Thursday October 23, 2025

Seven Upfront 2026: Seven goes all in: sport, streaming, and smarter data lead 2026 strategy

If Nine’s 2026 Upfront leaned on Olympic prestige and “defining Australian moments,” Seven’s response is all about rhythm – a year-round, data-fuelled strategy built on live sport, trusted news, and big entertainment.

At its 2026 Upfront presentation, held at Royal Randwick, the network positioned itself as the home of consistency: sport every week, entertainment every night, and data precision every second.

“There are two certainties in life: death and taxes. And there are two certainties in broadcast television – sport and news,” Angus Ross, Group Managing Director, Seven Television told Mediaweek. “Our slate will provide certainty across the entire year.”

The network’s key announcement was that it has secured the exclusive Australian rights to the Rugby League World Cup 2026 (RLWC2026), from 15 October 2026.

The announcement, made by Mel McLaughlin, and Hamish McLachlan is promising 80 hours of premium live sport.

Kicking off with a clash between Australia and New Zealand at Sydney’s Allianz Stadium, Seven’s month-long coverage will showcase the very best of international rugby league with 18 men’s, 15 women’s and 20 wheelchair matches.

Seven West Media Managing Director and Chief Executive Officer, Jeff Howard, said: “Seven is proud to be the unrivalled home of Australian sport. The Rugby League World Cup is a significant world-class event and hosting it on home soil makes it even more special.”

Owning the sporting calendar

The rest of Seven’s 52-week sport slate remains its commercial backbone, spanning AFL, cricket, Supercars, horse racing, NFL, LIV Golf, and the Glasgow 2026 Commonwealth Games.

The Games, which run from 23 July to 2 August, land neatly between Paris 2024 and Los Angeles 2028. It’s a neatly packaged and strategic play that keeps Seven top-of-mind between Olympic cycles.

“If you want to reach a large audience in one place at one time, sport is where you do it,” Ross said. “If you’re not investing in news and sport, you’re not a complete network.”

Gereurd Roberts

Gereurd Roberts, Group Managing Director, Seven Digital, added that sport’s power lies in passion. “There’s no more engaged audience than a passionate sports audience,” he told Mediaweek.

“Advertisers are trying to reach those highly engaged viewers who are therefore more receptive and open to their advertising and we can offer them that every week of the year, not just for a few weeks in January or during the winter season.”

That commitment extends to accessibility. “Australians deserve the right to be able to watch their key sports for free,” Roberts said. “These are key cultural moments. They bring Australians together in ways never seen before, and that’s a really critical part of our cultural fabric.”

The Seven Upfront stage.

7plus: from catch-up to commercial engine

On the digital front, 7plus continues to be the network’s growth story.

What began as a catch-up service has evolved into one of Australia’s biggest free entertainment platforms, reaching more than one million daily users and adding 1.4 million new registrations in 2024–25.

Live streaming has surged off the back of free AFL and cricket coverage, up 62% year-on-year in FY25, and 84% year-to-date heading into this financial year.

VOD viewing is also up 25%, driven by younger audiences discovering Seven’s content on their own terms.

Roberts said the growth reflects Seven’s “total television” philosophy. “We don’t talk about digital instead of broadcast; we talk about digital as well as broadcast. Between the two, it’s an incredibly powerful proposition.”

He continued, “There’s actually only about 9% crossover between our live audiences on 7plus and our VOD audiences.

“So yes, we’ve got total television growth, and yes, the growth on 7plus is incredible — but it’s the growth in new and younger audiences who are going to become lifetime Seven customers that we’re really proud of.”

Data precision meets real-world results

Seven’s data proposition is also accelerating.

The network unveiled a new partnership with Westpac DataX, linking streaming ad exposure on 7plus directly to real-world sales through its 7REDiQ platform.

Brands can now connect ad impressions to point-of-sale results, online and in-store, across more than 50 product and service categories, combining Seven’s 15.2 million registered users with Westpac DataX’s 12 million customers.

“Financial data is a key focus for 7REDiQ, driving continuous innovation and improvement in how we measure impact and deliver real business outcomes,” Roberts said. “As new partners join, 7REDiQ creates even greater value and performance for advertisers with Seven, exclusively across the entire video streaming category.”

7GeoPlus: GPS-level accuracy for advertisers

Seven also announced 7GeoPlus, a new GPS-verified geolocation tool developed with GeoComply, designed to provide advertisers with targeting accuracy down to 20 metres.

“The geo-targeting work came from recognising that IP-based targeting can be a bit unreliable,” Roberts explained.

“For us, news is an incredibly critical part of the network. If you’re in a regional area, or somewhere near a border where standards aren’t up to scratch, we wanted to do better.”

Originally designed to deliver the right local news bulletin and AFL match to viewers, 7GeoPlus has evolved into a key commercial product.

“Advertisers want confidence in the precision of their geo-targeting,” Roberts said. “We simply saw an opportunity to add another layer of precision for advertisers, and we think it’s going to be really powerful for them.”

Phoenix and a full-stack trading future

Behind the scenes, Seven’s Phoenix trading platform continues to gain traction, used by more than 140 clients to dynamically optimise campaigns across broadcast, BVOD, and regional.

The platform automatically reallocates spend to ensure guaranteed delivery, effectively eliminating under-delivery issues that have long frustrated agencies.

Together, Phoenix, 7GeoPlus, and 7REDiQ represent what Seven describes as a “connected trading loop” — linking audience, geography, and delivery into a measurable ecosystem that delivers on both reach and return.

Familiar favourites and fresh formats

Seven’s 2026 entertainment slate blends returning tentpoles with new homegrown shows designed to broaden its reach across demographics. The network’s headline newcomers include:

• Caught in the Middle – a giant-arena quiz show from Talpa Studios (The Voice, The Floor), hosted by Shane Jacobson.

• My Reno Rules – a renovation competition hosted by Dr Chris Brown, giving everyday Aussies the chance to win their dream home.

• SAS: Australia v England – a new season of the hit format featuring a celebrity showdown filmed in the Moroccan desert.

• Once in a Lifetime – a travel-meets-wildlife adventure series starring Dr Chris Brown, Mick Molloy, and Amanda Keller.

• Tina Arena: Unravel Me – a landmark Helium Pictures documentary chronicling Arena’s 50-year career.

Ross said Seven’s entertainment approach for 2026 is about continuity with room to experiment.

“We’ve got a really consistent schedule for 2026,” he said. “It’s about delivering what Australians love: strong storytelling, live sport, trusted news, all while leaving just enough room to surprise them.”

Seven Upfront 2026: The verdict from Australia’s media and marketing leaders

Seven West Media has laid out a full-year playbook for 2026, putting live sport, streaming growth and data-driven insights front and centre.

Its upfront at Royal Randwick emphasised a “own the calendar” strategy, led by the exclusive rights to Rugby League World Cup 2026, augmented by a 52-week sport slate (AFL, cricket, Supercars, NFL, Commonwealth Games) and a fast-expanding streaming hub in 7plus that achieved double-digit growth in live viewing.

On the data and tech front, Seven unveiled its “connected trading loop”: streaming data tied to real-world sales through its 7REDiQ platform (in partnership with Westpac DataX), geolocation accuracy via 7GeoPlus, and automated campaign optimisation through its Phoenix trading platform.

It was a confident performance. But as always, the real test is in the agency response – who’s buying the pitch, and who’s not.

Taylor Fielding, Founder and CEO, TFM Digital

“It was an interesting session, but there wasn’t a lot of real ‘newness’ to it. They focused on three things: growth, partnership, and performance. It also felt like that previous tension and competition with Nine had softened, with a strong ‘free-to-air is amazing’ message running throughout. Commonwealth Games, cricket, Ashes, AFL – it’s all still there, but the slate itself felt fairly standard.”

“Audience precision targeting through 7GeoPlus caught my attention – and probably a few others’. It now allows brands to target viewers based on their actual location as they move around, rather than where they live or, worse, outdated registration data from years ago.”

“Tailoring offers to people who are literally about to pass your store makes a compelling case for franchises and retailers alike. For years, platforms have talked about local advantage, but this tech feels like it might actually deliver it. Expect stronger ROI from campaigns built on genuine proximity, not just broad regions. Brands need to be ready to rethink what ‘location’ really means on screen.”

Belinda Miller, Head of Partnerships & Growth, Havas Media

“Seven West Media is redefining growth, partnership, and performance for a new era of television. With 16 million Australians tuning into free-to-air each week and BVOD viewership among Gen Z up 42% year-on-year, free TV’s reach and relevance remain undeniable. Seven’s audience now rivals YouTube, Netflix, and Disney+, drawing 4.8 million viewers on Sunday nights and proving its strength as one of the most effective channels for both reach and brand impact.

“Innovations like the Phoenix platform, geo-targeted live feeds, and 7Geo+ are giving advertisers new levels of precision and performance. Combined with digital rights for the AFL and cricket, a 52-week sports calendar, and data partnerships through 7plus and Westpac, Seven is positioning itself as more than a broadcaster – reframing television as a dynamic, data-driven content destination that connects news, sport, and entertainment across every screen.

“And with the proposed SCA merger on the horizon, Seven’s vision of TV as an integrated, always-on content ecosystem feels closer than ever.”

Tom Carlon, Head Of Investment, IAG

“Seven’s Upfronts took an honest, bold, and strategic stance on the state of play at Seven West Media, showcasing its ambition to build a tech-driven video business. The presentation covered – and proved – the strength of its programming slate, scale, talent, and the enduring power of TV to drive results during key Australian cultural moments. But it was Seven’s focus on data and partnership capabilities, its acknowledgment of the recent SCA-SWM merger, and its confident defence of Free TV that really stood out.

“The resounding message throughout was that Seven’s mantra is growth, partnerships, and performance. Case studies from brands like Specsavers and Suncorp Group demonstrated how advertisers can integrate across the Seven West ecosystem in innovative ways – driving outcomes, boosting brand awareness, and increasing consideration through the strength of the big screen.

“While there was confidence in the established programming slate, Seven added a few new highlights to the lineup, including the Rugby League World Cup to bridge the gap between AFL and cricket, and fresh comedy offerings from familiar favourites like Mick Molloy and Russell Coight. Ultimately, the message was clear: despite the ongoing battle against the scroll, TV – and Seven West – continues to hold unmatched opportunities for advertisers to capture the heart and soul of Australians.”

Alexandra Thomas, National Trading Lead, Atomic 212°

“Seven’s 2026 strategy is a confident proposition built around growth, partnership and performance across its Total TV ecosystem, with a strong focus on the power of 7plus audiences. National coverage through the SCA acquisition positions Seven as a truly national broadcaster, soon able to offer reach and buying consistency not only across digital and streaming, but broadcast as well. The full trading roll-out is expected in the coming months.

“Innovation continues to fuel Seven’s momentum. The launch of 7Geo+ and the ongoing evolution of the Phoenix trading platform highlight smarter targeting, predictive buying and seamless execution. Together, they reinforce Seven’s position as a high-performing, data-driven partner delivering real commercial outcomes.”

Daniel Cutrone, Managing Partner, Media, Avenue C

“Seven’s 2026 upfronts marked a clear shift – less self-congratulation, more advocacy for Free TV as a collective force reaching 16 million Australians each day. It was a confident reminder that national storytelling still pulls audiences the global streamers can only chase.

“Seven leaned into its strengths of news, sport, and entertainment, but with a sharper, more refined approach. A solid spine built around the AFL, cricket, The Voice, Farmer Wants a Wife, MKR, and Australian Idol showed a network that knows what it does best. Add the Glasgow 2026 Commonwealth Games and Rugby League World Cup in the back half, and you’ve got a competitive formula that holds its own in the market.

“It was also smart to spotlight the growing power of Free TV’s BVOD audience, now roughly twice the scale of several SVOD competitors. With the Phoenix platform and data tools like 7Geo+ and Westpac DataX, Seven showed that scale and precision can finally work hand in hand. The SCA merger was touched on lightly, signalling long-term confidence without overstating the point. Overall, Seven’s tone heading into 2026 feels measured, data-led, and quietly ambitious – a network gearing up for a year of two strong halves.”

Sue Cant, Head of Investment, This is Flow

“Seven’s Upfront continued the recurring theme this year of simplicity, collaboration, and clarity – reinforcing the importance of thinking about both content and context together. Like other networks, Seven adopted a “play nice” tone, focusing less on competition and more on unity in delivering the Total TV promise laid out in previous years.

From a data perspective, the announcements were among the most compelling. The partnership with Westpac’s DataX – merging Seven’s 15 million-plus registered 7plus users with DataX’s 12 million customers – will allow for deeper insights into consumer behaviour. This integration aims to strengthen brand campaigns, reach audiences at scale, and improve measurement and attribution for better outcomes.

“7GeoPlus was another standout, offering geo-targeting capabilities across CTV to optimise ad placement, boost ROI, and increase relevance and engagement – paving the way for truly addressable campaigns. There was also a brief nod to the pending SWM and SCA merger, with Seven hinting at synergies across sport and news. It’s one to watch as the merger progresses next year.”

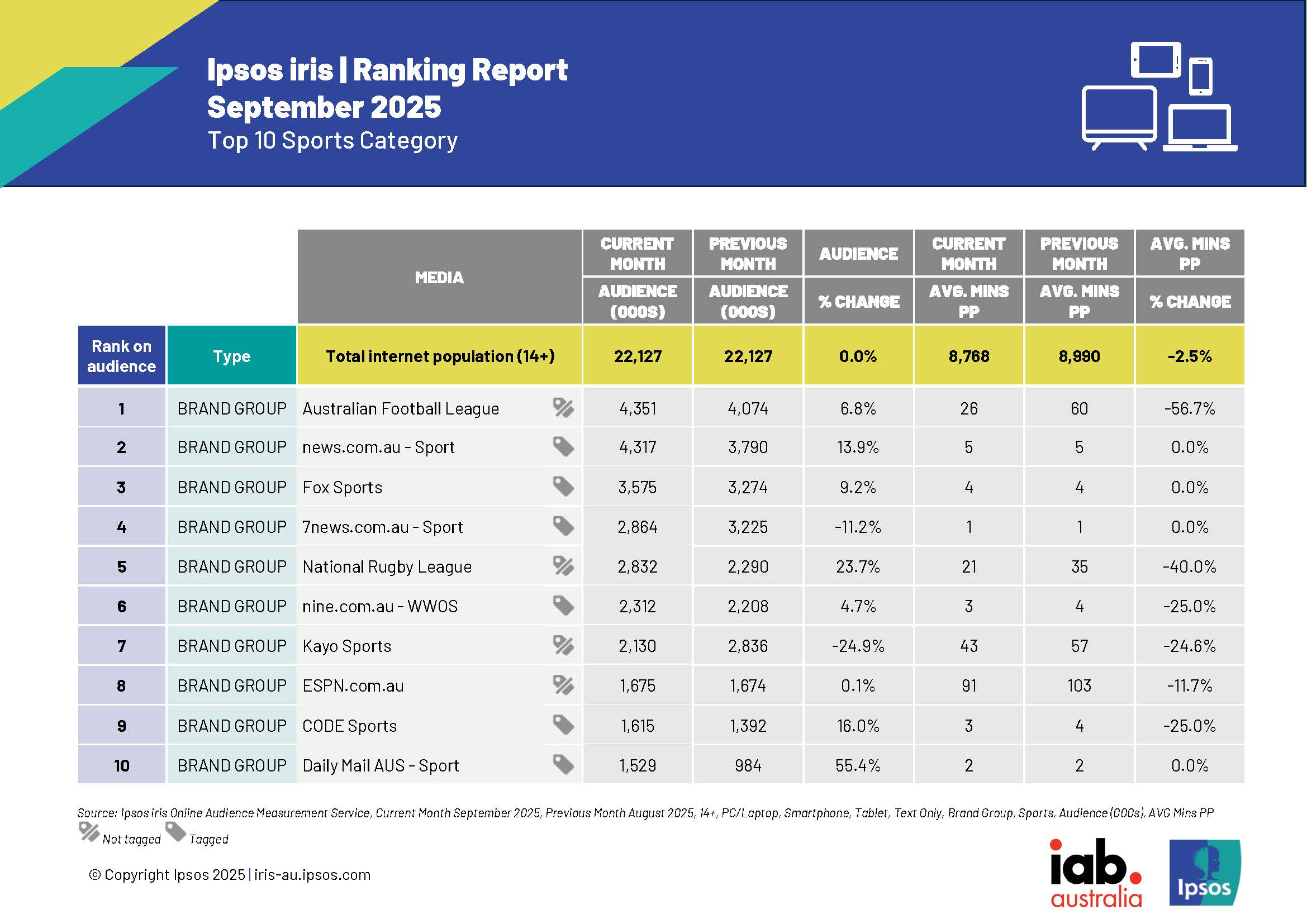

Ipsos iris: Aussie sports sites and apps soared in September as finals fever gripped the nation

More than six in ten Australians, or 14.06 million people aged 14+, visited a sports website or app in September as cliff-hanger AFL, NRL and NRLW finals captured national attention, according to the latest Ipsos iris data.

Ipsos iris serves as Australia’s endorsed digital audience measurement system under the Interactive Advertising Bureau (IAB). It measures digital behaviour across 22 million Australians aged 14+ and tracks activity across smartphone, tablet, and desktop.

Australian sports fans spent an average of 54 minutes consuming sports content online last month.

While both men and women engaged with sports news, men spent more than five times longer reading and watching sport online. That was 89 minutes compared to 17 minutes for women.

Audiences aged over 40 were the most avid consumers, spending 2.4 times more time on sports content than those under 40. They were also significantly more likely to visit a sports site, with 72% of over-40s doing so compared to 52% of under-40s.

Unsurprisngly the AFL’s own website was the most popular digital destination for sports fans, leading the September figures, while news.com.au sport pages and Fox Sports came in second and third.

7NEWS.com.au sport came in fourth, despite losing 11.2 per cent of its traffic month-on-month.

News consumption up +2.8% year-on-year

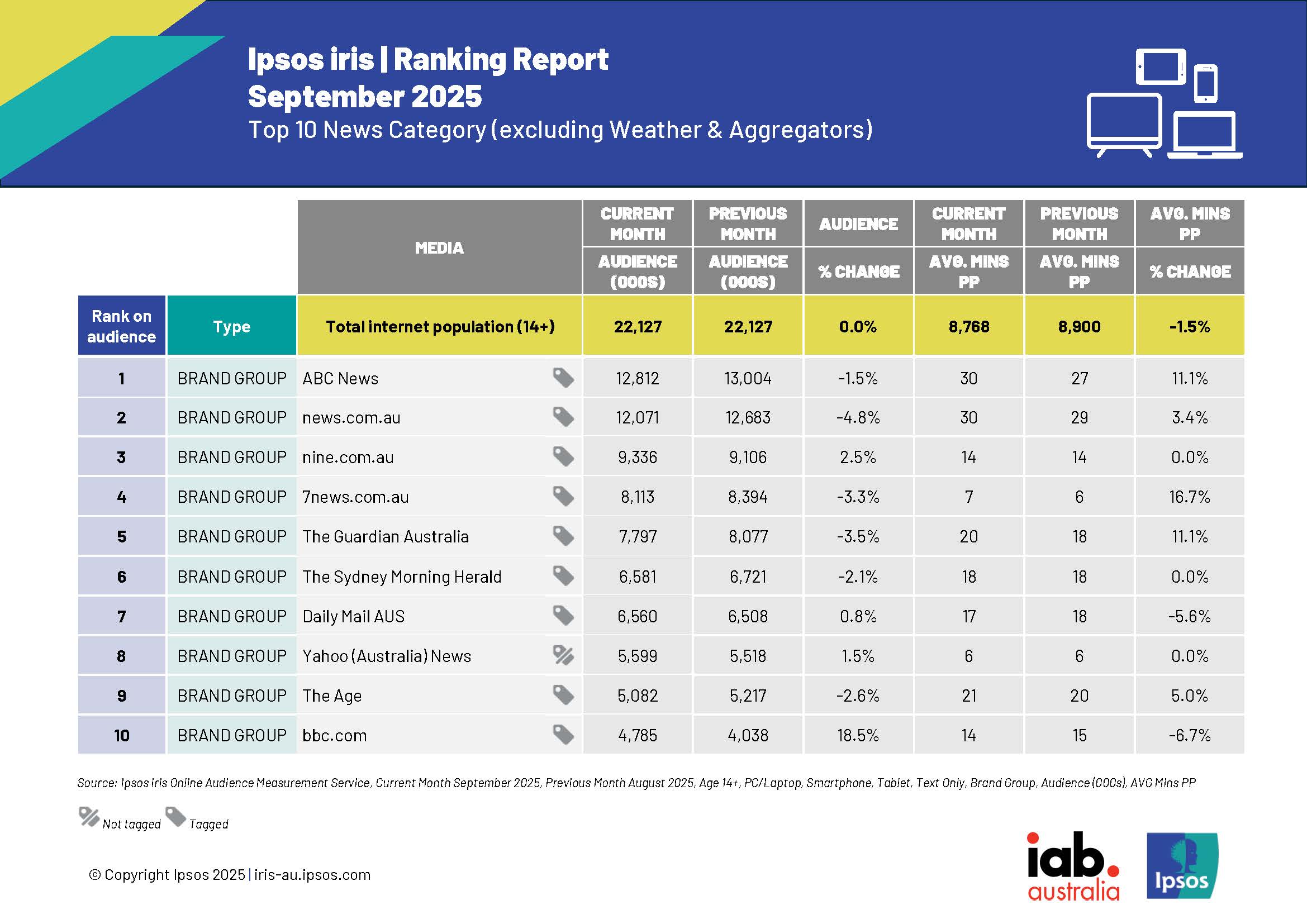

Online news audiences also grew in September, with 21.3 million Australians accessing a news website or app, a +2.8% increase year-on-year, reaching 96.4% of online Australians aged 14+.

Australians spent 4.56 hours consuming news content online, consistent with the same period last year.

Engagement was fuelled by a mix of sporting, celebrity and breaking news events, including the AFL Brownlow Medal, NRL Grand Final build-up, off-season trades, and Brownlow red-carpet coverage.

There was also high interest in entertainment and general news stories with the split between Nicole Kidman and Keith Urban, the manhunt for Dezi Freeman, the fatal shark attack at Sydney’s Long Reef Beach, and the sentencing of Erin Patterson all featuring.

Globally, news spikes were driven by the assassination of US political activist Charlie Kirk, Donald Trump’s State Visit to the UK, and ongoing conflicts in Gaza and Ukraine.

Top Ten News Category

As a result, the Ipsos iris ranking of top news digital sites shows ABC News at number one in audience with 12,812 – a decrease of -1.15 per cent.

News.com.au remains in second place for the month of September, marginally behind the ABC with an audience of 12,071.

Nine.com.au grew its audience by 2.5 per cent to remain in third position.

7NEWS.com.au declined again month-on-month in audience but keeps the fourth spot, while bbc.com saw a huge surge in traffic of 18.5 per cent to make it into the Top 10 News Category as The Australian bowed out of the table for this month.

Average time spent per person on the sites across the category was 8, 768 minutes, a marginal 1.5 per cent decline from August.

The chart below shows the News brands’ ranking during September 2025 by online audience size.

News Corp Australia dominates Ipsos iris rankings for news and sport in September

News Corp Australia has maintained its position as the country’s leading news and information publisher, reaching four in five online Australians in September, according to the latest Ipsos iris digital audience rankings.

The publisher recorded a total audience of 18.41 million people across its network, with an engaged reach of 145 browser page views per person. The data covers Australians aged 14 and above who accessed content across smartphone, PC, and tablet devices.

News category performance

In the news category, News Corp Australia recorded an audience of 14.72 million and 575 million browser page views – an engaged reach of 39 page views per person, up 4.1 per cent on August. Average time spent on-site was 44 minutes per person, while video views reached 71 million, up 6.55 per cent month-on-month.

Pippa Leary, managing director and publisher, free news and lifestyle, said the results highlighted the strength of audience connection across News Corp’s portfolio: “Building audience connections across all platforms not only enhances our reach on a larger scale but also drives improved results for our clients. We are pleased to see our overall engaged reach has grown by four per cent in September.”

Sport sees finals lift

In the sports category, buoyed by the AFL and NRL finals, News Corp Australia reached an audience of 6.84 million, up 13.9 per cent on August. The publisher generated 84 million browser page views, with an engaged reach of 12 page views per person and 12 million video views, up 9.4 per cent month-on-month.

Leary added that the company’s expanding video footprint continued to deliver results: “Our news video audience was up 6.55 per cent on last month, reaching more than 58 per cent of video consumers in the category, and our sports video audience also increased, representing 67 per cent of the total category.”

Top-performing brands

At a brand level, News.com.au led with an audience of 12.07 million and 350 million browser page views. Its engaged reach of 28 page views per person was up 14.15 per cent month-on-month, with an average time spent of 30 minutes per visitor. The site generated 59 million video views — accounting for 62.1 per cent of all video views in the news category, four times higher than its nearest competitor.

The Australian attracted an audience of 3.81 million, with average time spent on-site increasing 21.6 per cent month-on-month. In sport, News.com.au – Sport reached 4.31 million users with 10 million video views, representing 58 per cent of the sports category, while CODE Sports grew its audience 16 per cent to 1.6 million.

Lifestyle and engagement

In the lifestyle category, Taste.com.au delivered the highest engaged reach among the top 10 publishers, with an audience of 4.32 million and 59 million browser page views – an engaged reach of 13 page views per person, up 10.46 per cent on last month.

The Ipsos iris rankings are endorsed by the Interactive Advertising Bureau (IAB) Australia as the industry standard for digital audience measurement, tracking 22 million Australians aged 14+ across major devices.

Source: Ipsos iris Online Audience Measurement Service, September 2024–September 2025.

Top image: Pippa Leary

Warner Bros. Discovery reportedly turns down second Paramount Skydance bid

Warner Bros. Discovery (WBD) is reported to have refused an acquisition offer from Paramount Skydance for the second time in days.

According to Deadline, multiple sources familiar with the ongoing negotiations say the latest bid came in at $24 a share, which was more than an offer of $20, made just over a week ago.

The rejection of Paramount’s second bid, initially reported by the New York Post, was followed the company’s first confirmation that it is for sale. The company said it’s initiated a strategic review process in light of “unsolicited interest” from “multiple parties”.

In a press release, WBD said it had initiated “a review of strategic alternatives to maximise shareholder value.”

“We continue to make important strides to position our business to succeed in today’s evolving media landscape by advancing our strategic initiatives, returning our studios to industry leadership, and scaling HBO Max globally,” said chief executive David Zaslav.

The company said it will continue pursuing the planned split of its cable networks from its streaming and studio businesses, even as it explores potential sale or merger options.

Warner Bros. Discovery CEO David Zaslav

Sale update

Last month, reports surfaced that Paramount, owner of Network 10 in Australia, was preparing a majority-cash bid for WBD, backed by the Ellison family.

The speculation sent WBD shares soaring by almost 30% in late trading, despite no confirmation from either company.

In Australia, CNN and Discovery channels are currently carried by Foxtel and Fetch TV. HBO Max launched in March 2025 and continues to post strong TV and movie library sales across the market.

The exact scope of a proposed deal between Paramount and WBD is unclear.

WBD is still planning to move towards a split next year, separating studios and streaming from linear television, with the resultant stand-alone companies to be called, respectively, Warner Bros. and Discovery Global.

Foxtel’s Rebecca McCloy joins DAZN in global role

Foxtel Group’s long-time sports dealmaker Rebecca McCloy is heading to Europe, joining global streaming giant DAZN as its new Group Chief Commercial Officer.

Based in Europe, McCloy will report to DAZN Group CEO Shay Segev and oversee the company’s global rights and acquisition strategy – a portfolio that spans top-tier football, boxing, and women’s sport.

At DAZN, she’ll work across markets to drive fan engagement and commercial growth, continuing the global expansion of the sports streamer that has been rapidly scaling its presence in rights and technology.

“It’s been a privilege to work with some of the great off-field leaders in Australian sports to expand audiences for their codes and develop sport at the grassroots levels,” McCloy said.

“I’m so proud of the experiences we’ve delivered to Australian sports fans and the relationships that we’ve built with the teams along the way.

“I’m thrilled to have the opportunity to work in this global role with DAZN, and to maintain my relationship with the Foxtel Group as we unlock exciting opportunities ahead,” she said.

Adam Howarth

Foxtel’s next chapter in sport

McCloy’s move marks the latest in a string of global appointments reflecting Foxtel Group’s growing influence in international sports media.

Her successor, Adam Howarth, steps into the role of Executive Director – Commercial, Sport, overseeing Foxtel’s sport acquisition strategy and partnerships across Kayo Sports, FOX Sports Australia, and Foxtel.

A 30-year Foxtel veteran, Howarth brings deep experience across production, channel management, and acquisitions.

“Stepping into this role, for a company I’ve worked at for so long, is an utter privilege,” he said.

“I’m proud to take on this opportunity and continue building on the foundations that Rebecca has set. We have an outstanding team, and this is a world-class business.”

Howarth added that he’s eager to work closely with McCloy and DAZN to expand the reach of Australian sport globally: “Of course, this also heralds a new era for us to spread the love of Australian sports throughout the world using DAZN’s distribution and Rebecca’s advocacy.”

Foxtel boss Patrick Delany

Industry recognition and continuity

Foxtel Group CEO Patrick Delany praised McCloy’s appointment as a reflection of Australian media leadership on the global stage.

“This is an incredible opportunity for Rebecca, and great recognition of the talent we have at Foxtel Group,” Delany said.

“It reflects the quality of executives in Australia, as well as the opportunities that come from being part of a global business. I’m particularly pleased that we will continue to benefit from Rebecca’s counsel, as well as gain a new connection to global sports rights.”

Delany also expressed confidence in Howarth’s promotion, describing him as “deeply experienced, exceptionally knowledgeable, and genuinely passionate about sport.”

He added: “He’s incredibly well respected across the industry and among our sporting partners. I have every confidence he will do a fantastic job leading this critical area for our business.”

DAZN’s CEO Shay Segev said McCloy’s appointment strengthens the platform’s global leadership team. “Rebecca is highly regarded across the global sports landscape, having played leading roles in securing both Australian and international commercial deals for Foxtel Group, solidifying its position as Australia’s sport leader,” Segev said.

“Her experience will be valuable as we continue growing DAZN as the global home of sports.”

The dual appointments reflect an increasingly interconnected sports media landscape – one where rights, data, and distribution move fluidly across markets.

For Foxtel Group, McCloy’s elevation to DAZN creates a direct bridge to one of the world’s fastest-growing sports media networks, while Howarth’s promotion ensures strategic continuity at home.

The changes take effect in early November.

Main image: Rebecca McCloy

Paramount and Taboola team up to turn TV ads into performance powerhouses

Paramount Advertising has partnered with Taboola to launch Performance Multiplier, a new Paramount-branded solution designed to help small and medium-sized businesses (SMBs) measure and extend the performance of their connected TV (CTV) advertising across the open web.

Powered by Taboola’s Realize AI technology, the Performance Multiplier integrates directly into Paramount Ads Manager, the company’s self-service buying platform for SMB advertisers.

The new feature enables campaigns to reach matched and lookalike audiences beyond Paramount’s streaming platforms, extending across Taboola’s network of more than 9,000 publisher partners and hundreds of millions of users.

“At Paramount, we are proving that television advertising amplifies marketing results everywhere,” said Steve Ellis, Chief Operating Officer, Paramount Advertising.

“Together with Taboola’s extensive reach across thousands of trusted publisher websites and its proven performance marketing expertise, we’ll unlock even more ways to turn viewer attention into measurable action.”

This marks the first time a major streaming provider has adopted a solution like Taboola Realize, and the first deployment of Performance Multiplier.

According to both companies, the tool sets a new standard for linking CTV advertising with measurable performance across digital channels, including search, social and the open web.

Advertisers using Paramount Ads Manager will be able to run relevant campaigns across Taboola’s open web network, track post-view actions such as clicks and purchases, and view combined results directly in their Ads Manager dashboard.

“Advertisers today want more than reach- they want results,” said Adam Singolda, CEO and Founder, Taboola.

“By combining Paramount’s premium CTV environment with Taboola’s scale, this partnership opens a new demand channel for us, and reflects where the industry is heading—connecting TV to performance across the open web.”

The Performance Multiplier is currently in beta within Paramount Ads Manager, with general availability expected by early 2026.

Top image: Adam Singolda

Uncomfortable Growth® Uncut. Season 4, Episode 5 – Andrew Howie

In the latest episode of Uncomfortable Growth® Uncut, Rowena Millward welcomes Andrew Howie, a highly regarded CMO and founder of Gallant Creative Advisory. Their conversation dives into the uncomfortable growth moments that have shaped Andrew’s career, offering listeners valuable insights into resilience, leadership, and the importance of self-awareness

Andrew’s journey is a testament to the unpredictable nature of career paths. He reflects on his early aspirations of becoming a ski instructor, a dream abruptly cut short by his father’s insistence that he complete his degree. This pivotal moment set the stage for a career in marketing, where he found himself navigating the challenges of the Global Financial Crisis at a young age.

Andrew candidly shares his experiences of being made redundant and the emotional turmoil that accompanied it, highlighting the importance of understanding the distinction between external circumstances and personal capabilities.

He talks about learning to pause before reacting, leading with honesty (even when it’s hard), and letting go of people-pleasing in favor of being authentic. Now in his 40s, he’s more grounded, self-aware, and focused on creating space for others to grow — even if that means having the tough conversations.

My three favourite quotes from Andrew’s story are:

“It’s impossible to make everyone happy and, you know, people pleasing is just dumb.”

“The mark of a leader is determined by the leaders that they create and develop themselves.”

“I think as you get older, you not only get wiser, but you’re more experienced. And so you sit in a situation and you know when to shut up.”

Don’t miss this episode. It’s a refreshingly candid conversation about resilience, self-awareness, and the power of growing through the messy middle of your career and life.

The world doesn’t need more stories of success; it needs honest conversations about hard challenges, vulnerability, and proof that trials can ultimately become triumphs.

That’s why the Uncomfortable Growth® Uncut podcast was born. It’s a reminder that struggle and success are intrinsically linked, that growth is rarely easy, and that the moments we feel most uncomfortable are where our greatest breakthroughs lie.

Media

Trump clashes with Aussie reporter over Ukraine

As Steve Jackson writes in The Australian, the US President cut her off, saying she didn’t know what she was “talking about,” accusing her of oversimplifying the conflict.

Watch the exchange below:

2GB’s Mark Levy caught up in new court case

As Josh Hanrahan writes in The Daily Telegraph, it follows the collapse of Levy’s Sylvania restaurant, Pronto, which was recently wound up by the court.

Companies

Southern Cross chair downplays job cuts amid Seven merger

According to The Australian Financial Review’s Sam Buckingham-Jones, on-air talent, producers and sales teams across Triple M, Hit and LiSTNR are expected to stay put.