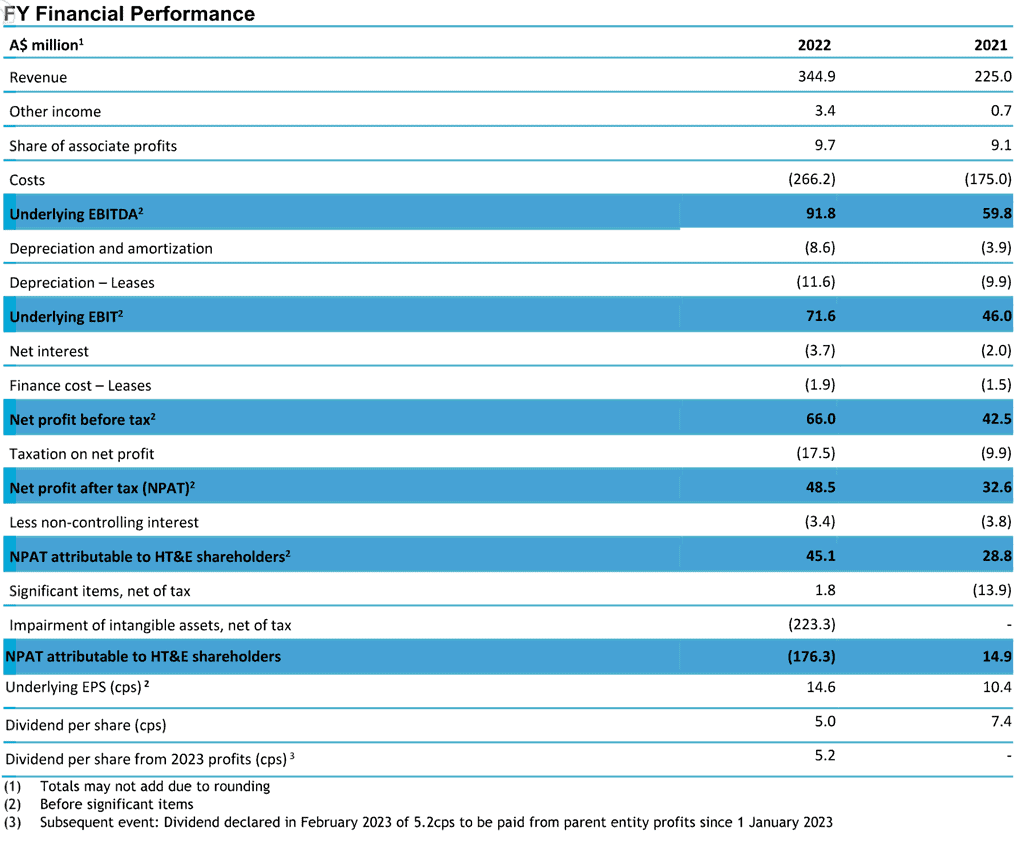

HT&E has announced its full-year financial results for 2022 with the key findings being:

• Revenues up 53% to $344.9 million, underlying EBITDA up 53% to $91.8 million owing to the acquisition of ARN Regional

• The impact of the acquisition of Grant Broadcasters saw the integration programme performing ahead of expectations and providing $7 million revenue synergy target

• Soprano sale for $66.3 million cash; FIRB approval expected March 2023

• Strong balance sheet; minimal debt following Soprano sale

• The expanded network delivered over 8 million listeners across 135 stations in every state and territory in the country

• Strong programming in Sydney and Melbourne deliver the strongest ever metropolitan ratings in the final survey of 2022

• The CADA launch targeting Australia’s youth audience saw growth in audience connections to over 3.5 million

• iHeart Podcast Network maintained its position as the #1 Publisher for 32 consecutive months

• Fully franked dividend of 5.2 cents per share (to be paid from parent entity profits since 1 January 2023)

• Future dividend policy revised upwards to 65-85% payout ratio

• Accretive share buy-back maintained, delivering improved returns for shareholders

• $249.9 million non-cash impairment charge booked reflecting macro-economic environment

2022 statutory revenues significantly improved on last year, up 53% to $344.9 million owing predominately to the acquisition of ARN Regional (Grant Broadcasters).

Metropolitan broadcast advertising revenues grew 3% to $192.5 million, with increasing audiences further strengthening ratings positions and driving revenue onto key eastern seaboard stations.

Regional advertising revenues grew 7% on a pro forma basis to $107.7 million, assisted by federal government election related spend and buoyant economic conditions. Increased revenue contribution from digital audio, up 8% on a pro forma basis to $14.6 million also assisted overall

growth.

Underlying earnings before significant items, interest, tax, depreciation and amortisation (EBITDA) was up 53% to $91.8 million.

HT&E Chairman, Hamish McLennan said, “HT&E delivered an exceptionally strong performance in a year of considerable change and transformation. The acquisition of 46 regional stations from Grant Broadcasters has proven to be an outstanding investment and demonstrates the Company’s ability to identify the right opportunities to drive shareholder value.

“Despite global and inflationary concerns impacting consumer and advertising sentiment in the second half, HT&E’s full year results demonstrate the strength of the audio offering we provide our clients and considerable progress was made delivering on our strategic intent to build the best broadcast radio and digital audio business in Australia.

“Importantly the sale of our stake in Soprano for $66.3 million in cash unlocks considerable value for shareholders and will effectively eliminate existing debt and puts the Group in an enviable position

to take advantage of future audio entertainment opportunities. We are open and proactive in identifying and assessing value accretive opportunities that are in the best interest of shareholders”

Hamish McLennan

The all-cash deal is expected to receive FIRB approval in March 2023.

HT&E declared a fully franked dividend of 5.2 cents per share. The Board said that is committed to maintaining strong dividends for shareholders thanks to the high cash-generating nature of the business, and announced an increase in the dividend policy to 65-85% payout ratio with a commitment to pay at the higher end if net debt leverage is under 0.5 times.

An impairment charge of $249.9 million was taken in the year, reflecting uncertainty associated with the current macro-economic environment.

HT&E CEO & Managing Director, Ciaran Davis, said, “HT&E finished the year with the best outright ratings performance ever, a reflection of our focus on quality content to drive audiences and creating the best broadcast radio and digital audio business in Australia. ARN continues to hold the position as the #1 metropolitan radio network, dominating the key markets of Sydney and Melbourne, as well as delivering equally impressive results across the country.

“Our ARN Regional strategy to fiercely protect the localised nature of the individual regional station brands and the connections to the communities they serve is incredibly powerful and has paid off

with improved ratings and growing revenues. We have created a unique position in the Australian media landscape with our commitment to local content and a recognition of the critical role we play in Australian regional communities.

“It is something we are committed to maintaining. Already strong local regional revenues are up by 7% on a pro forma basis, and importantly, the first year synergy target was delivered, with incremental revenues of $7 million, providing confidence in our ability to achieve the $20 million per annum target identified within three years of acquisition.

“The exceptional progress made during the year with the integration program is a testament to the hard work and commitment across the Group and we are on-track to conclude the major components by the end of 2023.

“Our low capital expenditure digital audio strategy continues to deliver as we remained Australia’s #1 Podcast publisher reaching an average of 5.4 million monthly listeners, growing podcast listening by 40% during the year. Listening hours on digital devices grew to over 10 million a month with over 2 million signed-in users. This acceleration of audiences has delivered improved advertising revenues in the second half, up 28% compared to the first half of the year, and provides increased confidence for a path to profitability by the end of 2024 – earlier than anticipated.

“We launched the new youth brand CADA in March 2022 and have quickly established over 3 million connections with 18-29 year olds. Delivering multi-platform advertising solutions for clients as seen new brands like Netflix and Bonds engaging with ARN. In 2023, our focus will be driving this new audience to engage with our core audio products of streaming and podcasting.

“While we are facing an uncertain macroeconomic environment, HT&E is incredibly well placed to withstand any potential short-term impacts to advertising revenues.”

Ciaran Davis

Australian Radio Network (ARN)

In Sydney, ARN has maintained its Breakfast duopoly leadership with KIIS 1065’s Kyle & Jackie O and WSFM’’s Jonesy & Amanda finishing in the #1FM and #2FM spots respectively.

ARN continues to be #1 metropolitan radio network in Australia reaching over 6 million people a week. Culminating with ARN’s strongest ever metropolitan ratings performance in the final survey of 2022.

In a highly competitive market, ARN finished 2022 as the #1 metropolitan network for people 10+, the #1 network for people 25-54, and with its highest ever 25-54 audience share and largest cumulative audience.

Across the metropolitan network, overall listeners increased by close to 12.7% year on year. ARN continues to lead key metropolitan markets with #1FM stations in Sydney, Melbourne and Adelaide. In Melbourne, GOLD104.3 is #1FM in all dayparts for the 24th consecutive survey, led by The Christian O’Connell Show.

Christian O’Connell

ARN Regional

ARN drove impressive results in the regional markets. In the largest non-capital city market of the Gold Coast, ARN’s Hot Tomato increased cume year on year and remained a strong overall #1.

Of the eight of ARN’s other major regional markets surveyed in 2022, ARN increased cume in five and held #1 rankings in Cairns, Mackay & Gympie. Cume also increased strongly in Wollongong and Hobart from prior surveys.

In February, ARN replaced all previously licensed content across the regional network with ARN original content. This saw us grow distribution and audiences for key properties and deliver value for their national commercial partners.

ARN Digital Audio Investments

ARN was pleased with the support from their key commercial partners, with CADA delivering major integrated campaigns for marquee clients including Bonds, Netflix and Collarts.

Bonds “Big Icon Energy” campaign saw Flex & Froomes record their show in front of a live studio audience with 170 attendees, prize winners and influencers. CADA have seen more success with the Flex & Froomes podcast reaching 1 million downloads in six months and becoming ARN’s 4th biggest catch-up podcast within 3 months of launch.

Left to right: Lucinda “Froomes” Price and Lillian “Flex Mami” Ahenkan

The iHeart Podcast Network Australia has grown at scale and maintained its position as the #1 Publisher on the Australian Podcast Ranker for 32 consecutive months. The iHeart Podcast Network Australia now reaches a further 4.7 million listeners via the podcast network.

Cody (HK Outdoor)

Cody Outdoor revenue and earnings increased 9% and 31% respectively on a like contract basis, and the business returned to cashflow profitability, the result of materially improved local market conditions and strong management of our network of tunnel advertising contracts.

The reopening of international borders and removal of quarantine nrequirements expected in the first half of 2023 will further assist the business.

Trading Update

According to ARN, Q1 radio revenues are pacing near flat on the same time last year cycling strong regional comparatives and impacted by reduced government spend for the period. Consistent with historical radio planning, ARN claims visibility into March and Q2 is short however current briefing activity levels remain strong.

ARN are forecasting total people and operating cost growth of 4% as they invest in digitisation and IT systems integration post-acquisition. Short-term cost levers are available to limit growth should market conditions dictate.

Annual capex is forecast to remain in the $8-10m range allowing for a structured regional station refurbishment program over the next 3-5 years.

HK

As the HK economy continues to reopen to international business and tourism, Q1 revenues for Cody Outdoor are forecast to grow over 50% on same time last year.