Insurance marketers are facing growing pressure to cut through a crowded market, as rising customer expectations, stricter data privacy rules, and increasing acquisition costs reshape how they connect with audiences.

Taboola has identified five key trends shaping insurance marketing in 2025, offering insights into how brands can stay competitive and meet customers where they are.

Trend 1: The rise of personalised customer experiences in insurance

Personalisation is no longer optional in insurance—it’s an expectation, according to Taboola. The research found consumers want tailored messaging throughout their buying journey, and marketers are responding by moving beyond traditional demographic targeting.

With growing concerns around third-party data, insurers are turning to first-party data and behavioural signals to deliver more relevant, personalised experiences across channels. This includes behavioural signals, intent data, dynamic landing pages that adjust in real time to reflect user interests

The research noted that personalisation helps insurers build trust early in the customer journey—particularly important in a category where decisions are emotionally driven and highly researched.

In a complex purchase journey with multiple touchpoints, relevance is critical. Personalised messaging can reduce friction by showing only what matters most to each individual—whether it’s a first-time renter looking for peace of mind or a driver comparing auto coverage, the research revealed.

However, the push for personalisation must be balanced with privacy. Insurers can build consumer confidence by maintaining clear, transparent data-use policies and offering easy opt-out options.

Trend 2: Leveraging AI and automation in insurance advertising

AI is changing how insurance marketers operate, offering more efficient ways to target audiences, manage budgets, and optimise creative output, according to the AdTech company.

Insurers are now turning to AI-powered tools to streamline lead generation and improve performance. Recent industry data revealed 82% of insurers say AI adoption is critical, and 79% of principal agents already use or plan to adopt AI.

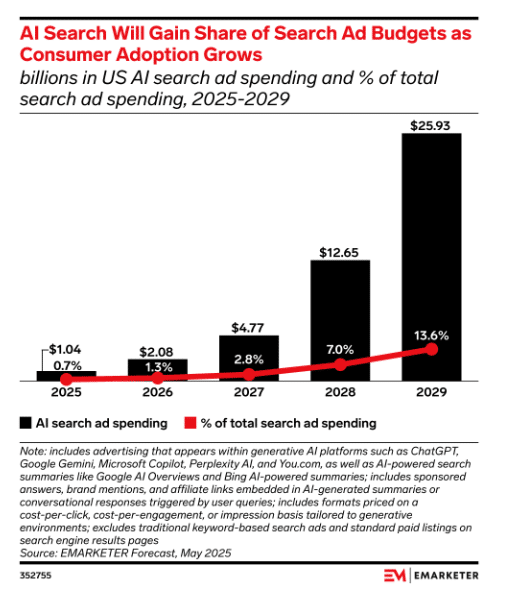

The data also revealed AI-driven search ad spend is projected to grow from $1 billion USD in 2025 to nearly $26 billion by 2029 Taboola noted insurers are applying AI through real-time targeting based on user behaviour and predicting future behaviour to optimise timing and messaging.

On the bidding front, AI helps automate ad placement and improve conversion efficiency. Taboola noted French insurer GMF used AI bidding and first-party data to achieve an 82% increase in lead volume—well above its initial goal.

AI supports creative optimisation by testing multiple ad variations and scaling what performs best. Progressive Insurance used generative AI to develop 96 audio ad variants in two weeks, resulting in a 31% increase in quote initiations. But the volume of variants also highlighted the importance of balance—too many versions can make modelling less effective.

Taboola noted insurers are using AI chatbots to manage basic customer queries, schedule consultations, and guide users through quotes to support lead conversion. The tools free up agents to focus on policy sales and service. The AdTech company highlighted GEICO has integrated a chatbot into its mobile app, helping users manage policies, view documents, and access coverage details.

AI tools can also forecast customer behaviour, identifying which users are most likely to convert and which offers are most effective. Predictive analytics support more accurate ad placement and campaign timing, while also helping marketers evaluate campaign effectiveness.

Taboola said insurers must navigate implementation costs, learning curves, and compliance challenges. Over-reliance on automation also presents risks—human oversight remains essential to ensure AI strategies align with customer expectations and industry regulations. Ongoing performance monitoring is key to achieving sustainable results.

Trend 3: The growing importance of digital channels and omnichannel strategies in insurance

For insurers, consistency is essential at every stage of the customer journey—from getting a quote to comparing providers. Taboola said predictable and seamless experiences build trust and drive conversions.

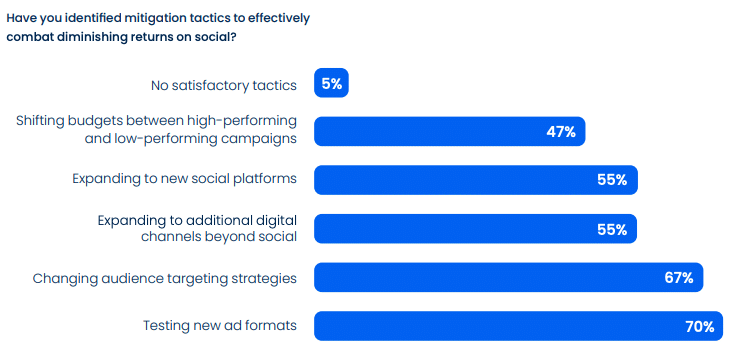

With rising costs across paid search and social, marketers are exploring more interactive ad formats to improve engagement and ROI. Many are also embracing omnichannel strategies that connect digital touchpoints and offline interactions.

Taboola noted that 78% of insurers plan to increase tech budgets in 2025, focusing on AI, big data, and cloud infrastructure.

It also reported half of insurance shoppers begin their journey on mobile, while 47% of all insurance purchases now happen through digital channels.

The AdTech company found the top-performing insurers are aligning their digital and offline experiences. A typical omnichannel journey might start with a targeted digital ad, followed by a personalised landing page, then email nurturing, and finally, a sales agent closing the deal.

Post-sale marketing also plays a key role. Tools like SMS reminders for policy renewals help retain customers and reduce churn.

Taboola revealed insurance marketers can optimise each stage of the buyer journey through awareness, consideration, decision and retention.

To avoid drop-offs, the AdTech company noted that marketers must also align digital and offline experiences. This includes consistent messaging across all channels and enabling quote progress to be saved and resumed on different devices.

Mobile optimisation remains critical and Taboola noted that as more consumers research and shop via smartphones, websites must feature fast load times, short and tap-friendly forms, and click-to-call functionality to meet mobile user expectations.

Trend 4: Content marketing and building trust in the insurance sector

Trust is essential in insurance and customers need that extra layer of comfort before signing a contract, so for that reason, content marketing has become a staple in the industry, according to Taboola.

The AdTech platform noted that some of the ways to build authority and foster trust for your insurance brand in 2025 include how-to guides, interactive quizzes, customer testimonials, premium and deductible calculators, thought leadership articles on industry changes, videos and blogs told from the perspective of licensed agents.

A few trends are shaping the type of content that’s landing in 2025. Interactive carousels and dynamic question-and-answer content can capture short attention spans and make customers feel as though they’re part of your brand.

The AdTech company research noted that 70% of marketers surveyed are experimenting with new ad formats but 86% of consumers say they understand.

For insurance marketers, investing in diverse formats should be a priority and interactive tools like premium calculators and educational articles can be ways to attract and engage customers.

Taboola noted that SEO is another area of marketing always changing and insurance marketers should tweak strategy for the techniques that work best in 2025. This includes long-tail queries, hyper-localisation, voice searches and tailoring content to be picked up by AI search.

Video is also dominating content marketing in 2025, particularly with a complex topic like insurance. Videos can help demystify various topics. DirectAsia used short-form video as part of a larger strategy that generated more than 2,000 leads in just a six-month period. Best of all, the company reduced its cost per lead by more than half.

Trend 5: Data privacy and regulatory changes impacting insurance digital advertising

Data privacy remains a critical issue for insurance marketers in 2025 amid changing consumer awareness and evolving global regulations. As insurers handle sensitive personal data, adapting to privacy-first strategies is no longer optional.

Taboola research found privacy laws cover 6.3 billion people—79% of the global population as of late 2024. It also reported 80% of consumers prefer transparency in how their data is used; 62% say they feel uncomfortable with online tracking.

The AdTech company noted that tighter laws now restrict the use of third-party cookies and personal identifiers without consent. This makes traditional retargeting more difficult, particularly across platforms that have reduced or eliminated cookie tracking.

Marketers are shifting toward contextual targeting and behavioural intent signals. For insurers, the stakes are higher with trust a key driver in policy selection, and marketing tactics perceived as intrusive can potentially undermine that trust.

To stay compliant and build confidence with consumers, Taboola suggested insurance marketers should use transparent, easy-to-understand consent language, provide clear options for data sharing and regularly audit third-party vendors for privacy compliance.

The AdTech company also focused on predictive tools that don’t rely on personal identifiers, and offer value in exchange for first-party data, such as useful tools or content

In a privacy-first environment, Taboola noted the ability to engage responsibly will be just as important as the message itself.

Taboola’s marketing insurance trend takeaway

Taboola said personalised insurance marketing is no longer optional, but AI-powered tools make it easier for brands to use contextual tracking and behavioural intent signals to target prospects.

The AdTech company added with many consumers now starting their insurance search on mobile, a seamless omnichannel approach is crucial, but it’s important to build in privacy protections in everything done.

Top image: Adam Singolda