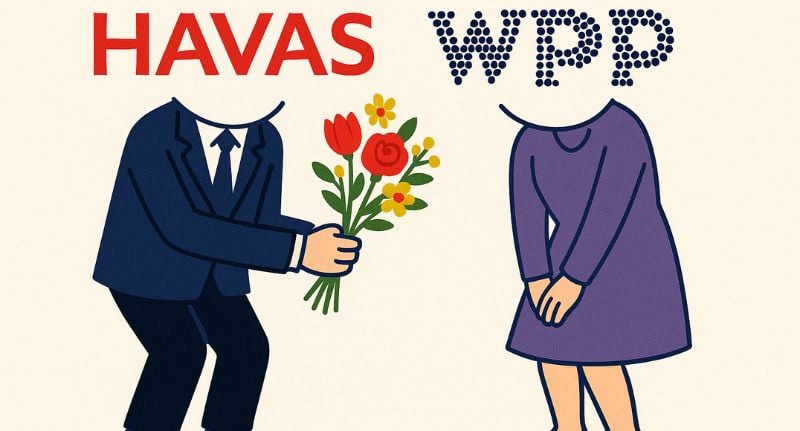

WPP and Havas are weighing a possible merger or partnership, with “serious talks” underway according to senior industry sources speaking to Ad Age.

The discussions come as global holding company consolidation intensifies following Omnicom’s acquisition of IPG, which will create the world’s largest agency group once the deal closes this month.

The publication claims sources said Havas has been exploring capital options, including private equity involvement, to assess whether a combination with WPP could work.

One insider described the conversations as “serious”, while another insisted formal engagement between the companies has not occurred.

Both Havas and WPP have declined to comment.

If a deal proceeds, a merged WPP–Havas entity would become the second-largest agency holding group globally by revenue, sitting behind Omnicom once its IPG acquisition is complete.

The timing is notable: Havas only became an independent, publicly listed company in late 2024 after its spin-off from Vivendi.

Since then, the company has been open to strategic moves, with CFO and COO François Laroze telling investors in October that Havas “would consider” potential partnerships, including with Dentsu.

WPP’s pressure points

Newly appointed WPP CEO Cindy Rose has repeatedly flagged the need to simplify the group’s offer and restore value after a bruising year.

WPP has lowered full-year revenue guidance, reported a weak third quarter and watched its share price fall more than 60% since early 2025, hitting its lowest point since 1998.

For the year to date, reported revenue was down 8.0% YoY and 2.8%, while revenue less pass-through costs fell 10.5% YoY and 4.8% LFL.

The company now expects 2025 like-for-like growth in revenue less pass-through costs to range between -5.5% and -6.0%, with a headline operating profit margin of around 13%.

“There is a lot to do, and it will take time to see the impact, but in my first 60 days we are already moving at pace with some initiatives already announced and more to come,” Rose said.

“We know what it takes to win: we are optimistic, energised and confident that we’re building the right plan and the right culture to secure a bright future for WPP, our people, our clients and our shareholders. We look forward to sharing more details early in the new year.”

Industry executives say this financial backdrop complicates any major dealmaking.

One senior figure warned that an acquisition by WPP would be difficult “given its current financial struggles and depressed share price”. Even so, several insiders believe a tie-up could help restore WPP’s market value and scale.

Any combination of WPP and Havas would materially reshape the global agency landscape, but the path forward remains uncertain.