The chief executive of HT&E, Ciaran Davis, has told shareholders the company is reviewing some of its digital investments.

The three investments highlighted were esport and video game business Gfinity, creative tech business un/bnd and cloud communication platform Soprano, in which HT&E holds 25%.

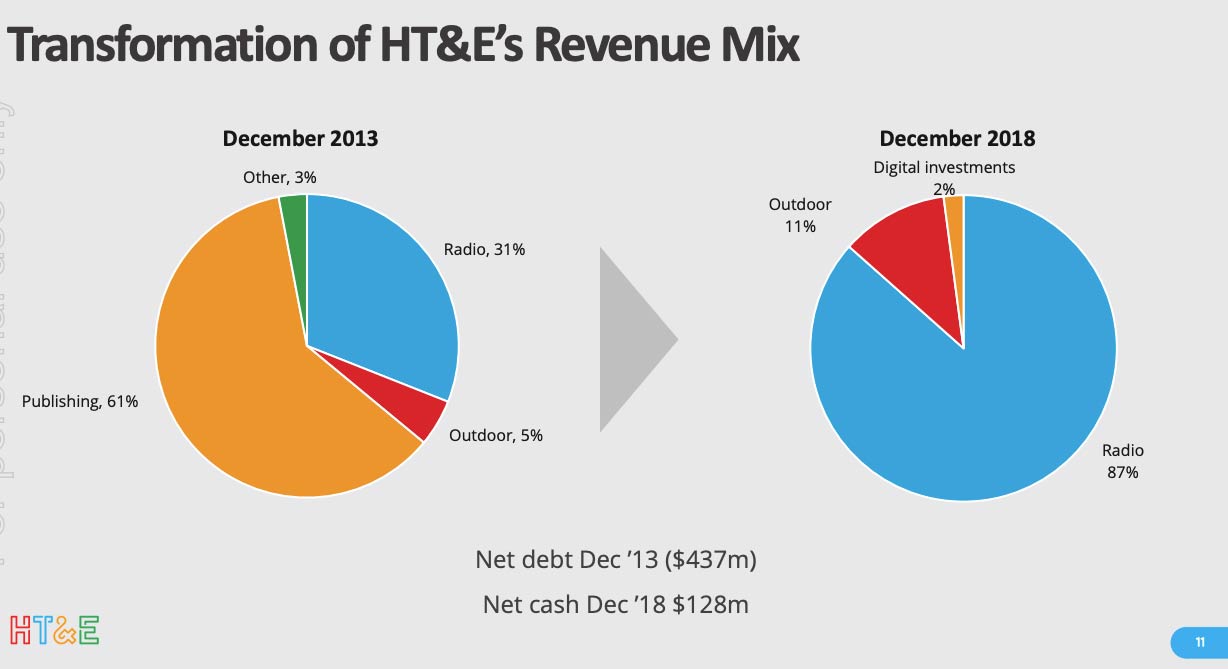

Davis shared a slide with shareholders at the HT&E annual general meeting, which showed the transformation of the company’s revenue mix.

The sale of its regional newspaper business to News Corp Australia has seen publishing revenue disappear off the radar after accounting for 61% of revenue in 2013. In the subsequent five year period radio revenue has increased from 31% to 87%.

HT&E’s remaining outdoor holdings account for 11% while digital investments contribute just 2%.

While the business is reliant on radio, Davis explained how the consumption of audio is changing. Live Australian radio listening in the marketplace accounts for 62% of audio, while streaming services like Apple Music and Spotify has grown to 15.3%. Podcasts account for just 3.8%, but is growing.

At the end of his presentation, Davis gave a trading update and noted a soft March was impacting Q1 with revenue down 5% year-on-year. There had been a slight uptick in April, with Davis confident enough to predict first half revenues to be down 2-3% on the previous tear, with cost savings mitigating the lower sales impact.