David Ellison just turned a bad week into an apocalyptic one.

Only 24 hours after suing Warner Bros. Discovery (WBD) to force transparency on the Netflix merger, Paramount Skydance suffered a stinging defeat in Delaware.

But if WBD boss David Zaslav thought a court win would end the headache, he miscalculated. Paramount immediately pivoted to the corporate equivalent of a nuclear strike: a proxy battle to replace the entire board.

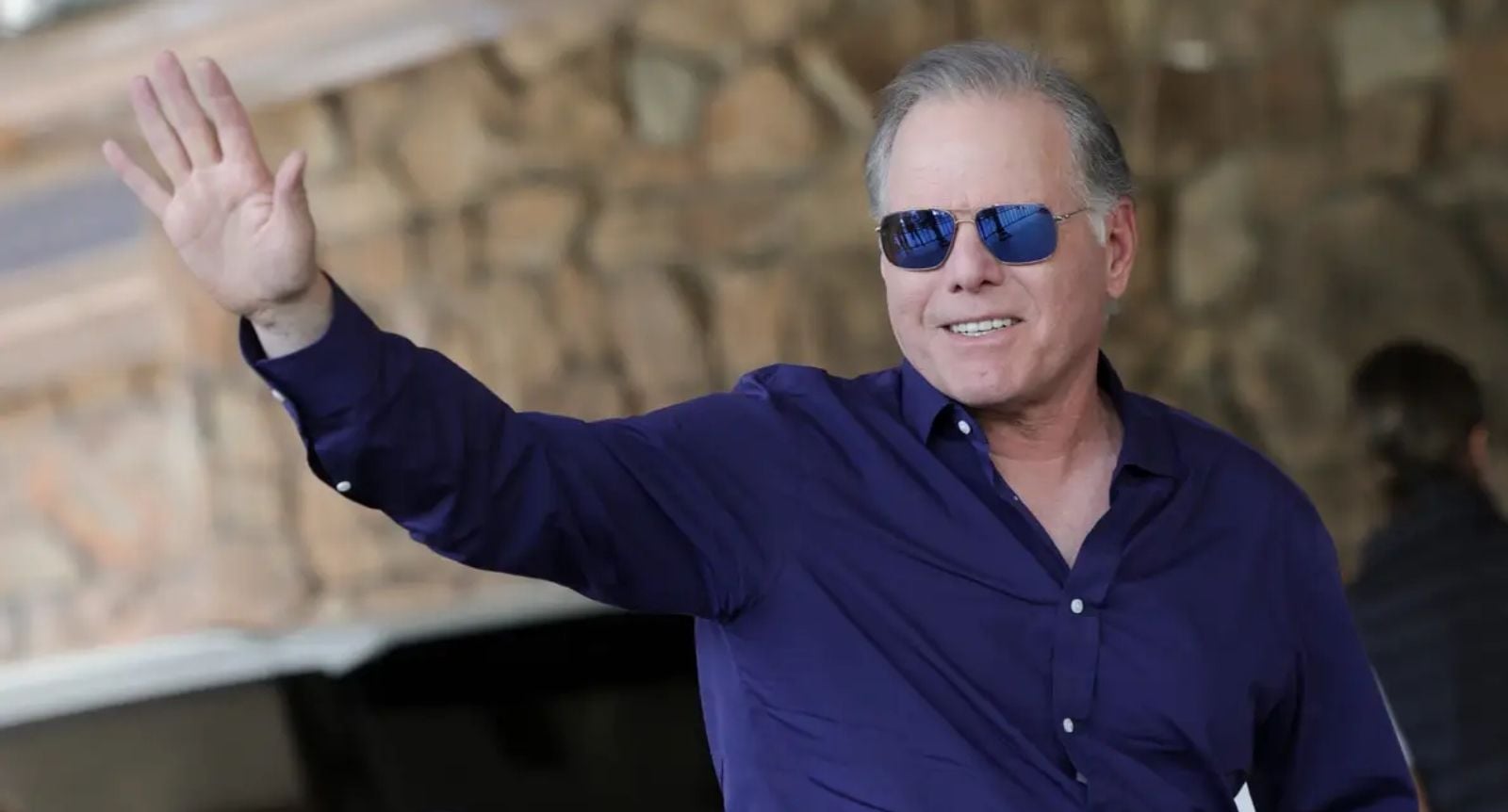

WBD’s David Zaslav is caught in an Ellison sh*t-storm

The gavel drops on Paramount’s foot

The first blow landed in the Delaware Chancery Court on Thursday. According to The Hollywood Reporter, a judge denied Paramount’s motion to “fast-track” its lawsuit.

Ellison’s legal team argued that time was critical. They claimed shareholders would fly blind when the hostile tender offer expires on January 21 unless the court forced WBD to reveal its valuation data immediately.

Paramount wanted the court to compel WBD to “show the math” proving why the Netflix deal beats Paramount’s cash offer.

The judge disagreed. The ruling stated that Paramount failed to prove “irreparable harm” would occur without an expedited timeline.

In plain English, the court told Ellison to wait his turn. This ruling creates a tactical disaster for Paramount. It virtually ensures the January 21 tender deadline will pass without the release of the coveted valuation data.

David Ellison will not take ‘no’ for an answer

The Nuclear Option

Paramount wasted zero time licking its wounds. Moments after the ruling, The Hollywood Reporter broke the news that Skydance had officially launched a proxy fight.

Paramount has nominated a slate of independent directors to stand for election at WBD’s 2026 annual meeting.

The goal is blunt. Ellison wants to install a friendly board that will torch the Netflix merger and accept his acquisition offer instead.

This move shifts the battlefield from a financial dispute to a political campaign for the company’s soul. It forces WBD shareholders to choose sides.

They can stick with the current board and their “Discovery Global” spinoff plan. Or they can vote for a new regime that promises an immediate cash exit.

Warner Bros. Discovery is keeping on, keeping on

WBD says business as usual

Warner Bros. Discovery projects an air of unbothered superiority. Insiders suggest the board views the court ruling as vindication of their process. They maintain that the Netflix merger remains the only path that guarantees long-term value and regulatory stability.

The deal values the company at roughly $82.7 billion.

However, the proxy fight ensures this distraction will drag on for months. Even if the tender offer expires next week, the threat of a board coup will hang over every decision Zaslav makes between now and the annual meeting.

The Clock Runs Out

The immediate casualty of this legal skirmish is the January 21 deadline. The court refused to expedite matters, so Paramount is now backed into a corner. They must convince shareholders to tender their shares based on faith and fury rather than new financial facts.

David Ellison might have lost the battle for the documents. But by launching a proxy war, he ensured the war for Warner Bros. Discovery is far from over.