Private equity interest in the B2B services sector surged in 2024, with a 21% year-on-year increase in investment activity from the market downturn in 2023.

The new data from SI Global’s Q2 2025 Private Equity Insights Report, which analyses more than 220 global transactions across the marketing, consultancy, and technology services sectors, tracks shifting investment patterns across global markets and uncovers the structural changes shaping PE activity in the sector.

Now in its second year, other key findings from the report found that while private equity investment rose sharply in 2024, exits slowed by 27% and refinancing declined 57%. Twice as many firms were found to hold beyond the common five-year cycle compared to last year, raising questions about exit readiness and valuation strategy.

The report found first-money investments dominate with 87% of new PE activity in 2024 came from first-time investments rather than reinvestments or bolt-ons. The finding reflected both investor appetite and the increasing volume of newly available assets in the market, especially at the smaller end of the scale.

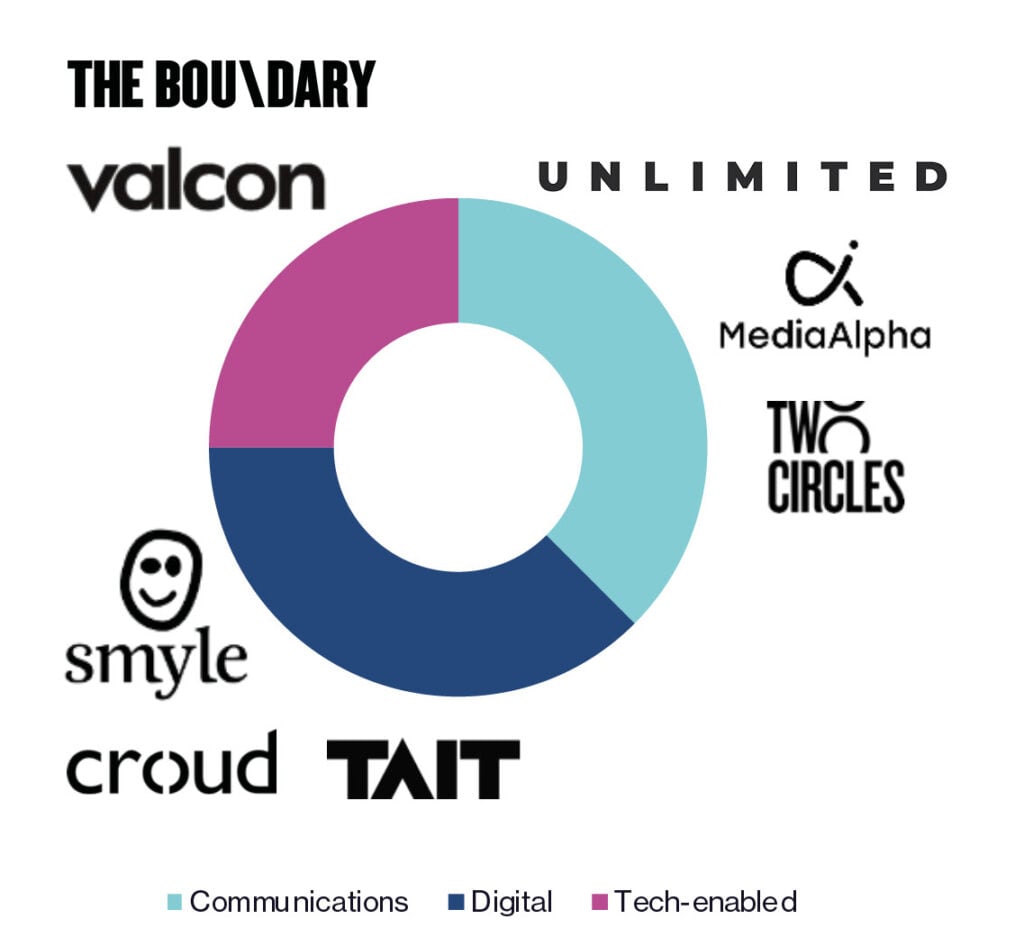

Digital, Social and Influencer agencies attract the bulk of capital, according to the report, with more than 50% of PE investments in B2B services went to digital businesses, a threefold (333%) increase on the previous year. Social and influencer-led agencies were in particular demand, reflecting broader shifts in brand spend and media engagement.

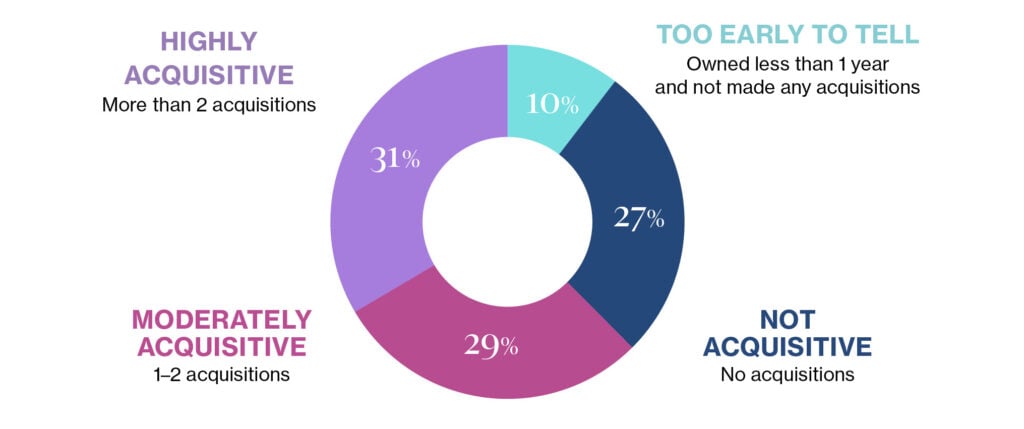

The report noted the number of firms making bolt-on acquisitions within their first year of investment fell by 92%, as funds pivoted away from multi-line roll-ups in favour of more focused go-to-market strategies, and platforms focused on margin improvement and organic growth.

SI Global also found that valuations remain resilient despite macroeconomic headwinds, intense competition for quality assets. The report noted that the tech-enabled sustained profit multiples well above pre-COVID levels.

“Private equity remains incredibly active in our space – but what they’re buying, how they’re buying it, and what they expect in return is changing,” Tristan Rice, Partner at SI Global, said of the findings.

“Investors are doubling down on quality, margin improvement and future-fit growth stories – particularly those that are tech-enabled and digitally mature.”

Alyssiah Tsui

Alyssiah Tsui, Partner at SI Global, said: “We’re seeing a strong appetite from Southeast Asia, the UK and the US – all of which continue to lead in PE investment.

“But each region has distinct drivers. From digital maturity in the UK to platform-building in Asia and increased first-money appetite in the US, global strategies are no longer one-size-fits-all.”

Joe Hine

Joe Hine, Managing Partner at SI Global, added: “The challenge now is readiness. The backlog of maturing assets will test valuation expectations, integration success and whether strategies like buy-and-build have truly delivered.

“This will be a defining year for platform exits – and for the advisors who guide them.”

Top image: Joe Hine and Alyssiah Tsui