Reddit has delivered a breakout fourth-quarter result, cementing its shift from a conversation-driven platform to a scaled, profitable advertising business, and sharpening its appeal to global marketers looking beyond the traditional social giants.

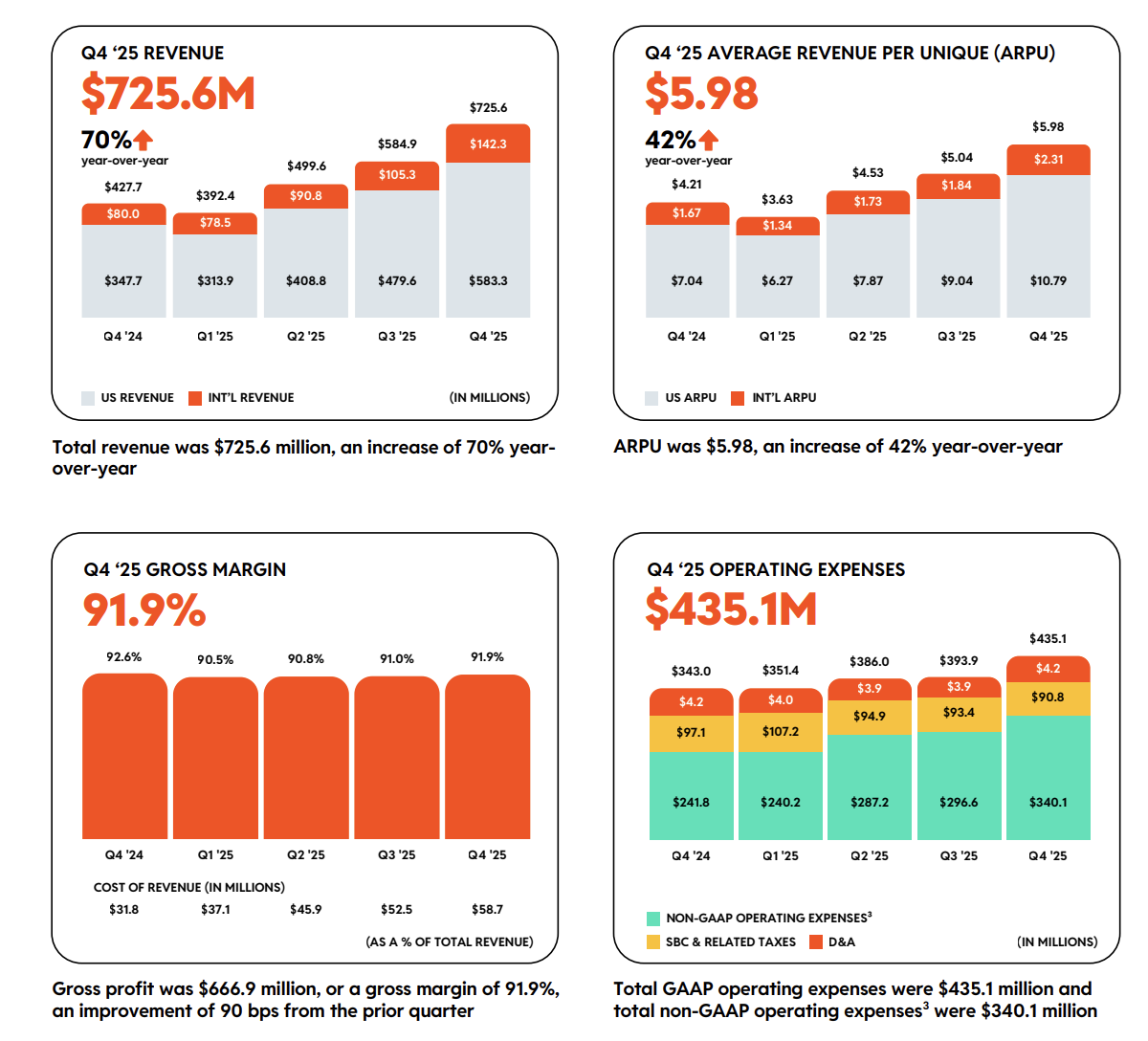

The company reported Q4 revenue of approximately A$1.1 billion, up 70% year-on-year, with advertising accounting for almost all of the growth.

Ad revenue climbed 75% to around A$1.03 billion, while full-year revenue rose 69% to approximately A$3.3 billion, including about A$3.2 billion in ad revenue, up 74%.

The result marks a decisive financial turning point. Reddit posted Q4 net income of roughly A$380 million, up from around A$107 million a year earlier, and full-year net income of approximately A$800 million, swinging sharply from a loss in 2024.

Advertising drives the growth story

From a trade perspective, the signal is clear: Reddit’s growth is being driven by advertising at scale, not experimental formats or ancillary revenue streams.

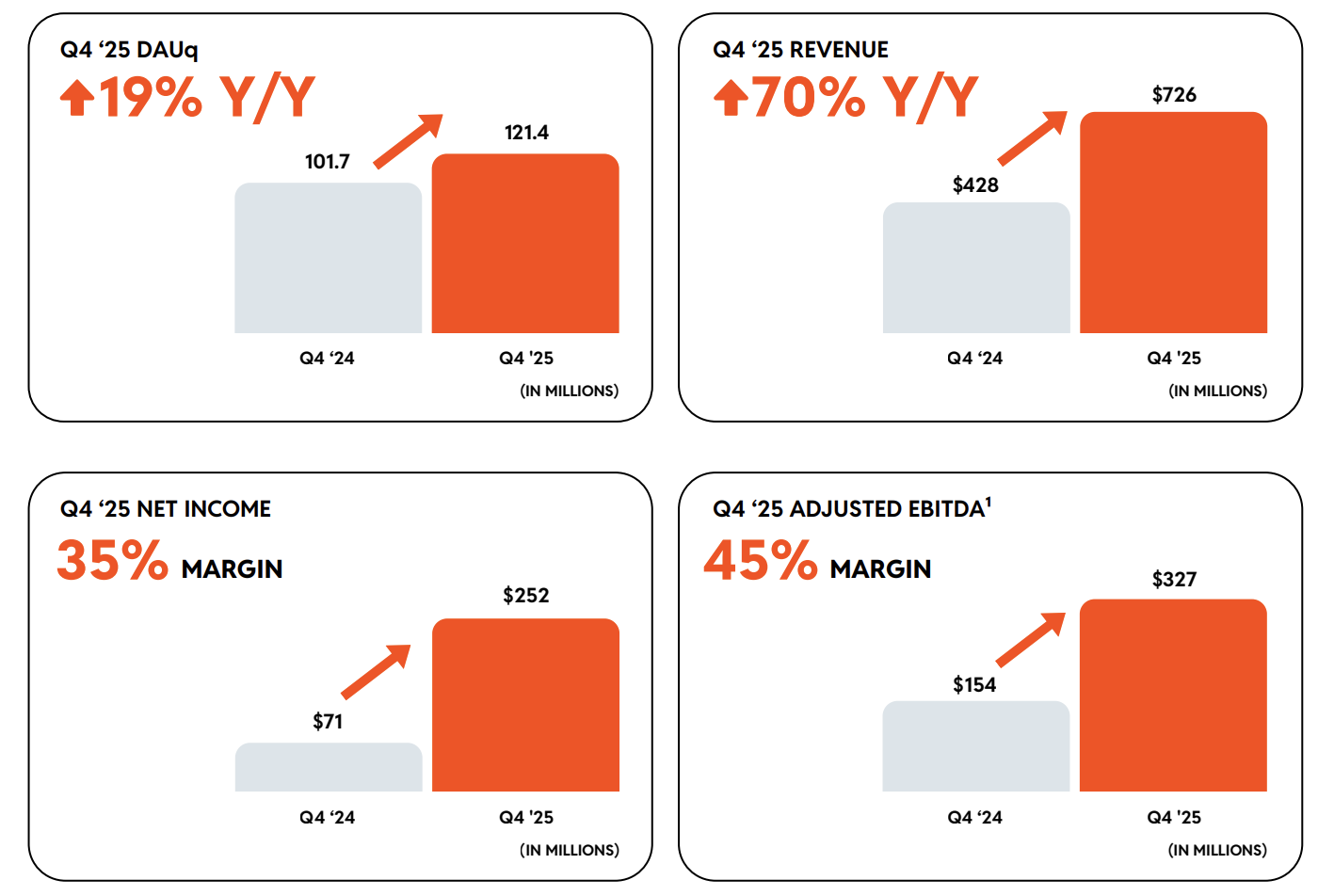

Daily Active Uniques (DAUq) grew 19% to 121.4 million, with international audiences leading the charge. International DAUq jumped 28% year-on-year, compared to 9% growth in the US, and that momentum flowed directly through to revenue. International revenue climbed 78% in Q4, reinforcing Reddit’s growing relevance outside its home market.

For agencies and advertisers, monetisation was the standout metric. Global ARPU rose 42% to around A$9.00, while US ARPU surged 53% to approximately A$16.20, highlighting Reddit’s improving ability to turn engagement and intent-rich conversations into advertising dollars.

Adjusted EBITDA for the quarter came in at approximately A$490 million, delivering a 45% margin – a level of profitability that places Reddit firmly in the top tier of global ad-supported platforms.

‘The next era of Reddit’

Co-founder and CEO Steve Huffman framed the result as a strategic inflection point for the company.

“We’re entering the next era of Reddit – defined by sharper execution, global expansion, and product innovation that puts real people and conversations at the centre,” Huffman said.

“Our focus is on turning Reddit’s authenticity into even more everyday utility.”

That positioning matters for advertisers, who are increasingly wary of brand safety concerns, signal loss, and diminishing returns across established social platforms. Reddit’s pitch – grounded in community, context, and intent – is now backed by significant revenue growth and profit.

A bigger play for brand budgets

Digging into the cost base adds another layer to the story. Sales and marketing investment increased sharply year-on-year, signalling a more aggressive push into brand advertising, agency partnerships and larger media buys.

In trade terms, Reddit is no longer circling the edges of media plans. It is moving directly into competitive territory occupied by Meta, TikTok and YouTube – particularly for advertisers seeking alternatives that still offer scale.

Confidence in the trajectory was underlined by the board’s approval of a share buyback program of around A$1.5 billion, a bold move so soon after IPO and a strong vote of confidence in the durability of Reddit’s growth and profitability.

Momentum into 2026

Looking ahead, Reddit forecasts Q1 2026 revenue of approximately A$890–905 million, with adjusted EBITDA of around A$315–330 million, setting expectations for continued momentum into the new year.

For agencies and advertisers, the takeaway is becoming increasingly difficult to ignore: Reddit is no longer a niche or experimental buy. It is fast emerging as a mainstream, global advertising platform – profitable, scalable, and differentiated by conversation-led engagement.