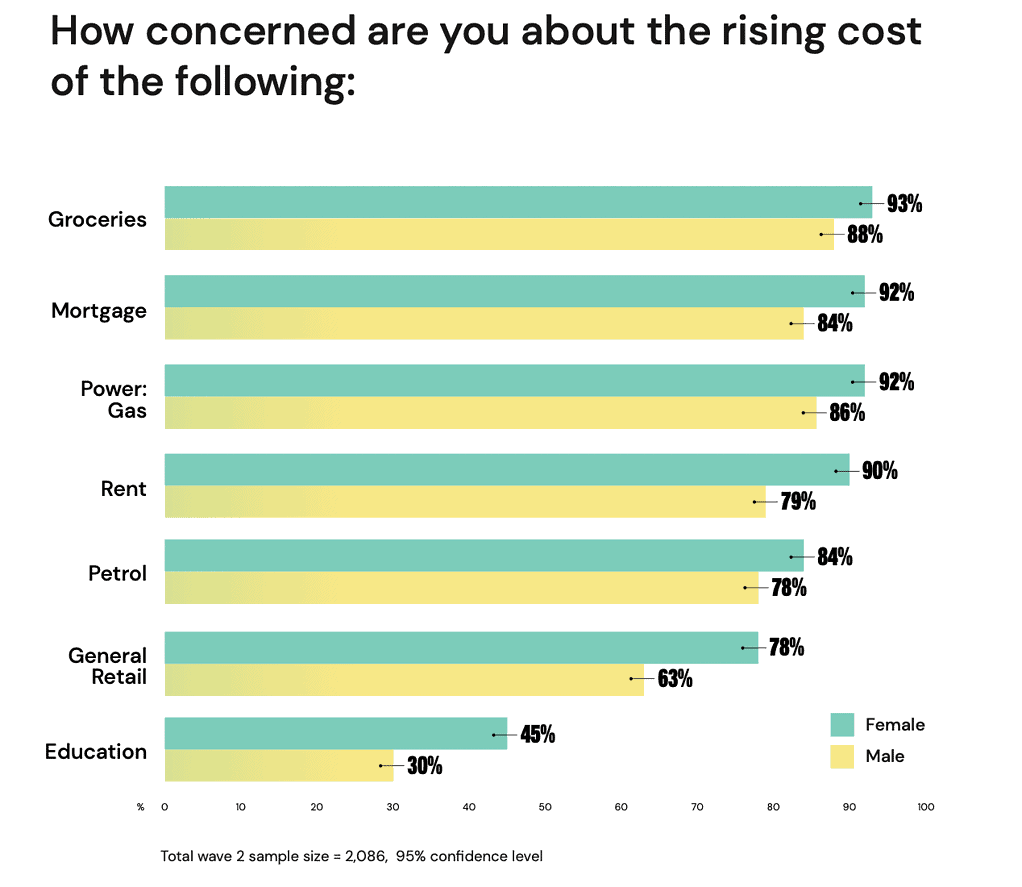

M&C Saatchi Group’s new report ‘Prioritisation, planning and promos: How Australia is learning to live with the cost of living crisis’ has revealed that women are exhibiting significant concern regarding the cost of living crisis.

According to the Group’s research, ,ore than a third (36%) of women feel anxious, which significantly surpasses the 20% of men that responded with the same concern. This marks a four percentage point increase for women between October 2022 and May 2023.

This has huge implications for brands and businesses, given women account for 85% of all purchases and drive 70-80% of all consumer spending.

This increased anxiety is driven by the fact women:

• Earn less on average (the national gender pay gap on base salary is 13.3%)

• Carry the mental load for many purchase decisions on a daily basis

Due to the increased anxiety amongst women, M&C Saatchi Group is seeing shifts in how consumers are spending, namely the emergence of the intentional shopper. A consumer who prioritises their spend in a much more planned and deliberate way (making sacrifices to protect what they value most). Through this proprietary study we explored how the cost of living crisis is significantly changing shopping behaviour, focusing on six key spending trends:

1. They are going deeper into their subscriptions: cancelling streaming services they don’t need but looking deeper into the archives of the ones that they are retaining. 26% of respondents will cancel one or more pay tv/streaming subscriptions in the next three to six months.

2. They are more open to substitution: we are seeing customers more likely to be open to try new brands or products, whether that be new retailers (e.g. supermarkets) or buying cheaper substitute brands like home brands.

3. They are using loyalty programs more: 24% of people are using loyalty program memberships more frequently.

4. They are squeezing the last drop: They are holding onto makeup products longer (91% are shopping less frequently for makeup and skin care and 90% are making products last longer).

5. They are more planned: There is less spontaneity and customers are going into supermarkets with a list and not deviating off those lists.

6. They are hunting for deals: Consumers are spending more time researching products and seeking discounts. Even Gen Z are seeking discounts and coupons and sharing them with a sense of pride with their networks.

Emily Taylor, chief strategy officer at M&C Saatchi Group, said proactive brands were acting now to stay in favour with consumers: “We have seen our clients take action in this cost of living crisis to really help their customers, including innovations and utility to better plan their spending. To stay in a customer’s consideration phase, brands need to be adapting to new behaviours; less sporadic spend and more intentional, conscious consumption.”

The Report highlights key ways in which brands can help customers through the cost of living crisis. For example, given it can cost five times more to acquire a new customer than retaining an existing customer, loyalty is extremely important.

The research also found that a one-size-fits all approach to brand marketing will not work in these conditions.

•18 – 34 year olds over indexed in more payment options (eg Afterpay), loyalty programs and education and content

• 35 – 54 year olds over indexed in more payment options, loyalty and better customer service (if products/services increase in price, so do customer expectations)

• 55+ year olds are over indexed in price capping and having more certainty on prices.

A female customer, 40-44, said: “Cutting back on expenses such as subscriptions. Eating more at home. Weekly shop at Aldi rather than Coles.”

Another female customer, 30-34, shared: “Buying more grocery homebrands and planning my shopping list better with current specials. I drive my car less and have a better plan for when I do drive. I cancelled a few monthly subscriptions which aren’t necessary. Eat less take away/restaurants.”

A hair salon owner from Inner West Sydney, shared his perspective. He said: “We’ve never had so many appointments cancelled and rebooked. People are definitely extending the time between visits.”