Quantcast has released its Asia Pacific 2023 Advertising State of Play Report, which explores the future of digital advertising.

Findings from the global advertising technology company’s latest study look at preparing for a cookie-less world, navigating ad spend during the global economic downturn, and the rise of programmatic video set to dominate advertising industry in 2023/24.

It also explores the future of digital advertising is headed, what challenges and opportunities lie ahead for advertisers and agencies, where brands are planning ad spend this financial year, and what barriers stand in the way of programmatic video adoption and success.

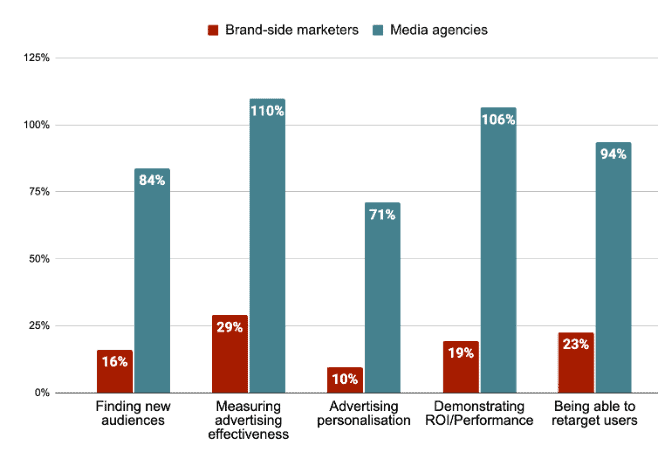

Quantcast spoke to marketers and agencies across the region and found that key challenges for both were the need to prove ROI/performance and effectiveness while personalising ads and finding new audiences, particularly amid the global economic downturn.

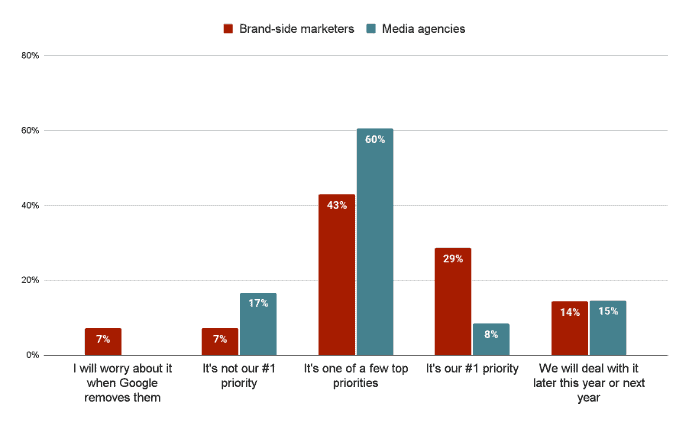

Preparing for a cookie-less world is also top-of-mind, with nearly two in three (60%) agencies and just under half (43%) of brand-side marketers naming it as their top priority for FY 23/24. Their focus will be on exploring cookie-less advertising solutions and getting deeper audience insights through first-party data over the next 12 months.

APAC marketers and agencies said the battle for consumer attention, delivering ROI, measuring ad effectiveness, and the impact of the economy were set to be their biggest challenges in the months ahead.

They also identified several opportunities including performance-led advertising, business growth, and investing in easy-to-use tools. Industry professionals across the board are looking to upskill their talent in cookie-less ad solutions, performance-led advertising, brand advertising tactics and audience behavioural change in the next financial year.

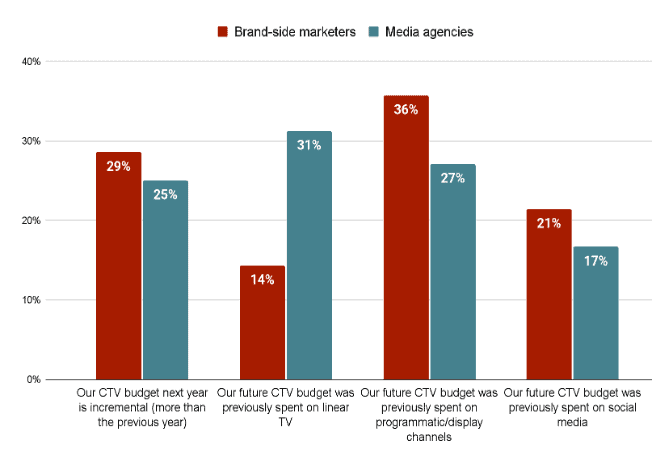

Marketers and agencies will look to significantly invest in digital channels, with programmatic video and search expected to grow significantly in APAC over the next year, particularly as social channels remain critical in countries including Hong Kong, Singapore, Thailand and the Philippines.

OTT investment in APAC is also expected to grow from US$4.3 billion to US$7.2 billion between 2020 and 2026 – a 67% increase within six years. Linear TV and radio are likely to see the largest decline in media investment, as advertisers allocate more budget into creating digital experiences.

However, the push towards more programmatic video is not without concern – APAC brand-side marketers are still worried about programmatic’s ability to deliver results and accurate measurement, while agencies are concerned with its technical aspects, including data and inventory quality.

Sonal Patel, Quantcast vice president, APAC, said: “Despite the challenging economic times globally, the digital advertising market in APAC is still expected to grow by 13.25% over the next year, adding US$2.87 billion over the next decade. This significant growth – echoed in recent Q2 agency revenue reports – is being driven by technological advancement, the increased investment in digital ad spending, growing internet users, mobile phone prevalence and a surge in digital media across the region.”

“In the coming months, we’re expecting to see advertisers continually asked to deliver more value, navigate more technological changes, and get on top of changing consumer behaviour to maximise advertising outcomes. To get ahead, APAC marketers will need to seize the opportunities to build their brands now. Businesses that increase advertising activities during downturns can snag market share from more conservative brands.

“Additionally, continuing to prepare for a cookie-less future is critical – brands should adopt a test-and-lead approach today to help better reach and connect with their customers as the demise of third party identification is on the way.”

The Quantcast Advertising State of Play Report was based on an online survey of nearly 480 advertising and marketing professionals from across Australia, New Zealand, and the Asia Pacific.