If David Ellison was hoping for a celebratory drink on the eve of his January 21 tender offer deadline, he might want to switch it to a double espresso. In a strategic power move that effectively calls ‘checkmate’ on Paramount Skydance’s hostile bid, Netflix and Warner Bros. Discovery (WBD) have abruptly amended their merger agreement to an all-cash transaction.

As reported by Variety, the revised deal keeps the valuation at US$27.75 per share, but swaps the previous mix of cash-and-stock for hard currency.

The move is designed to do two things. First, it accelerates the shareholder vote to April 2026. Second, it strips Paramount of its main talking point that Netflix’s stock was too volatile to trust.

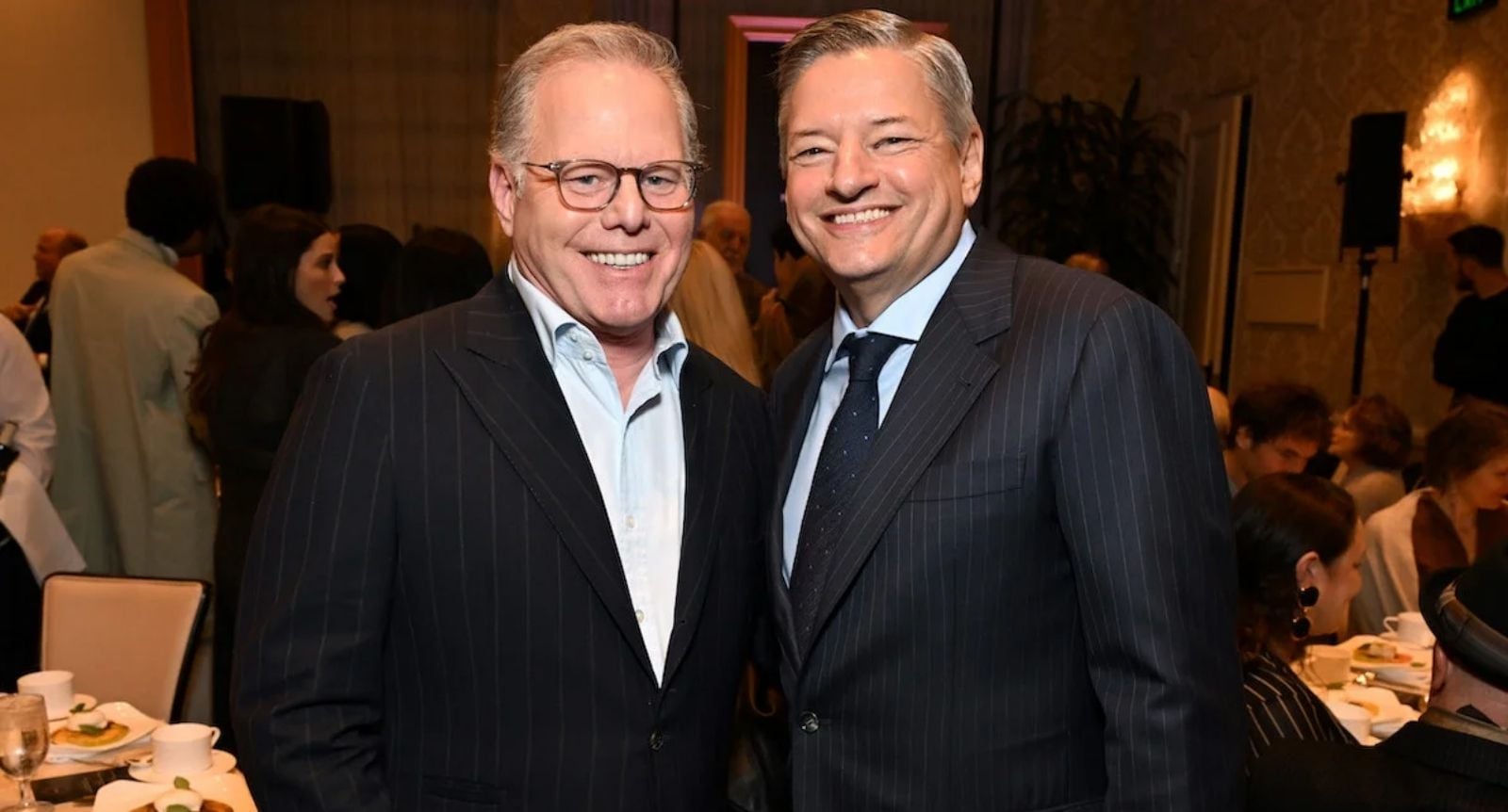

Netflix comes up with the cash. L to R- David Zaslov and Ted Sarandos

The ‘Put up or shut up’ moment

For months, Paramount Skydance has been campaigning on a simple premise. They argued their US$30-per-share cash offer is real money while Netflix’s paper promises are risky.

WBD boss David Zaslav and Netflix co-CEO Ted Sarandos clearly took that personally. By shifting to all-cash, they have effectively removed the ‘market risk’ argument from the table.

While Paramount’s US$30 offer is technically higher on paper, the WBD board argues that the certainty of the Netflix deal makes it the superior package. They also highlight the additional value of the separate ‘Discovery Global’ spinoff which shareholders still get.

WBD Board Chair Samuel Di Piazza Jr. didn’t mince words. He called the all-cash switch a testament to the board’s “unrelenting focus” on delivering value “at even greater levels of certainty.”

Translation: We found the cash, now go away.

Larry and David Ellison have gone quiet

The Silence of the Ellisons

The timing of this announcement is no accident. It lands right as Paramount’s hostile tender offer was set to expire. It is a corporate stiff-arm.

As of this morning, Paramount Skydance has been uncharacteristically quiet. There is no word yet on whether they will extend their tender offer deadline again or fold their hand.

However, having just lost a court bid in Delaware to fast-track valuation disclosures, David Ellison is rapidly running out of leverage.

His ‘Plan B’ is already in motion. This involves a proxy war to replace the WBD board at the 2026 annual meeting.

But convincing shareholders to overthrow a board that just secured them an all-cash exit is a much harder sell than it was yesterday.

Speed dating to a merger

The other major takeaway from the amendment is speed. Broadband TV News notes that WBD has already filed a preliminary proxy statement. They are eyeing a shareholder vote by April 2026.

This accelerated timeline puts immense pressure on Paramount.

A proxy fight is a slow burn, but Netflix and WBD are now sprinting toward the altar.

Unless Ellison can pull a legal rabbit out of a hat or raise his bid significantly above US$30, the ‘Two Davids’ feud might end with Zaslav cashing a very large check while Ellison is left holding the bill for a very expensive legal battle.