Nine’s profits fell 21% in the six months ending 31 December 2023, which the media company is blaming on “markedly weaker economic and advertising market conditions.”

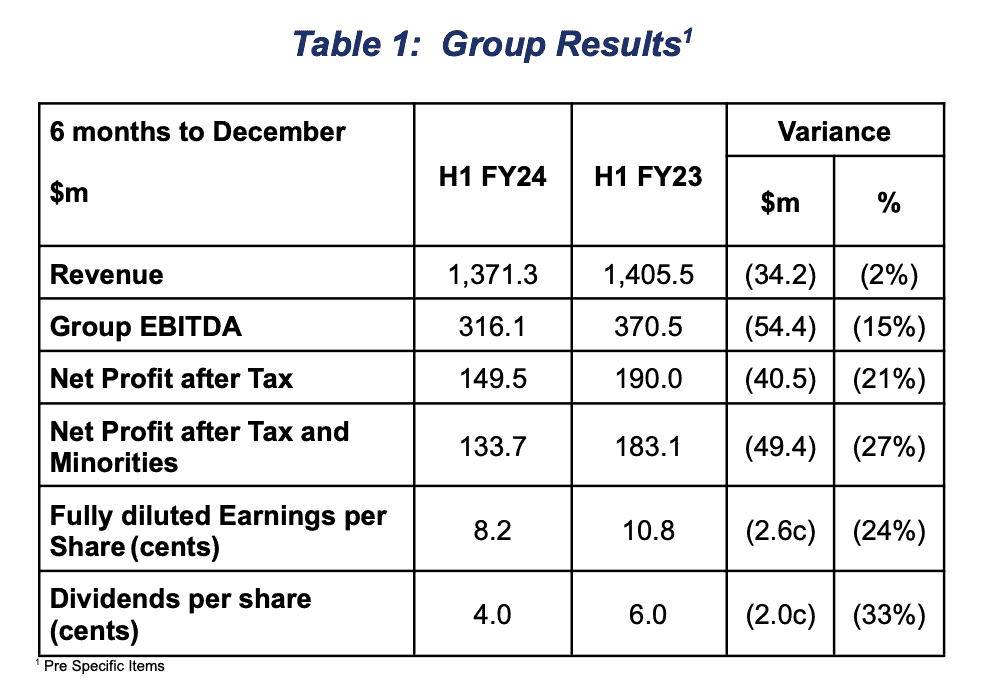

Against the previous year, Nine’s interim results showed revenue dropped 2% to $1.4bn, net profit fell 21% (after tax, net profit after tax and minorities fell 27%) to $149.5m, and earnings before interest, taxes, depreciation, and amortisation (EBITDA) was down by 15% to $316m.

CEO Mike Sneesby pointed to the subscription businesses as the half’s success story: “Notwithstanding the impact of challenging economic conditions on the broader advertising market, the breadth of Nine’s business underpinned some key operational highlights across the half. I am particularly pleased with the performance of our subscription businesses.”

Stan’s revenues jumped 11% and EBITDA was 40% up, which Sneesby called “a testament to Stan’s strong positioning in Originals and Sport which continues to pay off, as well as its focus on cost efficiencies.”

Television revenues fell 9% due to “the weak advertising market and challenging broader economy,” while the metro free to air market declined by 13% in the half. In 2023, TV ad spend was back 14% according to Guideline SMI’s figures.

Nine’s Chair Peter Costello was happy with the results, difficult though the market may be.

“I am very pleased with the way the company responded to the broader economic challenges in the second half,” he said. “We have enhanced our competitive position. We are positioned well for the future. The breadth of our different businesses has proven its worth in these conditions.”

Sneesby also insisted “our audience performance this half has been strong. FY24 to date, Nine’s audiences have shown clear growth in Total People, both broadcast FTA and BVOD, and also in the 16-39s which has typically been a more difficult demographic to reach. The strength of this audience performance gives us renewed confidence in our revenues once the advertising market begins to recover, and we expect to retain leadership from a revenue share perspective through 2024.”

Earlier this week, oOh! Media CEO Cathy O’Connor claimed the out of home industry would continue to claw budget away from TV. Speaking to Mediaweek about OOH and radio’s push for a greater piece of the pie, she said: “We will both grow at television’s expense.”

Sneesby continued that cost-cutting measures were working, and thanked “all of our people for their focus on efficiencies and willingness to embrace change.” He also used the opportunity to call on the government to ensure news businesses are being compensated fairly under the News Media Bargaining Code, following the government’s recent “comments confirming its support for the essence of the News Media Bargaining Code and its intent to enforce the Code.”

“For example, Nine’s premium video content continues to drive huge audiences on social media platforms, while we are also witnessing the rapid growth in generative-AI services which utilise our public interest journalism to build and train their models,” Sneesby said.