Australians are paying more for entertainment than ever, yet consuming less of it. It’s a decisive catch-22 pivot away from our “always-on” culture and towards selective, purpose-led viewing.

That’s according to Deloitte’s latest Media & Entertainment Consumer Insights report (MECI 2025) which points to a market breaking old habits and reshaping value expectations.

Deloitte Australia Telecommunications, Media & Technology Lead Partner Peter Corbett frames it as a behavioural milestone: “Australians are paying more for entertainment than ever before, but spending less time consuming it. MECI 2025 captures a nation rethinking its relationship with media, technology, and time.”

The implications? Pricing power meets real pressure, scrolling slows, and attention becomes a privilege, not a given.

Subscriptions climb, value anxiety grows

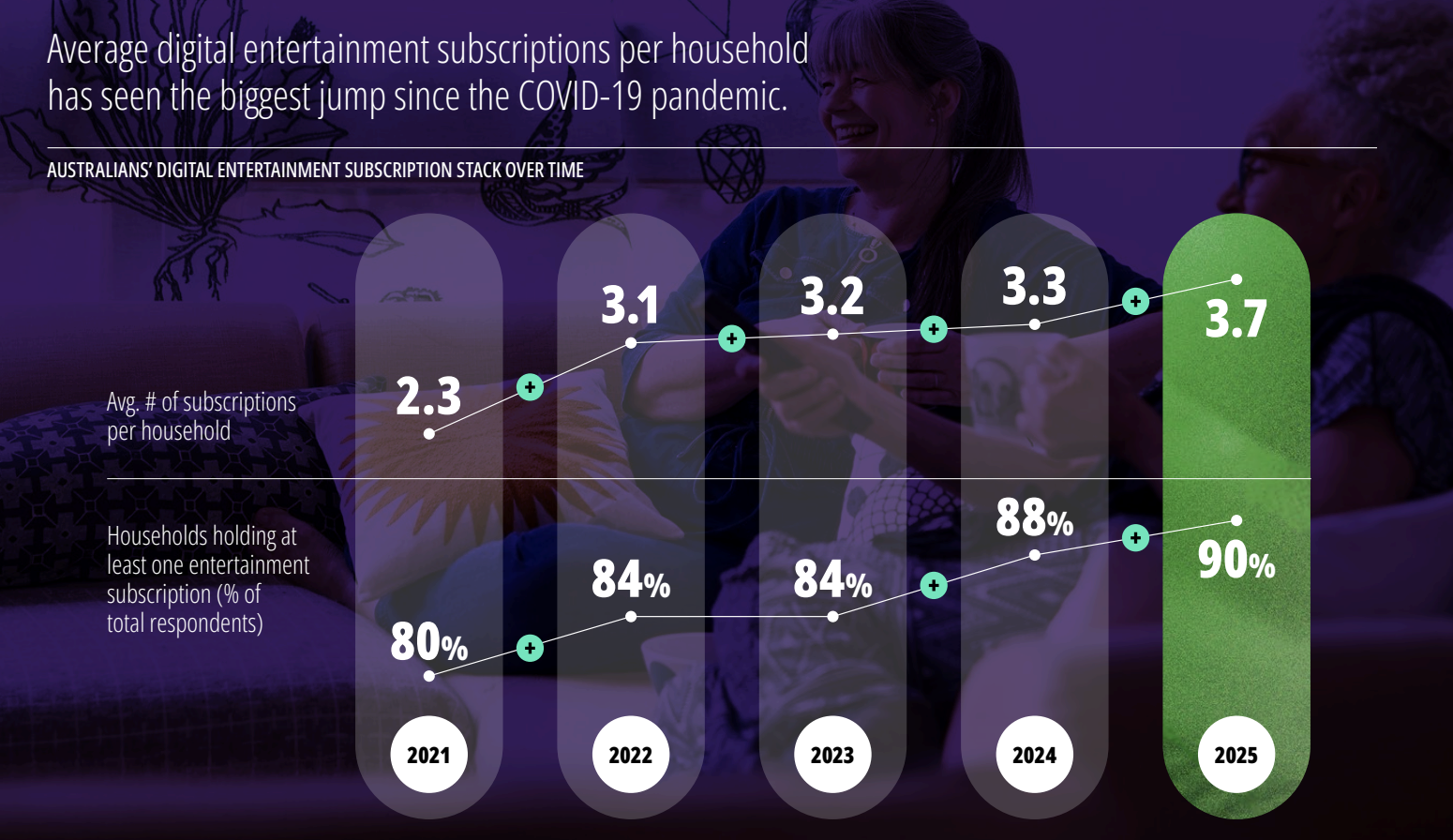

Subscription stacks continue to rise, with Aussie households now holding an average 3.7 services, the biggest lift since COVID, up 61% since 2021. With more platforms entering the market and content spread wider than ever, viewers are chasing breadth – and paying for it.

That abundance comes with fatigue.

As Corbett notes, “The number of streamers in the Australian market has continued to expand, with the content Australians want to watch increasingly spread over multiple providers.”

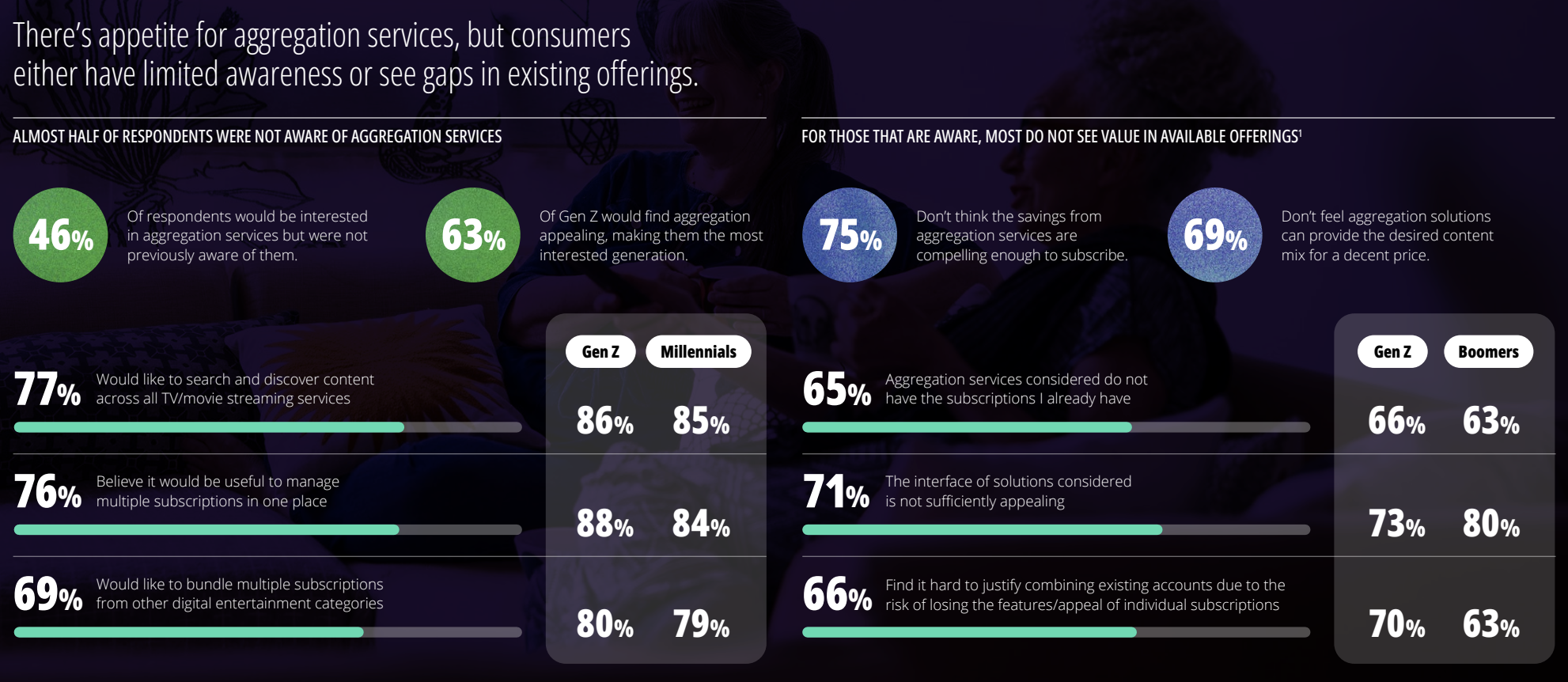

It’s little surprise nearly half of consumers say they’re open to bundling or aggregation, if anyone can do it well.

“The complexity and expense of managing multiple subscriptions means almost half of consumers say they are interested in an aggregation service,” Corbett said. “It suggests there is an opportunity in the market.”

In other words: the bundling era is here, and it may reshape power centres all over again.

Gen-Z leads the way

Australians are spending more than ever on digital entertainment, with monthly household spend rising to $78 – up 25% year-on-year.

The increase is being fuelled almost entirely by younger consumers.

For the first time, Gen Z households have crossed the $100 mark, with Millennials close behind at $97 a month.

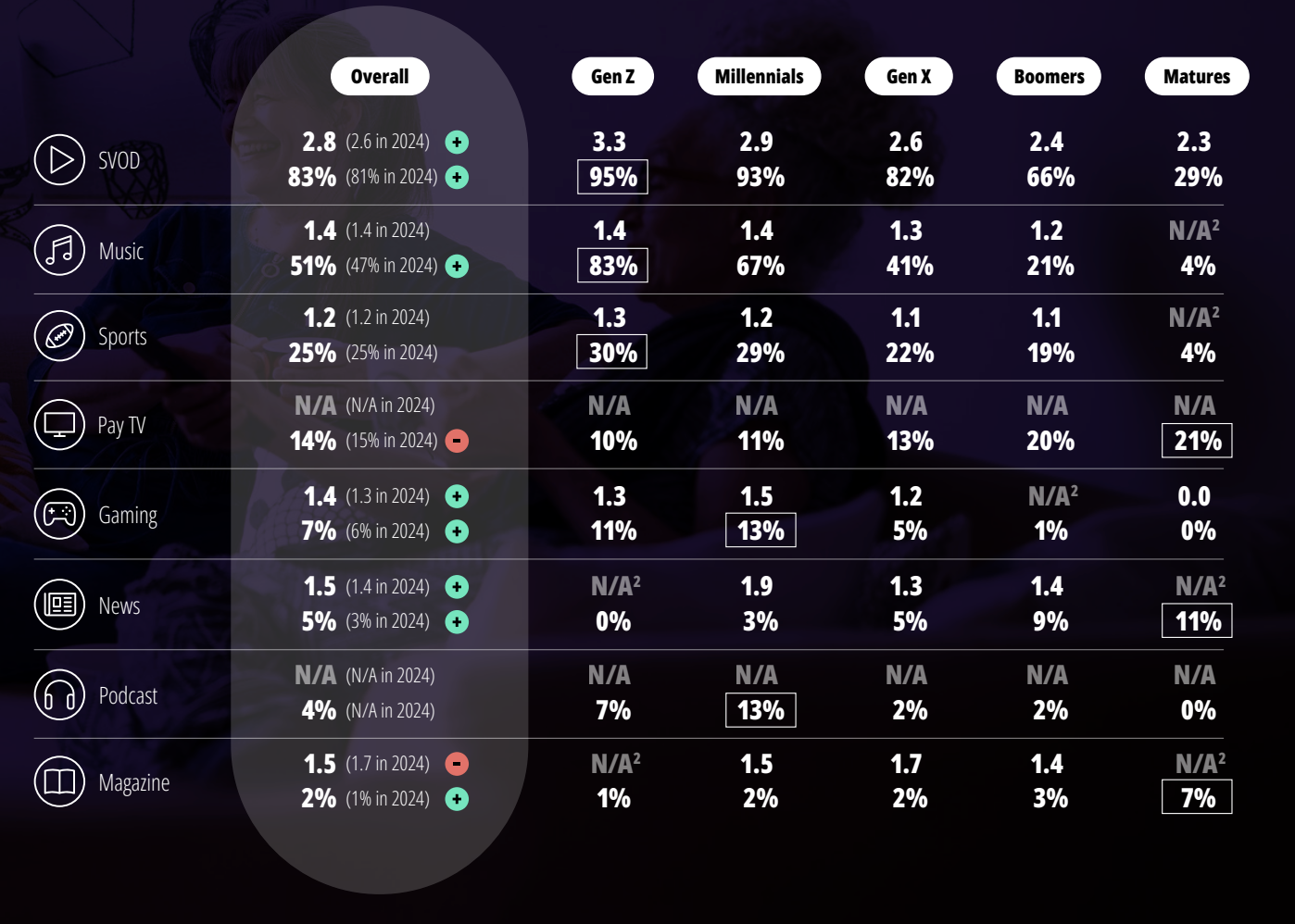

Price rises across major SVOD platforms and new market entrants are partly to blame, but behaviour is playing a role too: 65% of consumers say they need multiple subscriptions to access the content they want.

Cost anxiety is also climbing, with 78% of Australians worried about their subscription spend.

Older audiences are tightening belts, with Boomers and Matures trimming monthly costs and the least likely to overshoot their budgets.

Yet younger households are still leaning in. Gen Z respondents are now the most likely to overspend, underscoring a generational split in how viewers prioritise premium content.

Attention contracts, audio expands

Despite higher spend, engagement time continues to fall, 42 hours and 45 minutes weekly, down 3.4%, as Australians choose experience over algorithm.

The biggest retreats:

• News/magazines: -26%

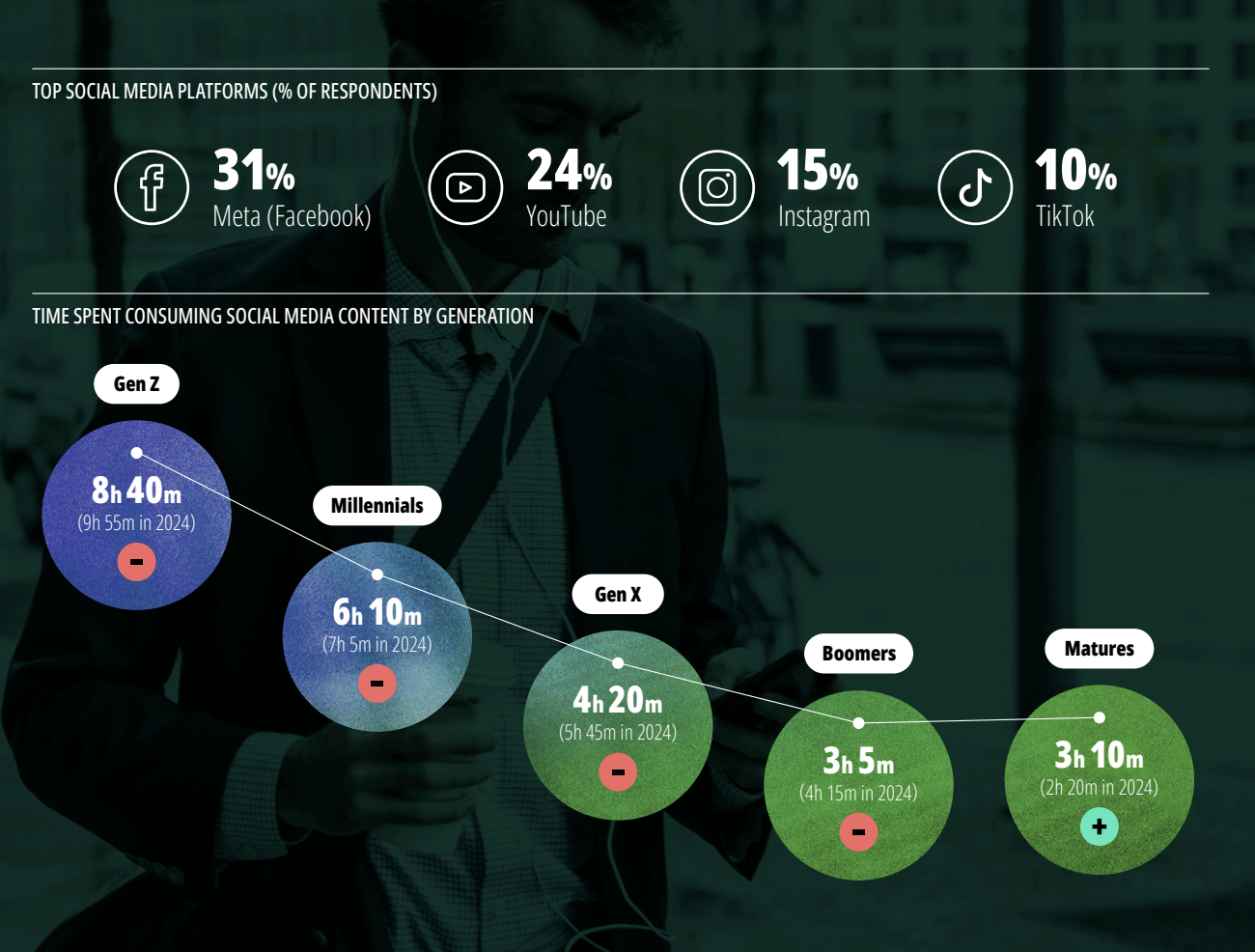

• Social media: -16%

• Video: -13%

Screens are slipping. Audio is soaring – up 34%, now 29% of all digital media time.

“Audio is the noticeable exception,” Corbett said. “Younger Australians spending more time streaming music and podcasts while older Australians still prefer the radio.”

Social fatigue meets regulation reality

Social time is down a full hour per week across every cohort except Boomers, with parents driving a cultural and political shift in expectations.

“Parents want stronger rules and regulations governing children’s access to social media as well as greater support from government and industry,” Corbett said.

The upcoming Online Safety Minimum Age Bill plugs into real momentum: legislative will, plus voter appetite. It’s a structural shift, platforms are moving from growth engines to regulated utilities.

Overall consumption is down 15% year-on-year, though platforms remain especially sticky for Gen Z. Meta continues to dominate the local social landscape, driven largely by older users – 38% of Gen X, 40% of Boomers and 46% of Matures engage weekly – reinforcing Facebook’s role as the default hub for legacy audiences.

Meanwhile, 40% of Australians still consume news via social platforms, with Millennials and Gen X the most likely to lean on social feeds for headlines (both 43%).

Still, trust dynamics matter. “Australians trust domestic publishers the most: more than three in four consumers consider national and regional Australian news publishers moderately or very trustworthy.”

• Social remains powerful – but its halo has burned off.

• Sport still anchors loyalty – but generational competition heats up

Sport stays top

Sport is one of the few irreplaceable content categories, with 57% of Aussies willing to pay. AFL tops the table at 42%, but younger fandoms show the future is more diverse.

“AFL shouldn’t rest on its laurels and needs to continually engage young fans because its popularity is virtually neck-and-neck with soccer among Gen Zs and Millennials,” Corbett said.

Meanwhile, women’s sport continues to grow, driven by, perhaps unexpectedly, male fans. “Australians, and particularly Australian men, are now enthusiastically embracing women’s sport.”

Investment, access, and visibility will define who wins that momentum.

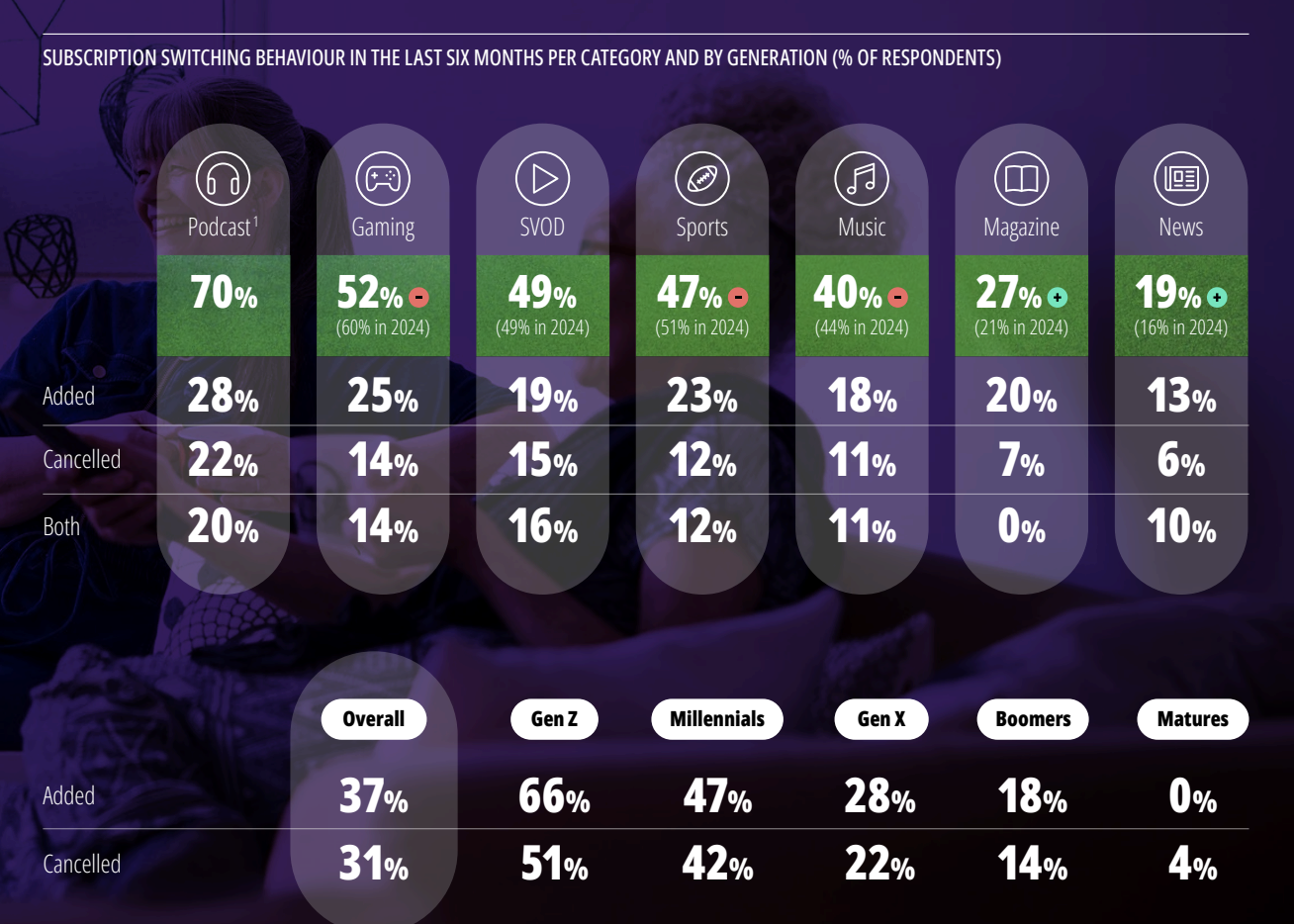

For streamers, the growth era built on “more subs, more content” has given way to something trickier: keeping audiences, not just signing them.