Tuesday December 5, 2023

QMS’ John O’Neill on MOVE 2.0: “The industry will grow significantly, and very quickly”

QMS chief executive John O’Neill predicts the company will experience double-digit growth in 2024 as the out-of-home industry continues to experience strong growth in ad revenues despite the tough economic headwinds.

As 2023 closes out on another good year for outdoor advertising revenues, O’Neill told Mediaweek, the long-awaited arrival of the audience measurement system MOVE 2.0 (Measurement of Outdoor Visibility and Exposure) will help the industry deliver similar growth in 2024.

The system will deliver an update on the current MOVE 1.5, which was launched by The OMA in 2022, to provide “much more detail” for advertisers as well as extend the measurement system into extend into regional areas.

“What [MOVE 2.0] is going to do is provide much more granular data for advertisers and agencies to be able to plan their media campaigns. At this stage, the transition from MOVE – which was basically a static measurement system – into MOVE 1.5 has been received really well,” said O’Neill.

“There will be a transition period, but once we get to the stage where critical mass exists in the market, and you’ve got MOVE 2.0 with all of the data sets, I think you’ll find the industry will grow significantly, and very quickly.”

QMS City of Sydney – Uber

O’Neill listed Nine, Paramount, Seven, SCA, most of the radio stations, and all the streaming services as media brands making the most of the digital network. When it comes to attracting ad dollars – from within the media industry and out of it – he said that the key has been the measurement system of MOVE 1.5.

“The measurement system plays a huge part, because we’ve got a much greater understanding of where audiences are. Having a digital platform plays into the hands of that well, because, at the end of the day, we can serve ads when we need to with appropriate creative at different times, and be very targeted and immediate with it.

“The dominance and the recall that we’re getting have been fantastic. We get a chance to get greater stats around long-term memory encoding, and that influences sales and brand awareness.”

To this end, O’Neill predicts a good year for the QMS business as it focuses on “strengthening relationships with clients and advertisers.”

“We’re very focused on development in New South Wales, we’ve got three pretty exciting tenders to announce over the next few weeks. There’ll be 30 plus large format digital locations for us – 60 to 70% of those will be New South Wales, all A-Grade, quality locations, which will enable us to fight for a bit more of that New South Wales money. That will have a flow-on effect with our network balance around the country.

“From our perspective, we’re forecasting double-digit growth on the basis that we’ll have a new suite of assets, new stories to tell, more digital, and we’ve just introduced Performance Plus – it’s almost like a post-analysis scenario, which has never really been done in out of home before. There’s a third party verification piece that exists, we guarantee our audience and the numbers, and we make up for the audience numbers afterwards,” he said.

QMS City of Sydney – Paspaley

With October marking one year of the QMS City of Sydney street furniture network, O’Neill said the asset has “always been the envy of all of the suppliers in market.”

“To win the tender and have the opportunity to represent that really heavily sought-after audience within the 26k radius of the CBD of Sydney is something that we didn’t take on lightly.

“We had the opportunity to digitise it, set new tones, new benchmarks, and new communication pieces, that’s been the thing that’s revitalised the industry. If you have a look at the street furniture category that it exists in, it’s only now trading at 2019 levels – but the revenue that we’re writing in City of Sydney has far exceeded where we thought we’d be,” said O’Neill.

See Also: “Exhilarating, challenging, highly rewarding”: One year of QMS’ City of Sydney network

–

Top Image: John O’Neill

Prime Video lands exclusive broadcast rights for ICC Cricket

The International Cricket Council (ICC) and Prime Video have announced a four-year deal to provide exclusive live broadcast rights in Australia for ICC cricket, making matches available on Prime Video Australia. The deal includes streaming rights in Australia for 448 live games from 2024 to 2027, and does not include an attached free-to-air partner.

The partnership will see Prime Video Australia exclusively stream all men’s and women’s events, including the Men’s and Women’s Cricket World Cups, T20 World Cups, Champions Trophy, U19s and the World Test Championship Final.

The new partnership begins in January 2024, and will provide broadcasts at no extra cost to a Prime membership.

Prime members will be able to watch all live ICC matches anywhere and anytime on their Prime Video app for smart TVs, mobile devices, Fire TV, Fire TV stick, Fire tablets, Apple TV and stream online. In the Prime Video app, Prime members can download matches on their mobile devices and tablets and watch anywhere offline at no additional cost.

Head of Prime Video Australia and New Zealand, Hushidar Kharas said: “Prime Video has worked to create a single destination for audiences to find new movies, live sports, and their favorite TV shows. We are always looking for ways to deliver more value to our customers and live sports is consistently one of their top requests. We are thrilled to be able to offer our customers the live broadcast of the Cricket World Cup included in their Prime membership! The Cricket World Cup is one of the most viewed sporting events in the world; the recently concluded edition was watched by hundreds of millions of people! Over the next four years, Prime members in Australia will be able to watch their favourite cricket teams and players compete for the game’s biggest prize, on demand, on the device of their choice—exclusively on Prime Video.”

ICC Chief Executive, Geoff Allardice said: “We are very excited to be entering a new four-year partnership with Prime Video for ICC cricket rights in Australia. The recently concluded Men’s Cricket World Cup has highlighted the interest and passion for ICC Events across the globe, and especially in Australia where cricket fans have enjoyed the recent success of their men’s and women’s teams. We look forward to working with Prime Video Australia to provide an innovative coverage of world class cricket to more fans in Australia.”

The deal follows the ICC Men’s Cricket World Cup 2023 which culminated in Australia lifting the trophy. The Cricket World Cup set new records for in-stadium attendance and broadcast viewership, whilst becoming the most digitally engaged event to date.

See Also: Kayo reports viewership and streaming numbers for 2023 ICC Men’s World Cup

VOZ, BVOD and brand safety: Paramount’s Rod Prosser & Daniel Monaghan wrap up 2023

In a year dominated by the sweeping changes in TV, as linear ad spend began its decline and advertisers followed audiences onto new platforms. Mediaweek is ending the year by catching up with content and sales executives from each network, and first up is Paramount ANZ’s SVP content and programming, Daniel Monaghan, and chief sales officer, Rod Prosser.

When asked what the highlight reel of Paramount’s 2023 looks like, both Monaghan and Prosser had a list of achievements to point to – across both content and brands.

Monaghan: “We’ve had the most-watched entertainment shows for younger audiences, so that’s something to crow about. We’ve had Thank God You’re Here as the biggest comedy launch in four years, we’ve got the number one and number two 8:30pm shows on television with Have You Been Paying Attention? and Gogglebox.

“Nickelodeon’s launching this year was a big one for us, bringing that brand across to Free to Air and then growing a linear channel. 10 Play is the fastest growing BVOD platform, it’s already up 25% year on year, we have 50 FAST channels on the platform now, and we’ve got daily viewing up over 200% after the FAST channels have launched. And we’ve got a lot more to come in 2024.”

See Also: Why bringing Nickelodeon to FTA has been a good slime for Paramount

Prosser: “What’s been really exciting for me is to engage with advertisers, talking about the breadth in our business – we really are the only network now with free-to-air, BVOD, SVOD, and AVOD with FAST. What that means for advertisers is that we’re connecting to a really broad range of audiences, and in particular we’re seeing our FAST channels bringing in a younger cohort, and bringing them back into the free environment.”

Throughout the year, the pair say that there have been some unmissable trends emerging in regard to both audience consumption and the ever-increasing desire to seek out brand safety.

Monaghan: “As a global brand, things that target a broad family dynamic have really worked well, we’ve seen great success with that. We’ve seen success with IP and things that are based on real life – particularly on Paramount+.

“People really want to laugh at the moment. 10 has the most watched comedies on TV, and we moved that over to Paramount+ with The Inspired Unemployed. That was a giant success there. The news cycle is quite heavy, people really want to laugh – from a content perspective, we’re very happy to oblige.”

Prosser: “A common theme that has popped up is brand safety. We’re living in some really interesting times with some really tragic situations going on around the world – not being attached to misinformation is critical. Responsibility and integrity in journalism are definitely important to brands, and I suspect that’s because of what’s surfacing on social platforms.

“Outside of that, on a more positive note, we’ve seen brands really want to innovate through content and look at how they can partner with our various shows in a much more meaningful way. That’s good for us, because we’ve worked really closely with the producers of the shows, and they really leaned into how they execute brand partnerships.”

2024 is already shaping up to be a big year, with the launch of VOZ and VOZ Streaming on the horizon. Predicting the impact of the rollout, Prosser said that “full-stop, VOZ is the best measurement and representation of how and what Australians are viewing on free to air.”

Prosser: It will be currency, allowing buyers to find mass reach efficiently and effectively. I think it’s a game-changer.

“In terms of VOZ streaming, we are a massive advocate of the product. It’s in the hands of the OzTAM board, the MFA, and a lot of other various vendors. The important thing for us is that the product will need to evolve to ensure that the total TV picture is being measured, and at some point that will be broader than just our free to air assets.”

2024 will also see Paramount+ launch its ad tier – something Prosser said the team is “super excited” about.

Prosser: “In terms of the SVOD space, we are attracting a younger audience. We’re having conversations with brands, who are having a good look at our services. We’ve got some really nice gains in younger audiences.”

As for whether there are any categories that are investing more in streaming than perhaps they would be in other spaces, Prosser said of SVOD that “There are no particular brands as such, but I think that what it’s doing is re-energising the television sector.”

–

Top Image: Rod Prosser and Daniel Monaghan

Avis Budget Group retains Havas Media Network and Havas Red

Avis Budget Group has retained Havas Media Network and Havas Red, following a competitive pitch, as it prepares for a 15% surge in growth as restrictions ease and higher numbers of international tourists return to Australia.

Havas Media Network CEO Virginia Hyland told Mediaweek it was “a significant win” for both agencies, adding that Avis Budget is a top seven client for Havas in terms of billings and revenue. The agency has signed a three-year contract with the vehicle rental brand.

The Avis account, which includes brands such as Avis, Budget and Apex, was up for grabs after the agency held it for five years. The pitch, which included media and PR, involved a mix of indie and global agencies.

Hyland said Avis called the pitch in a bid to understand other market opportunities. “The client recognised having an integrated approach and being able to access specialists across all different agencies of the Village is critical to their success moving forward.”

To better service the account, Havas has bolstered its e-commerce capabilities and skills, paid media, and content engagement services, in addition to staff changes.

“Some new faces and some old faces just to give it a real revamp as to how we transition into the future and support them much better.”

Next year is shaping into an interesting year in the vehicle rental industry in Australia, which has shrunk as a result of rising competition and the continuing impact of COVID-19, dropping 0.7% over the past five years, according to data from IBIS World.

Avis, which competes with Thrifty, Hertz and German-owned Sixt, will be looking to capitalise on a predicted 15% growth surge next year as restrictions ease and the return of international tourists to Australia increases with the market expected to reach $1.5 billion next year.

Hyland said: “We’re looking very closely at what they’re doing and how we ensure that the experience the Avis brand is giving consumers right from the time they pick up their car, when they’re online, deciding which car to rent is really special.

“I think the experiential part of working with Avis Budget will help elevate how they engage with audiences and consumers versus just running advertising campaigns,” she added.

Shane Russell, Havas Red CEO, also celebrated winning Avis Budget, noting that the brand is paving the next wave of innovation in the travel and transportation spaces.

He said: “With that comes a tremendous opportunity for our team to craft evolving narratives and connect each brand to customers and partners through earned media activities.”

Hyland said that the industry can expect to see Havas take on the economic challenges ahead.

“We love to challenge the market, and we’ve invested heavily in tools and data from a global perspective in the past year. We’ve also invested in our team and talent; we’ve got some of the best team members now working at us.

“Havas always acquires agencies that have been indies previously, so we’re very much entrepreneurial at our heart, giving us the freedom to be more creative.”

For Hyland, she revealed that she has been given a green light to begin acquiring other businesses in the Australian market to fuel Havas’ growth further.

“It’s exciting for us that we’re on the acquisition trail,” she said.

Although Hyland kept mum on 2024 acquisition plans, she highlighted her journey as a blueprint for the future.

“Some indies out there have seen what I’ve done and how I’ve moved into Havas, and I feel very comfortable trusting that it’s a great environment to foster that entrepreneurial spirit. But being backed by and supported by the investment from globals, particularly with tools, technology, and data, costs so much more than ever.”

–

Top image: Virginia Hyland

Mediaweek’s A to Z of 2023: C is for Cinema

To wrap up 2023, Mediaweek is looking at the biggest trends, events, platforms, and brands of the year. Welcome to Mediaweek’s A to Z of 2023 … and beyond.

By Guy Burbidge, Managing Director, Val Morgan

This year in cinema has been unlike any other. Records have been broken both locally and globally. We witnessed a resurgence in genre filmmaking which saw the box office driven by one of the most diverse slates from studios and distributors spanning action, family, comedy, horror, and even concert films resulting in the top ten films of the year so far comprising of five different genres.

The year started strong with some big moments. Avatar: The Way of Water captivated cinemagoers across the world, smashing records to achieve the third highest-grossing film of all time both worldwide and in Australia. At Easter, we saw The Super Mario Bros Movie the number one animated film of all time in Australia, beating out a 20-year record held by Shrek 2. Spider-Man: Across the Spider-Verse and John Wick 4 both overdelivered significantly on their prior films and then the most monumental cinematic cultural moment of the year, Barbie, turned the world pink.

The film’s success – aside from the incredible marketing machine behind the film – lay in its broad multi-generational appeal, resonating and connecting with both young females and an older demographic. It quickly became a cultural phenomenon. With $1.4 billion at the global box office, Barbie has become the number one comedy film of all time and broke into Australia’s top four films of all time.

Barbie

Then there was Barbenheimer, the showdown of Barbie and Oppenheimer releasing on the same day which created a social trend that swept the internet, and no doubt helped drive Oppenheimer to become the second highest-grossing drama in Australia, ever.

Thrillers have also had a successful year at the box office. 2023 was the year of fear with titles like The Nun II, Scream VI, M3GAN, and Talk To Me all appealing to the next generation of horror enthusiasts and Five Nights at Freddy’s crept its way to the fourth-highest grossing horror film ever in Australia.

The demand for culturally and linguistically diverse films in Australia also reached an all-time high, with Pathaan becoming Australia’s biggest Bollywood movie ever early in the year, and Jawan which was released in September sitting firmly behind in second place.

Fascinatingly, it’s the first time since 2017 that a superhero film won’t be in the top three movies of the year, indicating audiences shifting towards a more diverse content slate.

Cinema experiences have hit new strengths. Not only have we seen the return of some of Australia’s most loved outdoor cinema experiences like Moonlight Cinema, but we’ve also seen the introduction of new innovative concepts, like Mov’in Bed Barangaroo Beach Club Cinema which officially kicks off next month, and Dendy Powerhouse Outdoor Cinema; a 350-seater outdoor cinema with lounge chairs, and wireless headphones, all of which provide audiences with the premium experiences they’re actively seeking.

One of the strongest indicators of the state of the industry is brand-new cinema complexes opening across the country. Palace Penny Lane, Reading Angelka and Reading Busselton have all opened this year, as well as the new IMAX in Sydney’s Darling Harbour. This cutting-edge cinema combines state-of-the-art Laser by IMAX technology for an experience like no other. Since opening in October, the Sydney IMAX has become the highest-grossing IMAX location globally outside the United States and the United Kingdom.

Not only are new cinemas opening up, major operators and independent exhibitors alike are investing in the refurbishment of cinemas across the industry and continuing to improve the customer experience from quality of the in-cinema experience through to F&B and amenities.

Brands have also capitalised on another strong year, with Cinema outperforming the market with the latest SMI data (Jan – Sept) reporting a 4.5% uplift in ad spend, the second highest YOY channel increase after Outdoor.

Australians love cinema. Incredible content paired with the cinemagoing experience is why 2023 saw cinema continue to hold its place at the forefront of culture, and why it’s considered an affordable luxury; one that despite challenging economic conditions Australians still spend on, with CBA reporting that spending on cinema tickets alone was up 31 per cent in the last quarter.

Looking ahead, 2024 is set to be a strong year for Cinema. With the SAG AFTRS strike now officially over, audiences can expect more. More quality content, a more diverse slate of films including movies that were meant to release in 2023 like Dune Part Two and Force of Nature: The Dry 2 as well as other highly anticipated titles like Godzilla x Kong: The New Empire, Furiosa, Deadpool 3, Mufasa: The Lion King, Joker: Folie à Deux, and Wicked Part One, all set to release in the new year.

See Also: Mediaweek’s A to Z of 2023: B is for BVOD

–

Top Image: Guy Burbidge

Mediaweek’s A to Z of 2023: D is for Data and Measurement

To wrap up 2023, Mediaweek is looking at the biggest trends, events, platforms, and brands of the year. Welcome to Mediaweek’s A to Z of 2023 … and beyond.

By Jonas Jaanimagi, technology lead of IAB

Making sense of measurement

Potential signal loss, both ongoing and forthcoming, continues to dominate the thinking for all parts of the industry, along with an increased focus on responsible addressability. These critical topics, which will continue into 2024, are impacting how publishers are strategically investing in their future products and capabilities and how marketers look to plan, activate, measure, and manage their digital campaigns.

The industry remains very focused on the deprecation of the 3rd party cookies as an identifier, but we’ve already seen restrictions on cookies in Apple’s Safari and Mozilla’s Firefox browsers as well limitations on Apple’s iOS device identifier. We also know that changes are coming in both Google Chrome and ultimately the Android device identifier, GAID. IAB has for some time been providing education and awareness around the various ID solutions and their related identifiers available here locally and we are committed to refreshing this guidance in early 2024.

From a measurement perspective, recent IAB Australia industry research showed an increased usage of more resilient measurement techniques such as experimental lift studies and MMM (Market Mix Modelling) to evaluate the success of digital advertising. Concurrently, the adoption of 3rd party cookie reliant methods such as MTA (Multi-Touch Attribution) have declined, supported by research such as was presented by Analytic Partners at our MeasureUp conference this year which clearly demonstrated the issues buyers will face if they continue to solely rely upon traditional direct response attribution techniques.

Responsible approaches to data collaboration in digital advertising have come forth this year, including Data Clean Rooms. Clean Rooms are gaining traction and are a good example of a PET (Privacy Enhancing Technology) as they are privacy preserving yet can still provide the capabilities for multiple organisations to come together to quantify the effectiveness of campaigns without exposing or directly manipulating any data shared or transferred between different parties.

PETs as a maturing category of innovation are also now assisting the resurgence for MMM leveraging advanced machine learning for even faster and deeper insights by surfacing more granular evaluation, prediction, and optimisation recommendations that are both meaningful but also actionable. There will be more examples of PETs in 2024 with solutions such as k-anonymity, trusted servers and synthetic data gradually coming to the fore and we’re looking forward to some related initial guidelines from the US-based IAB Tech Lab in the new year.

Industry collaboration will also be critical in CTV measurement (which remains an important area of growing spend) as we’ll soon see the delivery of best in class cross-media measurement here in Australia with a world first integration of CTV currency data from both OzTam and IAB endorsed Ipsos iris. This will provide de-duplicated total audience planning data for all buyers – across CTV, smartphones, tablets, and computers.

We’ll also be working hard to keep industry updated on the Attorney-General’s Department final decisions on privacy legislation amendments expected next year. Regardless we’ll be providing some guidance on managing consent from a technical perspective, highlighting the current requirements in both Europe and California as examples of what is possible and how the frameworks for both these markets work in practice. We also recommend regularly checking Google’s 2024 timelines for the final phase out of third-party cookies and evolving privacy-preserving APIs in both in-app environments (Android) and web (Chrome). It’s also been interesting to recently see a resurgence in actively testing between Mozilla and Meta of the Interoperable Private Attribution (IPA) proposal. IPA leverages another PET called Secure Multiparty Computation (MPC) and is quite forward thinking it it’s approach for both cross-device privacy but also conversion attribution.

It’s important for marketers to be aware of and better understand how technology and regulatory changes will impact their digital advertising and measurement capabilities in 2024 and to have a plan in place prior to the implementation of these changes next year. Importantly industry must be ready to competently and thoroughly test whilst 3rd party cookies are still functioning and in prevalent usage for a full comparison.

With new privacy legislation coming, the final step in retirement of 3rd party cookies in Chrome imminent, the adoption of strategies to decarbonise digital advertising increasing and the continued expansion of digital channels and formats, the industry will once again have to come together collaboratively in 2024 to make a difference. This is at the heart of how we function as an industry body, so we expect to be busier than ever next year. Ultimately it will require a portfolio approach to campaign activation, management, and measurement post 3rd party cookie deprecation and IAB Australia will continue to work hard to support industry through these changes via the various outputs from dedicated councils and working groups and at our various events through 2024.

See also: Mediaweek’s A to Z of 2023: C is for Cinema

–

Top image: Jonas Jaanimagi

beIN SPORTS launches on Prime Video after departure from Foxtel

Prime Video has announced a partnership with beIN SPORTS, which will see the service become available to Prime members on Prime Video Channels in Australia. The move comes after the departure of BeIN Sports from Foxtel on July 1st this year.

The exit from Foxtel marked the end of a seven-year stint with the brand, and at the time, a Foxtel Group spokesperson said the decision was made “as part of our constant evaluation of programming and channels.”

See Also: Foxtel to drop BeIN Sports and PBS Kids channels from July 1

beIN SPORTS will launch on Prime Video Channels in the coming weeks and will be the first standalone live sports channel for the service locally.

At $14.99 AUD per month, the service with Prime Video Channels will broadcast international football, tennis, and rugby, offering over 3,500 live events per year.

“This new partnership with beIN SPORTS is an exciting step forward for Prime Video’s sports offering, and gives our customers more choice of the best live and on-demand sports, all in one place,” said Hushidar Kharas, head of Amazon Prime Video Australia and New Zealand.

“We know our Australian customers are obessed with live sport, and the add-on of beIN SPORTS via Prime Video Channels will unlock thousands of marquee events for football, tennis, and rugby enthusiasts. I cannot wait for the service to launch in the coming weeks”

Mike Kerr, managing director, beIN Asia Pacific said “This partnership with Prime Video Channels marks a significant milestone for beIN SPORTS as we continue to enhance the sports viewing experience for fans in Australia. Through this exciting alliance, we are not only expanding our reach but also ensuring that the sports community have unparalleled access to our premium and exclusive sports coverage.

“We remain deeply committed to serving the passionate fans in the region and look forward to working closely with Prime Video Channels to reach new audiences and elevate engagement by providing a top-notch sports entertainment experience.”

Honda Australia on the hunt for a new media agency

Zenith Media Australia has confirmed it will not compete in the pitch for Honda Australia’s media account after managing the account for 17 years as its media agency.

Jason Tonelli, CEO of Zenith Media Australia, said: “We would like to thank the Honda Australia team for a successful 17-year partnership.

“Honda is a fantastic brand, and it has been a pleasure to work with the business and help with its transformation over such a long period of time.”

Honda Australia declined to comment.

The automotive industry is set for a big year in 2024 as auto brands battle to grab share in the growing hybrid and EV category.

While Honda has unveiled big goals for its global EV strategy, including a goal to make more than 2 million EVs a year by 2030, locally the brand is behind its competitors when it comes to electric vehicles.

Earlier this year, Honda Australia announced it would focus on hybrid vehicles in the short term and would take a “medium-term” view of electric vehicles.

“We think hybrid is the right strategy at this point in time … we don’t have any plans at the moment to introduce [electric vehicles],” Honda Australia director and COO Carolyn McMahon said in March.

McMahon said the auto giant believed the local market was not ready to accommodate electric vehicles. Motoring experts speculated the move could put the auto giant behind competitors such as EV giants Tesla and BYD, as well as Toyota, Mazda and Subaru.

Seven aims to grow total TV trading with Advanced Advertising team

Seven Network has announced the establishment of an “Advanced Advertising” division, aiming to drive the development and deployment of trading models within Seven’s national converged total TV ecosystem.

The newly formed team will oversee their total TV trading system, Phoenix. Phoenix integrates the reach of Seven and 7plus screens, providing brands with a unified platform for investment across capital cities, regional Australia, and digital channels.

See also: Seven Upfront 2024: Meet Phoenix, Seven’s total TV trading system

Alex Tansley, previously head of converged audience trading, assumes the role of head of advanced advertising, leading the team. Joining him are Liz Beverley as campaign delivery and optimisation manager, and Matt Murphy, appointed as audience predictions manager.

Tansley expressed, “With Phoenix, Seven is creating the future of total TV audience trading in Australia, underpinned by world-leading technology. The Advanced Advertising team will place the client at the forefront of everything we do, ensuring more effective and efficient outcomes across all campaigns.

Kurt Burnette, chief revenue officer at Seven West Media, emphasised the significance of Phoenix and the Advanced Advertising team, stating, “As the market rapidly evolves to total TV and video trading across screens and recognises its clear benefits, the demand from the market and the technology and capability that Seven is building has exponentially increased.

See also: Heavy Hitters SXSW episode 3: Seven’s Mel Hopkins and Kurt Burnette

“Phoenix will be an absolute game changer for marketers and media agencies – and the new Advanced Advertising team will be at the forefront of its rollout and implementation.”

–

Top Image: Alex Tansley

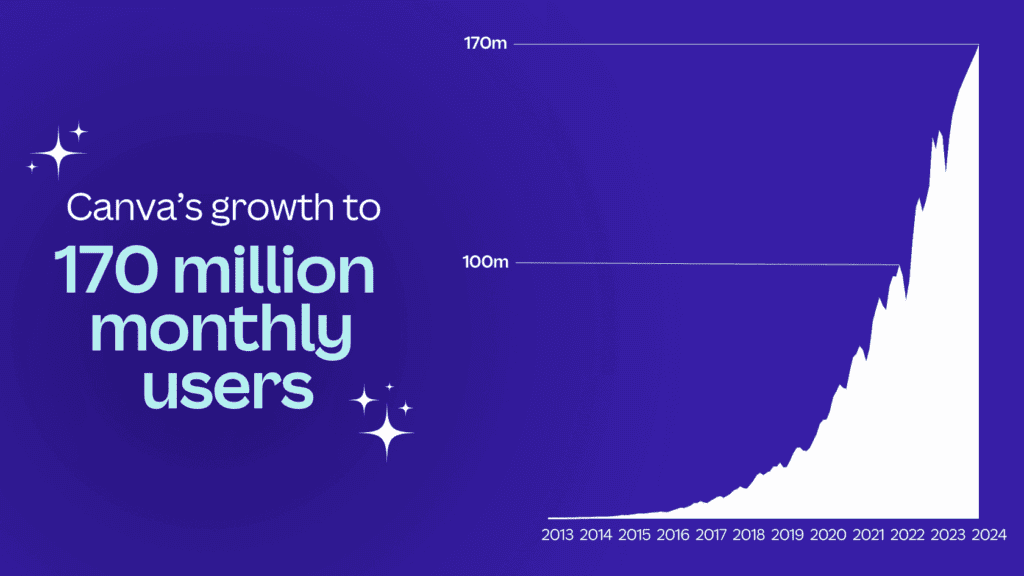

Canva reports biggest year of growth adding 60 million users to hit 170 million

Canva is celebrating hitting several key milestones as it marks its 10th anniversary.

The graphic design platform’s community has grown to more than 170 million people in 190 different countries using create and achieve their visual communication goals. This year alone saw the biggest growth, with 60 million joining over the past 12 months.

Along with a growing community, the number of designs created has seen a boom. In February, Canva reached 15 billion designs, and to close out the year, the platform has reported over 20 billion designs have been made, which the team at Canva have said is the equivalent of 280 every second, 16,000 every minute, or one million each hour.

Canva also launched a slew of new products and AI with their Magic Studio product that resizes, transforms, and translates designs. The platform’s AI product has been more than 4 billion times and placed second from Apple for their AI app of the year.

The platform is also empowering the education space as it supports more than 60 million students and teachers to unlock their creativity and achieve their goals through programs such as Canva for Education, Canva for Campus, Canva for Districts, and a new suite of educator products bringing customised lessons, student-safe AI products, and thousands of free resources to classrooms across the globe.

Canva also partnered with the University of California to bring the platform to more than 500,000 students and faculty across the university’s network.

The platform also supports more than 500,000 nonprofits across the globe as part of its efforts to do the most good it can. Among the organisations it helps are GiveDirectly and Watershed.

The Canva team has also grown rapidly over the last year, with the platform report more than 4,000 employees worldwide and launched new offices in Melbourne, Austin and London.

The Canva team said: “Celebrating our 10th anniversary moment was particularly special as we reflected on all the incredible milestones that defined the past decade.

“It’s been an extraordinary journey, but as we often say – we’re only 1% of the way there, and the best is yet to come.”

Mediahub announces expansion into New Zealand

Mediahub announced it is launching in New Zealand, providing its clients with a trans-Tasman offering.

The media agency, which is part of the IPG Mediabrands network, has offices in both Auckland and Christchurch and will use global Mediahub and Mediabrands proprietary tools, technology and processes, teamed with local expertise across AI, data, content, performance and digital.

The launch of Mediahub NZ move follows recent high-profile global brand wins such as New Balance and Bosch.

It will be created using a strong and already established NZ-based team of around 25 media and digital experts drawn from Attivo Group’s full-service agencies Farrimond in Auckland, and Harvey Cameron in Christchurch. Attivo is a Mediahub partner in ANZ.

Mediahub NZ will be led by Cushla Baggott, current managing partner of Harvey Cameron Media, and supported by Hugo Winter, general manager media (Auckland), Nicole Earnshaw, newly appointed general manager, media (Christchurch), and James Duggan, general manager digital.

Sue Squillace, CEO Mediahub ANZ, said the use of already established, local, performance-focused teams able to respond to changing market conditions to create Mediahub NZ was part of the agency’s ambitious growth strategy, and its bid to become one of the strongest media brands in ANZ.

She said: “With proven experience across the NZ media sector, the outstanding new Mediahub NZ team brings agility, new market thinking and a laser focus on generating business results, which we know brands and businesses need more than ever in the current environment.”

Squillace explained that expanding into NZ has always been an integral part of the region’s growth strategy and what their clients ask for.

“Not only will it resonate with our teams, but also our new global clients like New Balance and Bosch. Having this NZ capability as part of our core offering is incredibly exciting, and an appealing new offering for our business, clients and prospects alike,” she added.

Attivo CEO Cam Murchison said combining the company’s existing NZ media and digital smarts with Mediahub’s global tools and scale “will provide an unparalleled offering to NZ market”.

“We know that clients are looking for something different in NZ; something cost effective but cutting edge, using experienced talent teamed with best in market tools. What we’ve developed is an offering that will provide what the market needs right now, and what we can see they’ll need as economic challenges continue to bite. The strength of our partnership with Mediahub, teamed with a model that is both independent and connected will provide what clients are looking for.”

Murchison said Harvey Cameron and Farrimond’s creative, digital and strategic teams will remain operating under their respective agency brands, working hand in hand with Mediahub NZ’s media teams to continue providing a full-service capability.

Squillace was appointed as Mediahub ANZ’s CEO in June this year, and announced in November that the agency had been appointed by New Balance as its strategic media partner in NZ and Australia.

–

Top image: Sue Squillace

Box Office: The Hunger Games: The Ballad of Songbirds and Snakes knocks Napoleon off his perch

This weekend, the Australian box office made $11,597,209, up 3% from last week’s $10,095,728.

Top Five

Roadshow’s The Hunger Games: The Ballad of Songbirds and Snakes was back at the top of the Aussie box office this week. Even though it was down 29% from last week’s $3.4M, movie-goers once again flocked to the cinema spending $2.4 million. The film, which is the fifth instalment in the franchise has now made over $14.3M in Australia.

For its second week of release, Ridley Scott and Sony Pictures’ Napoleon came in at number two. Taking in just over $2M at the local box office. The film was down 50% on last week.

Taking the number three spot this week was Forum Distribution’s Animal, making its debut. The flick — which was directed by Sandeep Reddy Vanga — took $1.95M at the local box office.

Coming in at number four and also making its debut in the Aussie charts was Universal’s Trolls Band Together. Bringing in almost $1.7M, the Justin Timberlake-led movie is sure to continue its growth, given that the school holidays are just around the corner.

Finally, rounding out the top five was Piece of Magic Entertainment’s André Rieu’s White Christmas. Once again, the musician has attracted audiences, taking just over $715k for its debut.

Top 6 – 10

Other films in the top 10 this week were Renaissance: A Film by Beyoncé (debut), Saltburn, Godzilla Minus One (debut), The Marvels and Five Nights at Freddy’s.

TOP FIVE

1. The Hunger Games: The Ballad of Songbirds and Snakes – $2,437,194

Years before he becomes the tyrannical president of Panem, 18-year-old Coriolanus Snow, remains the last hope for his fading lineage. With the 10th annual Hunger Games fast approaching, the young Snow becomes alarmed when he’s assigned to mentor Lucy Gray Baird from District 12. Uniting their instincts for showmanship and political savvy, they race against time to ultimately reveal who’s a songbird and who’s a snake.

The film grossed $2,437,194, averaging $5,762 over 423 screens and has made $14,323,380 in Australian cinemas to date.

2. Napoleon – $2,034,774

A look at the military commander’s origins and his swift, ruthless climb to Emperor, viewed through the prism of his addictive and often volatile relationship with his wife and one true love, Josephine. Starring Joaquin Phoenix, Vanessa Kirby and Edouard Philipponnat.

The film grossed $2,034,774, averaging $3,514 over 579 screens and has made $7,385,843 in Australian cinemas to date.

3. Animal – $1,958,209

A son undergoes a remarkable transformation as the bond with his father begins to fracture, and he becomes consumed by a quest for vengeance.

The film grossed $1,958,209, averaging $16,051 over 122 screens.

4. Trolls Band Together – $1,699,265

Poppy discovers that Branch and his four brothers were once part of her favourite boy band. When one of his siblings, Floyd, gets kidnapped by a pair of nefarious villains, Branch and Poppy embark on a harrowing and emotional journey to reunite the other brothers and rescue Floyd from a fate even worse than pop culture obscurity.

The film grossed $1,699,265, averaging $3,924 over 433 screens.

5. André Rieu’s White Christmas – $715,622

Immerse yourself in the incomparable Christmas atmosphere of André’s winter wonderland while singing and dancing to timeless Christmas carols, romantic waltzes, and beautiful songs from around the world!

The film grossed $715,622, averaging $3,998 over 179 screens.

Mindshare extends Foxtel Group partnership for three more years

Mindshare has retained its long-time partnership with Foxtel Group for an additional three years and will continue to lead its media strategy, connections planning, and media buying for all offline channels across the Group’s portfolio of entertainment and sports brands.

The partnership between GroupM media agency and Foxtel Group began nine years ago and expanded its remit in 2020 to include the Group’s streaming brands, Binge and Kayo.

Mindshare has the added responsibility for Foxtel Group’s latest brand ‘Hubbl’ – Australia’s newest transformative TV technology, which will launch early next year. Hubbl is set to reshape the entertainment experience for viewers by bringing all paid and free viewing apps together.

Mindshare’s transformative “Good Growth” proposition has been central to this long-standing partnership and focuses on driving sustainable and responsible growth for clients through data-driven insights, strategic planning, and cutting-edge technology. The Good Growth approach has been instrumental in helping Foxtel Group adapt to the rapidly changing media and entertainment landscape and maintain its position as a market leader.

John Matthews, executive director of customer acquisition and group media of Foxtel Group, said the Group is looking forward to continuing its growth journey with the Mindshare team. He said: “Their strategy, insights, media trading and technology solutions are world class and more importantly, so are the team.”

Maria Grivas, CEO of Mindshare Australia & New Zealand, celebrated the three-year extension and her team’s ability to harness data and technology, drive meaningful and sustainable growth for the client, and deliver exceptional value. She added: “I’m so proud to extend our relationship with Foxtel Group for another three years. It’s a testament to the trusting partnership that has evolved over the past 9 years between our team and theirs.” She added

Kate O’Ryan-Roeder, Mindshare Sydney MD, said their team looks forward to to delivering the next era of good growth together. “We have a brilliant team, led by Linda Tyson, who take great pride in delivering exceptional media thinking that delivers positive business impact for Foxtel. A heartfelt thank you to both the Foxtel and the Mindshare teams, what a partnership and I can’t wait for what is to come!”

The extension of the Foxtel Group account comes after a successful year for Mindshare. The agency has retained close to $100 million of business in Australia without pitching, on top of significant new business wins, which most recently include Unilever and the National Bank of Australia.

Globally, Mindshare is Cannes Lions Media Agency of the Year 2023.

NRMA Insurance aims to redefine HELP with second phase of “Until Then” campaign

NRMA Insurance has launched the next chapter of its Until Then campaign in collaboration with creative agency Bear Meets Eagle On Fire, building upon the brand platform introduced last year.

The integrated campaign that spans across TV, cinema, radio, social media, and OOH, aims to redefine the concept of “HELP,” portraying it as a commitment to assist in times of trouble.

The central theme, “Until Then… we’ll be here to help,” envisions a world devoid of insurance needs, where mishaps and accidents are averted. However, recognising the current reality, the campaign showcases the necessity for assistance when life takes an unexpected turn.

NRMA Insurance – Until Then – Hailstorm 60sec from Bear Meets Eagle On Fire on Vimeo.

Directed by Steve Rogers at Revolver, the film titled Hailstorm narrates the tale of a small car seeking refuge from an approaching storm, successfully avoiding any damage.

The OOH component highlights various everyday mishaps, emphasising NRMA Insurance’s commitment to assisting customers in such situations. The social and radio segments delve into NRMA Insurance’s involvement in community initiatives for extreme weather preparedness.

Collaborating with UK director and photographer Dan Tobin-Smith and Time Based Arts, NRMA Insurance presents visually captivating brand idents that delve into the essence of the HELP promise. These idents will be featured in various media activities, including NRMA Insurance’s sponsorship of Channel Nine‘s weather segment.

Micah Walker, chief creative officer and Founder of BMEOF, expressed enthusiasm about the opportunity to deepen their thinking through product and retail, adding that the brand idents created with Tobin-Smith are a valuable addition to the narrative.

NRMA Home Insurance – ident from Bear Meets Eagle On Fire on Vimeo.

Running parallel to the brand campaign, the integrated product campaign titled We’ll Help, developed in partnership with BUCK, showcases how NRMA Insurance fulfils its commitment through a range of product propositions.

Zara Curtis, NRMA Insurance executive manager of customer experience, brand, and social Impact, commented on the campaign, stating, “This latest Until Then spot, Hailstorm, is timely for our customers in the face of changing and more frequent weather events. And with a creative system designed to work across the marketing funnel to meet our key business objectives.”

See Also: NRMA and NITV partner up in support of the Beyond 3% initiative

MAGNA predicts 3.8% growth in advertising revenues for 2024

The Australian advertising market is “slowing but positive” with MAGNA Global predicting +3.8% growth to reach $27.7 billion in 2024, after closing out 2023 with +4.9% growth to $26.7 billion.

The MAGNA forecast revealed a stronger-than-anticipated 2023, with digital media owners’ ad revenues growing +8.6% to $19.6 billion. Search advertising revenues jumped +7.6% to $9.9 billion, social media revenues surged +11.9% to $6.3 billion and digital video ad revenues grew 9.3% to $2.3 billion.

However, traditional media owners’ ad revenues dropped -4.2% to $7.1 billion, TV revenues decreased -8.7% to $3.9 billion, and publishing revenues fell by -12.4% to $700 million. Audio advertising revenues remained stable, while Out-of-home jumped 13.6% to $1.2 billion.

The report said, “Australia has seen linear advertising formats struggling because of general economic uncertainty and trading weakness. This decline has hit linear TV, especially in metro markets. Audiences continue to decline, and as costs become less resilient, revenues are also falling.”

The forecast remains positive for 2024, despite the slowing market. Magna predicts good growth for digital media owners’ advertising revenues which will reach $21.1 billion next year up +7.2% from 2023.

Search ad revenues are expected to increase +4.6% to $10.3 billion, social media advertising revenues will jump +13.3% to $7.1 billion, and digital video ad revenues will grow +6.3% to $2.4 billion.

MAGNA predicts traditional media owners will experience a -2.9% dip in ad revenues to $6.7 billion ($4.6 billion). TV revenues will drop -11.9%, to reach $3.5 billion.

Ros Allison, head of production & innovation at Magna Australia said: “In 2023 Australia has seen linear ad formats struggling with economic uncertainty and trading weakness. Tipping point now evident for linear TV as previously inelastic costs become less resilient, and revenues begin to follow audiences.

“We expect the Australian market to be subdued but positive into 2024, with easing inflation starting to loosen monetary policy. Accelerating growth for digital channels, including those owned by traditional media owners. New measurement metrics, continued digitisation and format innovation driving growth.”

Looking ahead to 2028, Australia’s total advertising revenues are expected to grow by +5.8% with Australia forecast to be the 5th largest global market in total ad spend. MAGNA predicts digital media will represent 83% of total advertiser budgets in 2028, up from 74% in 2023.

Across the Asia Pacific region, total advertising revenues are forecast to grow +6.3% to reach $304 billion, which is largely attributed to increasing investment in digital advertising revenues, which are forecast to grow +8.4% in 2024.

The APAC advertising market grew by +8.2% this year, which was higher than the global average of +5.5% and driven by India, Pakistan and China.

See also: MAGNA Global reveals Australia’s advertising market will grow by 4%

—

oOh!media expands large format digital network with 51 new sites in 2023

In a move to bolster its large format digital network, oOh!media has added 51 new sites throughout the year, with a particular focus on key locations in Sydney, Melbourne, and Brisbane. The media company recently introduced seven premium sites strategically positioned across major arterials in these cities.

Among the latest additions is a high-impact digital billboard in the Sydney suburb of Mosman. The overhead bridge location complements oOh!’s existing Mosman large format inbound digital sites and the Mosman Street Furniture network.

A second Sydney site is placed on Parramatta Road near the Norton Street hub in Leichhardt, targeting outbound CBD audiences on one of Sydney’s busy travel corridors.

The West Gate Freeway and Western Ring Road interchange are new sits for oOh!media in Melbourne. The locations offer advertisers the opportunity to engage eastbound traffic from the Princes Freeway.

Brisbane sees the launch of two large format digitals at the Inner City Bypass in Bowen Hills, a key arterial route connecting multiple roadways, including the Pacific Motorway, Clem Jones Tunnel, and Airport Link Tunnel. Additionally, two digital billboards have been added on Toohey Road in Salisbury, targeting traffic between the M1 and Kessels and Riawena Roads.

oOh!media’s chief revenue and growth officer, Paul Sigaloff, emphasised the company’s commitment to expanding the large format digital billboard network at premium locations, connecting brands with audiences at scale. Sigaloff commented, “These seven new screens launch at a time when more people are outdoors preparing to enjoy Christmas and summer holidays, and as we look ahead to next year, oOh! will continue adding premium new sites to capture audience attention at scale and make brands unmissable.”

oOh!media’s digital expansion aligns with its strategic network expansion plan, with 40% of the new sites located in the Sydney metro market. This expansion includes a significant long-term agreement with EiMedia to represent 17 digital billboards on major Sydney roads and motorways.

See Also: POLY and PHD team up to drive impact and awareness for Lynx Africa

Fran Kelly returns to ABC’s RN in overhaul of the station’s schedule

Fran Kelly is set to return to RN in 2024 as host of Saturday Extra. The show will be moved forward in the new year, broadcasting from the earlier timeslot of 7am.

She left the RN Breakfast slot in 2021 after 17 years, handing the reins over to Patricia Karvelas.

Of her return, Fran Kelly said: “I’m delighted to be back with the RN audience and looking forward to starting my Saturday talking about the things that are happening in your world and the world at large and having some fun along the way. It is the weekend after all.”

Current Saturday Extra host Geraldine Doogue has a new program, Global Roaming with Geraldine Doogue and Hamish MacDonald, discussing international affairs with a focus on Asia and the Pacific and Australia’s place in it. It will air on RN at 8.30 am Saturdays, 6pm Mondays and 5.30am Tuesday.

Doogue said: “It’s been a genuine thrill to present Saturday Extra for these past years, to cover such a sweep of events from post 9/11 to the GFC, to domestic politics dramas, the Queen and Duke’s death, COVID and lots more in-between.

”I’ve worked with some fabulous people to whom I’ll be ever grateful. It’s exemplified, I hope, that ambitious, generalist news coverage is the glittering prize on offer to journalism and the ABC. I wish it ongoing success.”

Norman Swan and Tegan Taylor will host The Health Report, which will include their new podcast, What’s That Rash?! where they take questions from listeners on a range of health issues. The Health Report will air on RN at 9am Saturdays and 3pm Mondays.

Blueprint for Living will now be heard at the new time of 10am Fridays and 1pm Saturdays.

Throughout the week, Patricia Karvelas will be back with RN Breakfast and Andy Park will also be back hosting RN Drive.

Other returning hosts include Phillip Adams on Late Night Live and Hilary Harper on Life Matters and recent Australian Podcast Award winners Days Like These and Background Briefing.

Other changes to ABC RN’s line up and schedule include Stop Everything!, which will return next year with Beverley Wang as host. Ben Law will step away to focus on his screen commitments. The program will air in the new weekday timeslot of 11.30am and Sundays at 2pm. Co-host of The Bookshelf, Kate Evans, will take an extended break at the beginning of next year, with Cassie McCullagh anchoring the show.

Earshot will cease production of new episodes but will continue to broadcast episodes drawn from its archive across the year. Two programs, Counterpoint – hosted by Amanda Vanstone – and Between the Lines will not be returning in the new year.

Manager ABC RN Cath Dwyer said: “I’m thrilled to welcome Fran Kelly back to RN to take the reins of Saturday Extra and continue this highly respected program that Geraldine Doogue has built over many years.

“I’m also excited at the prospect of hearing Geraldine and Hamish each week exploring big issues and important stories and talking with big thinkers from around the globe. I think listeners are in for a real treat.

“I’d like to thank Amanda Vanstone and Benjamin Law for their contribution to RN, and for bringing their ideas and perspectives to RN’s audience and wish them both the very best for the future.”

Seven reveals results of the second round of their AI innovation initiative

The Seven Network has revealed the results of the second round of its innovation initiative – Ignite – which saw seven employee-led generative AI concepts selected for prototype development.

Taking the top honours was Preview Town, a development concept that delivers a series of short trailer previews when a user selects a piece of content. Led by Liz De Nobrega, the winning team included Luke Jensen, Andrew Green, David Van Oosterom, Rakib Dewan, Aaron Bush, Stefan Creovina, Zinnia Wang, Safeera Kuttiyoth and Marcus Torre.

The three-week event focused on generative artificial intelligence in sport across the 7plus platform, using Amazon Web Services’ (AWS) to create the best user and client experience.

The judging panel included Nina Walsh, head of media & entertainment business development, Asia Pacific, Japan & Americas, AWS; Lucinda Gemmell, Seven’s chief people and culture officer, 7Sport digital executive producer Tara Carlon; and Rachel Page, Seven’s network digital sales director.

Seven’s director of product solutions, Will Everitt said that Ignite is a testament to the network’s commitment to developing their technology talent.

“By bringing together engineers with staff from diverse functions and backgrounds, Ignite encourages collaboration across traditionally siloed parts of the business. Engineers work directly with sports journalists, commercial teams and people from other departments to gain insights into challenges from different perspectives,” he said.

“The Ignite program highlights Seven’s focus on fostering innovation across its business. By the end of each Ignite event, participants have a deeper knowledge of the capabilities and limitations of emerging technologies. They learn how to scope projects, realistically based on available resources and timeframes. This increased technical literacy among non-engineers fosters a shared language and more productive partnerships across Seven.”

AWS’ Nina Walsh expressed that the development of talent, combined with the collaborative culture produced impressive results.

“It was inspiring to see how the creative groups used AWS services, bringing their concepts to life by leveraging our latest AI and ML technologies, including Amazon Bedrock. The calibre of concepts presented for judging was truly bar-raising,” she said.

TV Ratings December 4, 2023: Aussies can’t get enough of Jim Jefferies’ The 1% Club

• 991,000 tune in to The 1% Club in Total TV

Overnight TV Ratings, December 4

Primetime News

Seven News 836,000 (6:00pm) / 810,000 (6:30pm)

Nine News 696,000 (6:00pm) / 730,000 (6:30pm)

ABC News 547,000

10 News First 175,000 (5:00pm)/ 136,000 (6:00pm)

SBS World News 105,000 (6:30pm)/ 84,000 (7:00pm)

Daily Current Affairs

A Current Affair 635,000

7.30 505,000

The Project 169,000 6:30pm / 211,000 7pm

Breakfast TV

Sunrise 217,000

Today 203,000

News Breakfast 136,000

Share summary

Seven won Monday night with a primary share of 19.2% and a network share of 29.6%.

7Two has won multi channels with a 4.5% share.

Nine received a primary share of 19.9% and a network share of 28.5%.

10 took a 7.0% primary share and a network share of 14%.

Seven

428,000 began their evening with Border Security: Australia’s Front Line where a man from Amsterdam said he was here for a holiday, but his suspicious travel itinerary through China and an empty suitcase seem to tell a very different story…

543,000 then watched a repeat of Jim Jefferies and Seven’s The 1% Club.

Then it was time for two episodes of Big Brother Australia. During the first instalment, 135,000 watched as Josh and Tay finally find themselves on a date where what started as a romantic jungle picnic soon turned into a catastrophe. Then, 96,000 saw Big Brother surprise the housemates with a celebratory top-five brunch.

Nine

Nine’s A Current Affair (635,000) spoke to Olivia Duffin whose dream of becoming the Willy Wonka of ice cream is melting before her eyes after Central Coast Council shut down her shipping container scoop shop.

Then, 385,000 joined Sir David Attenborough for Planet Earth III. In this episode, he looked at freshwater and how it is a rich and diverse habitat filled with never-ending surprises.

298,000 also watched Australian Crime Stories: Investigators, which detailed how when Kim Meredith was aged 19 when she was savagely murdered in central Albury as she walked to meet friends at a nearby hotel after work in 1996.

Social Media Murders followed for 181,000.

ABC

505,000 watched ABC’s 7.30 explore how experts are calling on the Victorian government to pause or scrap the multi-billion-dollar Suburban Rail Loop. Plus, the program looked at the latest on the Israel-Gaza war and how a controversy has rocked the Australian theatre world.

467,000 then watched Australian Story which looked at Professor Richard Scolyer and how had put his life on the line to try and cure his own brain cancer, using the very treatment he helped pioneer to save melanoma patients.

458,000 also watched Media Watch before 302,000 tuned in to a repeat of Freddie Mercury – The Final Act.

10

On 10, The Project (169,000 6:30pm / 211,000 7pm) welcomed G Flip to the desk while I’m a Celeb’s Harry Garside also joined them. He spoke about how he has qualified for the 2024 Paris Olympics and revealed what the next 10 months will look like for him as he prepares for the games.

The Bachelors Australia then followed for 170,000 and it was the day after the opening ball, and the first opportunity the Bachelors had to invite the girls on single and group dates. Luke and Ellie embarked on a first date before Ben chose her to be on the group date as the boys continued to step on each other’s toes. Wes, on the other hand, revealed he was a virgin.

SBS

The highest rating non-news show on SBS was Riveted: The History of Jeans which revealed the fascinating and surprising story of the iconic American garment.

Total TV Ratings, November 27

991,000 saw Seven’s The 1% Club, up 13%.

972,000 viewed Seven’s Home and Away, up 26%.

764,000 tuned into 10’s Dessert Masters – Semi-Final, up 22%.

727,000 caught Australian Story, up 17%.

Week 49: Monday

| MONDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 15.5% | 7 | 19.2% | 9 | 19.9% | 10 | 7% | SBS | 3% |

| ABC KIDS/ ABC TV PLUS | 2.3% | 7TWO | 4.5% | GO! | 1.3% | 10 Bold | 3.4% | VICELAND | 1.5% |

| ABC ME | 0.5% | 7mate | 3% | GEM | 3.8% | 10 Peach | 2.8% | Food Net | 1.7% |

| ABC NEWS | 2% | 7flix | 1.6% | 9Life | 1.8% | Nickelodeon | 0.9% | NITV | 0.5% |

| 7Bravo | 1.4% | 9Rush | 1.7% | SBS World Movies | 0.9% | ||||

| SBS WorldWatch | 0% | ||||||||

| TOTAL | 20.3% | 29.6% | 28.5% | 14% | 7.6% | ||||

| MONDAY REGIONAL | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | Sky Regional | ||||||

| ABC | 14.2% | 7 | 18.8% | 9 | 18.3% | 10 | 5% | SBS | 2.7% | Sky News Regional | 4.9% |

| ABC KIDS/ ABC TV PLUS | 2.6% | 7TWO | 4.2% | GO! | 1.1% | 10Bold | 4.1% | VICELAND | 1.8% | ||

| ABC ME | 0.6% | 7mate | 4.3% | GEM | 4.1% | 10Peach | 2.4% | Food Net | 1.1% | ||

| ABC NEWS | 1.7% | 7flix (Excl. Tas/WA) | 1.8% | 9Life | 1.7% | Nickelodeon | 1.5% | SBS World Movies | 1% | ||

| 7Bravo | 1.9% | SBS WorldWatch | 0.0% | ||||||||

| NITV | 0.6% | ||||||||||

| TOTAL | 19.1% | 31% | 25.2% | 13% | 7.2% | 4.9% | |||||

| MONDAY METRO ALL TV | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FTA | STV | ||||||||

| 89.8% | 10.2% | ||||||||

MONDAY FTA

- Seven News Seven 836,000

- Seven News At 6.30 Seven 810,000

- Nine News 6:30 Nine 730,000

- Nine News Nine 696,000

- A Current Affair Nine 635,000

- ABC News ABC TV 547,000

- The 1% Club Seven 543,000

- 7.30 ABC TV 505,000

- Australian Story ABC TV 467,000

- The Chase Australia Seven 461,000

- Media Watch ABC TV 458,000

- Border Security – Australia’s Front Line (R) Seven 428,000

- David Attenborough’s Planet Earth III Nine 385,000

- Hot Seat Nine 323,000

- The Chase Australia Seven 316,000

- Freddie Mercury: The Final Act ABC TV 302,000

- Australian Crime Stories: The Investigators Nine 298,000

- Nine’s Afternoon News Nine 232,000

- Sunrise Seven 217,000

- The Project 7pm 10 211,000

Demo Top Five

16-39 Top Five

- Nine News 6:30 Nine 93,000

- Nine News Nine 90,000

- Seven News Seven 70,000

- A Current Affair Nine 68,000

- Seven News At 6.30 Seven 62,000

18-49 Top Five

- Nine News 6:30 Nine 153,000

- Seven News Seven 145,000

- Nine News Nine 142,000

- Seven News At 6.30 Seven 131,000

- A Current Affair Nine 126,000

25-54 Top Five

- Nine News 6:30 Nine 202,000

- Nine News Nine 189,000

- Seven News Seven 187,000

- Seven News At 6.30 Seven 174,000

- A Current Affair Nine 170,000

MONDAY MULTICHANNEL

- Endeavour 7TWO 116,000

- NCIS 10 Bold 107,000

- NCIS 10 Bold 103,000

- Goldfinger 9Gem 99,000

- Doc Martin 7TWO 87,000

- Bargain Hunt 7TWO 83,000

- Pop Paper City ABC Kids/ABC TV Plus 82,000

- Outback Opal Hunters 7mate 79,000

- Beep And Mort ABC Kids/ABC TV Plus 79,000

- The Big Bang Theory Ep 3 10 Peach 79,000

- Death In Paradise 9Gem 75,000

- Peppa Pig ABC Kids/ABC TV Plus 75,000

- Aussie Salvage Squad 7mate 75,000

- Would I Lie To You? ABC Kids/ABC TV Plus 75,000

- The Big Bang Theory Ep 2 10 Peach 67,000

- Bluey ABC Kids/ABC TV Plus 66,000

- Spicks And Specks ABC Kids/ABC TV Plus 66,000

- 8 Out Of 10 Cats Does Countdown SBS VICELAND 64,000

- Seinfeld 10 Peach 63,000

- Pj Masks ABC Kids/ABC TV Plus 63,000

MONDAY STV

- The Bolt Report Sky News Live 68,000

- Credlin Sky News Live 64,000

- Paul Murray Live Sky News Live 61,000

- The Late Debate Sky News Live 46,000

- Chris Kenny Tonight Sky News Live 40,000

- Sharri Sky News Live 40,000

- Highway Patrol Real Life 30,000

- The Late Debate: The Papers Sky News Live 29,000

- Long Lost Family Lifestyle Channel 28,000

- Escape To The Country Lifestyle Channel 25,000

- Police Ten 7 Real Life 24,000

- Selling Houses Australia Lifestyle Channel 24,000

- Selling Houses Australia Lifestyle Channel 23,000

- Live: Nfl: Packers V Chiefs ESPN 23,000

- The Big Bang Theory Comedy 20,000

- Antiques Roadshow Lifestyle Channel 20,000

- Easyjet: Inside The Cockpit Real Life 20,000

- The Big Bang Theory Comedy 20,000

- Signora Volpe UKTV 20,000

- Bargain Hunt Lifestyle Channel 19,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2023. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Business of Media

ARN to fight forced sale of Southern Cross stake

ARN Media and private equity firm Anchorage Capital lobbed a takeover bid for Southern Cross in mid-October. But the plans hit a roadblock when an activist shareholder, Keybridge Capital’s Nick Bolton, complained to the Takeovers Panel that an initial stake bought by ARN in June was acquired illegally.

The owner of the KIIS FM and Pure Gold radio networks, which holds a 14.8 per cent stake in Southern Cross, said on Monday it rejected the Takeover Panel’s ruling, which favoured Bolton’s complaint.

Rupert Murdoch steps out with Elena Zhukova, crates of wine

Zhukova, 66, is the mother of Dasha Zhukova, who was married to Russian oligarch Roman Abramovich until 2018. Zhukova has long been rumoured to be in a relationship with Murdoch, who handed the chairmanship of his media conglomerate to his son, Lachlan Murdoch, at the company’s annual meeting last month.

Spotify to cut 17 percent of global workforce

In a blog post published Monday, founder and CEO Daniel Ek wrote that the new layoffs would “reduce our total head count by approximately [17 percent] across the company.” The Stockholm-based company says approximately 1,500 jobs will be impacted by the cuts.

Meta faces lawsuit from Spanish media over advertising practices

The Asociacion de Medios de Informacion said Monday that it was seeking more than 550 million euros, equivalent to $598.6 million, from Meta, citing the “massive” and “systematic” use of personal data by the group’s platforms without users’ consent that handed Meta an “unfair” advantage in the advertising market.

News Brands

Jacinta Price rejected 52 ABC interview requests during Voice campaign

The report, authored by Mark Maley, chair of the ABC’s Referendum Coverage Review Committee (RCRC) and editorial policy manager, said Price did not agree to a single interview on any major broadcast program over the course of the campaign (August 30 to October 14). It added that the ABC had faced significant challenges in getting voices from the No camp to present their argument as opposed to those from the Yes camp.

Guardian bans open letters and social posts amid row over Israel

Days after more than 300 local journalists, including at least 25 from Guardian Australia, called for greater scepticism of Israel’s defence forces in coverage of the Gaza conflict, the British news organisation’s editor-in-chief, Katharine Viner, outlined the new rules to staff in an internal note.