News Corporation has reported financial results for the three months and fiscal year ended June 30, 2021. Commenting on the results, the media company‘s chief executive Robert Thomson told an analysts call this morning about record news subscriptions, record traffic at the news and real estate business and record subscriber numbers at Foxtel.

Thomson said: “Fiscal year 2021 was the most profitable year since we created the new News Corp in 2013, with revenues rising 4 percent in the full year and surging by 30 percent in the fourth quarter. Profitability improved by 26 percent for the year, when we had a record number of digital subscriptions, record revenue and profits at Move and record traffic at realtor.com, record profits at HarperCollins and the largest profit at Dow Jones since its acquisition in 2007.

“We also saw record subscriber growth at Foxtel, where, at the end of June, our paid streaming subscribers reached over 2 million, an increase year-on-year of 155 percent. That sterling performance has clearly given us much optionality as we consider Foxtel’s future, which is certainly bright, given that revenues rose 33 percent in the fourth quarter.

“Our strong record of cash generation, with a positive balance of $2.2 billion at the end of June, has given us enhanced flexibility. We were opportunistically able to take advantage of the required sale of OPIS, which we believe will be transformative for the already successful Dow Jones Professional Information Business. Our robust cash position has prompted the company to actively review our capital allocation policy, with a greater focus on buybacks.

“The intrinsic value of our content has been amplified through landmark news payment agreements with major tech platforms. These deals, which are confidential, will add revenue annually into nine figures and are a profoundly positive sign of the ongoing transformation of the news landscape.

“I want to express my sincere gratitude to the employees of News Corp, who have navigated these trying times with professionalism and with principle. Their efforts, their creativity and their commitment have built on the company’s proud foundations and been a catalyst for these particularly impressive results.”

Regarding the revenue from deals with Facebook and Google, Susan Panuccio, News Corp chief financial officer, indicated the impact will be felt in the new financial year when the company might share some detail regarding the benefit.

Full-year results

News Corp reported fiscal 2021 full-year total revenues of $9.36 billion, a 4% increase compared to $9.01 billion in the prior year, reflecting a $513 million, or 6%, positive impact from foreign currency fluctuations. The increase was also driven by growth at the Digital Real Estate Services, Book Publishing and Dow Jones segments and higher streaming revenues at the Subscription Video Services segment.

The growth was partially offset by lower revenues at the News Media segment, which was primarily due to the divestiture of News America Marketing in May 2020. Adjusted Revenues (which exclude the foreign currency impact, acquisitions and divestitures as defined in Note 2) increased 5%.

Foxtel

Full-year revenues increased $188 million, or 10%, compared with the prior year, reflecting a $217 million, or 12%, positive impact from foreign currency fluctuations and $89 million of higher revenues from Foxtel’s streaming products. The revenue increase was partially offset by the impact from fewer residential broadcast subscribers.

Lower expenses related to entertainment programming, transmission and employee costs were offset by increased investment in streaming products and $35 million of higher sports programming rights and production costs.

As of June 30, 2021, Foxtel’s total closing paid subscribers were 3.891 million, a 40% increase compared to the prior year, primarily due to growth in Binge and Kayo subscribers and higher commercial subscribers, partially offset by lower residential broadcast subscribers. 1.885 million of the total closing paid subscribers were residential and commercial broadcast subscribers, and the remaining 2.006 million consisted of Kayo, Binge and Foxtel Now subscribers.

As of June 30, 2021, there were 1.079 million Kayo subscribers (1.054 million paying), compared to 465,000 subscribers (419,000 paying) in the prior year.

Binge, which launched in May 2020, had 827,000 subscribers (733,000 paying) as of June 30, 2021, compared to 80,000 subscribers (56,000 paying) in the prior year. As of June 30, 2021, there were 228,000 Foxtel Now subscribers (219,000 paying), compared to 336,000 subscribers (313,000 paying) in the prior year.

Broadcast subscriber churn in the quarter was 17.1% compared to 13.2% in the prior year, due to fewer promotions, the roll-off of lower value subscribers, as well as the lapping of various measures implemented due to Covid-19 in the prior year. Broadcast ARPU for the quarter increased 4% to A$81 (US$63).

Robert Thomson noted the good work done by executive chairman Siobhan McKenna and CEO Patrick Delany at Foxtel. He added the improved financial position gives the business many more options across decisions relating to content acquisition and pricing. The Foxtel business is also looking forward to the introduction of the new iQ5 box in the new financial year.

Dow Jones

Fiscal 2021 full year revenues increased $112 million, or 7%, compared to the prior year, due to growth in circulation and subscription revenues and advertising revenues. Digital revenues at Dow Jones represented 72% of total revenues compared to 67% in the prior year. Adjusted Revenues increased 6% compared to the prior year.

Circulation and subscription revenues increased $105 million, or 9%, reflecting a $13 million, or 1%, positive impact from foreign currency fluctuations. The growth was primarily due to 9% growth in circulation revenues, reflecting higher digital-only subscriptions at The Wall Street Journal and Barron’s, 6% growth in professional information business revenues, which was driven by 23% growth in Risk & Compliance products, and higher revenues from content licensing partnerships, partially offset by lower print volume.

Risk & Compliance reached approximately $195 million in revenues in fiscal 2021. Digital circulation revenues accounted for 64% of circulation revenues for the year, compared to 58% in the prior year.

Advertising revenue increased $14 million, or 4%, the first year-over-year growth in a decade, primarily due to a 32% increase in digital advertising, partially offset by a 20% decline in print advertising. Digital advertising revenues accounted for 58% of total advertising revenues for the year, compared to 46% in the prior year.

Book Publishing

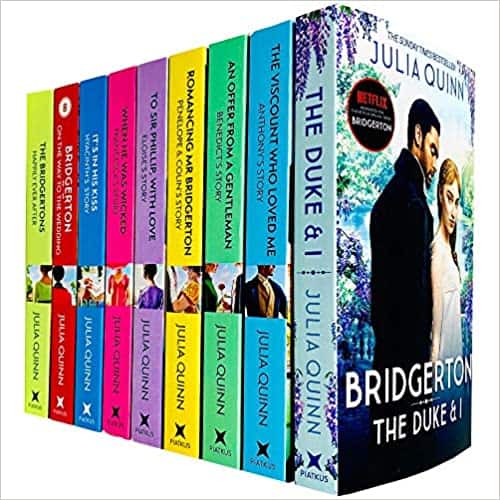

Full year revenues increased $319 million, or 19%, compared to the prior year, reflecting a $34 million, or 2%, positive impact from foreign currency fluctuations. The revenue growth was primarily due to strong backlist sales, including the series of Bridgerton titles by Julia Quinn, The Guest List by Lucy Foley and The Boy, the Mole, the Fox and the Horse by Charlie Mackesy, and the success of new titles such as The Order by Daniel Silva and Code Name Bananas by David Walliams.

Digital sales increased 16% compared to the prior year, driven by higher e-book sales and the continued growth in downloadable audiobook sales. Digital sales represented 22% of consumer revenues for the year.

News Media

Full-year revenues declined $596 million, or 21%, compared to the prior year, reflecting a $675 million, or 24%, negative impact related to News America Marketing and Unruly, which were divested in May and January 2020, respectively, and a $169 million, or 6%, positive impact from foreign currency fluctuations.

Within the segment, revenues at News Corp Australia declined 1% and revenues at News UK increased 5%.

Circulation and subscription revenues increased $104 million, or 11%, compared to the prior year, reflecting a $79 million, or 8%, positive impact from foreign currency fluctuations, digital subscriber growth and price increases, partially offset by lower single-copy sales revenue.

Advertising revenues declined $677 million, or 43%, compared to the prior year, reflecting $649 million, or 42%, of lower advertising revenues related to News America Marketing, a $90 million, or 6%, negative impact related to the closure or transition to digital of certain regional and community newspapers in Australia and continued weakness in the print advertising market, exacerbated by COVID-19.

The decline was partially offset by a $68 million, or 5%, positive impact from foreign currency fluctuations and growth in digital advertising, particularly at the New York Post. Other revenues decreased $23 million, or 8%, compared to the prior year, primarily due to the sale of Unruly in January 2020.

Digital subscribers and users across key properties within the News Media segment are summarised below:

Closing digital subscribers at News Corp Australia’s mastheads as of June 30, 2021 were 810,000, compared to 647,600 in the prior year (Source: Internal data)

The Times and Sunday Times closing digital subscribers as of June 30, 2021 were 367,000, compared to 336,000 in the prior year (Source: Internal data)

The Sun’s digital offering reached approximately 124 million global monthly unique users in June 2021, compared to 133 million in the prior year (Source: Google Analytics)

New York Post’s digital network reached approximately 123 million average monthly unique users in June 2021, compared to 150 million in the prior year (Source: Google Analytics)

See also: News Corp to acquire data and analytics provider OPIS for Dow Jones