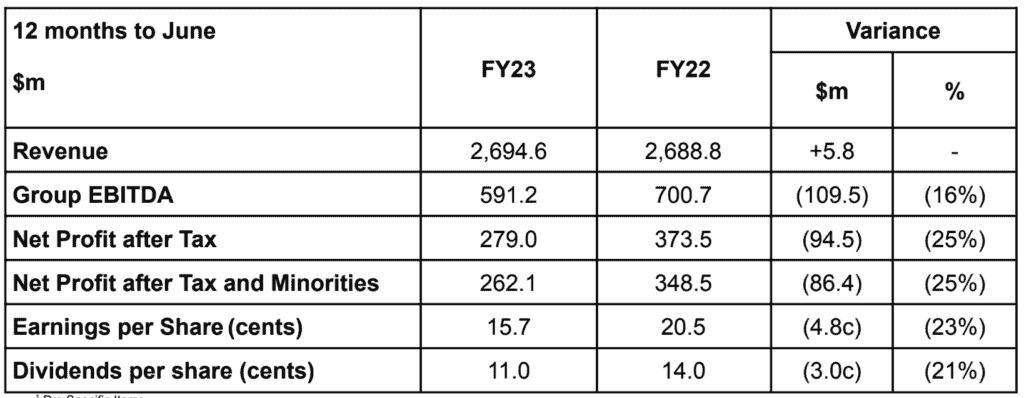

Nine Entertainment Co has released its results for the 12 months ending June 30, 2023. The company has reported revenue of $2.7b and a net profit after tx of $279m.

Nine has noted the highlights include:

• Targeted investment in content has strengthened Nine’s competitive position across all of its platforms – television, streaming, publishing and radio

• Overall revenue share growth in Radio, including 115% growth in digital revenues

• 9% growth in subscription revenues to 28% of total revenue (wholly owned, ex Domain)

• Strong performance from Stan Originals driving 12% revenue growth at Stan

• Strong performance from Publishing against a backdrop of challenging economic conditions

Peter Costello, chairman of Nine Entertainment Co. said: “Through FY23, Nine continued to solidify its position at the forefront of media in Australia. Whilst we faced tougher economic conditions which have impacted the broader industry, Nine has risen to the challenge, continuing to drive audience and revenue share, and investing in the future of the business while focussing on the efficiency of our cost base.”

Mike Sneesby, chief executive officer of Nine Entertainment Co. said: “Every month, across Nine’s television, publishing and audio assets as well as Stan and Domain, we reach almost 20m people. It is this broad reach which gives Nine its unique position – our ability to distribute content to the broadest possible audience; to monetise that content in multiple ways and to use our extensive first party data to ensure optimisation of audience and revenue.

“Our Total Television business has had an extraordinary year, achieving record revenue share results as our content strategy and investment continues to further strengthen our relative position. Our high quality talk radio assets have also grown share, whilst expediting the expansion into digital, with 115% digital revenue growth reported for the year.

“Subscription and licensing revenues at Nine’s wholly owned businesses, Stan and Publishing, together grew by around 9%, to 28% of total revenue ex Domain, with price increases successfully executed reflecting the strong content and engagement of the group’s growing subscriber bases.”

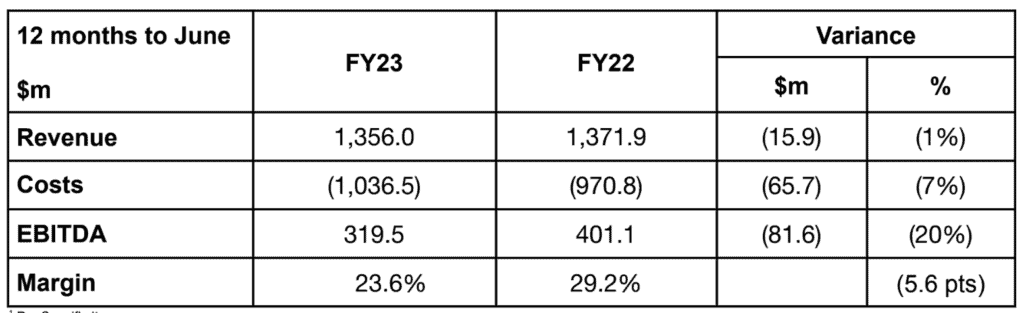

Nine broadcast division

Nine’s Broadcast division comprises Total Television (Nine Network and 9Now) as well as Nine Radio. Together, Broadcast reported EBITDA of $320m on revenues of $1.4b for the 12 months.

Whilst down on the record FY22 result, Nine Broadcast’s FY23 result was above pre-COVID levels.

Both Nine Network and 9Now comfortably outperformed their respective markets, growing Total Television share to an historically high level of 41.8% for the year, up 2.9 percentage points on FY22. Total TV revenue of $1.2b, was down 2% on FY22, with growth from 9Now close to offsetting the impact of weaker advertising markets on Nine Network. EBITDA of $307m was down 20% on FY22.

The Metro FTA advertising market declined by 11% for the year, and 15% for the second half, reflecting both the underlying weaker economy as well as Election-affected comparables. Nine Network markedly outperformed, with second half revenue share growth of 1.4 percentage points to 42.0% resulting in a Metro Free to Air (FTA) revenue share for FY23 of 40.7%, which is a more than 20-year high. As a result, Nine Network reported a revenue decline of just 4% for the 12 months to $1.1b.

Across the year, Nine Network was the #1 Network and Primary Channel of its targeted 25-54 demographic, attracting a commercial network share of 39.4%2 and a primary channel share of 40.7%, the latter a record share for any channel since OzTAM commenced.

Nine’s revenue from regional markets continues to reflect the strength of content and affiliation with WIN Corporation. For the 12 months to June, revenue share for Nine’s content across all regional markets (affiliated and wholly-owned) increased by 2.8 percentage points to 38.3%.

In FY23, 9Now revenue growth outperformed both the traditional BVOD market and the digital video market. During the year, 9Now’s revenue growth of 16% outperformed the traditional BVOD market of 9Now, 7-Plus and Ten Play, which grew by 6% to $392m.

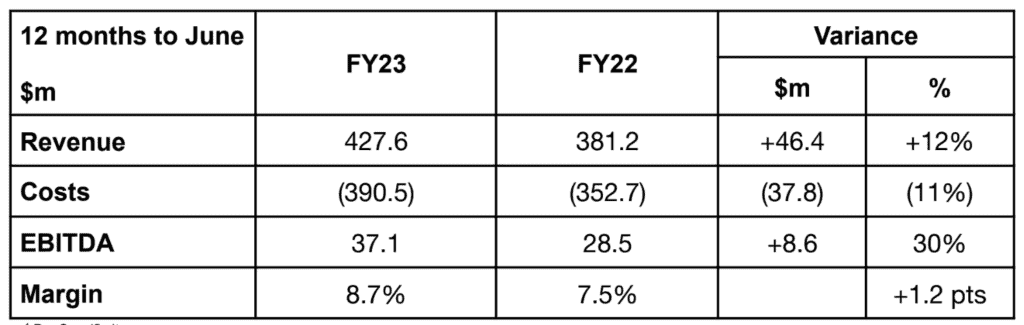

Stan

Stan’s Originals have been a significant driver of performance, proving to be one of the keys to Stan’s success, delivering four of the top six series and movies available on Stan in FY23. New original series such as Black Snow, Ten Pound Poms and Bali 2002 attracted strong viewership, complementing returning series such as Bump and Ru Paul’s Drag Race Down Under, as well as original movies including Transfusion, Poker Face and The Portable Door.

Stan Sport continued to extend its consumer proposition, securing the rights to the Rugby World Cup and successfully broadcasting the Women’s tournament, as well as the UCI World Championship cycling event in Wollongong.

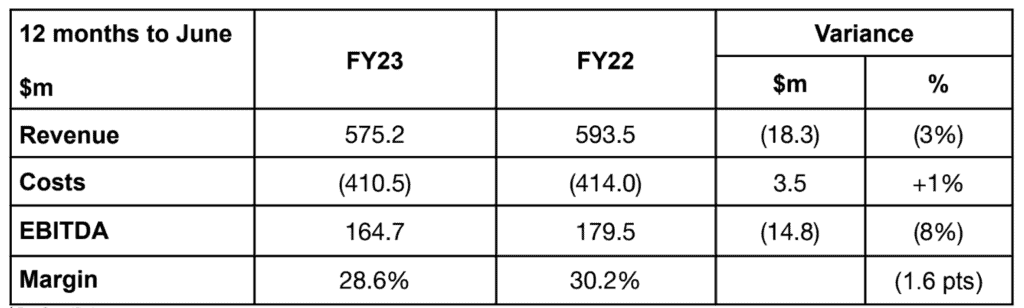

Publishing

Nine’s Publishing division includes the core Metro Media business, as well as nine.com.au, Pedestrian Group and Drive. Together, Publishing reported revenue of $575m and a combined EBITDA of $165m, down 8% on FY22’s record result. Digital accounts for more than 60% of Publishing revenue.

After a strong first half, Nine Publishing’s full year result was primarily impacted by the softer advertising market. Total advertising revenue was down by 16% in the second half, after a broadly flat H1, with digital advertising revenue (down 19% in H2 on pcp) reflecting softness in programmatic advertising and a decline in print advertising (down 10% in H2 on pcp) which compares against a previous corresponding period that was boosted by advertising associated with the 2022 Federal Election.

Total subscription revenue grew by 3%, despite the challenging consumer environment. Strong readership across The Sydney Morning Herald, The Age and The Australian Financial Review continued to translate to paying audiences, showing mid-single digit (%) growth in digital subscriptions over the past 12 months, to more than 460,000 active subscriptions at June year end.

Current trading environment and outlook

Reflecting the generally softer economic environment, FY24 has begun much as FY23 ended. The advertising market remains subdued, particularly in FTA, digital display and print publishing. Against this backdrop, Nine has continued to outperform in each of its operating segments.

Whilst the current market conditions remain challenging, Nine’s broad base of revenue and scale enables maintenance of investment in content and product. This is expected to result in further improvement in Nine’s competitive position through the cycle, while the Group also remains disciplined around operating costs and underlying efficiencies. Nine’s strong cash flow and balance sheet enables the continuation of the buyback and 60-80% dividend payout, as well as providing the flexibility to consider strategic and targeted investments that will underpin the longer term growth of the business.