Thursday February 21, 2019

Mediaweek TV

With 25 years experience in disruptive business models, Alex was instrumental in bringing both Seek and Carsales.com.au to the Australian stock market. During his time with Macquarie Group he also worked on the listings of Ten Network and Austereo.

New Mediaweek Podcast

Australian Crime Stories has been a staple on Nine on Sunday nights. A new series, from by Sydney production company The Full Box, is about to launch. Australian Crime Stories started life as Tough Nuts on Foxtel for Crime + Investigation. Nine bought the first two seasons and then rebranded it and the third season launches this February on Nine and 9Now. Mediaweek speaks with the production team of Bryan Cockerill, Gerri Coy and Adam Shand.

News Corp campaign: Ben English writes to Daily Telegraph readers

By James Manning

The campaign includes personal letters from the editors of each of its metro newspaper brands, published across the first two pages of the Wednesday newspapers.

A similar letter of commitment from editors will appear in the Sunday newspaper network this weekend and in the regional mastheads next week.

Digital subscribers to the News Corp Australia newspapers also got an email from their editors this week.

Each message is tailored to its local audience and reflects the editor’s personal connection and the mastheads’ overall commitment to its community.

The in-paper messages coincide with the return of the “We’re For You” TVC on screens nationally.

Today’s messages are the first in a broader series which will appear in coming months, with more from editors and writers across sport, opinion, business and lifestyle.

The Daily Telegraph editor Ben English revealed to readers he was a Sea Eagles fan.

“I grew up in the Sydney suburb of Seaforth in my early years,” English told Mediaweek. “Every second weekend I’d be watching the football at Brookvale with my father who started following the club when they started in 1947.”

Now his readers know his football team he will no doubt be criticised every time there is a Manly football story in the newspaper or website. “I think that is fun and people should look out for that. I wanted to let people know I am from Sydney and so are all of us on the paper.”

The interesting thing about the News Corp Australia marketing campaign is the prominence it is getting in the various publications. “We are recognising, belatedly, the value of content marketing. In the past we were probably complacent and thought our product spoke for itself.

“It is a very noisy market these days and it is important we do spell out what our value is and what we bring to the community.”

English agreed some traditional newspaper people have been reluctant in the past to talk about themselves or to push their product. But times are changing.

“That is also an Australian trait. Traditionally we haven’t been great at talking ourselves up. That is evolving pretty quickly. Among our young staff it is not a problem at all – we almost have to hold them back. They are a lot more adept at self-promotion than us older types.

“Everyone now seems to recognise the degree to which you amplify your content largely determines its success in terms of gaining traction. Our journos see the metrics and understand that.”

English told his readers he started at News Corp’s Sydney headquarters 28 years ago when it was a very different business. But to what extent are the publications still resourced to ensure the best possible quality and accuracy of news and information?

“At its heart The Daily Telegraph is a business and has to turn a profit. That probably wasn’t as much of an issue with people in my position in the past. I definitely think we are resourced enough to do the journalism that matters to our market.”

English said they are actually publishing fewer stories than in the past, but he thinks they are better at picking the right ones that matter to their audience.

“Paper’s used to be restricted by finite space, now we are restricted by finite resources.”

The news brand maintains quality control that not only edits content for the print edition but also everything that goes online. “We have a policy of not letting anything go online without passing through a second or third set of eyes. There is an urgency at times to get things up, but we hasten with caution.

“While content can be in print forever, it is also online forever.

“We are under more scrutiny than we ever were before. Our readers are much more sophisticated than they were in the past and far more demanding, which makes us a better business and a better paper.”

English said the time of this phase of the marketing campaign is important given the impending NSW and federal elections.

“We are prepared to put our reputation on the line over the next three or four months in terms of our election coverage. We are going to work our butts off to give our readers as much information and analysis collation of different views to enable them to make an informed decision.”

He added that won’t stop The Daily Telegraph from “being cheeky, entertaining, sometimes blunt and sometimes abrasive. We won’t insult our readers by telling them what to think.”

English has only been editing the Sydney daily since the end of October. After working as Telegraph deputy editor in the past under Paul Whittaker, he was appointed editor of The Townsville Bulletin (“Just before Clive Palmer walked out on the nickel plant”) and then he spent a year editing The Gold Coast Bulletin before returning to Sydney.

Of his new role: “It is seriously a great job,” he told Mediaweek.

What did the News Corp editors tell their print & online audience?

Here are the highlights of the messages from the pages of the daily newspapers:

In Sydney, The Daily Telegraph editor Ben English (who outed himself as a Sea Eagles fan) wrote:

“As editor, I’m entrusted to continue a conversation between The Daily Telegraph and you, our loyal readers that has endured nearly 140 years. You can trust that the stories we tell are the stories that touch your lives, that the issues we care about are the same as yours, that we love your city and state as deeply as you do.

“Unlike the digital giants that revolutionised the access to global information but have no reporters to heart the stories from the streets or real communities, The Daily Telegraph has lived in the same suburbs, the same city and the same state as its readers and you can trust we always will.

“Our news will never be fake. It will never be insincere. And it will never be contrary to what we know to be the facts. Our news will always be from the heart and delivered with consideration and conscience.”

In Victoria, Herald Sun editor Damon Johnston wrote:

“Trust has never been as important as it now is in this information age and its frenetic 24-hour news cycle. But trust is not simply given, it must be earned.

“Being accurate, being first, delivering the most comprehensive coverage and insight, being relevant – these are foundation tests the Herald Sun sets itself every day to inform and engage with the Victorian community.”

In Queensland, The Courier-Mail editor Sam Weir wrote:

“We’re for you whether we live in a ramshackle old Queenslander in the ‘burbs or a shiny new skyscraper in Brisbane or the Gold Coast. We live in the same streets as you, get to work on the same roads and droughts and hope for a food future for our kids, just like you.”

In Adelaide, The Advertiser’s editor Matt Deighton and deputy editor Jessica Leo-Kelton wrote:

“Trust is a two-way street. It’s built over time. It’s not easily won.

“You can trust us to break the stories that people don’t want told and trust us to hold authority to account. You can trust us to be balanced. You can trust us to get to the truth. Every single decision we make, every single day, must pass through this one filter – what does this mean for our readers?

“This newspaper is written, sub-edited, printed, photographed and published online by people living in the very same city as you.

“The Advertiser lives for South Australia and its people. It always has and it always will. And that is our commitment… We’re for you.”

Nine Entertainment Co reports half-year profit steady despite TV down

Nine has flagged these half year highlights:

• Strong FTA share and double digit cost reduction, offsetting weakness in the FTA market

• 39% growth in Digital & Publishing EBITDA underpinned by >50% growth in both Metro Media and 9Now

• Broadly flat contribution from Domain (ex Consumer Solutions businesses) in a cyclical housing market

• Close to 1.5m active subscribers at Stan, growth of more than 60% over the 12 months, with Stan expected to move into profit from Q4

Hugh Marks, chief executive officer of Nine Entertainment Co. said: “The merger with Fairfax has created Australia’s pre-eminent media company, with a diverse suite of assets that now reach more Australians each week than those of any other local media company.

“This half year result is a testimony to the new Nine. With around 55% of our revenue coming from a stable base of broadcasting and 45% coming from businesses that are in strong long-term growth markets. Meaning we’ve been able to grow EBITDA through a more demanding operating environment, at the same time investing for the future of our business.

“Nine is now uniquely positioned through the combination of the operating strength of our traditional media assets as well as an increasing exposure to the continued transition of the market towards digital media assets.”

Nine’s Broadcasting division, which comprises Nine Network as well as the consolidated results of Macquarie Media (of which Nine owns a 54.5% stake), reported EBITDA of $177m on revenues of $632m for the half.

Nine Network reported a revenue decline from $637m to $564m for the six months. One less week ($15m) and absence of Foxtel simulcast revenues ($9m) accounted for around one-third of this shortfall. In a more difficult FTA market (-5% for the half), Nine held or grew share in each month other than in November-December when the cricket-related comparables impacted. Overall, Metro FTA share for the half was 39.3%.

For the six months to December, Nine attracted a #1 commercial network share of 36.7% of the 25-54 demographic, notwithstanding the absence of cricket. For the primary channel, Nine’s share of the 25-54s was 37.1%3, around 3.4 share points ahead of its nearest competitor.

Reported costs improved by 13% or $62m for the six months. The considered move away from Cricket accounted for much of this change as Nine refocused its summer sport to tennis.

FTA EBITDA fell by 6% or $11m for the half, the bulk of which could be attributed to the extra week in H1 FY18. As such, the reduction in Nine’s costs offset almost all of the impact of the softer overall Free To Air market. Nine’s FTA margins were a post IPO high of 28.6%.

Macquarie Media reported its H1 FY19 results on 15 February. Reported revenue was broadly flat at $68m – the Group’s News Talk network continuing to outperform the overall radio market, with 4% revenue growth, offset by the short-term revenue impact of the launch of Macquarie Sports Radio. EBITDA, before Specific Items of $15.4m, was down around 5% on previous corresponding period.

Nine’s Digital & Publishing division includes Metro Media and 9Now, as well as Nine’s other Digital Publishing titles including Pedestrian, CarAdvice and nine.com.au. Together, Digital & Publishing reported revenue of $328m (of which less than half was derived from Print, and less than half that again from Print Advertising), and a combined EBITDA of $60m, up 39% for the half.

Metro Media reported overall revenue growth of 4% after three years of single digit declines. Continued strong readership of the group’s mast-heads drove 12% growth in digital revenues, and stabilising print revenues (both in terms of circulation and advertising). Metro Media’s ongoing focus on costs resulted in a further decline of c$6m. EBITDA increased by 58% to $40m, the fifth consecutive half of EBITDA growth for the Metro Media business.

In a BVOD market, which grew by 41% for the half to almost $60m, 9Now further increased its share to 47.5%, for revenue growth of more than 50%. Content such as Love Island, The Block and Manifest drove audiences throughout the half, with long form streams increasing by 66%. 9Now increased its EBITDA contribution from $10.7m to $16.4m, up 54%.

Other key components of Digital & Publishing together contributed revenue of $58m, and EBITDA of $4m with softer conditions in the broader digital display market impacting.

Domain recorded flat revenues in a cyclical operating environment, specifically in its key markets of Sydney and Melbourne. Notwithstanding, the group made clear progress. Core digital revenues grew by 5%, with residential revenue up by 9%. Offsetting this ongoing digital growth, print revenues fell by 24%, and now represent less than 20% of Domain group revenues.

Costs rose by less than 4% on a reported basis, with the savings from print and other initiatives invested in continuing to develop the growth drivers of the business.

Reported EBITDA was down by 7% – most importantly, Core Digital EBITDA was stable. Underlying depth and yield improvements

Stan recorded a very strong period for sign-ups, with active subscribers now of 1.5m. Stan’s consistent roll-out of exclusives like The Harry Quebert Affair and Who Is America? and local content like Bloom complemented the addition of Disney from mid-December. Usage per subscriber continues to increase, with daily total hours streamed now exceeding 1m.

Revenue growth of 50%, and a cost increase of 19% again highlights the leverage of this business. The strong subscriber growth, coupled with the recently announced price increase means that Stan is expected to exit FY19 with a positive profit run-rate, and expectations of a net positive EBITDA contribution in FY20.

ACM had a difficult half, with the Australia-wide drought affecting both agricultural and regional markets and publications. Revenue declined by 8%, and EBITDA dropped by 42% to $21m for the half.

Stuff experienced similarly difficult advertising conditions in its core market of New Zealand, reporting an EBITDA decline of 23% to $15m.

Following implementation of the merger with Fairfax Media on 7 December 2018, Nine has completed its review of the breadth and scope of the combined group.

In order to align with the group’s strategic objectives and future focus, Nine is exploring potential value maximising opportunities for its non-metropolitan media assets, namely Australian Community Media and Printing (ACM), Stuff New Zealand and Events.

To this end, Nine has appointed an advisor to manage the divestment processes, and has received initial indications of potential interest from a number of parties in relation to each business for sale.

Current trading environment and outlook

The FTA market conditions of the first half have continued into the current quarter. However, Nine has increased its share and expects to grow year on year revenue in the quarter by approximately 3%.

Nine believes that the FTA market should improve in the run up to, and post the Federal Election, currently expected in May, and that it will continue to record share growth. Full year FTA costs are now expected to be down by around 4%. On this basis, EBITDA from broadcasting is expected to be broadly in line with Pro Forma FY18, excluding the impact of the extra week.

Digital and Publishing is expected to continue to grow through H2 FY19 and into FY20, driven both by top line growth and further cost efficiency gains in Metro Media and continuing strong growth at 9Now.

As Domain commented with their result last week, the short term outlook remains defined by growth in yield and lower listing volumes. Continued investment in growth initiatives is being supported by ongoing cost discipline.

On the back of the increased subscriber numbers, and the recent price increase, Stan expects to be profitable in Q4 FY19, and report a positive contribution to EBITDA in FY20.

The above performance by Nine’s operating divisions will be supported by further delivery of merger synergies in H2FY19 and in FY20.

In terms of the FY19 result, Nine is expecting to report Pro Forma Group EBITDA on a continuing business basis of at least $420m, which equates to growth of at least 10% on the FY18 like-basis result of $385m. It is expected that positive momentum will continue at the Group level in FY20.

triple j fave Ocean Alley + Kwame first guests on MTV’s TRL

2018 saw Ocean Alley solidify their position as one of Australia’s most exciting bands, making their mark on the local and international touring circuit.

Their Platinum-certified Top 10 single Confidence took out the top spot in the triple j Hottest 100 of 2018, and the band premiered their new single Stained Glass this week – the first taste of new music since their second album Chiaroscuro.

Kwame, the young hip-hop prodigy bursting into the industry as a writer, artist and producer on his debut EP Lesson Learned. With over five million steams between hit singles Wow and No Time in just a few months, he has a growing legion of fans.

TRL will premiere Friday March 8 at 6pm AEDT on MTV and MTV Music on Foxtel, Foxtel Now and Fetch.

Fans can also engage with TRL online at mtv.com.au and across social on YouTube (@TRL Playlist), Instagram (@mtvaustralia #TRL) Facebook (@TRL Australia) and Twitter (@mtvAustralia).

TRL is hosted by Ash London and Angus O’Loughlin, DJ Flex Mami and MTV.com.au editor and on-air presenter, Lisa Hamilton.

Each episode of TRL will be filmed in front of a live studio audience at MTV HQ in Sydney with new episodes premiering every Friday at 6pm.

TV Ratings Analysis: February 20

Wednesday: Week 8 2019

By James Manning

• FTA TV news/current affairs

• Seven News 914,000/877,000

• Nine News 858,000/846,000

• A Current Affair 743,000

• ABC News 671,000

• 7.30 589,000

• The Project 227,000/401,000

• 10 News First 336,000

• SBS World News 100,000

Breakfast TV

• Sunrise 277,000

• Today 182,000

Seven

Home and Away was under 600,000 with 583,000.

My Kitchen Rules was on 724,000 with the last episode for the week down on 766,000 on the same night last week.

Undercurrent: Real Murder Investigation did 415,000 after 277,000 a week ago.

Nine

A Current Affair did 743,000 after two nights over 850,000 earlier this week.

It was time for the Wednesday dinner parties, which always perform well for Married At First Sight. The dinner party last week was week seven’s second most-watched program on 1.288m. This week it was not far off Tuesday’s new high for MAFS with 1.329m.

New Amsterdam then did 493,000. A week ago Nine’s medical entrant was on 452,000.

10

The Project again hovered just above 400,000 after 7pm with Bananarama’s Keren and Sara guests on the show. They were great guests who seemed to really bond with the hosts. There should be an 80s pop sensation on every week.

Bondi Rescue returned to 7.30pm weekday primetime with a new season. The episode could only manage 321,000, but that was up over 100,000 on the Changing Rooms audience a week ago. A repeat episode then did 268,000.

Law & Order: SVU then did 167,000.

ABC

Hard Quiz was on 610,000 after 607,000 last week.

After 430,000 a week ago, midweek sitcom Rosehaven did 408,000.

Get Krackin’ then had 224,000 watching after 233,000 a week ago.

SBS

A repeat of Gourmet Farmer followed the SBS World News with 106,000. Repeats at 7.30pm seem to be a roadblock for audiences on some nights.

Great British Railway Journeys was on 173,000 followed by the biggest audience of the night watching Secrets Of The Chocolate Factory: Inside Cadbury with 339,000.

The second week of McMafia then was on 145,000 after 9.30pm after 173,000 last week.

Week 8 TV: Tuesday

| WEDNESDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 11.9% | 7 | 20.0% | 9 | 26.3% | 10 | 7.7% | SBS One | 5.2% |

| ABC KIDS/ ABC COMEDY | 2.1% | 7TWO | 2.9% | GO! | 3.3% | 10 Bold | 4.0% | VICELAND | 1.0% |

| ABC ME | 0.5% | 7mate | 2.4% | GEM | 2.2% | 10 Peach | 2.8% | Food Net | 1.1% |

| ABC NEWS | 1.3% | 7flix | 1.6% | 9Life | 2.5% | NITV | 0.2% | ||

| 7Food | 0.9% | ||||||||

| TOTAL | 15.8% | 28.0% | 34.3% | 14.4% | 7.5% | ||||

| WEDNESDAY REGIONAL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | |||||

| ABC | 11.4% | 7 | 20.5% | 9 | 20.5% | WIN | 7.7% | SBS One | 4.9% |

| ABC KIDS/ ABC COMEDY | 3.1% | 7TWO | 4.8% | GO! | 3.6% | WIN Bold | 3.3% | VICELAND | 1.3% |

| ABC ME | 0.8% | 7mate | 2.6% | GEM | 3.8% | WIN Peach | 2.8% | Food Net | 1.1% |

| ABC NEWS | 1.4% | 7flix | 3.2% | 9Life | 1.9% | Sky News on WIN | 1.0% | NITV | 0.2 |

| TOTAL | 16.7% | 31.1% | 29.8% | 14.8% | 7.5% | ||||

| WEDNESDAY METRO ALL TV | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FTA | STV | ||||||||

| 87.7% | 12.3% | ||||||||

Wednesday FTA

- Married At First Sight – Nine 1,329,000

- Seven News Seven 914,000

- Seven News / Today Tonight Seven 877,000

- Nine News Nine 858,000

- Nine News 6:30 Nine 846,000

- A Current Affair Nine 743,000

- My Kitchen Rules – Seven 724,000

- ABC News ABC 671,000

- Hard Quiz S4 ABC 610,000

- 7.30 ABC 589,000

- Home And Away Seven 583,000

- New Amsterdam Nine 493,000

- The Chase Australia Seven 490,000

- Hot Seat Nine 471,000

- Undercurrent: Real Murder Investigation Seven 415,000

- Rosehaven ABC 408,000

- The Project 7pm 10 401,000

- Secrets Of The Chocolate Factory: Inside Cadbury SBS 339,000

- 10 News First 10 336,000

- Bondi Rescue 10 321,000

Demo Top 5

16-39 Top Five

- Married At First Sight – Nine 417,000

- New Amsterdam Nine 126,000

- My Kitchen Rules – Seven 122,000

- A Current Affair Nine 117,000

- Nine News 6:30 Nine 114,000

18-49 Top Five

- Married At First Sight – Nine 675,000

- Nine News 6:30 Nine 239,000

- Nine News Nine 230,000

- My Kitchen Rules – Seven 229,000

- A Current Affair Nine 224,000

25-54 Top Five

- Married At First Sight – Nine 717,000

- My Kitchen Rules – Seven 277,000

- Nine News 6:30 Nine 273,000

- A Current Affair Nine 268,000

- Nine News Nine 262,000

Wednesday Multi Channel

- Talking Married 9Life 170,000

- NCIS: Los Angeles (R) 10 Bold 138,000

- Dino Dana ABCKIDS/COMEDY 137,000

- Ben And Holly’s Little Kingdom ABCKIDS/COMEDY 135,000

- NCIS (R) 10 Bold 123,000

- Bluey PM ABCKIDS/COMEDY 120,000

- Andy’s Wild Adventures ABCKIDS/COMEDY 119,000

- Pie In The Sky PM 7TWO 119,000

- Peter Rabbit ABCKIDS/COMEDY 118,000

- Kiddets AM ABCKIDS/COMEDY 118,000

- Hey Duggee AM ABCKIDS/COMEDY 114,000

- Go Jetters PM ABCKIDS/COMEDY 114,000

- Pj Masks PM ABCKIDS/COMEDY 113,000

- The Hive AM ABCKIDS/COMEDY 112,000

- NCIS: Los Angeles Ep 2 (R) 10 Bold 112,000

- The Big Bang Theory Tx3 9GO! 111,000

- Neighbours 10 Peach 110,000

- Noddy Toyland Detective PM ABCKIDS/COMEDY 110,000

- Peppa Pig PM ABCKIDS/COMEDY 109,000

- Rusty Rivets ABCKIDS/COMEDY 109,000

Wednesday STV

- Gogglebox Australia LifeStyle Channel 136,000

- Paul Murray Live: Our Town Sky News Live 46,000

- Kirstie And Phil’s Love It Or List It LifeStyle Channel 45,000

- Paul Murray Live: Our Town Sky News Live 39,000

- Paw Patrol Nick Jr. 39,000

- The Bolt Report Sky News Live 38,000

- Bones TVH!TS 35,000

- Blaze And The Monster Machines Nick Jr. 34,000

- Grand Designs Australia LifeStyle Channel 33,000

- CSI: Crime Scene Investigation TVH!TS 33,000

- Location, Location, Location LifeStyle Channel 31,000

- The First 48 crime + investigation 30,000

- Ron Iddles: The Good Cop crime + investigation 29,000

- Credlin Sky News Live 29,000

- NCIS TVH!TS 28,000

- Bizarre Murders crime + investigation 28,000

- Beverly Hills: Real Housewives Of… ARENA 27,000

- Criminal Minds TVH!TS 27,000

- Gogglebox Australia LifeStyle Channel+2 26,000

- Jeopardy! FOX Classics 26,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2018. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Business of Media

Wavemaker’s Jessica Torstensson appointed media director of Bohemia

Torstensson joins the agency with almost a decade of media experience. She began her career at Mindshare in Sweden and was most recently group business birector for GroupM agency Wavemaker.

She has previously worked with large-scale clients including Hungry Jacks and McDonald’s launching McDelivery in Australia and New Zealand as well as overseeing various Nordic Unilever campaigns.

In her role as media director, Torstensson will act as the client lead across the UBank, Freedom, news.com.au, Flexi Group and Employsure accounts.

Theo Zisoglou, Bohemia head of media and investment, said: “We met with quite a few candidates and were very impressed with the talent in-market but Jessica stood out due to her experience in both online and offline, as well as impeccable client service and running highly effective teams. She has a ‘can do’ attitude and is very positive, the hallmarks of a Bohemian. She’s a great cultural fit.”

Torstensson said: “I am thrilled to become a Bohemian and join the M&C Saatchi Group. My main focus will be to drive business growth for our clients and I can’t wait to contribute to the unique agency culture I have heard so much about.”

Bohemia is Australia’s happiest media agency, according to media i.

TEG Analytics launches Life Segments customer insights platform

This TEG Analytics release details the offer:

In an Australian-first, Life Segments delivers new, powerful insights about customers across all industries by analysing millions of transactions across the live economy. Life Segments turns fan data into actionable customer segments for the broader market.

Life Segments has seven distinct segments, categorising people’s leisure activities, interests and financial engagement, as well as providing insights into their event affinities, motivations and lifestyle preferences. Life Segments emphasises psychology or mindset and provides unique insight into audiences that goes beyond demographics.

On launching Life Segments, TEG’s general manager of analytics and insights Andrew Reid said: “Life Segments is a game-changer for the market research industry, providing clients and brands with invaluable customer insights based upon actual consumer behaviour as expressed through their discretionary spending, and not just survey data.

“Using the expertise of both TEG Analytics and TEG Insights, Life Segments has created an innovative and powerful market research tool for Australian businesses to measure a customer’s lifestyle preferences and passions across entertainment and sports.”

Advertisers Telstra & ANZ warn media groups of data overload

Most local media groups have completed their “upfront” market roadshows for 2019 – News Corp has its major portfolio briefing still to come next month – in which they pitch their initiatives and content investments to advertisers and agencies for the coming year.

Data-led customer and audience targeting and profiling programs were central to many 2019 media developments, but this week two of Australia’s bigger advertisers all but called a halt to the avalanche of data initiatives they are being offered by local media groups.

“From our perspective, I’m not really interested,” Telstra’s chief brand officer and marking lead, Jeremy Nicholas, told the Omnicom Media Group annual tech and media conference this week.

“It was really interesting being at the upfronts and certainly meeting with media owners seeing how focused they are on it. Our main thing is to sort out our own data and our own backyard. We feel we’ve got enough. We’ve got plenty of data and it’s actually about orchestrating that so we can improve the customer experience, satisfy customers better and deliver good value for the company.”

News Brands

Herald Sun hopeful Court of Appeal will allow Lawyer X reveal

The High Court ended years of secrecy over the Lawyer X scandal in December when it green-lighted the Director of Public Prosecutions to alert criminals that their convictions could have been tainted because she was used by police to inform on clients.

It ruled that her identity should be revealed on February 5.

But Victoria Police chief commissioner Graham Ashton launched an action in the Victorian Supreme Court of Appeal to stop her ever being named.

The police had already fought for years to keep the detail of the scandal secret.

The Herald Sun and Royal Commission into Police Informers – which is seeking submissions from anyone who had dealings with Lawyer X – yesterday challenged the police’s latest cover-up bid.

Trump supporter in photo with Native American sues Washington Post

The lawsuit, filed in US District Court in Kentucky by Covington Catholic High School student Nicholas Sandmann, 16, seeks $US250 million ($349 million) in damages, the amount that Jeff Bezos, founder of Amazon.com and the world’s richest person, paid for the Post in 2013.

The lawsuit claims that the newspaper “wrongfully targeted and bullied” the teen to advance its bias against US President Donald Trump because Sandmann is a white Catholic who wore a Make America Great Again (MAGA) souvenir cap on a school field trip to the March for Life anti-abortion rally in Washington on January 18.

Social Media

Electoral Commission welcomes Twitter’s new election ad rules

Under Twitter’s new policy, any advertising that “advocates for or against a clearly identified candidate or party for Australian federal elections” must be authorised by a certified profile that has undergone identity and proof of address checks.

The company will make additional information like billing information, ad spend and demographic targeting data searchable for paid content posted in the previous seven days. Twitter has also banned the use of foreign payment methods for political advertising.

Twitter’s local head of public policy Kara Hinesley said the company’s decision to go beyond the requirements of the legislation, which requires notice of authorisation for political ads, reflected a commitment to “promoting the health of the public conversation”.

Television

Breakfast TV: Focus groups asked about Today host Georgie Gardner

Following Monday’s dire ratings where the show suffered its worst numbers since 2006, insiders say Nine executives, including the station’s director of news Darren Wick, held a series of closed door crisis meetings on Tuesday.

New Today boss Steve Burling, understood to be involved in the secret meetings, is under extreme pressures after taking the helm to champion the failed relaunch.

The Daily Telegraph can reveal independent analysts have been commissioned to conduct focus groups in an attempt to understand why audiences are not tuning in.

Nine’s Darren Wick accuses Daily Telegraph of bullying Today host

“This is one of the most deliberate acts of bullying I’ve ever seen. There are no facts attached to the claims. And the reporter didn’t bother to contact Nine to put the claims to me or anyone else for comment.

“Nine’s position is that this is an outrageous, false, reckless and defamatory attack on Georgie Gardner and the Today show. The claim by the Daily Telegraph reporter that Nine has conducted focus groups this year is wrong. We haven’t as yet commissioned any focus groups for the Today show, let alone held them in 2019.

“The allegations from the article that Georgie Gardner was perceived as an ‘Ice Maiden’ and is somehow responsible for the poor numbers of the show this year is a fabrication and irresponsible reporting.

“Nine conducted a number of focus groups throughout the last six months of 2018, under my supervision, and the feedback from those viewers was overwhelmingly positive about Georgie Gardner. She rated head and shoulders above every other on-air presenter. And that’s consistent with all Today show focus groups we’ve held during the last seven years, while I’ve been in the national news director role.

“I don’t shy away from the weaker numbers the Today show has recorded in 2019. But just five weeks into a new team on-air, we’re not about to hit the panic button. We’ve been through this battle before with other programs, where a section of the media is quick to write us off. We’re in for the long haul.”

Company behind Nine advertorial in growing political storm

The company’s travel series, which began on Nine last October features Ray Martin, Sonia Kruger, Bec Hewitt, Steve Jacobs, Lauren Phillips, Matt Wilson, Ashley Hart, Denis Walter and Vince Sorrenti. It screens on Sunday afternoons, normally devoted to advertorial or sport content.

This week Cormann had to defend a family holiday booked through the company in January 2018, repaying $2780 for flights to Singapore after it was revealed he got the holiday for free. He said he was unaware he had not been charged for it and blamed it on an administrative error.

This Sunday’s edition includes Bec Hewitt in the Daintree Rainforest, Stevie Jacobs in the Cook Islands and Ray Martin exploring Tokyo.

Modern Murder Mysteries never met a 60s cliche it didn't like

Well, it certainly seems to be set in a parallel universe that looks like ours but isn’t quite.

It’s Melbourne in 1964, but here the sun always shines, the populace is harmoniously diverse, both ethnically and sexually, and a woman with absolutely no qualifications at all is able to sashay her way into any place she likes, using nothing more than a bobby pin and an abundance of charm.

Gritty realism is clearly not the territory this spin-off series of four telemovies is staking out. The plots run along much the same lines as your average episode of Scooby-Doo, only with a little more unresolved sexual tension thanks to the simmering attraction (more of a slow percolate, to be honest) between Peregrine and detective James Steed (Joel Jackson), who always arrives on the scene of the crime just after she does. The only thing missing is the face-mask reveal at the end.

In other words, Ms Fisher never met a 60s cliche it didn’t like. I haven’t seen the final episode, but if it doesn’t give us a death by beehive while the Beatles are in town, I’ll be a little disappointed.

Ms Fisher: Faithful whodunit is ABC’s loss and Seven’s gain

Hakewill is a delight, driven with determination and a twinkle in her eye. She is easily able to handle the procedural and personality elements of a very entrenched franchise. Joel Jackson (is there anything this guy can’t do?) is positively debonair on screen, fitting for the era.

But it’s just a shame the pacing drags due to the telemovie length. The script doesn’t quite pack enough punches to sustain the length and I can’t help but wonder if that’s due to the show now being on Seven with commercials.

The Every Cloud production is clearly faithful to the whodunit genre and while TV is missing some of its favourite ABC sleuths, it is arguably Seven’s gain. I suspect its biggest challenge is forging a new identity with those obsessed with Essie Davis and the roaring 20s original. For this to work it needs to move on quickly from Phryne references and claim the turf as their own.

Sports Media

Roy Masters: Other codes gasp for air as NRL and AFL grip ratings

For the first time since 2010, the NRL had a higher season audience, with a cumulative viewership of 94.3m, compared to the AFL’s 89.2m.

The average free-to-air NRL game drew in 600,181 viewers, down 7 per cent, while the AFL’s average was 307,793, down 13 per cent. (The AFL has cross over time-slots, meaning it doesn’t go FTA with the same game nationally).

Foxtel’s ratings were similarly superior for the 13-a-side code, with NRL games averaging 240,879 (up 3 per cent) and AFL 184,821 (down 7 per cent).

A-League ratings have dropped a frightening 28 per cent between rounds one and 11, compared to last season.

Can the second edition of AFLX grow on the numbers from 2018?

Following an encouraging introduction this time last year in three states and involving all 18 clubs, this year’s tournament consists of four all-star teams all playing on one night only following extensive research by the AFL.

The inaugural short-game concept, with each team fielding seven players on soccer-style grounds with new and adapted rules, attracted more than 40,000 fans last year to tournaments in Adelaide, Melbourne and Sydney, and rated well on television.

Allianz Stadium in Sydney got its first taste of modified Australian football with 9892 attending on a Saturday night. Coopers Stadium in Adelaide launched the series two nights earlier with a near-capacity crowd of 10,253 while Marvel Stadium attracted 22,585 on the Friday night.

On opening night, the 3½ hour broadcast on Fox Footy lured 82,000 viewers, while a free-to-air audience on 7TWO peaked at 643,000 viewers, with an average audience of 171,000.

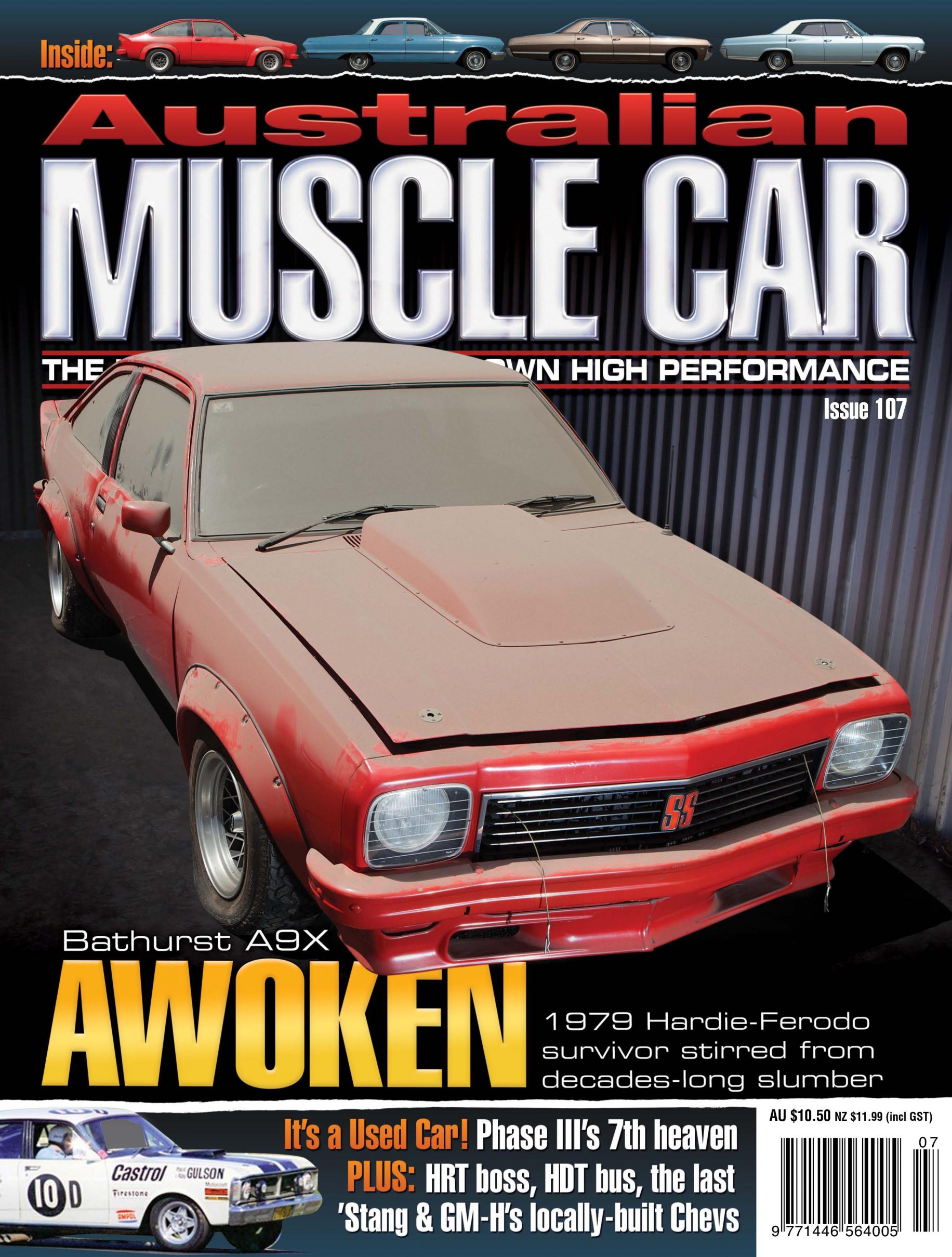

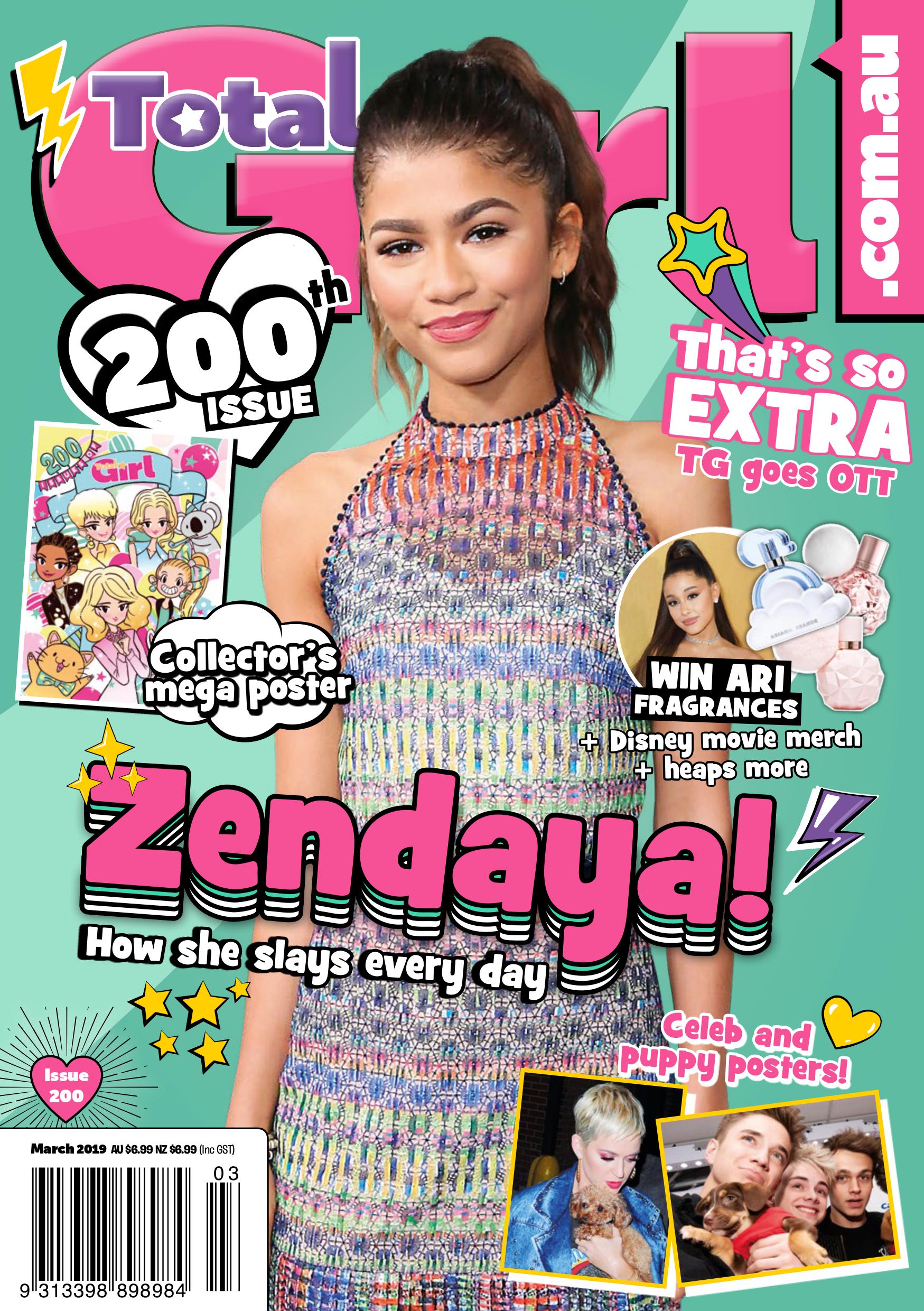

New Magazines This Week