The second OUCH! Factor Report: Revealing The Hidden Costs of Pitching, gives a detailed analysis of the findings from a national survey into the pitching behaviours of Australian agencies across digital, media, PR, full service, creative and more.

The report, published by New Business Methodology (NBM) in partnership with SI Partners, revealed that while media agencies are winning new business by pitching efficiently, many creative agencies are pitching for projects that will never see profitability.

The OUCH! Factor Survey questioned 94 CEOs, CFOs and MDs from across a range of agency services on their pitch performance in 2021. The survey investigated factors such as pitches won and lost, win rates and hours invested in pitching.

NBM was able to calculate the implied additional timescale and revenue that an agency would need to generate to recover the cost of pitching by looking at what the time invested in pitching would equate to if it were spent on billable activities, in combination with the average agency EBITDA.

The analysis includes a breakdown by agency discipline, agency headcount size, and ownership type comparing the average performance of each of these groups of respondents.

Highlights:

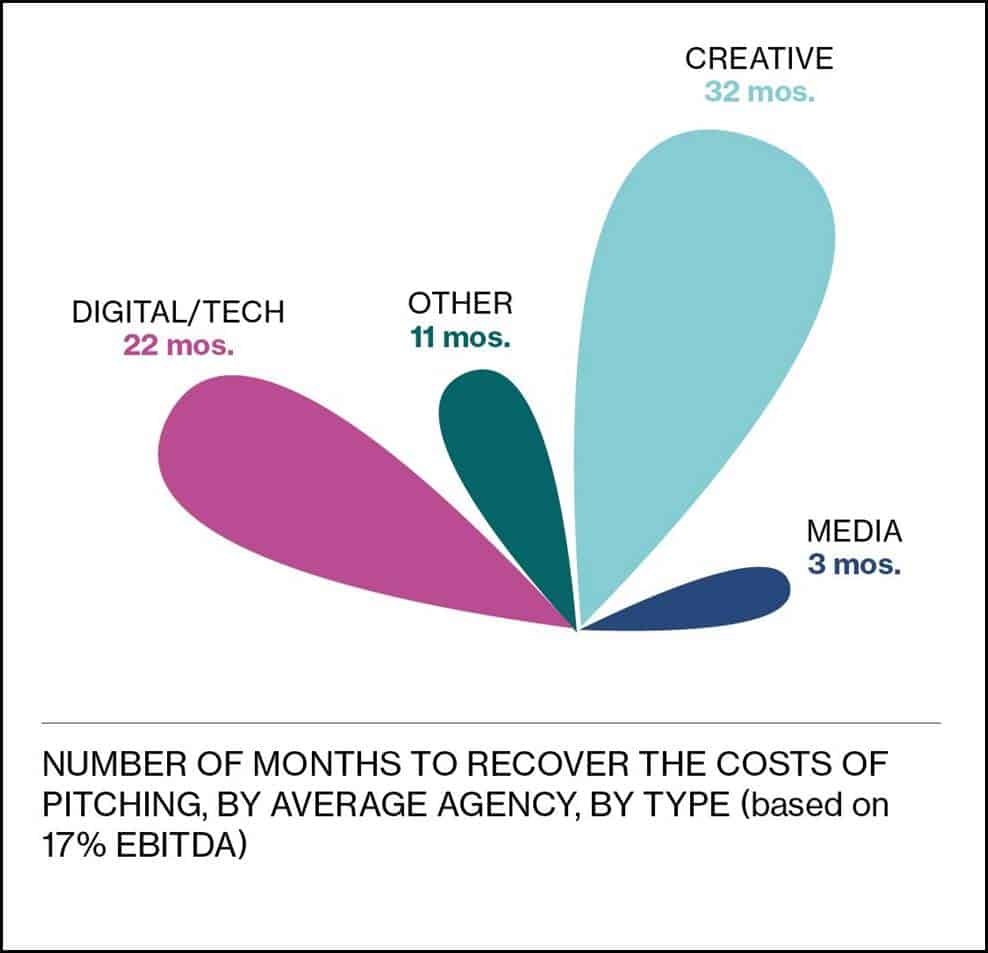

• The results reveal that it would take almost 32 months for the average creative agency respondent to recover the costs of pitching, compared to 3 months for the average media agency respondent.* (Fig.1)

• Of all the disciplines,digital/tech agencies competed for the biggest prizes with the toughest competition. They invested the most per pitch in non-billed hours and had the lowest average win rate. But by pitching for larger revenue projects they are still more likely than creative agencies to recover their costs, taking on average 22 months.* (Fig.1)

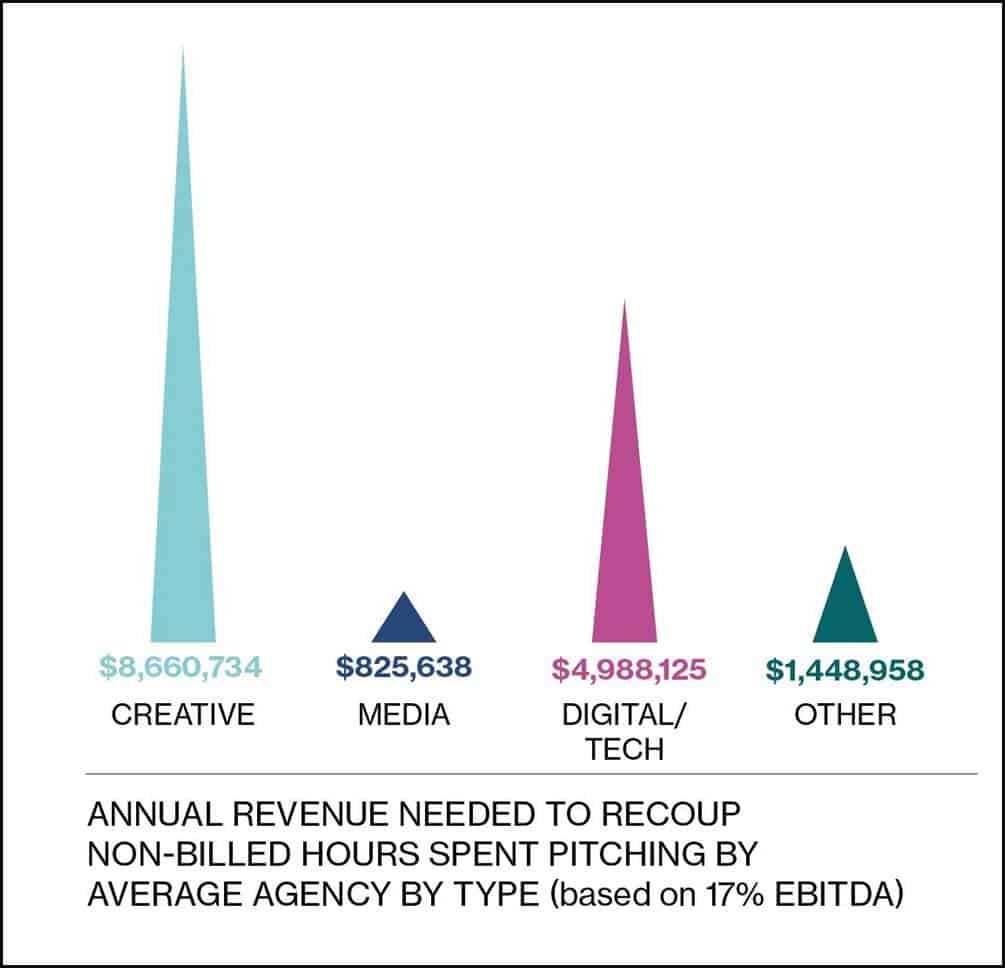

• The average creative agency respondent would need to earn $8.7m in additional revenue to recoup the cost of their annual pitch hours, versus $826k for the average media agency respondent.* (Fig.2)

• The average digital/tech agency respondent would need to earn $5m in additional revenue to recoup the cost of their annual pitch hours.* (Fig.2)

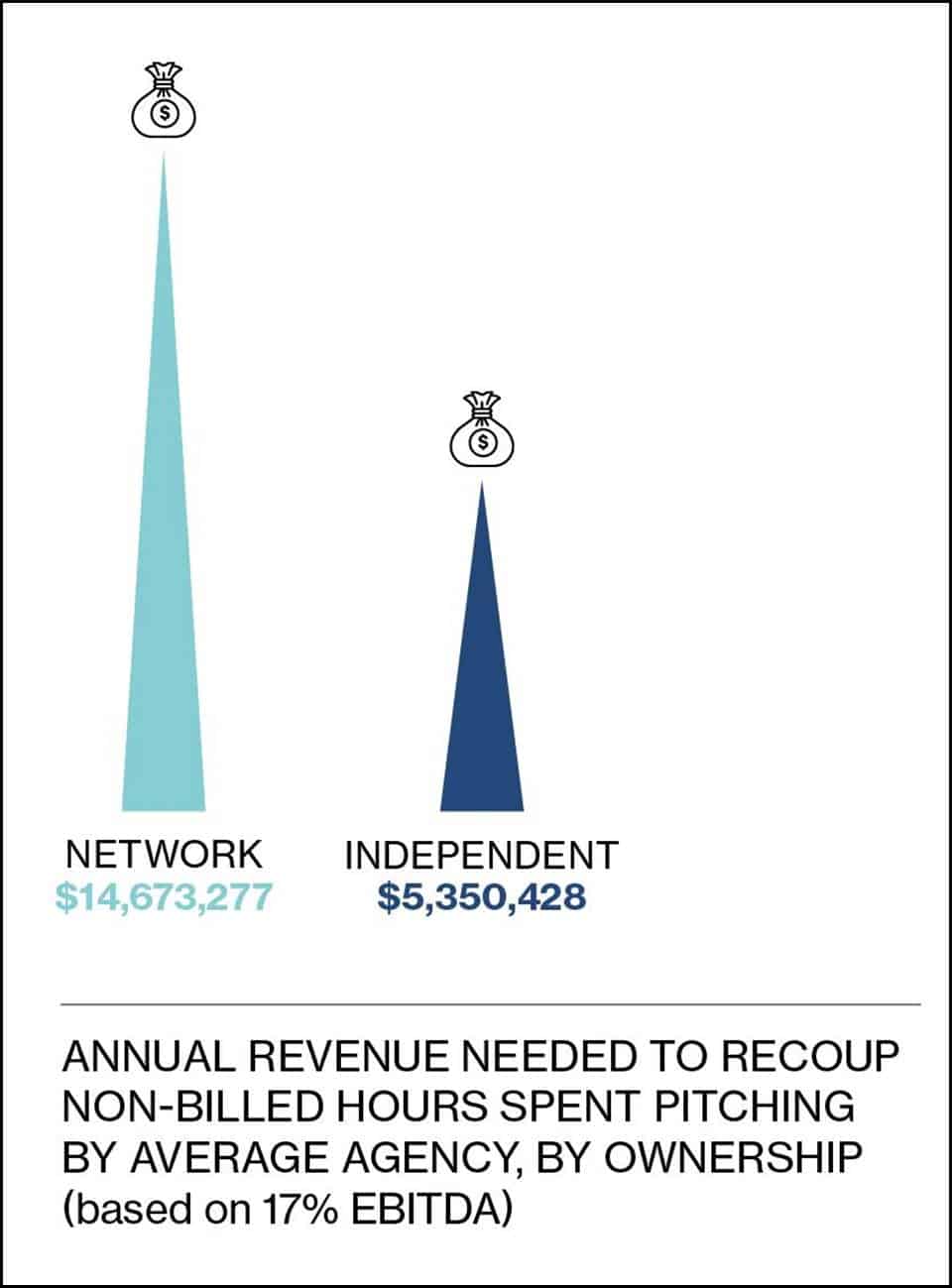

• When comparing by ownership type, independent agencies typically appear more efficient than network agencies, investing 50% of the hours to win a pitch compared to network agencies. As a result, the average independent respondent would need to earn $5.4m in additional revenue to recoup the cost of their pitch hours, versus $14.7m for the average network respondent.* (Fig.3)

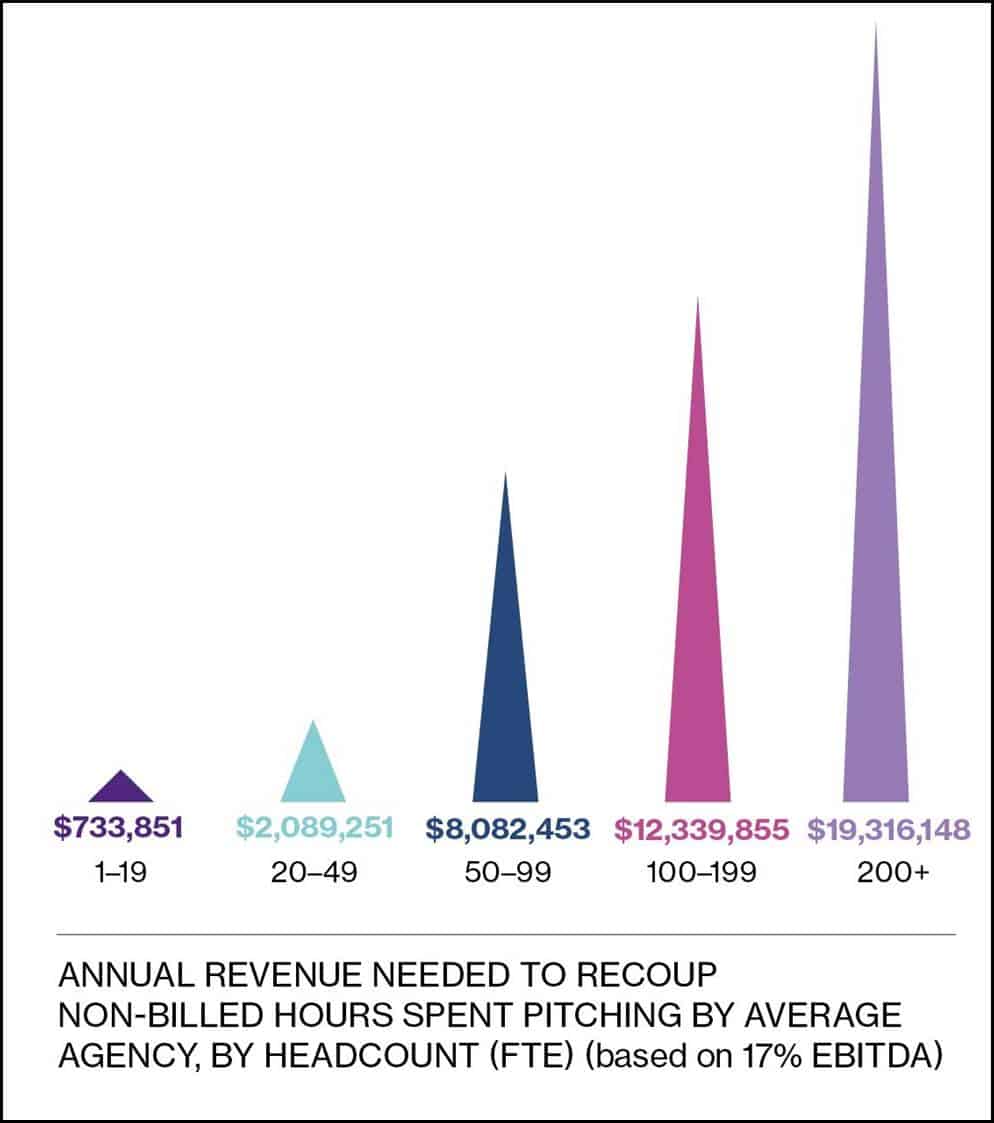

• When comparing by headcount, the smallest agencies (under 20 FTEs) were often the most efficient at pitching. They invested only 10% of the revenue value of their pitches to win, implying that it would take only 7 months to recover their costs.* (Fig.4) They would only need to earn $734k in additional revenue to recoup the cost of their annual pitch hours, compared to $19.3m for the average 200+ FTEs agency respondent.* (Fig.5)

• Mid-size agencies (50-99 FTEs) were the least efficient, ofteninvesting over 50% of the revenue value of all pitches on pitching and having the lowest pitch win rate at 32%. This implies a 33-month recovery period for their investment in the pitch.* (Fig.4). The average mid-size agency respondent would need to earn $8.1m in additional revenue to recoup the cost of their annual pitch hours.* (Fig.5)

(* based on the average EBITDA of 17%)

Another outcome from the OUCH! survey was that it would appear pitch fees made very little impact on covering agency costs. The pitch fees paid covered less than 1% of the average cost of pitching.

The second OUCH! Factor Survey included a broader range of agencies than the previous year, thanks to the backing of the following industry associations: Advertising Council Australia (ACA), Australian Association of National Advertisers (AANA), Media Federation of Australia (MFA), Independent Media Agencies of Australia (IMAA) and the Public Relations Institute of Australia (PRIA).

Julia Vargiu, director Australia, SI Partners and founder & managing director of New Business Methodology, said: “The second OUCH! Factor Report showed us that the hidden cost of pitching in Australia is getting worse. The way creative agencies pitch has stayed the same since the 1950s. But pitch costs and agency salaries have increased while project sizes have shrunk and client tenure has shortened, so the scale of projects and the margins are lower.

“Is there a way to break this cycle? It is made more difficult by the fact that many agencies do not track the hours invested in pitching, they are unaware of the work they need to win simply to recover this investment and the fact that their wins must also pay for the time they spend losing. This is an industry where 25% plus margins are achievable, but not when you’re pitching unprofitably.”

Alistair Angus, Partner, SI Partners, said: “These new insights reveal that mid-size creative agencies are trapped in a cycle of working and winning but not necessarily increasing profitability. They need to find more efficient ways to grow profitably. The report would suggest that many agencies are investing to win work from which they will never recover the costs of pitching. The culture of agencies continuing to pitch against strong competition without understanding the revenue and profit opportunity leads to many agencies to overinvest in pitching.”