Australian Radio Network (ARN) has posted a seven per cent year-on-year drop in total revenue for the six months to 30 June 2025, with metro advertising proving the biggest drag amid ongoing softness in the broader radio market.

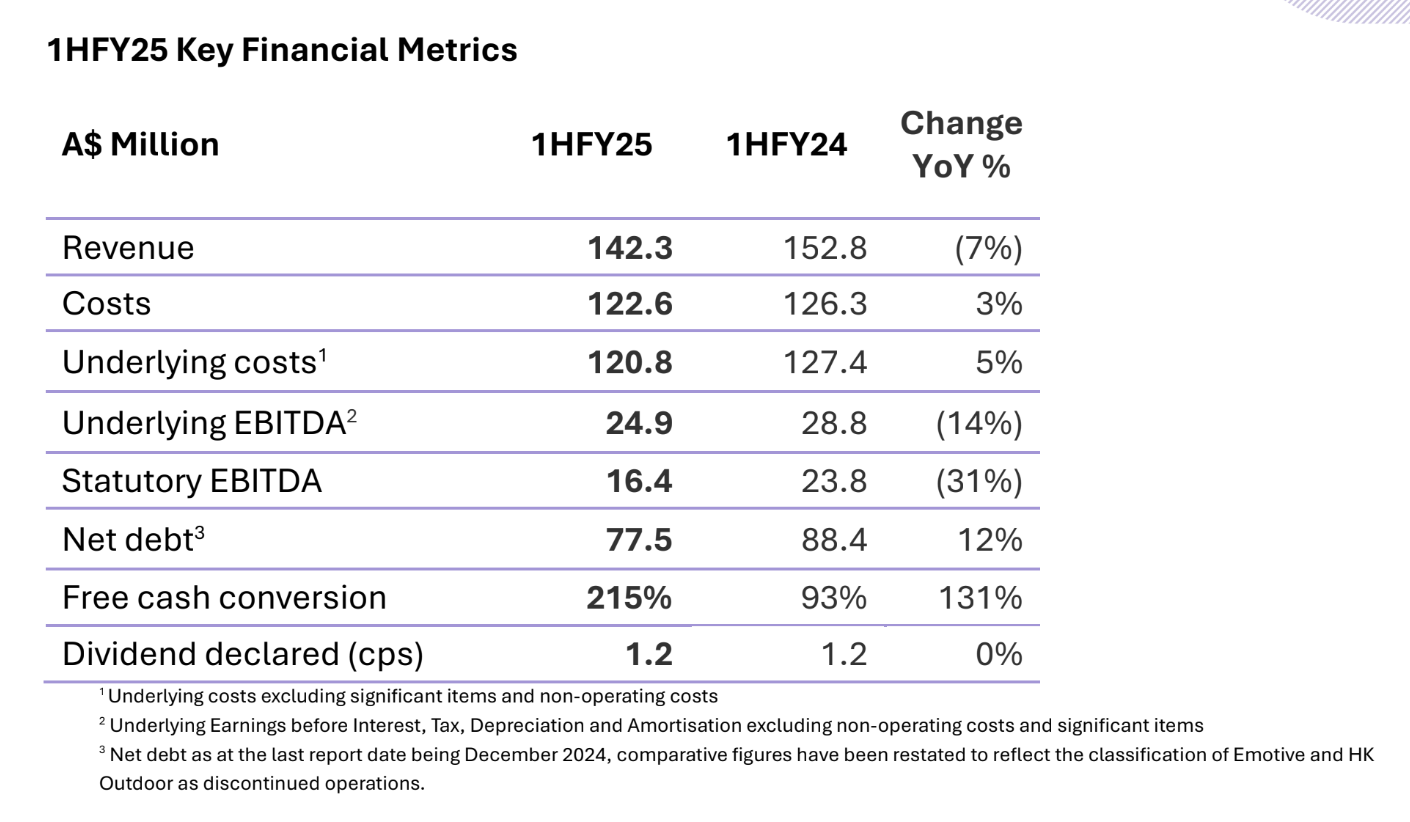

Revenue declined to $142.3 million in the half, down from $152.8 million in the prior corresponding period. The fall was driven by a 12 per cent decline in metro radio, with regional revenue also down 5 per cent. ARN noted that digital audio revenue grew 21 per cent to $13.4 million but remains a small share of the overall business, accounting for just 9 per cent of total revenue.

Underlying EBITDA also slipped 14 per cent to $24.9 million, down from $28.8 million, with statutory EBITDA falling 31 per cent to $16.4 million. The declines come despite the business implementing cost reductions as part of a $40 million transformation plan, of which $35 million has already been executed.

Metro pressure, structural reset

Ciaran Davis, CEO of ARN Media, said the company’s performance reflected “challenging market conditions” but pointed to long-term repositioning efforts including a leadership refresh, commercial team restructure, and increased focus on digital audio and podcasting.

“We’re executing a strategic transition from broadcast to digital,” Davis said. “While the metro market remains under pressure, we are focused on operational discipline and investing in long-term digital growth.”

Gross margin improved slightly to 82.8 per cent, and cost reductions helped push underlying costs down 5 per cent to $120.8 million. However, the benefits of these savings are expected to be felt more fully in the second half and into FY26.

Cashflow positive, but topline still contracting

While the top line contracted, cash flow performance was strong. ARN reported $19.5 million in free cash generated – up 30 per cent year-on-year – and net debt fell by $10.9 million to $77.5 million.

The company also maintained its dividend, declaring a fully franked interim payout of 1.2 cents per share, representing 66 per cent of NPAT before significant items.

Outlook cautious as transformation continues

• Second-half FY25 revenue is forecast to decline again in the low to mid-single digits.

• Metro radio remains under commercial pressure, though ARN anticipates some share regain in 2HFY25.

• Digital audio revenue is projected to accelerate in the second half.

• Cost reductions are expected to have greater impact in 2HFY25 and into FY26.

Hamish McLennan, Chairman of ARN Media, acknowledged the revenue challenges but said the transformation program was “unlocking funds for reinvestment into content, audience growth, and the digital future.”

The company also confirmed its Hong Kong out-of-home business, Cody, is up for sale after posting 157 per cent revenue growth to $24 million with no cash funding required during the half.

ARN Media trades on the ASX under the code A1N.