Tuesday September 9, 2025

Sydney Radio Ratings 2025 Survey 5: Kyle & Jackie O claim Breakfast, but Smooth retains station crown

Sydney Radio Ratings

GfK Survey 5 2025

Survey Period: Sun 1 June to Sat 5 July 2025, Sun July 20 to Sat August 23 2025

Biggest Movers:

UP: KIIS 1065 0.7

DOWN: 2UE 954 -1.1

Smooth FM has retained its crown as Sydney’s most listened-to station in the latest GfK radio ratings survey, holding first place with an 11.8% share, down slightly from 12.3% last round.

Talkback leader 2GB slipped again, easing to 11.4% from 11.6%, while KIIS recorded a solid jump, rising to 11.1% from 10.4%.

At the other end of the dial, 2DayFM’s music reboot continues to battle for traction, edging down to 4.1% from 4.3%.

Kyle and Jackie O have posted a big lift in the latest Sydney breakfast numbers, jumping to 15.3% from 13.9%.

Australian Radio Network (ARN) Chief Audience and Content Officer, Lauren Joyce, said: “Today’s results are a clear sign of the momentum we’re building [with] Kyle & Jackie O cementing their place as Australia’s biggest show

2GB’s mornings continue to soften, slipping to 14.2% from 14.7%, while ABC Sydney slid again, with Hamish Macdonald’s show down to 7.6% from 8.0%.

Nova 96.9 edged up, climbing to 7.5% from 7.1%.

Triple M’s Sydney breakfast show posted a solid gain, rising to 5.3% from 4.5% in the latest survey. While 2DayFM breakfast also inched up, lifting to 3.9% from 3.8%

Matthew O’Reilly, Southern Cross Austereo’s (SCA) Head of Broadcast Content, said: “Sydney’s momentum is building with both 2Day FM and Triple M lifting in Breakfast. These results are a testament to the strength of our brands, the talent of our teams, and the loyalty of our listeners.”

smoothfm 95.3 11.8% (12.3%)

Cume: 1,383,000 (+61,000)

Breakfast: 8.1% (9.2%)

2GB 11.4% (11.6%)

Cume: 646,000 (-9,000)

Breakfast: 14.2% (14.7%)

KIIS 1065 11.1% (10.4%)

Cume: 1,165,000 (+12,000)

Breakfast: 15.3% (13.9%)

Gold 101.7 7.9% (8.5%)

Cume: 711,000 (-88,000)

Breakfast: 8.2% (9%)

Nova 96.9 7.4% (7%)

Cume: 1,040,000 (+1,000)

Breakfast: 7.5% (7.1%)

ABC Sydney 5.6% (5.7%)

Cume: 529,000 (-51,000)

Breakfast: 7.6% (8%)

104.9 Triple M 5.5% (5.4%)

Cume: 708,000 (-25,000)

Breakfast: 5.3% (4.5%)

Triple J 4.3% (3.9%)

Cume: 503,000 (+36,000)

Breakfast: 3.4% (3.6%)

104.1 2Day FM 4.1% (4.3%)

Cume: 659,000 (-71,000)

Breakfast: 3.9% (3.8%)

ABC Classic 2.7% (2.5%)

Cume: 219,000 (+1,000)

Breakfast: 2.3% (2.1%)

2UE 954 2.4% (3.5%)

Cume: 226,000 (-31,000)

Breakfast: 2% (2.4%)

ABC NewsRadio 1.8% (1.6%)

Cume: 335,000 (+11,000)

Breakfast: 2.9% (2.8%)

Sky Sports Radio 1.4% (1.2%)

Cume: 178,000 (+2,000)

Breakfast: 2.2% (1.6%)

SEN 1170 1.1% (0.9%)

Cume: 104,000 (-3,000)

Breakfast: 1.2% (1.2%)

RN 1.1% (1.2%)

Cume: 131,000 (+7,000)

Breakfast: 1.3% (1.5%)

Melbourne Radio Ratings 2025 Survey 5: 3AW reclaims Melbourne radio lead

Melbourne Radio Ratings

GfK Survey 5 2025

Survey Period: Sun 1 June to Sat 5 July 2025, Sun July 20 to Sat August 23 2025

Biggest Movers:

UP: 3AW 1.6

DOWN: Gold 104.3 -0.9

3AW has returned to the top of Melbourne’s radio ratings in Survey 5, bouncing back with a 13.5% share after slipping to 11.9% in the previous survey. Greg Byrnes, Nine’s National Content Manager, said: “The 3AW result today is stunning with gains right across the day and a big increase in listeners 40+.”

Former leader GOLD suffered a drop, sliding to 11.2% from 12.1%. Meanwhile, KIIS posted a marginal gain, edging up to 5.6% from 5.5%.

3AW’s breakfast team has enjoyed a major boost in Survey 5, jumping to a commanding 19.0% share from 16.6% in the previous book.

Kyle and Jackie O also recorded an increase in Melbourne, climbing to 6.1% from 5.6%. The rise was addressed by Kyle Sandilands on his Breakfast show this morning: “A lot of the newspapers and a lot of the podcasts about radios were saying, oh, they’re s**t, they’re no good. Well, thanks for all the negative publicity, because people have read those filthy outright lies, and they’ve come and had a listen, and they’ve never turned off.”

Fox FM has inched higher in the latest Melbourne breakfast survey, lifting to 9.0% from 8.9%.

Triple M also gained ground, rising to 7.7% from 7.4%.

Matthew O’Reilly, Southern Cross Austereo’s (SCA) Head of Broadcast Content, said: “We’re thrilled to see flagship shows like Fox’s Fifi, Fev & Nick and Triple M’s Mick in the Morning continue to grow in Melbourne.”

3AW 13.5% (11.9%)

Cume: 675,000 (-19,000)

Breakfast: 19% (16.6%)

Gold 104.3 11.2% (12.1%)

Cume: 1,153,000 (-10,000)

Breakfast: 10.1% (10.1%)

smoothfm 91.5 9.8% (9.7%)

Cume: 1,065,000 (-7,000)

Breakfast: 8% (8.1%)

105.1 Triple M 8.2% (7.7%)

Cume: 800,000 (+8,000)

Breakfast: 7.7% (7.4%)

101.9 Fox FM 8.2% (8.3%)

Cume: 1,152,000 (+27,000)

Breakfast: 9% (8.9%)

Nova 100 8.1% (8.7%)

Cume: 1,280,000 (-46,000)

Breakfast: 10% (10.8%)

ABC Mel 5.8% (5.9%)

Cume: 495,000 (+35,000)

Breakfast: 5.5% (6.8%)

KIIS 101.1 FM 5.6% (5.5%)

Cume: 946,000 (+10,000)

Breakfast: 6.1% (5.6%)

SEN 1116 4.3% (4.2%)

Cume: 410,000 (+11,000)

Breakfast: 4.5% (4.4%)

Triple J 3.1% (2.9%)

Cume: 495,000 (+10,000)

Breakfast: 3.1% (3.1%)

ABC Radio National 2.2% (2.1%)

Cume: 160,000 (-6,000)

Breakfast: 2.4% (2.3%)

3Mp 1377 1.7% (1%)

Cume: 169,000 (+12,000)

Breakfast: 1.3% (0.9%)

Magic 1278 1.7% (1.9%)

Cume: 179,000 (-11,000)

Breakfast: 1.3% (1.1%)

ABC NewsRadio 1.7% (1.8%)

Cume: 265,000 (+5,000)

Breakfast: 2.5% (2.5%)

ABC Classic 1.7% (2%)

Cume: 193,000 (-39,000)

Breakfast: 1.7% (2%)

Who is getting what as Lachlan Murdoch wins the family business in succession battle with family

When news broke this morning that the Murdoch family has come to an agreement over the lengthy succession battle to control the business, it stopped media watchers dead in their tracks as they hurriedly tried to understand who is getting what in the deal.

It’s an ongoing, high-stakes drama that would have already generated tremendous interest, but with the zeitgeist hit Succession stimulating curiosity in the real-world inspiration for the fictitious family in the HBO TV show, the news today had even greater impact.

In one corner, you have conservatively-minded Lachlan Murdoch, already the chairman of News Corp and executive chairman of Fox Corporation.

In the other you have his siblings Prudence, Elizabeth, and James. It is understood that they are less enthusiastic about the political lean of the family business.

Had an agreement not been reached, the existing family trust was set to expire in 2030, which would have given Prudence, Elizabeth, and James the ability to sell their shares, which would have seen the Murdoch family lose control of the business.

The deal

In the deal brokered, the existing family trust will be dissolved. In its place will be two trusts, the first is to be shared by Prudence, Elizabeth, and James. It has been valued at $US3.3 billion, which delivers each of them US$1.1 billion each.

The new trust fund held by the trio will be filled with the proceeds of approx 14.2 million News Corp Class B shares and 16.9 million Fox Corporation Class B shares. The Class B shares will give them voting rights.

Meanwhile Lachlan and the two youngest siblings, twentysomethings Grace and Chloe, will be given their own trust. This trust holds the rest of the Murdoch family stake in the two companies – 33.1 per cent of News Corp and around 36.2 per cent of Fox Corporation.

The new trust for Lachlan, Chloe, and Grace will keep the business in the hands of Lachlan Murdoch until at least the time comes for the trust to expire in 2050.

Lachlan has come out the big winner in the agreement, keeping control of News Corp and Fox Corporation for what may be the rest of his professional life.

What does the Murdoch empire control?

The most relevant Murdoch business for Australians is News Corp thanks to its large presence locally with national, state, and local newspapers, as well as incredibly strong digital holdings.

News Corp holdings include:

• The Australian

• State-based papers The Sydney Morning Herald, The Herald Sun, The Courier Mail, The Advertiser, The Mercury, and the NT News.

• Community papers, inclusive of the Quest newspapers, and the Leader newspapers.

• REA Group, which includes realestate.com.au locally and realtor.com in the US.

• Dow Jones & Company, Inc, which includes The Wall Street Journal

• HarperCollins

• The New York Post

• UK papers The Times, The Sunday Times, and The Sun

• UK radio stations including Talk (formerly TalkTV) and Virgin Radio UK

Due to the size of the US market, the Fox Corporation business delivers significantly higher revenues than News Corp. It recently reported revenues of over US$16 billion for 2024-25. News Corp reported revenue of US$8.45 billion for 2024/25.

Fox Corporation Holdings include:

• Fox News Media, which includes the Fox News Channel, Fox Business, DTC business Fox Nation, Fox Weather, and the growing Fox News Audio.

• Fox Entertainment, which is comprised of three business units: The Fox TV network, production with Fox Entertainment Studios, and the worldwide content sales and licensing unit Fox Entertainment Global

• Fox Sports Media Group, which includes Fox Sports 1, Fox Sports 2, and Fox Sports Radio

• Tubi

Prime Video secures Sony and Roadshow films in new multi-year Pay-1 deals

Prime Video has signed two new multi-year agreements with Sony Pictures Entertainment and Roadshow Films, securing exclusive Pay-1 streaming rights to their theatrical film slates in Australia.

Under the agreements, Prime Video will become the first streaming destination for all Sony Pictures and Roadshow Films titles following their theatrical and digital rental windows. The deal began in August 2025, with major films such as 28 Years Later, A Big Bold Beautiful Journey, and In The Grey among the first to join the platform.

This marks the first time Sony’s entire theatrical slate will land exclusively on Prime Video in Australia. It also extends Prime Video’s existing output deal with Roadshow, which began in July 2024.

Expanding a blockbuster pipeline

The new arrangements bolster Prime Video’s positioning as a one-stop destination for movie lovers. The combined catalogue adds to a growing slate that already includes The Boys, Fallout, Red One, The Summer I Turned Pretty, and Australian Originals like Deadloch, The Test, and The Narrow Road to the Deep North.

“By securing exclusive first streaming rights to films from Sony Pictures and Roadshow, we ensure Prime members get first access to stream these movies after their theatrical runs and digital rental windows,” said Tyler Bern, Head of Content Strategy and Content Acquisition for Canada, Australia and New Zealand at Prime Video. “This delivers more choice, more convenience, and incredible value for customers.”

What’s coming to Prime Video

Key upcoming titles under the Sony Pictures deal include:

• 28 Years Later – from director Danny Boyle and writer Alex Garland

• Karate Kid: Legends – starring Jackie Chan, Ralph Macchio and Ben Wang

• I Know What You Did Last Summer – revival of the ’90s horror franchise

• Bring Her Back – Australian horror from the team behind Talk to Me

• Caught Stealing – crime caper starring Austin Butler and directed by Darren Aronofsky

• A Big Bold Beautiful Journey – romantic drama with Colin Farrell and Margot Robbie

From Roadshow, audiences can expect:

• In The Grey – directed by Guy Ritchie and starring Henry Cavill and Jake Gyllenhaal

• Conclave – an award-winning papal drama

• A sequel to the young adult thriller Fall

Other upcoming films coming to Prime Video include The Monkey, a Stephen King adaptation directed by Osgood Perkins (streaming from 30 August), Addition from Made Up Stories, and Den of Thieves 2 starring Gerard Butler.

Content partnerships continue to grow

Adam Herr, Senior Vice President of Distribution, APAC at Sony Pictures Television, said the studio was excited to bring its lineup to Australian audiences through Prime Video: “Over the coming years, we have an exciting slate of theatrical films featuring some of the most iconic talent, directors and IP in Hollywood, and we can’t wait for audiences in Australia to enjoy them on Prime Video.”

Will Meiklejohn, Director of Acquisitions, Television & Home Entertainment at Roadshow Films, added: “This agreement cements Prime Video as the home for the extraordinary films we’ve championed on the big screen, from powerful Australian stories to internationally loved blockbusters.”

Prime membership in Australia costs $9.99 per month or $79 per year, giving access to SVOD content, live sport, TVOD purchases, and add-on subscriptions. All SPE and Roadshow content will be available via the Prime Video app across devices and downloadable for offline viewing.

Brisbane Radio Ratings 2025 Survey 5: Triple M holds station top spot and Breakfast crown

Brisbane Radio Ratings

GfK Survey 5 2025

Survey Period: Sun 1 June to Sat 5 July 2025.

Biggest Movers:

UP: ABC Bris 1.2

DOWN: 4Bh 1116 -1.5

Triple M has held onto the number one spot in Brisbane with a 12.9% share, down slightly from 13.3% in the previous survey.

B105 also eased, slipping to 11.8% from 12.2%, while KIIS973 dropped to 8.5% from 9.3%.

Nova 106.9 was the only station to lift, edging up to 10.6% from 10.3%.

Triple M’s breakfast show lifted to 13.8% in up from 13.2% last survey maintaining its dominance. Sister station B105 slipped slightly to 12.7% from 13.1%

Matthew O’Reilly, Southern Cross Austereo’s (SCA) Head of Broadcast Content, said: “Brisbane remains a powerhouse with Triple M and B105 leading the market.”

KIIS 97.3 fell again, down to 9.3% from 9.7%. The continued slide comes as speculation grows that the show will be replaced in 2026 by Kyle and Jackie O, who are already locked in to expand their network presence.

104.5 Triple M 12.9% (13.3%)

Cume: 588,000 (+42,000)

Breakfast: 13.8% (13.2%)

B 105 11.8% (12.2%)

Cume: 654,000 (+16,000)

Breakfast: 12.7% (13.1%)

Nova 106.9 10.6% (10.3%)

Cume: 635,000 (+12,000)

Breakfast: 13.1% (12.1%)

4Bh 1116 8.6% (10.1%)

Cume: 255,000 (+8,000)

Breakfast: 8.7% (10%)

KIIS 973 8.5% (9.3%)

Cume: 503,000 (+29,000)

Breakfast: 9.3% (9.7%)

ABC Bris 7% (5.8%)

Cume: 260,000 (+21,000)

Breakfast: 8.8% (7.2%)

Triple J 5.2% (4.5%)

Cume: 336,000 (+28,000)

Breakfast: 4.9% (5%)

4BC 882 4.8% (5%)

Cume: 134,000 (-10,000)

Breakfast: 4.1% (4.6%)

ABC Classic 2.5% (1.7%)

Cume: 88,000 (steady)

Breakfast: 1.7% (1.3%)

ABC NewsRadio 1.7% (1.3%)

Cume: 122,000 (+8,000)

Breakfast: 2% (1.9%)

ABC Radio National 1.6% (1.5%)

Cume: 58,000 (-3,000)

Breakfast: 2% (2.5%)

Senq 693 0.6% (0.7%)

Cume: 51,000 (-4,000)

Breakfast: 1.2% (1.5%)

Adelaide Radio Ratings 2025 Survey 5: Double delight for Triple M claiming both the station and Breakfast crown

Adelaide Radio Ratings

GfK Survey 5 2025

Survey Period: Sun 1 June to Sat 5 July 2025, Sun July 20 to Sat August 23 2025

Biggest Movers:

UP: Cruise 1323 and Triple M 0.9

DOWN: ABC Ade -0.7

Triple M has climbed to number one in Adelaide with a 14.0% share in Survey 5, up from 13.1% last round. Of the results, Matthew O’Reilly, Southern Cross Austereo’s (SCA) Head of Broadcast Content, said: “Adelaide has a new #1 station.”

Mix 102.3 slipped slightly to 13.2% from 13.5%, while Nova 91.9 also dipped, easing to 11.2% from 11.7%.

SAFM edged lower too, dropping to 7.9% from 8.2%.

FiveAA has posted a strong lift in Adelaide breakfast, climbing to 13.1% from 11.4% in the latest survey.

Triple M also gained ground, rising to 14.8% from 14.2%, while Mix 102.3 was steady on 11.4% compared to 11.5% last round.

Nova 91.9 slipped, dropping to 10.9% from 12.4%.

Triple M Adelaide 14% (13.1%)

Cume: 314,000 (+15,000)

Breakfast: 14.8% (14.2%)

Mix 102.3 13.2% (13.5%)

Cume: 338,000 (-12,000)

Breakfast: 11.4% (11.5%)

Nova 91.9 11.2% (11.7%)

Cume: 370,000 (-5,000)

Breakfast: 10.9% (12.4%)

FIVEaa 8.9% (8.4%)

Cume: 141,000 (-7,000)

Breakfast: 13.1% (11.4%)

SAfm 7.9% (8.2%)

Cume: 254,000 (-13,000)

Breakfast: 7.2% (7.6%)

Cruise 1323 7.2% (6.3%)

Cume: 175,000 (+3,000)

Breakfast: 6.3% (4.8%)

ABC Ade 6.9% (7.6%)

Cume: 139,000 (+1,000)

Breakfast: 10.2% (11.3%)

Triple J 4.5% (4.8%)

Cume: 147,000 (-4,000)

Breakfast: 4.6% (5.1%)

ABC Classic 2.2% (1.8%)

Cume: 64,000 (+9,000)

Breakfast: 1.9% (1.7%)

ABC NewsRadio 1.9% (1.7%)

Cume: 64,000 (+9,000)

Breakfast: 3.2% (2.7%)

Perth Radio Ratings 2025 Survey 5: Nova 93.7 hits top spot as 96FM drops

Perth Radio Ratings

GfK Survey 5 2025

Survey Period: Sun 1 June to Sat 5 July 2025, Sun July 20 to Sat August 23 2025

Biggest Movers:

UP: Nova 93.7 1.4

DOWN: 96Fm -1.7

Nova 93.7 13.7% (12.3%)

Cume: 676,000 (-6,000)

Breakfast: 16.4% (15.5%)

96Fm 13.1% (14.8%)

Cume: 449,000 (-57,000)

Breakfast: 10.8% (13%)

Mix 94.5 11.2% (12.4%)

Cume: 550,000 (-69,000)

Breakfast: 10.7% (12.3%)

92.9 Triple M 10% (10.9%)

Cume: 448,000 (-6,000)

Breakfast: 12.3% (13.4%)

ABC Per 6.9% (6.3%)

Cume: 220,000 (+21,000)

Breakfast: 8.4% (6.4%)

6Jjj 5.8% (6.1%)

Cume: 311,000 (+5,000)

Breakfast: 5.6% (6%)

6iX 5.5% (5.5%)

Cume: 148,000 (+5,000)

Breakfast: 4.3% (4%)

6PR 5.5% (6.7%)

Cume: 153,000 (-11,000)

Breakfast: 7.8% (8.3%)

ABC Classic 2.4% (2.4%)

Cume: 100,000 (+6,000)

Breakfast: 2.4% (2.4%)

ABC NewsRadio 2% (1.3%)

Cume: 101,000 (+19,000)

Breakfast: 3% (1.8%)

ABC Radio National 1.1% (0.6%)

Cume: 56,000 (+4,000)

Breakfast: 1.1% (0.7%)

ADMA report reveals fast AI adoption outweighs training uptake

The Association for Data-Driven Marketing and Advertising (ADMA) has released AI, Talent & Trust: A New Blueprint for Marketing Leadership, a new report outlining how marketers can lead effectively in an AI-powered environment.

The report highlights both the rapid uptake of AI tools and the capability gap within the industry. ADMA’s survey of more than 1,000 Australian marketers found 75% now use AI weekly, but only 29% have completed formal training.

“The future isn’t coming – it’s already here. AI is no longer a curiosity on the side; it’s already in our workflows, campaigns and customer conversations,” Andrea Martens, CEO of ADMA, said.

“But while AI can generate at scale, it cannot imagine, empathise or judge. That is why this report goes beyond technology – it is about people, creativity and trust. By providing clear frameworks and ethical guardrails, we want to ensure marketers can lead with confidence and unlock the full potential of an AI-powered future.”

Authored by AI experts Lisa Talia Moretti and Daniel Bluzer-Fry, the report includes insights from industry leaders such as futurist Tom Goodwin, Deloitte’s David Phillips, Archie CEO Steve Brennen, and ADMA regulatory advisor Peter Leonard.

The blueprint is part of ADMA’s National Workforce Intelligence Partnership with Reejig, mapping in real time how AI is reshaping marketing roles and skills. It sits alongside ADMA’s Capability Compass, workforce intelligence data, and regulatory initiatives aimed at embedding ethics, transparency and accountability into AI use.

Key takeaways from the report

• AI skills gap: While 75% of marketers use AI weekly, only 29% have formal training, revealing a clear skills imbalance. This gap exposes weaknesses in marketing technology, data management, and automation that could limit marketers’ ability to fully harness AI’s potential. ADMA’s Capability Compass shows foundational skills like consumer behaviour and brand positioning remain strong, but without closing these technical gaps, teams risk falling behind in an AI-driven landscape.

• Augmentation, not automation: Marketers are using AI to support, not replace, their work: from content creation and idea generation to refining brand tone. More than 70% of respondents are optimistic about AI’s long-term impact on effectiveness, but the oversaturation of AI-generated content, loss of originality and data privacy concerns remain key risks.

• X-shaped people and multidisciplinary teams: The report highlights the need for “X-shaped” professionals who combine breadth across creativity, strategy and data with depth in specialist expertise. These individuals are essential for guiding AI tools effectively and ensuring multidisciplinary teams work seamlessly across silos.

• The importance of experimentation: The organisations that thrive will be those embedding experimentation and continuous learning into their culture. The report outlines practical steps such as creating safe “sandboxes” to test tools, building “AI champions” within teams and encouraging peer-to-peer learning to drive responsible adoption.

• Responsible AI as a brand imperative: Trust is the business model; and responsibility must be built in, not bolted on. Yet only 36% of Australians say they trust AI, highlighting the fragile foundation on which adoption currently sits. The report calls on marketers to lead the way, embedding Fairness, Accountability, Transparency and Ethics (FATE) into AI workflows to protect consumer confidence and position responsible AI as the basis for loyalty and long-term growth.

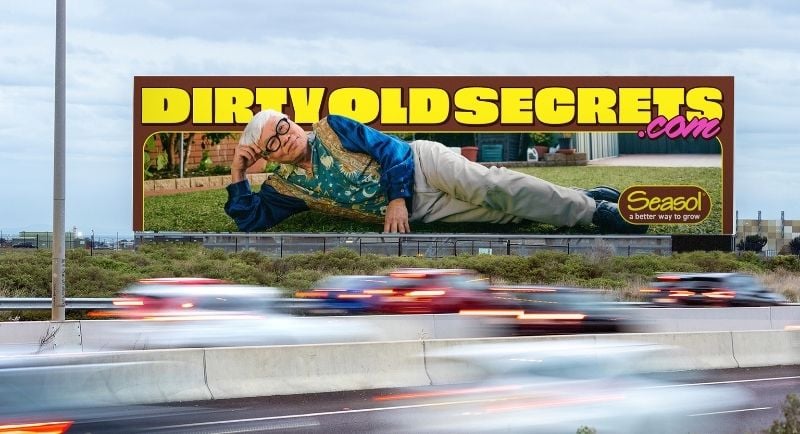

Older Aussies share their offbeat gardening hacks for Seasol

Seasol has launched a new branded content series, Dirty Old Secrets, with Howatson+Company.

The ten-part short-form documentary series, directed by Good Oil’s Connor Pritchard, spotlights older Australian gardeners sharing practical tips and unconventional hacks built up over decades. The series is voiced by hip hop artist L-Fresh the Lion.

Seasol head of marketing Greg Matheson said the series responds to growing interest in gardening among younger Australians, pairing that enthusiasm with the knowledge and experience of older generations.

Howatson+Company CCO Gavin Chimes said the series was designed to keep Seasol culturally relevant while celebrating its most loyal consumer base.

Matheson said: “We’re seeing a surge in younger Australians discovering the joy of gardening, but many are lacking the knowledge and gardening experience to help their plants truly thrive.

“Meanwhile, older generations have decades of proven expertise, often with Seasol at the heart of their success.

“With Dirty Old Secrets, we’re ensuring that invaluable wisdom is preserved and passed on, while cementing Seasol’s role as a trusted partner for every gardener.”

Chimes said: “When your most loyal consumers are ageing, you have two options: fade away with them or create new relevance.

“Dirty Old Secrets takes what quietly happens in the best backyards in the country and makes it loud, bold and impossible to miss.”

The campaign will run across DirtyOldSecrets.com, TikTok, Instagram, social and streaming platforms, and is supported by OOH, PR, and influencer activity.

Brand: Seasol

Group Capability Director Brand and Digital, DuluxGroup: Antoinette Tyrell

Head of Marketing: Greg Matheson

Brand Manager: Taryn Splatt

Assistant Marketing Manager: Sue Edwards

Marketing Communications Specialist: Jade Bravery

Agency: Howatson+Company

Group Managing Director: Renee Hyde

Client Partner: Sophie Sykes

Business Director: Sophie Grierson

Chief Strategy Officer: Dom Hickey

Executive Planning Director: Georgia Pritchard

Senior Planner: Jade Hickey

Chief Creative Officer: Gavin Chimes

Executive Creative Director: Jeremy Hogg

Creative Director: Simon Friedlander

Senior Copywriter: Katy Hulton

Senior Art Director: Elly Pipiciello

Chief Design Officer: Ellena Mills

Design Director: Trent Michael

Designer: Harry Chambers, Gabriella Dudman, Henry Leng, Jason Nguyen

Group Head of Digital: Anna Boucaut

Digital Producer: Grace Bruty

Senior Experience Designer: Chloe Schumacher

Studio Lead: Simon Merrifield

Finished Artist: Patrick Rivera

Head of Production: Holly Alexander

Senior Producer: Caitlin Perz

Videographer (social): Mark Broome

Photographer: Marta Bacardi

Head of Post Production: King Yong

Editor (social): Mark Broome

Head of PR: Ben Handberg

PR Senior Account Director: Michael Rossiter

PR Senior Account Executive: Grace Powers

Vocalist: Simon Friedlander

Senior Lead – Sound & Music: Shane Vancuylenberg

Production Company: Good Oil

Director: Connor Pritchard

Executive Producer: Juliet Bishop

Producer: Ellie Craven

DoP: Deven Narsai

Production Design: Imogen Walsh

Art Director: Ed Whitfield

Media Agency: Team Inspire, IPG Mediabrands

Group Business Director: Mark Dawson

Client Director: Tase Jaycobs Stefkov

National Head of Strategy: Ali Coysh

Strategy & Comms Design Director: Lauren Corner

Mentos set to 'Mouth Off' with 3D cube campaign at World Square

Val Morgan Outdoor (VMO) has launched its first campaign on The Cube, partnering with Perfetti Van Melle’s Mentos and Havas Media.

The 4×4 metre LED installation at Sydney’s World Square is being used to promote Mentos’ new cube gum range and “Mouth Off” campaign.

The creative mirrors the product’s cube shape, featuring 3D animations, POV-style video and dynamic effects across surrounding screens.

“We’re beyond excited to be the first brand to bring a campaign to life across VMO’s new format, which perfectly and creatively aligns to our new product,” Nikolah Gibson, Senior Brand Manager – Australia & New Zealand at Perfetti Van Melle, said.

“To connect with Gen Z, we knew we had to break the mould. Mentos Cube isn’t just gum—it’s a burst of flavour that celebrates self-expression and individuality. This campaign gives our target market something as fresh and bold as they are.”

Paul Butler, Managing Director of VMO, said: “Seeing the first campaign come to life on The Cube shows exactly why this format is changing the outdoor game in Australia. It’s bold, unmissable and unlike anything else.

“We’re thrilled to have Mentos on board as the launch partner. This campaign captures everything The Cube was built for – bright, powerful creative, spot-on alignment, and an execution that not only looks epic, but proves how well innovation and creativity play together on this game-changing format.”

The campaign includes sampling activity at World Square and will run on The Cube until Sunday.

It is also being amplified across VMO’s path-to-purchase and large-format retail networks, as well as transit and social channels targeting Gen Z audiences.

Tania Teurquetil, Strategist at Havas Media, said: “Showcasing the cube was central to our strategy – carrying Mentos Cube’s distinctiveness from product to media through its bold cube packaging and form.”

Laura Beckmann, Account Director at Havas Media, added: “Pairing Mentos Cube with a media format that brought this to life ensured it stood out and became unmissable for Aussie gum chewers.”

The Cube is part of VMO’s new Dimensions suite of outdoor screen solutions, launched earlier this year.

Credits:

Client: Perfetti Van Melle

Strategy and Media: Havas Media

Publisher Partner: VMO

Campaign Creative: The Idea Shed

The Growth Distillery and Pureprofile reveal five travel booking intent signals

The Growth Distillery and Pureprofile have released the findings from Signals of Intent: Travel, a new study identifying behaviours that predict when consumers are ready to book a trip.

The research analysed 500,000 travel transactions and surveyed 3,000 travellers to uncover five key intent signals. Findings show confident travellers spend 40% more, convert 25% faster, and deliver stronger ROI for marketers.

The five types of behaviours that predict travel readiness include:

1. Content Consumption: confident travellers who read travel content, consume 60% more content from trusted travel websites.

2. Social Media: excessive social media engagement often indicates uncertainty when it comes to planning the next trip.

3. Journey Decisiveness: confident consumers visit fewer sources and make travel decisions with greater focus and speed.

4. Risk and Safety Concerns: frequent visits to government safety websites signal weak booking confidence.

5. Life Stability: major life changes such as a new job, relationship or moving house significantly reduces travel confidence.

The research also uncovered four critical actions for travel marketers:

• Reduce Decision Paralysis: limit options to 3-5 to prevent choice overload

• Optimise for Speed: streamline booking flows with express purchase options

• Target Upselling Strategically: embed additional options within simple purchase paths

• Consolidate Platform Experience: provide inspiration, reassurance, and booking tools in one place

Jessica Folkard

The Growth Distillery Senior Manager Audience Intelligence Jessica Folkard said: “Greater frequency of content consumption from trusted publishers is a clear signal of purchase intent. Confident travellers actively seek quality information before booking, whilst uncertain consumers get lost in endless social media scrolling.

“Instead of chasing every signal, marketers should focus on identifying and targeting confident consumers who move decisively through the purchase journey.”

The Growth Distillery is News Corp Australia’s independent research think tank.

Gary Head launches CART Index AI to boost retail media creative

Gary Head, former General Manager of Omnichannel at Mars United Commerce ANZ, has launched CART Index AI, a new platform aimed at improving creative effectiveness in retail media.

The tool is designed to help brands, agencies and retailers test and optimise creative before it hits the shelf, addressing a long-standing gap in retail media strategy. According to Analytic Partners, creative accounts for up to 70 per cent of campaign performance, yet fewer than half of marketers test creative, and testing is rare in retail media specifically.

With retail media spend in Australia forecast to reach $2.6 to $3 billion by 2026–27, the blind spot is costly. CART Index aims to close that gap by providing rapid AI-powered diagnostics, including a score out of 100, shopper heatmaps, and actionable recommendations.

“Time and again, I’d see two campaigns with similar products and media plans deliver vastly different ROI,” said Head. “The missing variable was creative. CART Index helps fix that.”

Built on decades of shopper behaviour research and eye-tracking data, the platform evaluates assets across four dimensions: attention attraction, message clarity, brand recognition and trigger power. Users receive detailed insights within minutes, contrasting with traditional pre-testing methods that can be slow and expensive.

Early adopters include Sanitarium, maker of Weet-Bix, UP&GO and So Good, which is using the platform to test campaigns across Australia and New Zealand. Agencies like Connecting Plots have also integrated CART Index into their creative review workflows.

““Retail media isn’t just another ad channel, it’s one of the few places left where attention is captive.” said Dave Jansen, Executive Creative Director at Connecting Plots. “When the creativity’s good? It doesn’t just ‘show up on shelf. ’It changes behaviour at the shelf. That’s the power of CART Index. We’ve finally got a shared language between creative and media,”

Helen Vacher, Senior Shopper Marketing Manager at Sanitarium, added: “Having CART Index as a third-party validation tool takes the subjectivity out of creative and provides a clear rationale to defend and optimise our shopper centric execution.”

About CART Index

CART Index is an Australian-based AI platform that helps test and optimise retail media creative. It provides instant diagnostic scores, heatmaps, and AI-generated recommendations. The tool is built on shopper research, marketing effectiveness studies and visual attention modelling.

Companies

Murdoch family feud finally resolved

As Brian Steinberg writes in Variety, the agreement gives Lachlan Murdoch control of the voting shares that steer both News Corp and Fox Corp.

The deal also sees Rupert’s other children – Prudence MacLeod, Elisabeth Murdoch and James Murdoch – step away from any say in the family trusts

Online

Google shifts tone on the open web

As Emma Roth reports in The Verge, the line contrasts sharply with the company’s public stance that traffic is healthy and search is sending users to more sites than ever.

The filing comes as Google faces another major antitrust showdown in the US, this time over its dominance in advertising technology.

Legal

High Court showdown in the Perry v Perry case

On one side is Australian designer Katie Taylor (who trades under her maiden name Katie Perry) and on the other is pop star Katy Perry, whose real name is Katheryn Hudson.

Following?

As Michael Pelly writes in Capital Brief, the dispute kicked off back in 2008 when the singer tried to stop the designer from trademarking “Katie Perry” in fashion.

Former Wiggles boss takes band to court

O’Neill, who joined in 2023 to grow revenue and oversee hiring, alleges Field signed off on questionable travel and hiring expenses tied to family and friends.

As Clareese Packer details in The Daily Telegraph, The Wiggles’ lawyers say the claims will be denied, with a formal defence still to come.

Sport

Seven circles Netball Australia broadcast rights

The timing works in Netball Australia’s favour, thanks to a new deal with World Netball that lets it package the sport’s World Cup rights into any future contract.

Fox Sports’ current $35 million deal runs until the end of 2026, covering both rights and production.

Streaming

AI

eSafety chief slams tech giants on child abuse content

As The Guardian’s Henry Belot writes her comments coincide with six new industry codes tackling harmful content, including risks from AI chatbots.

She also revealed 100,000 Australians a month use an app generating fake nude images, even of students.

![Sydney Radio Ratings Survey 5, 2025. [click to expand.]](https://images-r2.thebrag.com/mw/uploads/2025/09/GfK_RADIO-360_Radio-Ratings-Report-Sydney_Survey-5-2025_page2.png)

![Melbourne Radio Ratings Survey 5, 2025. [click to expand.]](https://images-r2.thebrag.com/mw/uploads/2025/09/GfK_RADIO-360_Radio-Ratings-Report-Melbourne_Survey-5-2025_page2.png)

![Brisbane Radio Ratings Survey 5, 2025. [click to expand.]](https://images-r2.thebrag.com/mw/uploads/2025/09/GfK_RADIO-360_Radio-Ratings-Report-Brisbane_Survey-5-2025_page2.png)

![Adelaide Radio Ratings Survey 5, 2025. [click to expand.]](https://images-r2.thebrag.com/mw/uploads/2025/09/GfK_RADIO-360_Radio-Ratings-Report-Adelaide_Survey-5-2025_page2.png)

![Perth Radio Ratings Survey 5, 2025. [click to expand.]](https://images-r2.thebrag.com/mw/uploads/2025/09/GfK_RADIO-360_Radio-Ratings-Report-Perth_Survey-5-2025_page2.png)