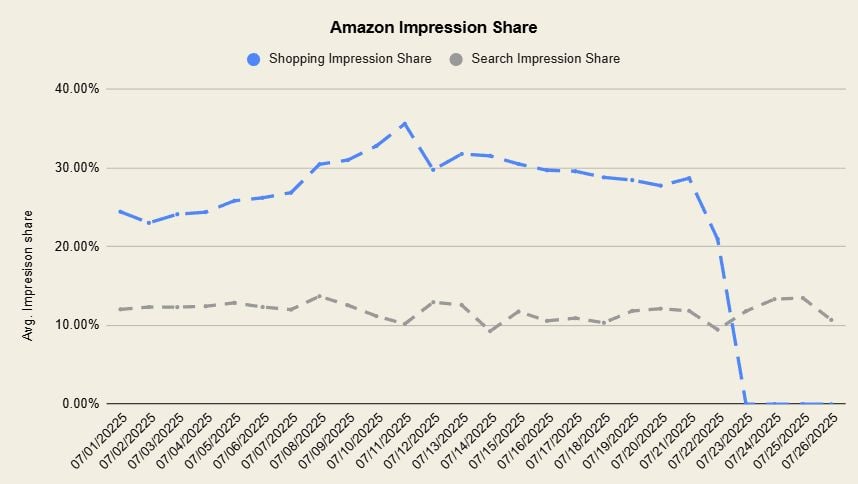

Retail giant Amazon has pulled out of bidding for ads on Google Shopping in a major move that has seen rivals snatch up the new inventory opportunity. It paused its activity on 22 July with no visible signs yet that it plans to resume spending.

Josh Duggan, co-founder of the London-based eCommerce consultancy company Vervaunt, has been tracking the impact of the pause. He reported that Amazon generally appears in around 30% of Vervaunt clients shopping auctions, so the decision to pull out was noticed.

Graph published by Josh Duggan

Duggan noted that competitors Temu and Shein pulled US spend on Google several months ago amid the uncertainty created by Donald Trump’s proposed tariff hikes.

This isn’t the first time that Amazon has paused activity on Google, with the retailer notably pausing ad spend on Google Shopping during the COVID-19 pandemic in 2020.

There is no public statement from Amazon on what most in the industry is viewing as a pause. Mike Ryan, who is head of Ecommerce Insights at Smarter Ecommerce has pitched a couple of theories: “Is Amazon tired of funding competitor Google? Is there a particular sticking point related to Amazon’s own ad ambitions? Something about AI? The channel efficacy for Amazon?”

The AI theory is interesting, with speculation mounting that it may related to Amazon testing the impact of a post-search retail marketing environment.

Right now the industry is left to speculate, with competitors snatching up inventory in Amazon’s absence.

While there was an initial assumption that cost-per-click (CPC) prices would be lower without Amazon’s aggressive bidding driving prices up, Duggan doesn’t think that there’s much likelihood of costs falling.

“As soon as one advertiser leaves – it is very likely that after a period, bidding will return to its prior levels as the remaining advertisers’ continue competing to win in the auction – provided the final bid stays below what’s needed to meet their target return of ad spend (ROAS). As long as the two highest bidding brands still keep their same bid – the one who wins will still need to pay the same level of CPC,” Duggan noted in a LinkedIn post.

Heidi Sturrock, the lead Google strategist for OMG Commerce, has reported that she hasn’t seen much of an impact for her own clients, but notes that large volume players like Walmart, Target, Uline, and eBay has seen “significant shifts (at least 20%) in impression share.”