• MAFS and Lego Masters help offset TV revenue decline in first half

On a Statutory basis, Nine has reported a net profit after tax of $234m, up 12% on the previous corresponding 12 months.

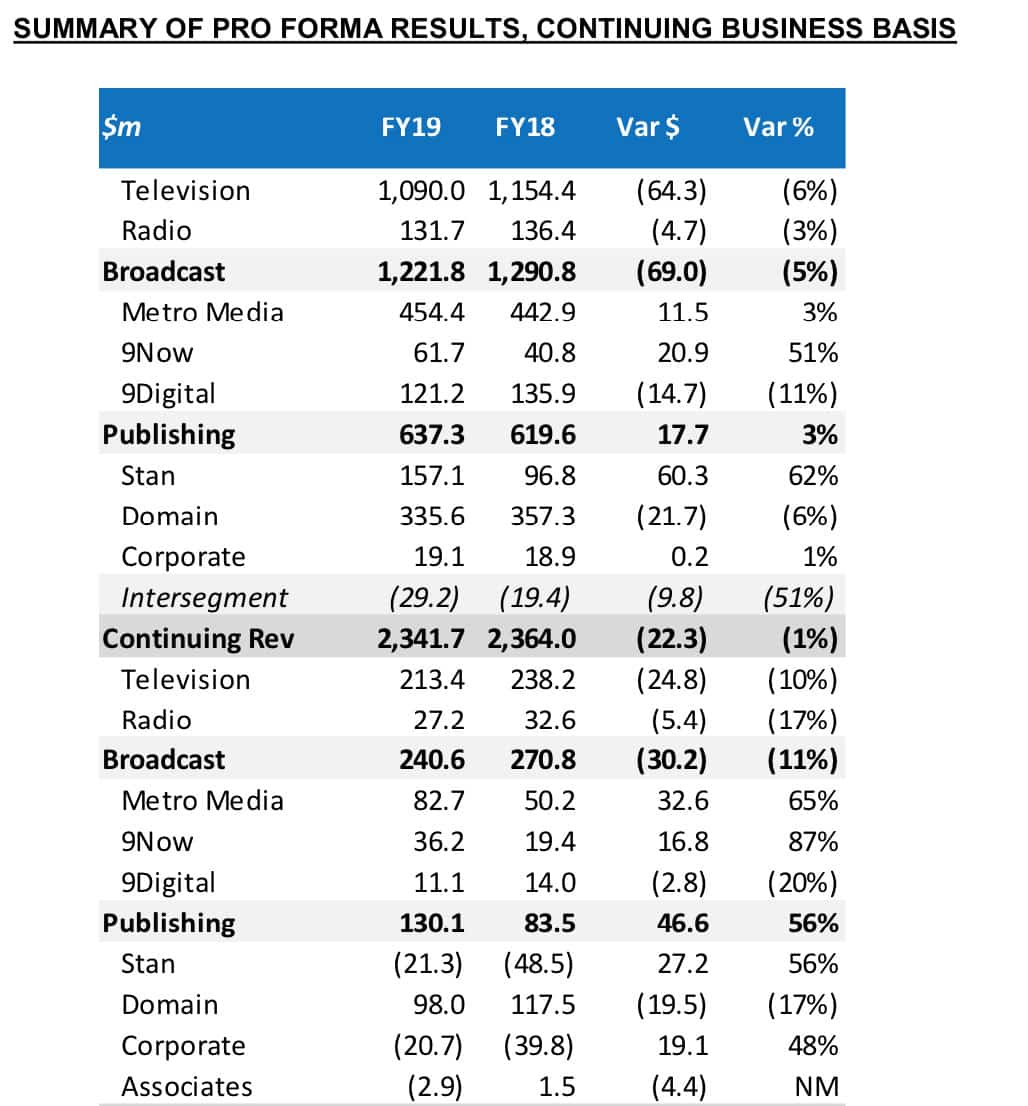

On a Pro Forma, Continuing Business and pre Specific Item basis, Nine reported Group EBITDA growth of 10% to $424m, on Revenue of $2.3b (-1%) and Net Profit After Tax and Minority Interests of $198m (+16%).

Highlights include:

• Strong FTA revenue share (+1.0pts) coupled with lower costs (-4%), partially offsetting weakness in the FTA market

• 56% growth in Digital & Publishing EBITDA underpinned by >60% growth in both Metro Media and 9Now

• More than 1.7m active subscribers at Stan, and cash flow and EBITDA positive in H2

• Solid contribution from Domain in a cyclically challenging housing market

Chief executive’s commentary

Hugh Marks, CEO of Nine said: “To achieve 10% EBITDA growth in this cyclically challenging FTA and housing market was a very strong result. It’s a validation of our strategy, the success of the investments we have made, and the efforts of our people.

“Nine has real operating momentum in each of our divisions, with an earnings composition increasingly weighted to high growth businesses. In particular, we are well placed to further expand our share of the rapidly growing digital video market. Not only through 9Now and Stan but also more broadly across our digital assets. We will continue to draw on the strength of our traditional media assets to help us successfully build complementary, high growth, digital media businesses of the future. A strategy that has, of course, been greatly enhanced by the merger with Fairfax.

“Growth in Digital & Publishing and the move to profitability through the second half at Stan enabled us to grow Nine’s EBITDA year on year, giving us further confidence that we are investing in the right content and technology for the future of our business.”

Broadcasting results, ratings and ad share

Nine’s Broadcasting division, which comprises Nine Network as well as the consolidated results of Macquarie Media (of which Nine owns a 54.4% stake), reported EBITDA of $241m on revenues of $1,222m for the year.

Nine Network reported a revenue decline from $1,154m to $1,090m for the year. The decline however, was confined to the first half – second half revenues grew by 2%, as share gains more than offset the impact of a difficult FTA market (-5.1%1 for the year and -5.2%2 in H2). After a first half Metro FTA share 39.3%, Nine’s H2 share of 39.9% was up 2.9 pts on pcp and resulted in a full year #1 revenue share of 39.6%.

On a ratings basis, for the year, Nine attracted a #1 commercial network share of 38.3% of the 25- 54 demographic, up 1.3 pts on pcp. For the primary channel, Nine’s share of the 25-54s was 39.3%, up 1.6 points, and 5.7 share points ahead of its nearest competitor.

Reported FTA costs improved by 4% or $40m for the year – the phasing first half to second half reflecting both the move from cricket to tennis as well as the conscious decision by Nine to further strengthen its first half CY19 programming schedule.

Nine’s Digital & Publishing division

Nine’s Digital & Publishing division includes Metro Media and 9Now, as well as Nine’s other Digital Publishing titles including Pedestrian, CarAdvice and nine.com.au.

Together, Digital & Publishing reported revenue of $637m, up 3% on pcp. Within Digital and Publishing, total print revenues were broadly flat year on year. Print now represents less than half D&P revenues, while print advertising contributes around 20% of total Digital and Publishing revenues.

Digital and Publishing reported a combined EBITDA of $130m, up 56% for the year, and growth of more than 60% in the second half.

Stan into profit with 1.7m subs

Stan grew its active subscriber numbers to 1.7m currently, with the strong summer period continuing through the second half. Stan’s consistent roll-out of exclusives like Billions and Who Is America? and local content like Bloom complemented the addition of Disney from mid-December. Usage per subscriber continues to increase, with daily total hours streamed now reaching 1.5m.

The combination of the strong subscriber build, and the $2 price rise from March increased Stan’s revenue by 62% across the year and resulted in the Group’s first EBITDA positive result in the second half.

Current trading environment and outlook

FTA market conditions remained weak in July. Nine has seen some improvement in August, and currently sees further improvement from September onwards. As a result, while Nine expects its FTA revenue in the current quarter to be down by ~4%, conditions are expected to improve into Q2.

Over the year, Nine expects the FTA market to decline by low single digits, partially offset by growth of at least 1 revenue share point.

In FY20, costs in FTA are expected to increase by ~4% driven by factors including contracted sports rights inflation of ~$27m, and incremental costs of ~$15m associated with The Ashes and World Cup Cricket. Overall, non-sports FTA costs are expected to be no worse than flat in FY20, notwithstanding the maintenance of a relatively high level of investment in local content, allowing Nine to capitalize further on current ratings and revenue share momentum.

Digital and Publishing is expected to continue to grow in FY20, driven both by top line growth and further cost efficiency gains in Metro Media, and continuing strong growth at 9Now.

As Domain commented with its result last week, the short term outlook remains defined by growth in yield and lower listing volumes, albeit there have been some encouraging signs of activity in the first weeks of FY20. Continued investment in growth initiatives is being supported by ongoing cost discipline.

On the back of the increasing subscriber numbers, and the recent price increase, Stan expects to move strongly into profitability in FY20.

In terms of the FY20 result, assuming the market conditions above and incorporating previously detailed merger synergies, Nine is expecting to report Pro Forma Group EBITDA growth on a continuing business basis of around 10%.