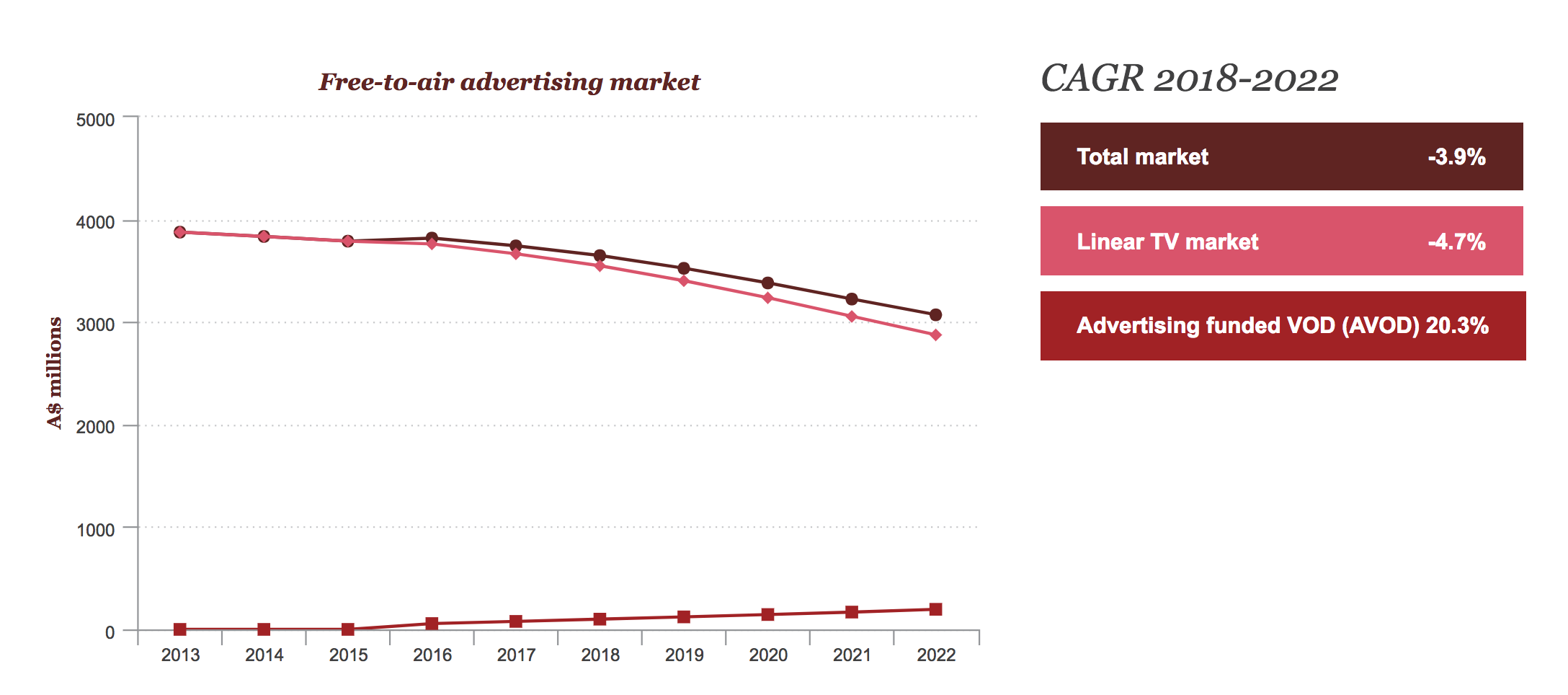

PwC Australia has forecast the newspaper, free-to-air television, magazine and filmed entertainment spending markets will reduce in size from 2018 to 2022.

For FTA TV, PwC comments AVOD revenues are small but growing strongly over the forecast period.

For subscription TV, SVOD will grow strongly over the forecast period, surpassing premium box-delivered revenue (Foxtel, Fetch) in 2022.

Podcasting and interactive games top performers

Podcasting and interactive gaming continue to outperform other consumer-funded entertainment sectors such as music and filmed entertainment.

The interactive games market shows signs of strong growth into 2022, with the sector forecast to attract 11.8% of the total Australian consumer spend in 2022.

—

Top photo: Shutterstock