For a nation known for its drinking habits the idea of a booze-free beer once seemed unlikely.

But in 2017, challenger brand Sobah proved otherwise, launching as Australia’s first non-alcoholic craft beer company. Just a year later, Carlton & United Breweries (CUB) followed suit, releasing one of the earliest zero-alcohol beers from a major local brewer.

Nearly a decade on, the category has defied expectations (and Australian sensibilities), emerging as one of the fastest-growing beverage markets worldwide.

No one is less surprised by the rise of the little guys than Connor Archbold, CEO of brand tracking platform Tracksuit.

“Any company that launches does well by starting with a niche,” Archbold told Mediaweek.

“Challenger brands help create category growth by launching with a niche in mind and building for that niche. Sometimes they even create categories – non-alcoholic drinks, for example, is a great growth story that was more or less started by challengers before incumbents jumped in.”

Punching above their weight

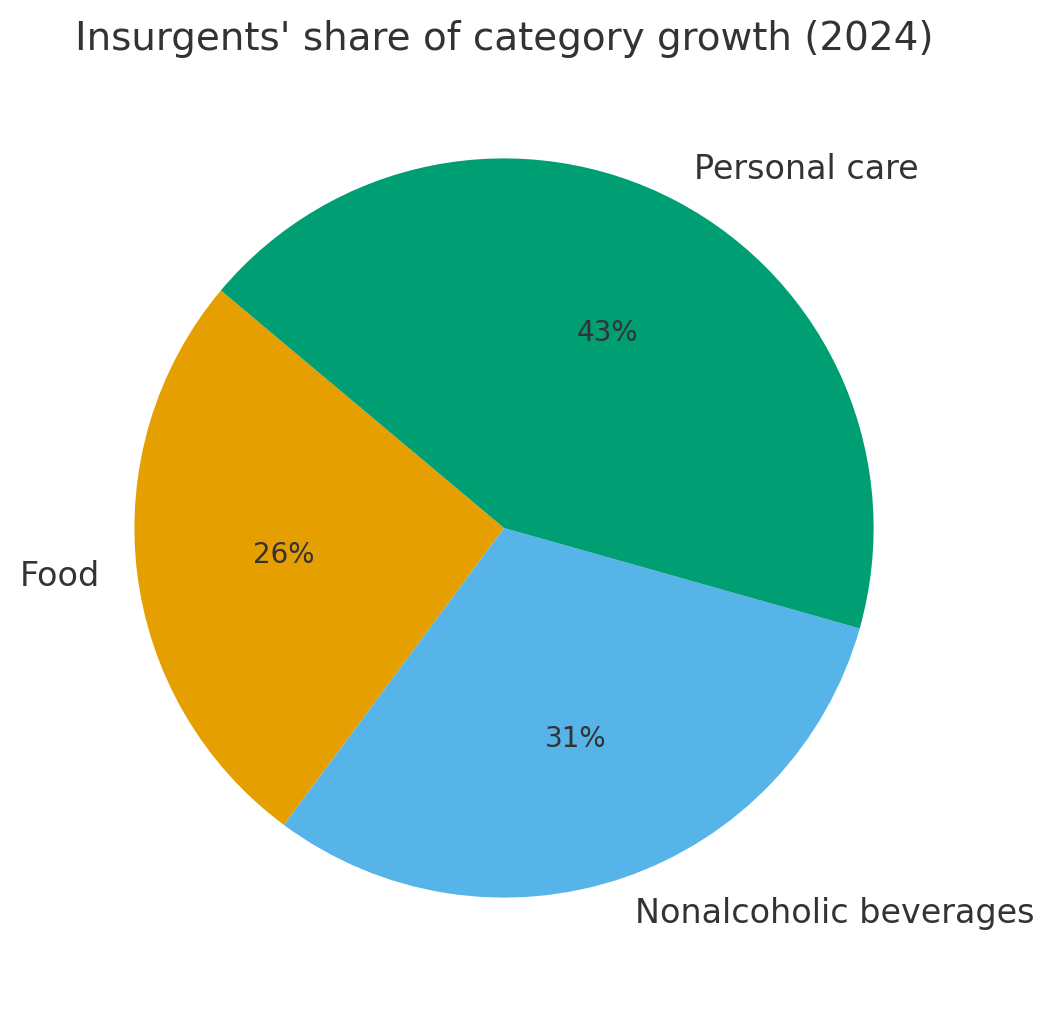

Bain & Company’s Insurgent Brands 2025 report shows just how significant the shift has become.

It identified 120 insurgent brands in the US last year, together driving 39% of incremental category growth while holding under 2% of market share – up from 17% in 2023.

Archbold said the appeal lies in freshness and focus: “When challenger brands launch, often they’re building for themselves. You see the founder has that insight: ‘I wanted vegan, cruelty-free skincare, so I went and built it.’ That’s how they often start. They’re addressing a new need, or a novel use case, or a demographic that incumbents hadn’t yet spoken to.”

That agility, explained Archbold, allows them to cut through.

“We talk about challenger brands sometimes as the underdog, because incumbents already have share of mind and consistent messaging after years of marketing,” Archbold said.

He continued: Challenger brands have to capture share of mind, often with smaller budgets. But they can be more flexible, take risks, and define themselves creatively. By launching for a niche, they can target the edges of the consumer group with more wild messaging. Look at the canned water company Liquid Death in the States, or sunscreen brand Vacation Inc. – they’re entertaining, and in the attention economy, entertaining brands are the ones people buy.”

Source: Bain & Company

Lessons for incumbents

For established players, the data presents both a warning and an opportunity. Bain highlighted 103 “emerging insurgents” that generated between US$10 million and US$25 million in revenue, with 18 graduating to insurgent status – a reminder that today’s niche player may be tomorrow’s acquisition target.

Archbold sees incumbents as powerful but sometimes cautious.

“I love incumbent brands. As someone who loves marketing effectiveness, those long-standing brands are fascinating. They’ve built huge loyal audiences, but I always encourage them to take more risks while remaining consistent.

“Nike’s ‘Why Do It’ campaign – as opposed to their classic ‘Just Do It’ tagline – was a risk to appeal to new audiences. Jaguar’s rebrand got lots of press and is still being talked about more than a year later,” he said.

But, he added, “When you take risks, you do open yourself up to falling flat with your core base. Sometimes that’s why you see acquisitions instead – rather than departing too far from brand strength.”

Growth through insights

The latest Bain report highlighted the headwinds facing FMCG – from flat volumes to price sensitivity and growing scrutiny of ultra-processed foods.

But Archbold said insurgent brands have managed to sidestep many of those pressures by staying nimble and sharply focused. For him, the difference lies in how they use data. “As they grow, challenger brands need to build off clever insights,” he explained.

“With Tracksuit, for example, we gather insights on categories, demographics, and who’s underserved. Challenger brands can target those edge cases with less risk than an incumbent. The key is holding on to those new entrants in a category, rather than losing them to incumbents who have lower prices and better distribution,” he said.

That focus often means rethinking assumptions about audiences. “Brands might think they need to target Gen Z, but our data might show Gen X to be the biggest spenders,” Archbold said.

“It’s about really understanding who’s spending in a category, why, and what they care about, then framing your strategy accordingly.”

Behind the scenes, that insight comes from an enormous flow of consumer data.

“We do hundreds of thousands of surveys daily, tracking around 15,000 brands. We ask about purchasing, awareness, consideration, and preferences, and then capture open-text answers about what people think and feel. That helps leaders see category shifts, understand who’s entering or leaving, and identify blank spaces that aren’t being served well,” he added.

Trust in an AI future

As technology reshapes the landscape, Archbold believes trust will be the factor that separates lasting brands from the rest.

“In this AI future, the barrier to entry for creating brands will drop dramatically,” he explained. “You’ll be able to source products, build, and launch a brand almost instantly. With so many new brands, trust will become even more important.”

For consumers, that might mean reverting to the labels their parents bought or leaning on recommendations from friends. For businesses, the path looks different depending on their position in the market.

“Challenger brands need to win trust in their niche first, then expand,” Archbold said. “Incumbents should lean into the trust and share of voice they already have.”

Main image: Tracksuit CEO Connor Archbold