A new Google Cloud report has found that businesses adopting AI agents early are realising significant financial and operational returns, with 88 per cent already seeing ROI from generative AI use cases.

The second annual ROI of AI 2025 study, conducted with National Research Group, surveyed 3,466 senior leaders from enterprises with more than $10 million in annual revenue across industries including media and entertainment, retail, finance, healthcare, manufacturing, telecoms and the public sector.

The research highlights a shift from experimentation with generative AI to scaling agentic AI. If agentic AI is still a term you’re getting familiar with, these are AI systems capable of executing tasks and making decisions independently from humans.

According to the findings, 52 per cent of organisations using generative AI now have AI agents in production, with 39 per cent running more than 10 agents across their operations.

Where companies are seeing returns

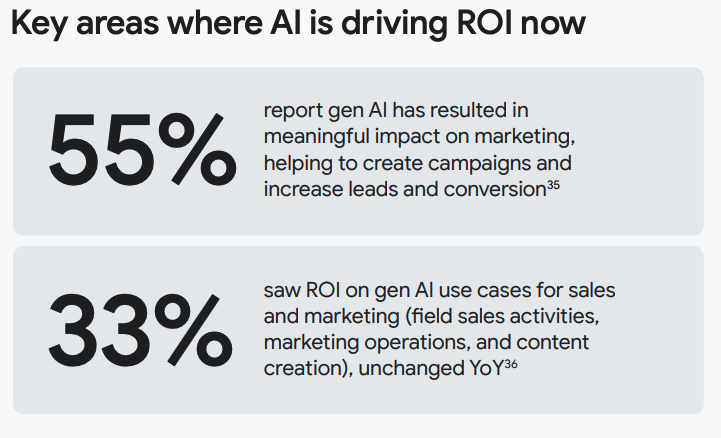

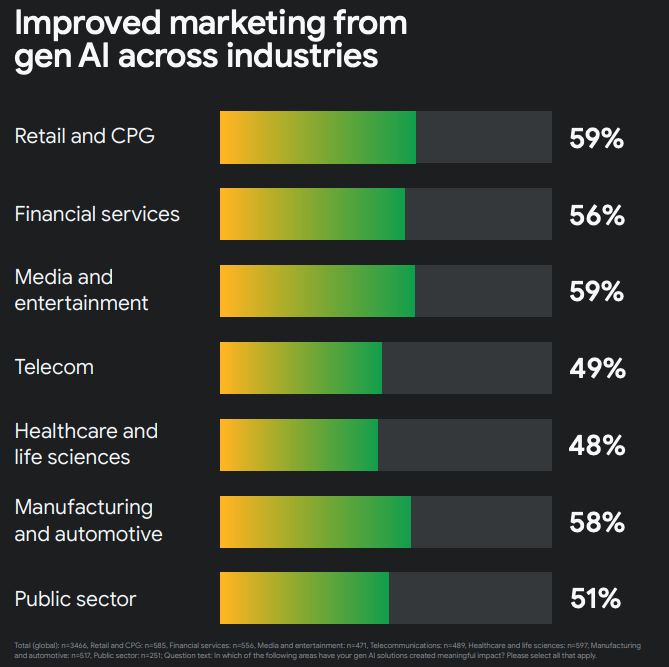

Google Cloud identified five key areas where AI is driving measurable ROI: productivity, customer experience, business growth, marketing, and security. Seventy per cent of executives reported improved productivity, while 63 per cent cited improved customer experience. Business growth (56 per cent), marketing (55 per cent) and security (49 per cent) also recorded significant impacts.

Early adopters are prioritising investment accordingly. On average, they allocate 50 per cent of future AI budgets to agents and dedicate 39 per cent of total IT spend to AI, compared with 26 per cent for other organisations.

Executives who have been quick to adopt also reported faster time-to-market.

Executive sponsorship critical

The report emphasises the importance of C-suite backing, with 78 per cent of organisations that have comprehensive executive sponsorship seeing ROI from at least one generative AI use case. By comparison, adoption rates and returns were lower in organisations where executives had not bought in.

Quoted in the report is Cristina Nitulescu, Head of Digital Transformation and IT at Bayer Consumer Health: “You have to look at ROI as not just size of return but also speed of return. AI initiatives are sizable investments that are not commodities yet, so we have to look at where hyper-automation and scaling with AI is actually generating a return first. How fast is your investment coming back to the organization and what capabilities are you investing in now that will scale up and create more efficiencies or business transformation down the road?”

Regional and industry differences

Adoption patterns vary by geography and industry. In JAPAC, customer service is the leading use case, while in Europe technical support is a priority. Media and entertainment respondents pointed to improvements in media production workflows, while retail and consumer goods companies highlighted gains in customer service and marketing.

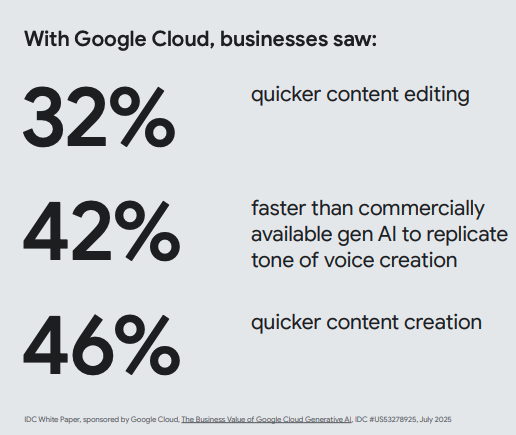

The benefits for media production workflow was highlighted in the report:

Challenges remain

Despite strong returns, barriers remain for broader rollout. Data privacy and security was cited as the top consideration when evaluating large language model providers, ahead of integration with existing systems and cost. Executives also flagged the need for robust governance frameworks and investment in upskilling staff to ensure sustainable adoption.

“Deploying AI agents while covering enterprise security, compliance and other requirements is still tremendously difficult,” said Christoph Rabenseifner, Chief Strategy and Innovation Officer at Deutsche Bank. “A modern, integrated data strategy is essential.”