Amazon has reported a stronger December quarter, with advertising and AWS both accelerating as the company flagged a sharp lift in AI-led investment for 2026.

In its fourth quarter results for the period ended 31 December 2025, Amazon said net sales rose 14 per cent year-on-year to AU$307.4 billion. Operating income increased to AU$37.3 billion, up from AU$31.7 billion a year earlier.

What were Amazon’s key Q4 2025 numbers?

- Net sales: AU$307.4 billion, up 14 per cent year-on-year (12 per cent excluding FX benefits).

- Operating income: AU$37.3 billion, up from AU$31.7 billion.

- Net income: AU$31.7 billion, up from AU$29.9 billion.

- Diluted EPS: AU$2.91, up from AU$2.78.

Amazon noted its Q4 operating income included three “special charges”: AU$1.64 billion tied to tax dispute resolution in Italy and a lawsuit settlement, AU$1.09 billion in estimated severance costs, and AU$911 million in asset impairments largely related to physical stores. Excluding those items, it said operating income would have been AU$40.9 billion.

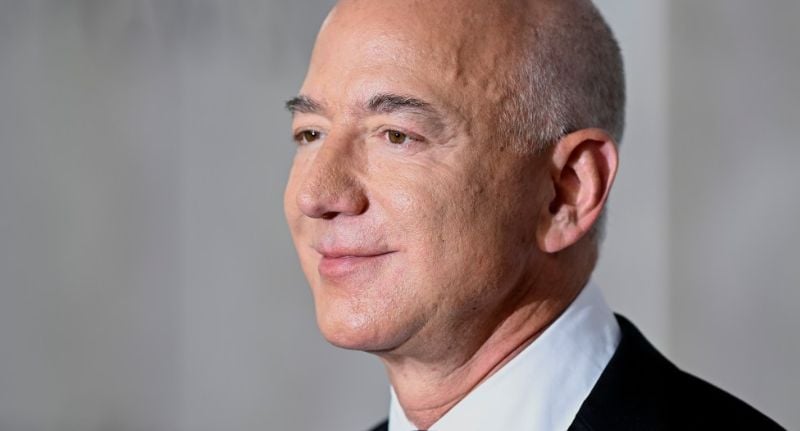

Bezos faces backlash over Washington Post job cuts

Outside the numbers, Amazon’s results landed amid growing scrutiny of founder Jeff Bezos following deep cuts at The Washington Post, which he owns.

The newspaper confirmed it is cutting more than 300 roles, around 30 per cent of its workforce, with sports, local news and international coverage among the hardest hit, according to reporting by The New York Times.

Management cited prolonged financial losses and the need to refocus the business, but the scale of the layoffs has triggered a fierce backlash from staff and former editors, who argue the cuts risk hollowing out the newsroom and damaging the paper’s credibility at a time when trust in journalism is already under pressure.

AWS accelerates, while advertising climbs

AWS revenue rose 24 per cent year-on-year to AU$53.2 billion, with operating income of AU$18.7 billion (up from AU$15.8 billion). Amazon described it as AWS’ fastest growth in 13 quarters.

Amazon’s advertising services revenue increased to AU$31.8 billion in the quarter, up 23 per cent year-on-year (or 22 per cent excluding FX). The line item covers ad sales across sponsored ads, display, and video advertising.

By segment, North America sales were AU$189.8 billion (up 10 per cent), International sales were AU$75.7 billion (up 17 per cent, or 11 per cent excluding FX), and AWS was AU$53.2 billion (up 24 per cent).

Prime Video sports and streaming highlights

For media buyers and rights watchers, Amazon’s release leaned heavily into Prime Video’s sports performance and pipeline.

- Amazon said the fourth season of Thursday Night Football averaged more than 15 million viewers, up 16 per cent year-on-year.

- It said the Packers vs Bears Wild Card Playoff game drew more than 31 million viewers, which it described as the most-streamed NFL game in history.

- Amazon also said it debuted NBA on Prime in more than 200 countries, including coverage of the Emirates NBA Cup.

- In Europe, it said it extended UEFA Champions League broadcast rights in Germany, Ireland, Italy and the UK through the 2030/31 season.

AI investment and a $200 billion capex signal

Andy Jassy, Amazon President and CEO, attributed the momentum to new products and infrastructure across cloud, retail and hardware, pointing to AI, chips, robotics and low Earth orbit satellites as long-term bets.

“AWS growing 24% (our fastest growth in 13 quarters), Advertising growing 22%, Stores growing briskly across North America and International, our chips business growing triple digit percentages year-over-year—this growth is happening because we’re continuing to innovate at a rapid rate, and identify and knock down customer problems,” Jassy said.

He added: “With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about US$200 billion in capital expenditures across Amazon in 2026, and anticipate strong long-term return on invested capital.”

The company also reported a widening gap between operating cash flow and free cash flow. Operating cash flow for the trailing 12 months rose 20 per cent to AU$208.3 billion, while free cash flow fell to AU$16.7 billion. Amazon said the decline was driven primarily by a year-on-year increase of AU$75.7 billion in purchases of property and equipment, largely reflecting AI-related investment.

What guidance did Amazon give for Q1 2026?

For the first quarter of 2026, Amazon guided:

- Net sales: AU$259.0 billion to AU$266.5 billion (11 to 15 per cent growth year-on-year), including an estimated 180 basis point FX tailwind.

- Operating income: AU$24.6 billion to AU$32.1 billion, compared to $18.4 billion in Q1 2025.

Amazon said the operating income outlook includes around $1 billion of higher year-on-year costs tied to scaling “Amazon Leo” in 2026, as well as investment in quick commerce and sharper pricing in its international stores business.