The Australian media agency market has passed $9 billion in annual ad spend for the first time, according to the latest data from Guideline SMI, with digital and outdoor media setting new records across both calendar and financial year periods.

Agency bookings rose 2.4 per cent for the first half of calendar 2025, while financial year 2024/25 ad spend grew by $212 million compared to the prior year. The results still marked a record high even after stripping out elevated government and political party spend linked to this year’s federal election.

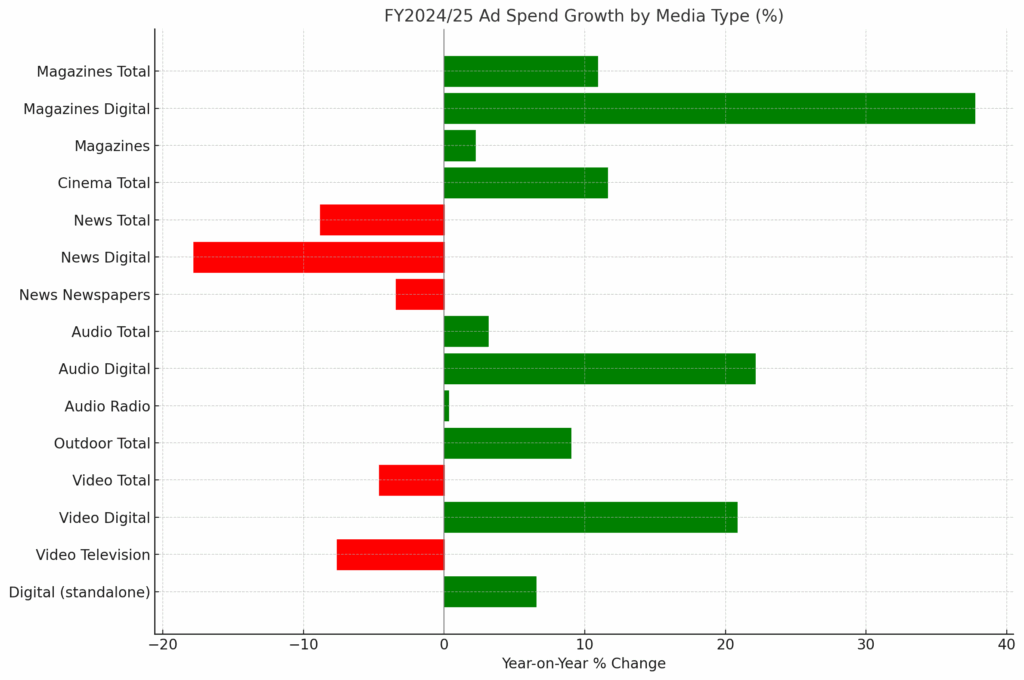

Not faring well in the annual report was Television as a category, which saw a 7.6% decline on last year. News Publishing also took a hit: Newspapers saw a 3.4% decline, while Digital News saw a double-digit decline of 17.8%.

Jane Ractliffe, Guideline SMI APAC managing director, said the data reflected a decade of structural change in media buying. “Media agencies clearly continue to deliver valuable media advice and services to their brand clients as evidenced by the 31.4% increase in the value of the advertising campaigns booked by agencies over the past ten years, representing an extra $2.15 billion in media investment,’’ she said.

“But we’ve also arguably seen the biggest change in media habits over that time, with agencies literally doubling their investment in both the Digital and Outdoor media over those ten years. However, the number of individual media on which they bought campaigns reduced from 7,400 in FY2014/15 to 6,000 in 2024/25.”

FY2025 media spend highlights

- Digital hit a record 46.4% share of total spend, up 6.5% YoY

- Outdoor rose 9%, now accounting for a record 16% share

- Cinema grew 11.6% YoY, approaching pre-pandemic levels

- Digital Video and Digital Audio climbed 20.8% and 22.1% respectively

- Magazines (inc. digital) rose 10.9%

June 2025 media spend trends

June saw a post-election pullback, with total agency spend falling 7.1 per cent year-on-year. The biggest contributor was a 34 per cent drop in government category bookings, alongside a 21 per cent fall in food/produce/dairy ad spend.

Despite the soft June, some sectors performed strongly. Cinema was up 12.6 per cent for the month, outdoor grew 5.4 per cent, and retail spend rebounded (+10.4 per cent). Insurance also gained ground (+11.4 per cent), while digital video continued its momentum (+12.3 per cent).

By contrast, newspapers and radio both suffered steep monthly declines (-23.3 per cent and -14.6 per cent respectively), while television spend fell 16.1 per cent.

Guideline SMI’s Australian data captures more than 98 per cent of all media agency spend, aggregated directly from agency billing systems. It offers a comprehensive view of market activity across media types, product categories and more than 150 subcategories.