Taboola has announced its results for the quarter ended March 31, 2023.

Adam Singolda, CEO and founder, Taboola, was proud of the company’s strong performance for the period.

“We had a strong performance in Q1, beating the high end of our guidance across all metrics. This was primarily driven by the core business tracking ahead of our expectations, helped by key publisher partners like Condé Nast, Univision, The Blaze, Kicker in Germany and others, along with continued strength from eCommerce. We’re also seeing Taboola News outperforming our internal expectations,” he said

Singolda continued: “From where we are now, we are hyper-focused on what we need to do to execute on our objectives and mission. Once the Yahoo integration is 100% live we expect to be at a $2.5B revenue run-rate. This will still be a small portion of the $70B Open Web market, so there remains a lot of growth for us to capture.

“To do that we are laser focused on four company priorities – performance advertising, ecommerce, bidding, and Yahoo. We have all we need to execute and generate our financial objectives. These are times to remain focused, stay very close to our partners and customers, and execute – that’s all we care about now,” Singolda said of his outlook for the company.

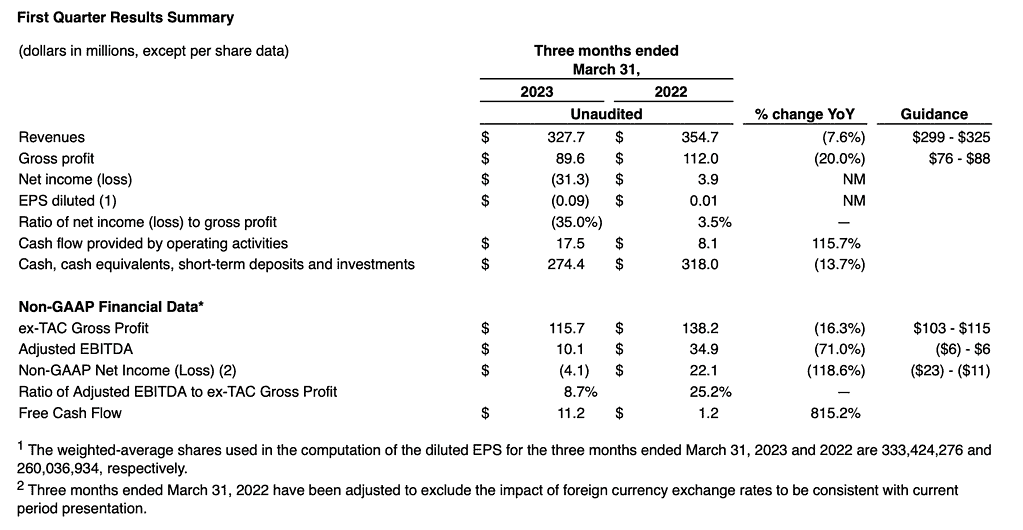

Fiancncial Highlights for Q1 2023:

• Q1 2023 Revenues of $327.7M, Gross Profit of $89.6M, ex-TAC Gross Profit of $115.7M, Net loss of $31.3M and Adjusted EBITDA of $10.1M, exceeding the high end of all guidance metrics.

• Net cash provided by operating activities of $17.5M and Free Cash Flow in Q1 2023 of $11.2M after net publisher prepayments of ($3.9M)** and $5.1M in cash interest payments.

• Announcing share buyback program of up to $40M in 2023. Repaid $30M of long-term debt in April (totaling $91M since Q4 2022) and expect to continue to repay debt up to an additional $50M this year.

• Updated 2023 guidance raises the mid-point: Revenues of $1,427M – $1,469M, Gross Profit of $418M – $436M, ex-TAC Gross Profit of $529M – $546M, Adjusted EBITDA of $65M – $80M. Positive Free Cash Flow.

• 2024 guidance assumes investments will begin to pay off: at least $200M Adjusted EBITDA, at least $100M Free Cash Flow.

Business Highlights for Q1 2023:

• Revenue from new publisher partners continues to be an area of strength – Publisher wins from competitors included L’Express, Condé Nast, Kicker, Funke, and DuMont.

• Renewed relationships with many well-known publishers including Sinclair, Advance Local, O Dia, Slate France, and Seven West Media.

• Received approval from Israeli regulators to finalize the Yahoo deal; transitioned into the next phase of integration, the build and test phase.

• Launched TIME and Advance Local on Taboola Turnkey Commerce, publishing over 100 finance articles on TIME with subsequent launch of the TIME eCommerce section planned for May.

• Further deployed AI to enhance our Life Time Value (LTV) vision, a holistic approach that enhances publisher revenue and empowers diversification of channels (eCommerce, subscription, native, bidding and video).

• Continued to see eCommerce strength in the bottom of funnel channel from key partners such as Walmart, Wayfair, and Macy’s.

• Rolled out Generative AI in beta form on Taboola Ads which suggests data-driven titles and thumbnails to creatives, accelerating the speed and efficiency of launching campaigns.

–

Top image: Adam Singolda