Mass magazine titles prove resilient

Magazine subscriptions in Australia for the first half of 2021 are on par with sales in 2020. The pandemic’s effect on consumer behaviour in 2020 resulted in about a 30% uplift in sales on isubscribe.com.au overall.

isubscribe is Australia’s most comprehensive provider of magazine subscriptions online, with currently over 4,000 print and digital magazine titles on offer on our Australia site. The business also operates in New Zealand and UK.

For the first half of 2021, despite not experiencing equivalent lockdowns due to the pandemic as in the first half of 2020, mass title sales have proved resilient and growth was observed in niche categories.

For this report, YoY sales comparisons for 1 Jan 30 June 2021 and 2020, then 2021 and 2019 are shown to create a more complete picture of subscription sales during these unique times.

The report shows that where 2021 results have not surpassed 2020, the figures are deceivingly still positive, ahead of 2019 sales, a period that experienced more similar conditions to 2021. The report will also identify individual titles’ performances and review magazine category sales to look at broad magazine subscription trends.

To three magazine categories remain unchanged

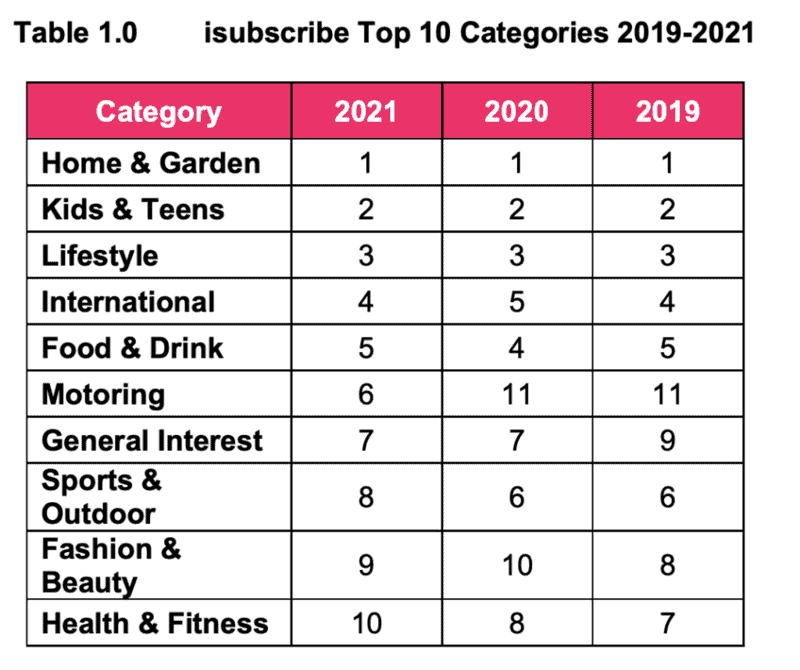

Looking at the top 10 performing categories on isubscribe.com.au YoY from 2019-2021, table 1.0 shows the top 3 categories remain unchanged, but movement amongst the top 6-10 categories, reflective of notable changes in the market. An account of these changes is below.

Lifestyle

The lifestyle category’s consistent performance is underpinned by two important factors. Firstly, Are media listed The Australian Women’s Weekly in late 2020 with isubscribe, which has positively skewed the YoY results for 2021. There are however some other success stories. The growth in subscription sales YoY of relatively new, niche lifestyle titles: Graziher, Ruth and Dare magazines. These titles target specific regional audiences in the case of Graziher and Ruth magazines and for Dare magazine, the active over sixties demographic is its target audience.

International

The international category has maintained a consistent position in the top 5, trading positions with the Food and Drink category in recent years. Since 2020, there’s clearly been more demand coupled with difficulty purchasing from retailers.

Motoring

The most significant factor affecting the motoring category’s sales performance is the addition in late 2020 of Are Media’s bestselling motoring titles to isubscribe, such as Wheels, 4×4 Australia, MOTOR, Street Machine and Unique Cars.

Fashion & Beauty

Bauer announced the closure of Harper’s Bazaar, Elle and InStyle magazine in May 2020. While the category understandably dropped two places from 8 to 10 between 2019 and 2020, it’s pleasing to see the category improve to 9th position for the first half of 2021. Vogue Australia is showing strong resilience in 2021 achieving the same subscription sale volumes for the first half of the year as in 2020. Womankind magazine has also achieved a huge uplift in subscription volume YoY for 2021/20. This is mostly due to the publication ceasing sales for a time during the first half of 2020. It’s an encouraging result to see the title’s sales respond so well the following year.

Health & Fitness

Despite the temporary closure of Women’s Health and Men’s Health in 2020 and change of ownership, subscription sales have been strong in 2021 with these titles returning to the top-selling positions in the category.

Australian magazine subscription performance by title

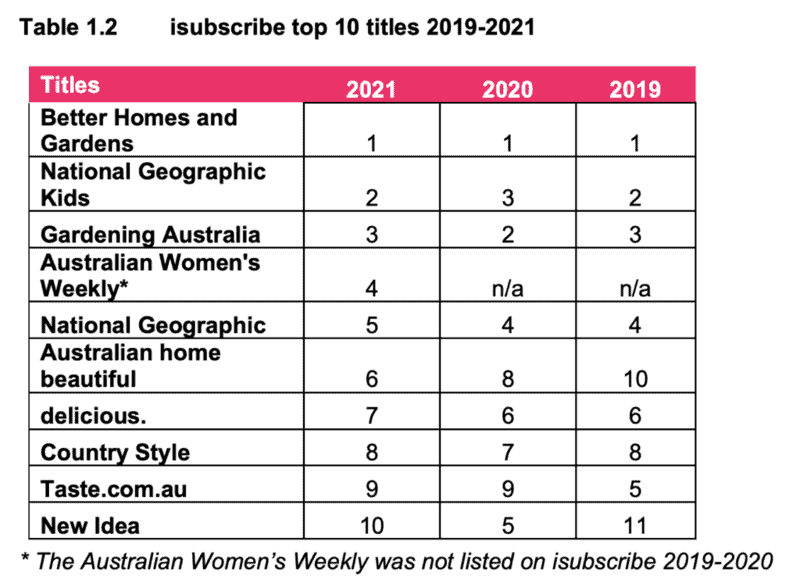

The top 10 titles on isubscribe over the past three years have remained consistent with a few exceptions and movements within the rankings. As with the category rankings, most of the movement occurs in places 6-10 between the top-selling food and home magazines.

Looking at individual titles’ performances and sales trends as a whole, there are some stand-out magazine titles selling more subscriptions in 2021 than 2020.

The most significant trend is the growth in kids magazine subscription sales YoY, specifically: National Geographic KiDS, Double Helix and Teen Breathe which are all in the top 20 selling titles on isubscribe.com.au overall. The popularity of kids magazines, particularly the top sellers, continues to increase as the awareness of their advantages for offline entertainment and education grows.

Two other standout titles in distinct categories are Money Magazine which is up 57% YoY for subscription volume on isubscribe.com.au in 2021 and Australian Homespun which is up 18% YoY. For Australian Homespun, having a range of subscription options and prices appears to be delivering returns while there’s a renewed interest in hobbies as a result of the pandemic.

Money Magazine’s strong subscription sales performance is, in part, due to the magazine steadily increasing its engagement with isubscribe.com.au and participating in campaigns and opportunities to grow its presence every quarter.

A positive signal for the ongoing opportunities presented in magazine publishing and subscriptions is that the largest number of new magazines listed on isubscribe in the past three years has been this year, 2021 with a total of 57 new titles. A total of 42 new magazines listed in 2020 and 50 new titles in 2019.

Next week: New Zealand’s magazine subscription market

See also: Magazines Now – Rolling Stone audience grows 15 months after launch plus Readership update